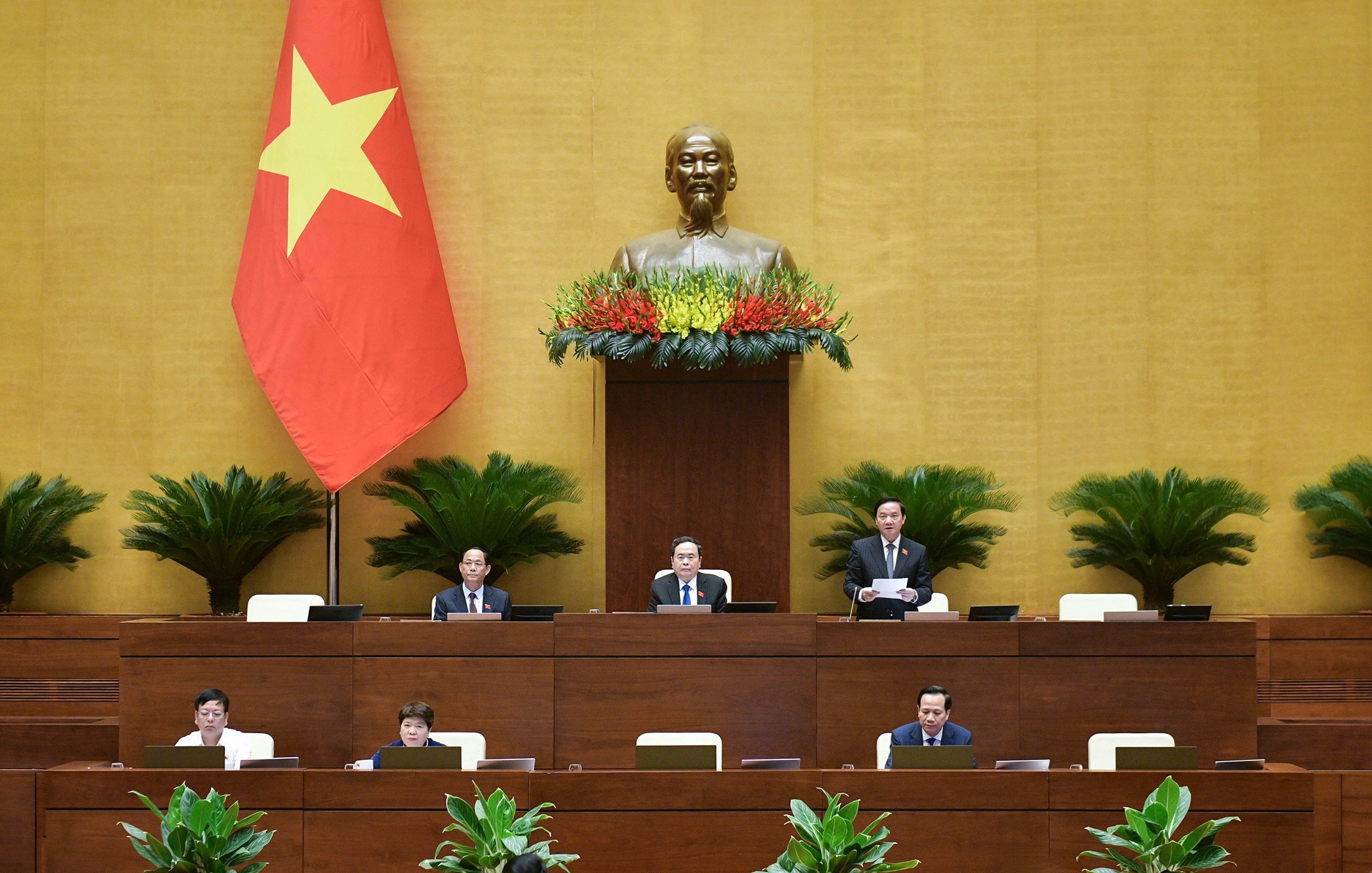

Continuing the 7th Session of the 15th National Assembly, on the morning of May 27 at the National Assembly House, under the chairmanship of National Assembly Chairman Tran Thanh Man, the National Assembly held a plenary session in the hall to discuss a number of contents with different opinions of the draft Law on Social Insurance (amended). Vice Chairman of the National Assembly Nguyen Khac Dinh chaired the session.

Continuing the 7th Session of the 15th National Assembly, on the morning of May 27 at the National Assembly House, under the chairmanship of National Assembly Chairman Tran Thanh Man, the National Assembly held a plenary session in the hall to discuss a number of contents with different opinions of the draft Law on Social Insurance (amended). Vice Chairman of the National Assembly Nguyen Khac Dinh chaired the session.

7th Session, 15th National Assembly

At the meeting, the National Assembly listened to Member of the National Assembly Standing Committee, Chairwoman of the National Assembly's Committee on Social Affairs Nguyen Thuy Anh present a Report on explanation, acceptance and revision of the draft Law on Social Insurance (amended). After the National Assembly discussed a number of contents with different opinions of the draft Law on Social Insurance (amended), the submitting agency and the agency in charge of the review coordinated to explain and clarify a number of issues raised by National Assembly deputies. The National Assembly's Electronic Information Portal will continuously update the content of the meeting... 09:21: Delegate Nguyen Thi Thu Thuy - Delegation of National Assembly deputies of Binh Dinh province: Need to complete and supplement in the direction of protecting the rights of workers as the top priority. Through studying the draft Law on Social Insurance (amended), delegate Nguyen Thi Thu Thuy realized that the Drafting Committee had fully absorbed the opinions of National Assembly deputies at the previous session and expressed agreement with the Review Report of the Social Affairs Committee. Regarding the protection of employees' rights when handling violations of social insurance, health insurance and bankruptcy procedures, the delegate said that, in order of priority, based on Article 54 of the Bankruptcy Law 2014, the costs that enterprises need to prioritize payment: costs of enterprise administrators, auditing costs, asset liquidation costs...; payment of salary debts, severance pay, social insurance, health insurance for employees and other benefits according to the labor contract that the company has signed... Therefore, the delegate said that caring for, protecting, creating long-term benefits for employees to build a stable and sustainable labor relationship is a vital factor to help businesses develop sustainably.

Regarding the protection of employees' rights when handling violations of social insurance, health insurance and bankruptcy procedures, the delegate said that, in order of priority, based on Article 54 of the Bankruptcy Law 2014, the costs that enterprises need to prioritize payment: costs of enterprise administrators, auditing costs, asset liquidation costs...; payment of salary debts, severance pay, social insurance, health insurance for employees and other benefits according to the labor contract that the company has signed... Therefore, the delegate said that caring for, protecting, creating long-term benefits for employees to build a stable and sustainable labor relationship is a vital factor to help businesses develop sustainably.  From Article 37 to Article 40, the delegate found that the draft Law clearly stipulates, in line with the current context, the principle is to handle violations to the extent. Regarding the contents related to the specific mechanism in Article 41, delegate Nguyen Thi Thu Thuy said that this is a process of implementing social insurance in line with point a, clause 1, Article 54 on the order of asset division in the Bankruptcy Law 2014. Therefore, the delegate suggested that the Drafting Committee continue to research, perfect, and supplement in the direction of protecting the rights of employees in any case, they are considered the top priority, must carry out legal procedures on bankruptcy and handle violations of social insurance and health insurance with enterprises.

From Article 37 to Article 40, the delegate found that the draft Law clearly stipulates, in line with the current context, the principle is to handle violations to the extent. Regarding the contents related to the specific mechanism in Article 41, delegate Nguyen Thi Thu Thuy said that this is a process of implementing social insurance in line with point a, clause 1, Article 54 on the order of asset division in the Bankruptcy Law 2014. Therefore, the delegate suggested that the Drafting Committee continue to research, perfect, and supplement in the direction of protecting the rights of employees in any case, they are considered the top priority, must carry out legal procedures on bankruptcy and handle violations of social insurance and health insurance with enterprises.  Regarding the measures to handle violations of slow and evasive social insurance payments by enterprises as stipulated in Articles 37 to 40, delegate Nguyen Thi Thu Thuy noted that the Drafting Committee has received and revised it in the direction of maximally protecting the rights of employees. However, there is a lack of compatibility between the Law on Health Insurance and the draft Law on Social Insurance (amended) this time. Therefore, the delegate suggested that the Drafting Committee should study and clearly define the responsibilities of State management agencies on insurance and the responsibilities of enterprises to ensure that the rights of employees are not affected in handling or imposing sanctions on violating enterprises. 9:15: Delegate Dao Chi Nghia - Delegation of National Assembly Deputies of Can Tho City: Proposed to add a provision that employers are responsible for reporting the status of social insurance payments for employees Delegate Dao Chi Nghia basically agreed with the report on receiving, explaining and revising the draft Law of the National Assembly Standing Committee. Commenting on the subjects participating in compulsory social insurance and voluntary social insurance, the delegate said that the current scope of regulation stipulated in the draft law is very broad, making it difficult for the authorities to manage. There is currently no database on labor, so the feasibility is not high. Therefore, it is recommended to study this content more clearly to ensure feasibility.

Regarding the measures to handle violations of slow and evasive social insurance payments by enterprises as stipulated in Articles 37 to 40, delegate Nguyen Thi Thu Thuy noted that the Drafting Committee has received and revised it in the direction of maximally protecting the rights of employees. However, there is a lack of compatibility between the Law on Health Insurance and the draft Law on Social Insurance (amended) this time. Therefore, the delegate suggested that the Drafting Committee should study and clearly define the responsibilities of State management agencies on insurance and the responsibilities of enterprises to ensure that the rights of employees are not affected in handling or imposing sanctions on violating enterprises. 9:15: Delegate Dao Chi Nghia - Delegation of National Assembly Deputies of Can Tho City: Proposed to add a provision that employers are responsible for reporting the status of social insurance payments for employees Delegate Dao Chi Nghia basically agreed with the report on receiving, explaining and revising the draft Law of the National Assembly Standing Committee. Commenting on the subjects participating in compulsory social insurance and voluntary social insurance, the delegate said that the current scope of regulation stipulated in the draft law is very broad, making it difficult for the authorities to manage. There is currently no database on labor, so the feasibility is not high. Therefore, it is recommended to study this content more clearly to ensure feasibility.  Regarding the employer's responsibility in Article 12, delegate Dao Chi Nghia proposed adding a provision that employers are responsible for reporting the social insurance payment status for employees quarterly to the competent authority to ensure the rights of employees. This is also a form of inspection and supervision of social insurance payment for employees.

Regarding the employer's responsibility in Article 12, delegate Dao Chi Nghia proposed adding a provision that employers are responsible for reporting the social insurance payment status for employees quarterly to the competent authority to ensure the rights of employees. This is also a form of inspection and supervision of social insurance payment for employees.  Regarding the responsibility of the social insurance agency in Article 17, delegate Dao Chi Nghia said that the regulation on the time for the social insurance agency to report to the Social Insurance Management Board, the Ministry of Labor, War Invalids and Social Affairs, the Ministry of Health, the Ministry of Finance, and the People's Committees at the same level on the situation and issues related to social insurance and periodically every 5 years to assess the ability to balance the Retirement and Death Funds in the report on the management of the Social Insurance Fund is too long and does not promptly handle existing problems. Therefore, the delegate proposed to reduce the time prescribed in this Article in the following direction: The social insurance agency periodically reports to the management agency every 3 months, reports to the Ministry of Labor, War Invalids and Social Affairs and related ministries every 6 months; reports to the People's Committees at the same level every 6 months and periodically every 3 years will assess and forecast the ability to balance the fund.

Regarding the responsibility of the social insurance agency in Article 17, delegate Dao Chi Nghia said that the regulation on the time for the social insurance agency to report to the Social Insurance Management Board, the Ministry of Labor, War Invalids and Social Affairs, the Ministry of Health, the Ministry of Finance, and the People's Committees at the same level on the situation and issues related to social insurance and periodically every 5 years to assess the ability to balance the Retirement and Death Funds in the report on the management of the Social Insurance Fund is too long and does not promptly handle existing problems. Therefore, the delegate proposed to reduce the time prescribed in this Article in the following direction: The social insurance agency periodically reports to the management agency every 3 months, reports to the Ministry of Labor, War Invalids and Social Affairs and related ministries every 6 months; reports to the People's Committees at the same level every 6 months and periodically every 3 years will assess and forecast the ability to balance the fund.  Regarding measures to handle violations of late payment of compulsory social insurance, delegate Dao Chi Nghia proposed to add a regulation requiring competent authorities to notify employees of the names and addresses of enterprises that are late in paying or evading social insurance on mass media, as well as update the database system of job referral and brokerage centers... so that employees have full information before making a decision to work. This regulation also aims to enhance warning, deterrence and information transparency. Regarding one-time social insurance, delegate Dao Chi Nghia agreed with option 2. The delegate said that although this option does not end the situation of one-time withdrawal of social insurance, it ensures the right to choose of social insurance participants; retains employees to participate in social insurance for a long time and in the long term, employees will be guaranteed social security. 9:08: Delegate Bui Thi Quynh Tho - National Assembly Delegation of Ha Tinh Province Speaking at the meeting, delegate Bui Thi Quynh Tho expressed her basic agreement with the Report on explanation, acceptance and revision of the draft Law. The draft Law submitted to the National Assembly at the 7th Session has received the opinions of the National Assembly deputies.

Regarding measures to handle violations of late payment of compulsory social insurance, delegate Dao Chi Nghia proposed to add a regulation requiring competent authorities to notify employees of the names and addresses of enterprises that are late in paying or evading social insurance on mass media, as well as update the database system of job referral and brokerage centers... so that employees have full information before making a decision to work. This regulation also aims to enhance warning, deterrence and information transparency. Regarding one-time social insurance, delegate Dao Chi Nghia agreed with option 2. The delegate said that although this option does not end the situation of one-time withdrawal of social insurance, it ensures the right to choose of social insurance participants; retains employees to participate in social insurance for a long time and in the long term, employees will be guaranteed social security. 9:08: Delegate Bui Thi Quynh Tho - National Assembly Delegation of Ha Tinh Province Speaking at the meeting, delegate Bui Thi Quynh Tho expressed her basic agreement with the Report on explanation, acceptance and revision of the draft Law. The draft Law submitted to the National Assembly at the 7th Session has received the opinions of the National Assembly deputies.  Regarding specific issues, the draft Law has expanded a number of subjects participating in compulsory social insurance, including registered business owners, business managers, unpaid cooperative and cooperative union operators, etc. Regarding research, delegates said that according to the provisions in the draft Law, business owners and unpaid enterprise managers, cooperative and cooperative union operators will have to shoulder two roles, both as employees and as employers, and must contribute a total of 25%.

Regarding specific issues, the draft Law has expanded a number of subjects participating in compulsory social insurance, including registered business owners, business managers, unpaid cooperative and cooperative union operators, etc. Regarding research, delegates said that according to the provisions in the draft Law, business owners and unpaid enterprise managers, cooperative and cooperative union operators will have to shoulder two roles, both as employees and as employers, and must contribute a total of 25%.  The delegate stated that the positive impact is that when expanding the above subjects, there will be an increase in the number of people participating in social insurance, increasing the social insurance fund. However, regarding the interests of the affected subjects, the Government's impact assessment report only gives very qualitative comments, without data proving that this group of subjects has a need to participate in compulsory social insurance. Delegate Bui Thi Quynh Tho said that the drafting agency needs to organize to collect opinions from subjects affected by the draft Law, ensuring fairness between these subjects and other subjects paying social insurance, not ignoring the needs and wishes of the subjects for the purpose of increasing the number of people paying social insurance. Along with that, it is necessary to study and consider whether the above subjects should participate in compulsory or voluntary social insurance.

The delegate stated that the positive impact is that when expanding the above subjects, there will be an increase in the number of people participating in social insurance, increasing the social insurance fund. However, regarding the interests of the affected subjects, the Government's impact assessment report only gives very qualitative comments, without data proving that this group of subjects has a need to participate in compulsory social insurance. Delegate Bui Thi Quynh Tho said that the drafting agency needs to organize to collect opinions from subjects affected by the draft Law, ensuring fairness between these subjects and other subjects paying social insurance, not ignoring the needs and wishes of the subjects for the purpose of increasing the number of people paying social insurance. Along with that, it is necessary to study and consider whether the above subjects should participate in compulsory or voluntary social insurance.  Regarding workers who work abroad under contract, the delegate said that in recent times, many social insurance agencies in localities have reported that it is very difficult to collect social insurance from these subjects. The delegate analyzed that these subjects may have a situation where after 3 to 5 years of working abroad, if they want to enjoy social insurance, retirement and death benefits, they must pay for another 12 to 15 years if they do not want to lose the amount they have paid. Therefore, there needs to be a flexible mechanism for applying compulsory social insurance and voluntary social insurance for Vietnamese workers who return home from working abroad in cases where their income is unstable and continuous, ensuring correct and sufficient collection while also meeting the rights of workers. 9:01: Delegate Nguyen Thi Yen Nhi - National Assembly Delegation of Ben Tre Province: It is necessary to add options on time off from work to enjoy benefits when having a pregnancy check-up for employees. Delegate Nguyen Thi Yen Nhi agreed and agreed with the majority of the contents of the draft Law, highly appreciated the acceptance of the issues raised by the National Assembly Delegates, and commented at the 6th session and at the Conference of specialized National Assembly Delegates. To complete the draft Law, the delegates commented on a number of contents:

Regarding workers who work abroad under contract, the delegate said that in recent times, many social insurance agencies in localities have reported that it is very difficult to collect social insurance from these subjects. The delegate analyzed that these subjects may have a situation where after 3 to 5 years of working abroad, if they want to enjoy social insurance, retirement and death benefits, they must pay for another 12 to 15 years if they do not want to lose the amount they have paid. Therefore, there needs to be a flexible mechanism for applying compulsory social insurance and voluntary social insurance for Vietnamese workers who return home from working abroad in cases where their income is unstable and continuous, ensuring correct and sufficient collection while also meeting the rights of workers. 9:01: Delegate Nguyen Thi Yen Nhi - National Assembly Delegation of Ben Tre Province: It is necessary to add options on time off from work to enjoy benefits when having a pregnancy check-up for employees. Delegate Nguyen Thi Yen Nhi agreed and agreed with the majority of the contents of the draft Law, highly appreciated the acceptance of the issues raised by the National Assembly Delegates, and commented at the 6th session and at the Conference of specialized National Assembly Delegates. To complete the draft Law, the delegates commented on a number of contents:  Regarding the time off work to enjoy the regime when having a pregnancy check-up, delegate Nguyen Thi Yen Nhi said that Article 53, Clause 1 stipulates: "During pregnancy, female workers are allowed to take time off work to go for a pregnancy check-up up to 5 times. The maximum time off work to enjoy the regime when having a pregnancy check-up is 2 days for 1 pregnancy check-up". In fact, through contact with voters who are workers and employees in enterprises, there are many opinions on this content. When pregnant female workers go for a routine pregnancy check-up, the doctor usually orders a follow-up examination after 30 days. However, according to current regulations and the draft Law, female workers are only allowed to take time off work to go for a pregnancy check-up up to 5 times. If the fetus develops normally, but if the fetus develops abnormally, the doctor will order a follow-up examination after 1 week, 10 days, 15 days, etc. for the doctor to monitor. Thus, the time prescribed in the draft Law and the current Law is only allowed to take no more than 5 breaks, which is too low for cases where the fetus is not developing normally. To ensure good health care conditions for pregnant female workers to work with peace of mind, delegates suggested that it is also necessary to consider and stipulate the option of taking a maximum of 5 breaks, each time not exceeding 2 days, or increasing the number of prenatal check-ups to 9-10 times during pregnancy to ensure that female workers are fully monitored for the health of the fetus to develop well.

Regarding the time off work to enjoy the regime when having a pregnancy check-up, delegate Nguyen Thi Yen Nhi said that Article 53, Clause 1 stipulates: "During pregnancy, female workers are allowed to take time off work to go for a pregnancy check-up up to 5 times. The maximum time off work to enjoy the regime when having a pregnancy check-up is 2 days for 1 pregnancy check-up". In fact, through contact with voters who are workers and employees in enterprises, there are many opinions on this content. When pregnant female workers go for a routine pregnancy check-up, the doctor usually orders a follow-up examination after 30 days. However, according to current regulations and the draft Law, female workers are only allowed to take time off work to go for a pregnancy check-up up to 5 times. If the fetus develops normally, but if the fetus develops abnormally, the doctor will order a follow-up examination after 1 week, 10 days, 15 days, etc. for the doctor to monitor. Thus, the time prescribed in the draft Law and the current Law is only allowed to take no more than 5 breaks, which is too low for cases where the fetus is not developing normally. To ensure good health care conditions for pregnant female workers to work with peace of mind, delegates suggested that it is also necessary to consider and stipulate the option of taking a maximum of 5 breaks, each time not exceeding 2 days, or increasing the number of prenatal check-ups to 9-10 times during pregnancy to ensure that female workers are fully monitored for the health of the fetus to develop well.  Regarding one-time social insurance, delegates proposed to choose Option 1, which is "Employees who have paid social insurance before the effective date of this Law, after 12 months are not subject to compulsory social insurance, do not participate in voluntary social insurance and have paid social insurance for less than 20 years". Delegate Nguyen Thi Yen Nhi said that Option 1 is to ensure the correct implementation of the principles of social insurance and ensure old-age security for employees, limit complications in the organization and implementation, this option also received many supportive opinions during the consultation process and this is a safer option.

Regarding one-time social insurance, delegates proposed to choose Option 1, which is "Employees who have paid social insurance before the effective date of this Law, after 12 months are not subject to compulsory social insurance, do not participate in voluntary social insurance and have paid social insurance for less than 20 years". Delegate Nguyen Thi Yen Nhi said that Option 1 is to ensure the correct implementation of the principles of social insurance and ensure old-age security for employees, limit complications in the organization and implementation, this option also received many supportive opinions during the consultation process and this is a safer option.

Prime Minister Pham Minh Chinh at the meeting.

In the long term, it is necessary to have a communication orientation to participate in social insurance to aim for a sustainable social security regime for workers in case of illness, work-related accidents - occupational diseases, health insurance, pensions when retiring. The encouragement to participate and not receive one-time social insurance also depends on the socio-economic development situation, labor - employment. At the same time, it is necessary to study to have a credit support policy with preferential interest rates for workers who lose their jobs, are sick, ... to overcome immediate difficulties. Complaints and settlement of complaints; lawsuits against decisions and actions on social insurance of social insurance agencies, At Point b, Clause 3 of the draft Law stipulates: "The head of the social insurance agency at a higher level is responsible for resolving second-time complaints against decisions and administrative actions of the head of the social insurance agency at a lower level that have been resolved for the first time but are still being complained about or the first-time complaint has expired but has not been resolved". Delegates suggested that continuing to inherit the regulations on the order of handling complaints about decisions and actions on social insurance in Clause 2 and Clause 3, Article 119 of the 2014 Law on Social Insurance would be more suitable to reality, that is, assigning the state management agency on labor (People's Committees at all levels) to handle the second complaint would be more objective and convincing. Regarding denunciations and handling of denunciations on social insurance (Article 132), Clause 2, Article 132 of the draft Law stipulates: "Denunciations of violations of the law by agencies, organizations and individuals in complying with the provisions of the law on social insurance before 1995, the state management agency on labor at the provincial level shall be responsible for handling them based on the advice of the provincial social insurance agency". The delegate proposed to remove the phrase "based on the advice of the provincial social insurance agency" because it was not appropriate and said that in principle, the Law and specialized Laws only need to stipulate the authority and responsibility for handling complaints. 8:54: Delegate Tran Khanh Thu - National Assembly Delegation of Thai Binh Province: Towards a sustainable social security regime for workers when they are sick or have work-related accidents Delegate Tran Khanh Thu assessed that the content of the draft Law is consistent with the Party's guidelines, policies and guidelines, consistent with the Constitution, ensuring consistency in the legal system. However, he suggested that the Drafting Committee continue to review to ensure consistency and consistency, based on scientific grounds, practicality, careful assessment, specific calculation, high predictability and codification of regulations on policies and laws on social insurance. The draft Law after being accepted and revised includes 11 Chapters and 147 Articles, adding 11 new articles and adjusting most of the articles.

Delegates suggested that continuing to inherit the regulations on the order of handling complaints about decisions and actions on social insurance in Clause 2 and Clause 3, Article 119 of the 2014 Law on Social Insurance would be more suitable to reality, that is, assigning the state management agency on labor (People's Committees at all levels) to handle the second complaint would be more objective and convincing. Regarding denunciations and handling of denunciations on social insurance (Article 132), Clause 2, Article 132 of the draft Law stipulates: "Denunciations of violations of the law by agencies, organizations and individuals in complying with the provisions of the law on social insurance before 1995, the state management agency on labor at the provincial level shall be responsible for handling them based on the advice of the provincial social insurance agency". The delegate proposed to remove the phrase "based on the advice of the provincial social insurance agency" because it was not appropriate and said that in principle, the Law and specialized Laws only need to stipulate the authority and responsibility for handling complaints. 8:54: Delegate Tran Khanh Thu - National Assembly Delegation of Thai Binh Province: Towards a sustainable social security regime for workers when they are sick or have work-related accidents Delegate Tran Khanh Thu assessed that the content of the draft Law is consistent with the Party's guidelines, policies and guidelines, consistent with the Constitution, ensuring consistency in the legal system. However, he suggested that the Drafting Committee continue to review to ensure consistency and consistency, based on scientific grounds, practicality, careful assessment, specific calculation, high predictability and codification of regulations on policies and laws on social insurance. The draft Law after being accepted and revised includes 11 Chapters and 147 Articles, adding 11 new articles and adjusting most of the articles.  Regarding the conditions for receiving one-time social insurance, the delegate said that the two options proposed in the Draft Law are not optimal options, because they have not completely resolved the situation of receiving one-time social insurance and have not created high consensus. In which, Option 1 has more advantages. To ensure the correct implementation of the principles of social insurance and ensure old-age security for workers, limit the arising of complications in the organization and implementation, Option 1 basically ensures the inheritance of current regulations, does not cause disruption in society, and limits the situation of a social insurance participant receiving multiple one-time social insurance benefits in the past. In the long term, new participants will no longer receive one-time social insurance, contributing to increasing the number of people staying in the system to enjoy social insurance benefits from the accumulation process when participating in social insurance and reducing the burden on the whole society; gradually moving towards the universal principle of social insurance that when having a job and income, one must participate in social insurance to accumulate for the future when retiring in the context of increasing aging, our country has officially entered the stage of population aging.

Regarding the conditions for receiving one-time social insurance, the delegate said that the two options proposed in the Draft Law are not optimal options, because they have not completely resolved the situation of receiving one-time social insurance and have not created high consensus. In which, Option 1 has more advantages. To ensure the correct implementation of the principles of social insurance and ensure old-age security for workers, limit the arising of complications in the organization and implementation, Option 1 basically ensures the inheritance of current regulations, does not cause disruption in society, and limits the situation of a social insurance participant receiving multiple one-time social insurance benefits in the past. In the long term, new participants will no longer receive one-time social insurance, contributing to increasing the number of people staying in the system to enjoy social insurance benefits from the accumulation process when participating in social insurance and reducing the burden on the whole society; gradually moving towards the universal principle of social insurance that when having a job and income, one must participate in social insurance to accumulate for the future when retiring in the context of increasing aging, our country has officially entered the stage of population aging.  The delegate also emphasized that in the coming time, there should be a communication orientation on participating in social insurance to aim for a sustainable social security regime for workers in case of illness, work-related accidents - occupational diseases, health insurance, pensions when they retire. The encouragement to participate and not receive one-time social insurance also depends on the socio-economic development situation, labor - employment. At the same time, it is necessary to study to have a credit support policy with preferential interest rates for workers who lose their jobs, are sick, ... to overcome the immediate difficulties. 8:47: Delegate Tran Kim Yen - Delegation of National Assembly Deputies of Ho Chi Minh City. Ho Chi Minh City: Business households should not be transferred to the group of mandatory social insurance participants. Delegate Tran Thi Kim Yen, concerned about the regulations on subjects participating in mandatory social insurance, added the case of being identified as an employee but the two parties did not sign a labor contract but had the content of the agreement under a different name but the content was expressed in terms of paid work, salary and management, operation and supervision by one party, stipulated in a, clause 1, Article 3 of the draft law.

The delegate also emphasized that in the coming time, there should be a communication orientation on participating in social insurance to aim for a sustainable social security regime for workers in case of illness, work-related accidents - occupational diseases, health insurance, pensions when they retire. The encouragement to participate and not receive one-time social insurance also depends on the socio-economic development situation, labor - employment. At the same time, it is necessary to study to have a credit support policy with preferential interest rates for workers who lose their jobs, are sick, ... to overcome the immediate difficulties. 8:47: Delegate Tran Kim Yen - Delegation of National Assembly Deputies of Ho Chi Minh City. Ho Chi Minh City: Business households should not be transferred to the group of mandatory social insurance participants. Delegate Tran Thi Kim Yen, concerned about the regulations on subjects participating in mandatory social insurance, added the case of being identified as an employee but the two parties did not sign a labor contract but had the content of the agreement under a different name but the content was expressed in terms of paid work, salary and management, operation and supervision by one party, stipulated in a, clause 1, Article 3 of the draft law.  According to the delegate, if the assessment is in essence consistent with the provisions on labor contracts stipulated in the Labor Code (Article 13), however, in terms of form, labor contracts must be concluded in writing for contracts with a term of 1 month or more and ensure the basic contents as prescribed by the Labor Code. Therefore, if it is determined that a labor relationship exists and the two parties have not complied with the provisions of the labor law, timely adjustments must be made. The implementation of insurance obligations must be determined and based on a legal labor contract. Only then can inspection and supervision work be carried out well.

According to the delegate, if the assessment is in essence consistent with the provisions on labor contracts stipulated in the Labor Code (Article 13), however, in terms of form, labor contracts must be concluded in writing for contracts with a term of 1 month or more and ensure the basic contents as prescribed by the Labor Code. Therefore, if it is determined that a labor relationship exists and the two parties have not complied with the provisions of the labor law, timely adjustments must be made. The implementation of insurance obligations must be determined and based on a legal labor contract. Only then can inspection and supervision work be carried out well.  Many opinions assess that this regulation will pave the way and indirectly acknowledge these types of contracts with other names, however, in reality, many businesses have used this method to avoid fulfilling their obligations under the provisions of labor law. Therefore, if this type of labor contract is discovered, it is necessary to adjust the form and content, thereby clearly defining the obligations of the parties participating in the insurance. The drafting committee also needs to study and evaluate an additional subject that needs to be expanded in the provisions of the Law on Social Insurance, which is labor that does not choose time, such as technology car workers. If according to Article 13 of the Labor Code, this subject is essentially a labor relationship, so it is necessary to add this as a subject that needs to participate in compulsory social insurance in the spirit of Resolution 28.

Many opinions assess that this regulation will pave the way and indirectly acknowledge these types of contracts with other names, however, in reality, many businesses have used this method to avoid fulfilling their obligations under the provisions of labor law. Therefore, if this type of labor contract is discovered, it is necessary to adjust the form and content, thereby clearly defining the obligations of the parties participating in the insurance. The drafting committee also needs to study and evaluate an additional subject that needs to be expanded in the provisions of the Law on Social Insurance, which is labor that does not choose time, such as technology car workers. If according to Article 13 of the Labor Code, this subject is essentially a labor relationship, so it is necessary to add this as a subject that needs to participate in compulsory social insurance in the spirit of Resolution 28.  The draft law also adds at point m, clause 1 of Article 3 that business owners of business households are required to register their business. The delegate said that the nature of this group of subjects is different from that of salaried workers. This is a group of subjects who can be completely self-sufficient in income through production and business activities and proactive in finding financial solutions to ensure family life. Therefore, this group of subjects should not be transferred to compulsory social insurance but should still be kept under voluntary social insurance. The delegate also proposed to add to Article 16 on the right to sue of social insurance agencies, because in reality, it has been shown that in the recent past, when the Trade Union organization carried out the task of suing employers for violating social insurance laws, it was very difficult to access and collect evidence and access documents and data related to social insurance. Delegates proposed to add policies to encourage people who want to have children, because Vietnam is experiencing a rapid population aging; at the same time, add policies to encourage people who want to have children, that is, add to the social insurance leave when going to see a doctor and receiving infertility treatment... 8:42: Delegate Nguyen Tri Thuc - Ho Chi Minh City National Assembly Delegation: Continue to research and clarify some provisions of the Draft Law on Social Insurance (amended). Delegate Nguyen Tri Thuc said that in Article 47 on recuperation and health recovery after illness, there are still unclear words such as: 10 days off for workers whose health has not recovered, 07 days for people who have not recovered after surgery,... Delegate Nguyen Tri Thuc assessed that this provision is still vague, so experts should decide on each specific case.

The draft law also adds at point m, clause 1 of Article 3 that business owners of business households are required to register their business. The delegate said that the nature of this group of subjects is different from that of salaried workers. This is a group of subjects who can be completely self-sufficient in income through production and business activities and proactive in finding financial solutions to ensure family life. Therefore, this group of subjects should not be transferred to compulsory social insurance but should still be kept under voluntary social insurance. The delegate also proposed to add to Article 16 on the right to sue of social insurance agencies, because in reality, it has been shown that in the recent past, when the Trade Union organization carried out the task of suing employers for violating social insurance laws, it was very difficult to access and collect evidence and access documents and data related to social insurance. Delegates proposed to add policies to encourage people who want to have children, because Vietnam is experiencing a rapid population aging; at the same time, add policies to encourage people who want to have children, that is, add to the social insurance leave when going to see a doctor and receiving infertility treatment... 8:42: Delegate Nguyen Tri Thuc - Ho Chi Minh City National Assembly Delegation: Continue to research and clarify some provisions of the Draft Law on Social Insurance (amended). Delegate Nguyen Tri Thuc said that in Article 47 on recuperation and health recovery after illness, there are still unclear words such as: 10 days off for workers whose health has not recovered, 07 days for people who have not recovered after surgery,... Delegate Nguyen Tri Thuc assessed that this provision is still vague, so experts should decide on each specific case.  In Article 53, regarding pregnancy examination, Delegate Nguyen Tri Thuc said that it should be divided into 02 groups: normal pregnancy and pathological pregnancy and in Article 54, there is no basis for dividing gestational age. Therefore, Delegate Nguyen Tri Thuc suggested that the Drafting Committee review these 02 Articles. Finally, in Section 1, Clause c, Article 74 stipulates that the subjects who are eligible to withdraw social insurance at one time are those who are suffering from one of the following diseases: cancer, paralysis, cirrhosis, severe tuberculosis, AIDS. Delegate Nguyen Tri Thuc suggested removing this clause because there are some diseases that can be completely treated and the employee can return to work normally. Delegate Nguyen Tri Thuc also said that the above concepts have not updated medical knowledge, if included in the Law it would be inappropriate. Therefore, Delegate Nguyen Tri Thuc suggested removing this clause and for each case, the working capacity should be determined and the working capacity should be determined by the Medical Assessment Council. 8:37: Delegate Tran Thi Thu Phuoc - National Assembly Delegation of Kon Tum province: Clarifying the impacts and influences of new policies

In Article 53, regarding pregnancy examination, Delegate Nguyen Tri Thuc said that it should be divided into 02 groups: normal pregnancy and pathological pregnancy and in Article 54, there is no basis for dividing gestational age. Therefore, Delegate Nguyen Tri Thuc suggested that the Drafting Committee review these 02 Articles. Finally, in Section 1, Clause c, Article 74 stipulates that the subjects who are eligible to withdraw social insurance at one time are those who are suffering from one of the following diseases: cancer, paralysis, cirrhosis, severe tuberculosis, AIDS. Delegate Nguyen Tri Thuc suggested removing this clause because there are some diseases that can be completely treated and the employee can return to work normally. Delegate Nguyen Tri Thuc also said that the above concepts have not updated medical knowledge, if included in the Law it would be inappropriate. Therefore, Delegate Nguyen Tri Thuc suggested removing this clause and for each case, the working capacity should be determined and the working capacity should be determined by the Medical Assessment Council. 8:37: Delegate Tran Thi Thu Phuoc - National Assembly Delegation of Kon Tum province: Clarifying the impacts and influences of new policies  Delegate Tran Thi Thu Phuoc expressed her high agreement with the draft Law on Social Insurance (amended) which has been accepted and revised; at the same time, she said that the draft Law submitted at this Session has ensured to meet both theoretical and practical requirements. According to the delegate, this is of great significance in the context of the domestic, regional and global economies facing many difficulties due to the consequences of the Covid-19 pandemic as well as world political conflicts that have greatly affected the income and employment of workers...

Delegate Tran Thi Thu Phuoc expressed her high agreement with the draft Law on Social Insurance (amended) which has been accepted and revised; at the same time, she said that the draft Law submitted at this Session has ensured to meet both theoretical and practical requirements. According to the delegate, this is of great significance in the context of the domestic, regional and global economies facing many difficulties due to the consequences of the Covid-19 pandemic as well as world political conflicts that have greatly affected the income and employment of workers...  Therefore, delegate Tran Thi Thu Phuoc said that it is necessary to clarify all aspects, especially the impacts and influences of the new policies proposed in the draft Law, while promoting the spirit of democracy, listening with a spirit of openness, sharing the difficulties and aspirations of workers. "Because for them, just one sentence, one word changed in the promulgated legal document will decide the issue of social security for the whole life.", delegate Phuoc said. 8:31: Delegate Vuong Thi Huong - Delegation of National Assembly Deputies of Ha Giang province: Consider designing a way to calculate pensions with a sharing nature to support those with very low pensions

Therefore, delegate Tran Thi Thu Phuoc said that it is necessary to clarify all aspects, especially the impacts and influences of the new policies proposed in the draft Law, while promoting the spirit of democracy, listening with a spirit of openness, sharing the difficulties and aspirations of workers. "Because for them, just one sentence, one word changed in the promulgated legal document will decide the issue of social security for the whole life.", delegate Phuoc said. 8:31: Delegate Vuong Thi Huong - Delegation of National Assembly Deputies of Ha Giang province: Consider designing a way to calculate pensions with a sharing nature to support those with very low pensions  Regarding the subjects participating in compulsory and voluntary social insurance stipulated in Article 3 of the draft Law, delegate Vuong Thi Huong said that Clauses i and n of Article 3 stipulate that subjects participating in compulsory social insurance include business managers. According to Clause 24, Article 4 of the amended Law on Enterprises, business managers are private enterprise managers and company managers include private enterprise owners, general partners, Chairman of the Board of Members, members of the Board of Members, Chairman of the company, Chairman of the Board of Directors, members of the Board of Directors, Directors or General Directors and individuals holding other management positions as prescribed in the Company Charter. According to Clause 7, Article 3 of the Law on Management and Use of State Capital Invested in Production and Business at Enterprises, it is stipulated that: Business managers include Chairman and members of the Board of Members, Chairman of the company, General Director or Director, Deputy General Director or Deputy Director, Chief Accountant.

Regarding the subjects participating in compulsory and voluntary social insurance stipulated in Article 3 of the draft Law, delegate Vuong Thi Huong said that Clauses i and n of Article 3 stipulate that subjects participating in compulsory social insurance include business managers. According to Clause 24, Article 4 of the amended Law on Enterprises, business managers are private enterprise managers and company managers include private enterprise owners, general partners, Chairman of the Board of Members, members of the Board of Members, Chairman of the company, Chairman of the Board of Directors, members of the Board of Directors, Directors or General Directors and individuals holding other management positions as prescribed in the Company Charter. According to Clause 7, Article 3 of the Law on Management and Use of State Capital Invested in Production and Business at Enterprises, it is stipulated that: Business managers include Chairman and members of the Board of Members, Chairman of the company, General Director or Director, Deputy General Director or Deputy Director, Chief Accountant.  Thus, the same term of business manager, but in the two laws, there are different explanations. To unify the understanding and avoid arbitrary application in reality, deputies Vuong Thi Huong proposes to explain the word for the term "business manager" to apply in the scope of this law. This policy aims to concretize Resolution No. 28 of the Central Executive Committee on social insurance policy reform is suitable for reality when the labor market of our country is still in the early stages of development, creating opportunities for those who participate in social insurance late or the participation process does not continuously have time to pay social insurance.

Thus, the same term of business manager, but in the two laws, there are different explanations. To unify the understanding and avoid arbitrary application in reality, deputies Vuong Thi Huong proposes to explain the word for the term "business manager" to apply in the scope of this law. This policy aims to concretize Resolution No. 28 of the Central Executive Committee on social insurance policy reform is suitable for reality when the labor market of our country is still in the early stages of development, creating opportunities for those who participate in social insurance late or the participation process does not continuously have time to pay social insurance.  However, due to the calculation of monthly pension based on the time to contribute to the salary and income as a basis for social insurance premiums, the reduction of conditions for social insurance payment time will appear more cases of retirement workers with very low pension, male workers only enjoy 33.75%. Concerned and concerned can lead to the poverty of a part of the people in the future. 8h24: Delegate Le Thi Thanh Lam - Delegation of the People's Committee of Hau Giang province: It is necessary to support the group of subjects participating in social insurance both compulsory and voluntarily speak in the hall, delegate Le Thi Thanh Lam agrees with the need to issue the Law on Social Insurance Law (amended). Social insurance both compulsory and voluntary depending on the ability to balance the budget of each period.

However, due to the calculation of monthly pension based on the time to contribute to the salary and income as a basis for social insurance premiums, the reduction of conditions for social insurance payment time will appear more cases of retirement workers with very low pension, male workers only enjoy 33.75%. Concerned and concerned can lead to the poverty of a part of the people in the future. 8h24: Delegate Le Thi Thanh Lam - Delegation of the People's Committee of Hau Giang province: It is necessary to support the group of subjects participating in social insurance both compulsory and voluntarily speak in the hall, delegate Le Thi Thanh Lam agrees with the need to issue the Law on Social Insurance Law (amended). Social insurance both compulsory and voluntary depending on the ability to balance the budget of each period.  In Clause 2, Article 43, delegate Le Thi Thanh Lam proposes to stipulate additional time to take care of the sick child, in the case of a child under 16 years of age or the laborer is entitled to the sickness regime as prescribed at Point a, Clause 1, Article 44 and Clause 2, Article 44 of this Law. At Point b, Clause 1, Article 48 resident, or papers specify the date of admission.

In Clause 2, Article 43, delegate Le Thi Thanh Lam proposes to stipulate additional time to take care of the sick child, in the case of a child under 16 years of age or the laborer is entitled to the sickness regime as prescribed at Point a, Clause 1, Article 44 and Clause 2, Article 44 of this Law. At Point b, Clause 1, Article 48 resident, or papers specify the date of admission.  In Clause 1, Article 53, delegate Le Thi Thanh Lam proposes to study a minimum number of pregnancy check -ups, the number of times may be more than 5 times for the case of the practitioner in the medical examination and treatment facilities. 6. Immediately after the meeting, the Standing Committee of the National Assembly directed the agency to assume the prime institution in coordination with the drafting agency and the concerned agencies in organizing research activities, surveying the opinions of the subjects under the direct impact, experts and scientists to absorb, explain and revise the draft Law to submit to the National Assembly.

In Clause 1, Article 53, delegate Le Thi Thanh Lam proposes to study a minimum number of pregnancy check -ups, the number of times may be more than 5 times for the case of the practitioner in the medical examination and treatment facilities. 6. Immediately after the meeting, the Standing Committee of the National Assembly directed the agency to assume the prime institution in coordination with the drafting agency and the concerned agencies in organizing research activities, surveying the opinions of the subjects under the direct impact, experts and scientists to absorb, explain and revise the draft Law to submit to the National Assembly.  Vice Chairman of the National Assembly stated that the Standing Committee of the National Assembly realized that this is a law project with many large, complex, deep and socialized contents, highly socialized, the subject is very direct. Explain the opinions of the National Assembly deputies and relevant organizations. 8h01: Member of the National Assembly Standing Committee, Chairman of the Socialist Committee of the National Assembly Nguyen Thuy Anh presented the report, absorb and revised the Draft Law on Social Insurance (amended) reporting at the meeting on the conditions of a one -time social insurance for the case of an unpopular person who was entitled to pension, not continuing to pay social insurance, less than twenty years of social insurance and social insurance, the social insurance is required by the social insurance, The Government submitted to the National Assembly two options:

Vice Chairman of the National Assembly stated that the Standing Committee of the National Assembly realized that this is a law project with many large, complex, deep and socialized contents, highly socialized, the subject is very direct. Explain the opinions of the National Assembly deputies and relevant organizations. 8h01: Member of the National Assembly Standing Committee, Chairman of the Socialist Committee of the National Assembly Nguyen Thuy Anh presented the report, absorb and revised the Draft Law on Social Insurance (amended) reporting at the meeting on the conditions of a one -time social insurance for the case of an unpopular person who was entitled to pension, not continuing to pay social insurance, less than twenty years of social insurance and social insurance, the social insurance is required by the social insurance, The Government submitted to the National Assembly two options:  + Option 1: The employee is divided into two groups: Group 1, the employee participates in social insurance before the law takes effect (expected July 1, 2025), after 12 months, it is not subject to compulsory social insurance, not participating in voluntary social insurance and has time to pay social insurance less than 20 years. : Workers are partially resolved but not more than 50% of the total time has been paid to the pension fund and Tuat.

+ Option 1: The employee is divided into two groups: Group 1, the employee participates in social insurance before the law takes effect (expected July 1, 2025), after 12 months, it is not subject to compulsory social insurance, not participating in voluntary social insurance and has time to pay social insurance less than 20 years. : Workers are partially resolved but not more than 50% of the total time has been paid to the pension fund and Tuat.  The Chairman of the Social Committee said that most of the National Assembly Standing Committee agreed on plan 1 of the Government proposed and also the opinion of the majority of workers in some localities by the agency in charge of inspection. It is difficult, there are many different opinions and directly related to the rights of many workers in the present time and at the end of the working age.

The Chairman of the Social Committee said that most of the National Assembly Standing Committee agreed on plan 1 of the Government proposed and also the opinion of the majority of workers in some localities by the agency in charge of inspection. It is difficult, there are many different opinions and directly related to the rights of many workers in the present time and at the end of the working age.  Regarding electronic transactions in the field of social insurance, Chairman of the Social Committee Nguyen Thuy Anh said that receiving the opinion of the National Assembly deputies, the draft law has supplemented the rules of electronic transactions in organizing the implementation of social insurance. The Draft Law has also amended and supplemented sanctions for postponement of exit prescribed according to the reference to the application of the Law on exit and entry of Vietnamese citizens and the Law on Immigration, Exit, In transit and residence of foreigners in Vietnam and has not stipulated the sanctions to stop using invoices for acts of slow closing and evasion of social insurance.

Regarding electronic transactions in the field of social insurance, Chairman of the Social Committee Nguyen Thuy Anh said that receiving the opinion of the National Assembly deputies, the draft law has supplemented the rules of electronic transactions in organizing the implementation of social insurance. The Draft Law has also amended and supplemented sanctions for postponement of exit prescribed according to the reference to the application of the Law on exit and entry of Vietnamese citizens and the Law on Immigration, Exit, In transit and residence of foreigners in Vietnam and has not stipulated the sanctions to stop using invoices for acts of slow closing and evasion of social insurance.  Regarding the specific mechanism to protect workers in case the employer is no longer able to pay social insurance for workers, the draft law has added a "specific" mechanism to protect workers in case the employer fled, no longer able to pay social insurance for workers. Business signing " Supplementing and presenting Clause 2, Article 132 of settlement of denunciations for the time before 1995, which is responsible for provincial -level labor management agencies. Thoroughly in the context of salary reform and need to carefully assess the impact on pensioners at different times, in different areas and fields.

Regarding the specific mechanism to protect workers in case the employer is no longer able to pay social insurance for workers, the draft law has added a "specific" mechanism to protect workers in case the employer fled, no longer able to pay social insurance for workers. Business signing " Supplementing and presenting Clause 2, Article 132 of settlement of denunciations for the time before 1995, which is responsible for provincial -level labor management agencies. Thoroughly in the context of salary reform and need to carefully assess the impact on pensioners at different times, in different areas and fields.  Regarding the social retirement allowance, Chairman of the Social Committee Nguyen Thuy Anh said that to ensure the level of social retirement allowance suitable to each period, the National Assembly Standing Committee has directed the adjustment provided in Clause 1, Article 21 in the direction of: "Periodically, the Government reviews and proposes to adjust the social retirement allowance to report to the National Assembly when the State Budget is submitted. The reason includes 11 chapters and 147 articles (increasing 1 chapter and an increase of 11 articles compared to the draft law submitted by the Government) and 15 new points. Before the discussion, the National Assembly listened to the Member of the Standing Committee of the National Assembly, Chairman of the Social Committee of the National Assembly Nguyen Thuy Anh presented the report, acquiring and revising the draft Law on Social Insurance (amended)

Regarding the social retirement allowance, Chairman of the Social Committee Nguyen Thuy Anh said that to ensure the level of social retirement allowance suitable to each period, the National Assembly Standing Committee has directed the adjustment provided in Clause 1, Article 21 in the direction of: "Periodically, the Government reviews and proposes to adjust the social retirement allowance to report to the National Assembly when the State Budget is submitted. The reason includes 11 chapters and 147 articles (increasing 1 chapter and an increase of 11 articles compared to the draft law submitted by the Government) and 15 new points. Before the discussion, the National Assembly listened to the Member of the Standing Committee of the National Assembly, Chairman of the Social Committee of the National Assembly Nguyen Thuy Anh presented the report, acquiring and revising the draft Law on Social Insurance (amended)

Source: https://quochoi.vn/tintuc/pages/tin-hat-dong-cua-quoc-hoi.aspx?itemid=87099

![[Photo] General Secretary To Lam begins official visit to Russia and attends the 80th Anniversary of Victory over Fascism](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/5d2566d7f67d4a1e9b88bc677831ec9d)

![[Photo] Prime Minister Pham Minh Chinh meets with the Policy Advisory Council on Private Economic Development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/387da60b85cc489ab2aed8442fc3b14a)

![[Photo] National Assembly Chairman Tran Thanh Man chairs the meeting of the Subcommittee on Documents of the First National Assembly Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/72b19a73d94a4affab411fd8c87f4f8d)

![[Photo] President Luong Cuong presents the decision to appoint Deputy Head of the Office of the President](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/501f8ee192f3476ab9f7579c57b423ad)

![[Photo] General Secretary concludes visit to Azerbaijan, departs for visit to Russian Federation](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/7a135ad280314b66917ad278ce0e26fa)

![[Photo] Prime Minister Pham Minh Chinh talks on the phone with Singaporean Prime Minister Lawrence Wong](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/8/e2eab082d9bc4fc4a360b28fa0ab94de)

Comment (0)