When receiving deposits, credit institutions are not allowed to conduct promotions in any form (in cash, interest rates and other forms) that are not in accordance with the provisions of law.

State Bank issued Circular 48/2024 regulating the application of interest rates to deposits in Vietnamese Dong of organizations and individuals at credit institutions and foreign bank branches.

This Circular provides for the application of deposit interest rate in Vietnamese Dong of organizations (excluding credit institutions and foreign bank branches), individuals at credit institutions and foreign bank branches; deposits include forms of receiving deposits as prescribed in Clause 27, Article 4 of the Law on Credit Institutions.

Applicable subjects: Commercial banks, cooperative banks, general finance companies, specialized finance companies, people's credit funds, microfinance institutions, foreign bank branches (credit institutions) operating in Vietnam according to the provisions of the Law on Credit Institutions; organizations (excluding credit institutions), individuals depositing money at credit institutions (customers).

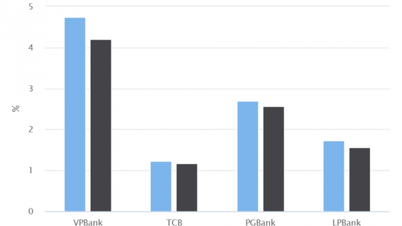

According to the Circular, credit institutions apply interest rates on deposits in Vietnamese Dong of organizations and individuals not exceeding the maximum interest rates for demand deposits, term deposits of less than 1 month, term deposits from 1 month to less than 6 months decided by the Governor of the State Bank of Vietnam in each period and for each type of credit institution.

Credit institutions apply interest rates on deposits in Vietnamese Dong for deposits with terms of 6 months or more of organizations and individuals based on market capital supply and demand.

The maximum interest rate for deposits in Vietnamese Dong prescribed in this Circular includes promotional expenses in all forms, applicable to the end-of-term interest payment method and other interest payment methods converted according to the end-of-term interest payment method.

Credit institutions shall publicly post interest rates on deposits in Vietnamese Dong at legal transaction locations within the credit institution's network of operations and post them on the credit institution's website (if any). When receiving deposits, credit institutions shall not conduct promotions in any form (in cash, interest rates and other forms) that are not in accordance with the provisions of law.

This Circular takes effect from November 20, 2024 and replaces Circular No. 07/2014 dated March 17, 2014 of the Governor of the State Bank regulating interest rates on deposits in Vietnamese Dong of organizations and individuals at credit institutions.

For agreements on interest rates on deposits in Vietnamese Dong before the effective date of this Circular, credit institutions and customers shall continue to implement the agreement until the end of the term. In case the agreed term expires and the customer does not come to receive the deposit, the credit institution shall apply the deposit interest rate according to the provisions of this Circular.

Source

![[Photo] Prime Minister Pham Minh Chinh receives Swedish Minister of International Development Cooperation and Foreign Trade](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/ae50d0bb57584fd1bbe1cd77d9ad6d97)

![[Photo] Prime Minister Pham Minh Chinh starts construction of vital highway through Thai Binh and Nam Dinh](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/52d98584ccea4c8dbf7c7f7484433af5)

![[Photo] Prime Minister Pham Minh Chinh works with the Standing Committee of Thai Binh Provincial Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/f514ab990c544e05a446f77bba59c7d1)

Comment (0)