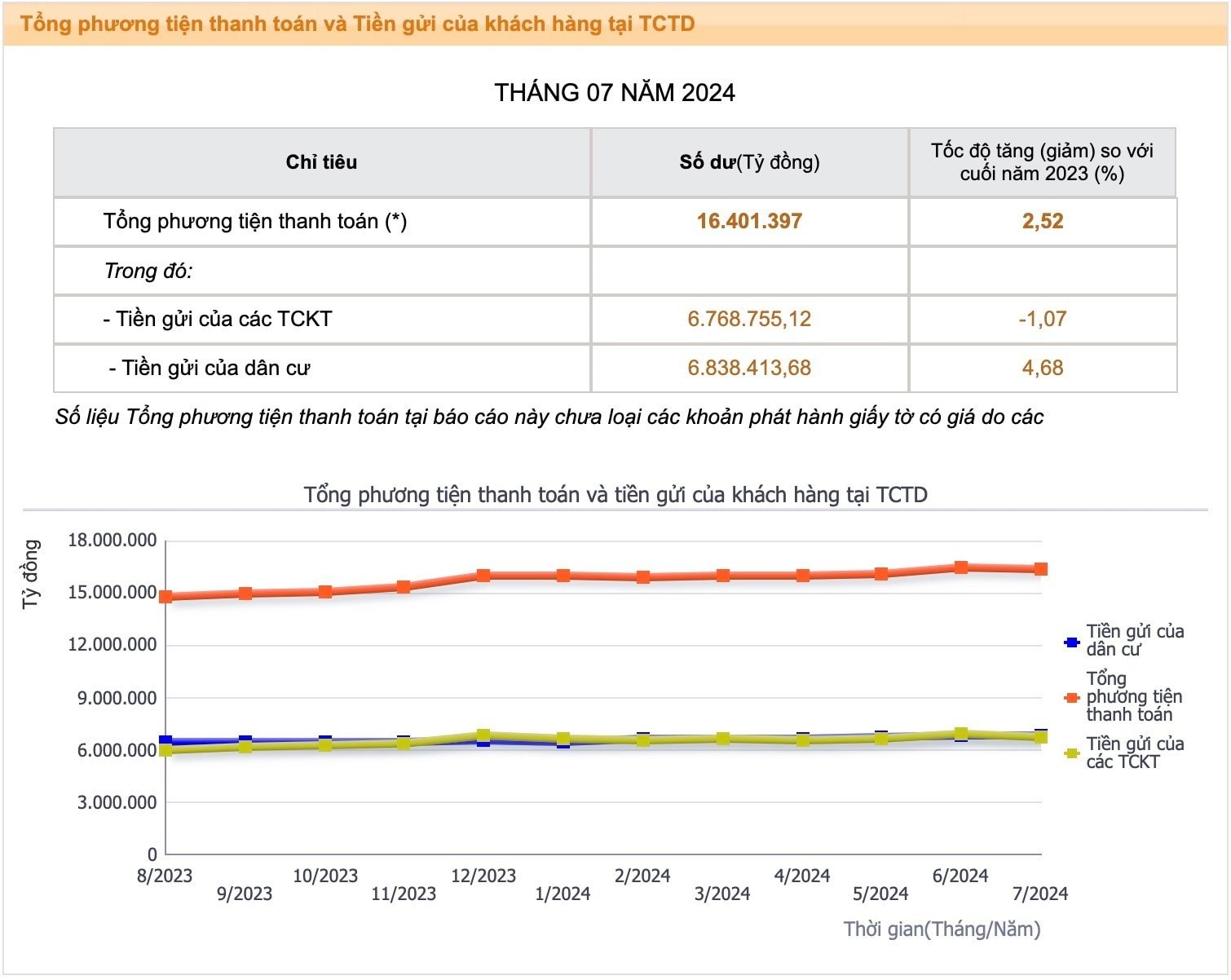

According to statistics from the State Bank of Vietnam, as of July, people's deposits in the banking system reached more than VND 6,838,413.68 billion, an increase of VND 305,672 billion, equivalent to an increase of 4.68% compared to the end of 2023.

This is also the highest number ever recorded for the amount of money people deposit into the banking system.

Meanwhile, the amount of deposits of economic organizations in banks was lower than that of the population, reaching 6,768,755.12 billion VND, a slight decrease of 1.07% compared to the end of last year.

According to data from the State Bank of Vietnam, the amount of money people deposit into the banking system has increased continuously over the past two years, despite the record low interest rates in the second half of 2023 and early 2024.

Bank deposit interest rates are expected to increase again from around April. This move in the deposit market is considered a stimulating factor that will cause people's deposits in banks to continue to increase.

Recently, many banks have continued to adjust their deposit interest rates in an upward direction. In September, some banks such as Bac A Bank, Nam A Bank, GP Bank, OCB… continued to increase interest rates, mainly for short terms.

Compared to the beginning of this year, interest rates for various terms at many banks have increased by 0.5-1%/year. Long-term interest rates have increased beyond 6.0%/year at many banks. Currently, some banks in the market are listing interest rates of 6-6.15%/year for terms of 18-36 months.

TB (according to VTC)Source: https://baohaiduong.vn/tien-gui-cua-nguoi-dan-vao-ngan-hang-dat-muc-cao-ky-luc-hon-6-838-trieu-ty-dong-394722.html

Comment (0)