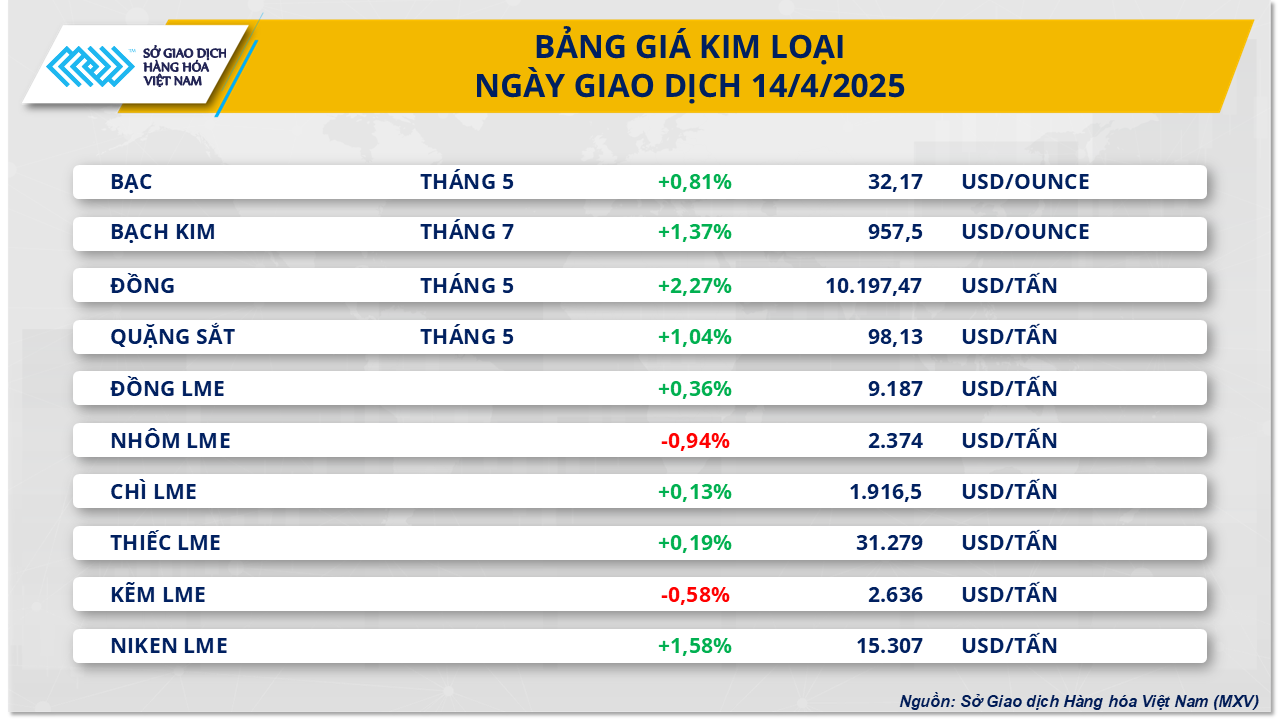

In the metal market, according to MXV, the first trading session of the week saw 8 out of 10 metal commodities increase in price. The main driving force came from concerns about tight supply and signs of recovering demand in the Chinese market.

For the precious metals group, silver prices continued to maintain their upward momentum, closing at $32.17/ounce, up 0.81% from the previous session. Platinum prices also increased by 1.37%, reaching $957.5/ounce.

The precious metals group continued to benefit as the US dollar index fell another 0.46% to 99.64 points. The weakening of the US dollar makes precious metals priced in this currency more attractive to international investors, thereby stimulating buying power.

Meanwhile, the platinum market is entering its third year of deficit. The deficit is expected to reach 848,000 ounces by 2025, up from its previous forecast, according to the World Platinum Investment Council (WPIC). At the same time, global supply is forecast to decline by 4% to around 7 million ounces – the lowest level since 2013, largely due to persistent weakness in both recycling and mining.

Source: MXV

In the base metals market, copper prices jumped 2.27% to $10,197/t amid concerns about supply shortages as smelters without mines face a shortage of concentrates. This has pushed up input costs, forcing many to reduce capacity to avoid losses. According to the SAVANT platform, copper smelting activities fell to a yearly low in March, with 12.6% of global capacity suspended, exceeding the peak in May 2023. In China alone, many factories had to carry out maintenance early in March instead of the usual second quarter to reduce losses, pushing the idle capacity rate in the month to 9.6%.

Meanwhile, iron ore prices received support from a clear improvement in demand, helping the price of this commodity recover by 1.04% to reach 98.13 USD/ton. According to data from the General Administration of Customs of China (GACC), in the first quarter, the country's finished steel exports reached 27.43 million tons, up 6.3% over the same period last year. In March alone, the export volume reached 10.46 million tons, up sharply by 30% compared to February. China's bustling steel export activities show that demand for input materials such as iron ore is recovering positively.

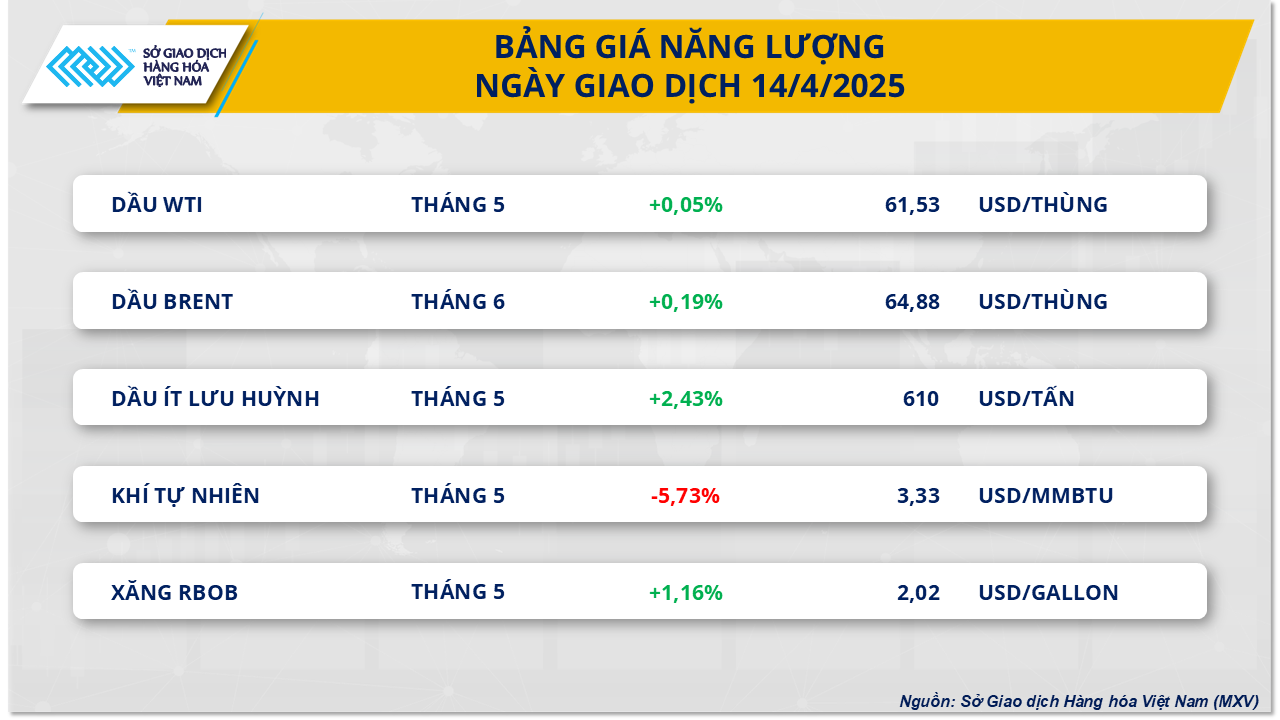

For the energy group, according to MXV, oil prices started the new week with a slight increase thanks to positive signals about oil consumption demand in China. At the end of the trading session, Brent oil prices increased slightly by 0.19% to 64.88 USD/barrel. WTI oil prices also climbed to 61.53 USD/barrel, corresponding to an increase of 0.05%.

Source: MXV

The main driver behind the recent oil price increase is investors' strong expectations for the Chinese market - the world's largest oil consumer. According to data from the General Administration of Customs of China, crude oil imports in March reached 51.41 million tons, equivalent to about 12.1 million barrels/day, setting a high level since August 2023. Notably, this figure increased sharply compared to the same period last year and far exceeded the average of the first two months of the year, showing that China's oil import demand is recovering impressively and continues to be an important supporting factor for oil prices in the international market.

China’s macroeconomic data also bolstered investor confidence. China’s exports grew by 13.5 billion yuan in March, up 12.4 percent year-on-year, beating the 4.4 percent forecast. China’s trade balance in March also beat market expectations.

The news that the US has removed phones, computers and many other electronic devices from the list of products subject to reciprocal tariffs has helped improve market sentiment and support the rise in oil prices in recent sessions. According to an announcement from the US Customs and Border Protection (CBP) on the evening of April 11 (local time), about 20 groups of goods, including smartphones, laptops, hard drives, memory chips, semiconductor manufacturing equipment, solar panels and flat TV screens, have been exempted from reciprocal tariffs. This decision takes effect from April 5, helping large technology corporations reduce the pressure on import costs.

Meanwhile, news from the Middle East has somewhat restrained the rise in oil prices. Over the weekend in Oman, the US and Iran held talks on Tehran’s nuclear program. Both sides gave positive responses, raising expectations of a possible reduction in tensions and an easing of sanctions on Iranian crude oil – a supply that has been under pressure from US sanctions related to the nuclear program.

Source: https://baodaknong.vn/thi-truong-hang-hoa-15-4-luc-ban-quay-lai-chiem-uu-the-249426.html

![[Photo] Closing of the 4th Summit of the Partnership for Green Growth and the Global Goals](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/c0a0df9852c84e58be0a8b939189c85a)

![[Photo] National Assembly Chairman Tran Thanh Man meets with outstanding workers in the oil and gas industry](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/1d0de4026b75434ab34279624db7ee4a)

![[Photo] The beauty of Ho Chi Minh City - a modern "super city" after 50 years of liberation](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/18/81f27acd8889496990ec53efad1c5399)

![[Photo] General Secretary To Lam receives CEO of Warburg Pincus Investment Fund (USA)](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/18/7cf9375299164ea1a7ee9dcb4b04166a)

![[Photo] Air Force practices raising flag in Ho Chi Minh City sky in preparation for April 30th holiday](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/18/de7139d9965b44f8ac1f69c4981196fd)

![[Photo] Nhan Dan Newspaper announces the project "Love Vietnam so much"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/362f882012d3432783fc92fab1b3e980)

Comment (0)