Mr. Le Hai Doan, Chairman of the Board of Directors of HIPT, successfully purchased 330,000 shares to increase his personal ownership in Vinasun to 2.11% and increase HIPT's total ownership in this enterprise to 5.47%.

This transaction was made by Mr. Doan on October 10. Based on the closing price of that day, which was 10,250 VND, the block of shares owned by the head of HIPT at Vietnam Sun Joint Stock Company (Vinasun, stock code: VNS) is worth about 3.4 billion VND.

After the successful transaction, Mr. Doan increased his ownership in Vinasun to 1.43 million shares (2.11% of charter capital) and added HIPT Group Joint Stock Company to the list of major shareholders when this enterprise held a total of more than 2.28 million VNS shares (5.47% of charter capital).

HIPT was established in June 1994 under the name of Information Technology Development Support Company Limited before changing to its current name in 2006. The company operates mainly in the field of providing information technology solutions such as system integration, software development and providing information technology equipment.

On the stock exchange, VNS shares have not fluctuated much, trading around the price range of 10,000-11,000 VND for the past 5 months. The average matched volume in the last 10 sessions is over 52,000 units. Market capitalization is over 692 billion VND.

In the first half of the year, Vinasun achieved net revenue of approximately VND532 billion, down 15.3% over the same period. Gross profit during this period was approximately VND98.5 billion, gross profit margin reached 18.5%.

After deducting expenses, the Company reported pre-tax profit of VND38.9 billion and after-tax profit of only VND9.6 million, down 58.2% and 97.6% respectively compared to the same period last year.

According to the explanation from the board of directors, in the first 6 months of this year, the company continued to implement additional support policies for drivers and partners, leading to a decrease in business results compared to the same period.

At the annual meeting at the end of April, many shareholders questioned Vinasun's board of directors about the impact on business operations due to the appearance of the SM Green Taxi company. Accordingly, the company's board of directors admitted that the company's market share was affected by two basic factors: the decline in consumer demand and competition from taxi companies in the industry. To overcome difficulties and increase competitiveness in the market, Vinasun plans to invest in 700 hybrid taxis this year (with a total investment of about 630-650 billion VND), and if things go well, it can increase to 1,000 vehicles. The company calculates that hybrid vehicles can reduce fuel costs by up to 50% compared to gasoline vehicles.

Because of anticipating the above unfavorable factors, plus the fact that profits are also affected by policies to support drivers and adjust fares and revenue sharing ratios of self-employed vehicles, vehicles in cooperation with individuals and franchised vehicles, Vinasun set a relatively cautious business target for 2024.

Specifically, the company expects total revenue and income this year to reach VND1,137.45 billion, down 10% compared to 2023 business results. Pre-tax profit target is VND80.51 billion, down 46.7%. Thus, the half-year business results complete 46.7% of the revenue plan and 48.3% of the profit target.

As of the end of the second quarter of 2024, the company had total assets of VND1,599 billion, a slight decrease compared to VND1,653 billion at the beginning of the year. Liabilities increased slightly compared to the beginning of the period, to VND494 billion, mostly short-term items. Owner's equity was about VND1,104 billion, and undistributed profit after tax was more than VND69.9 billion.

Source: https://baodautu.vn/taxi-vinasun-co-them-co-dong-lon-d227524.html

![[Photo] General Secretary To Lam holds talks with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/b3d07714dc6b4831833b48e0385d75c1)

![[Photo] National Assembly Chairman Tran Thanh Man meets with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/4e8fab54da744230b54598eff0070485)

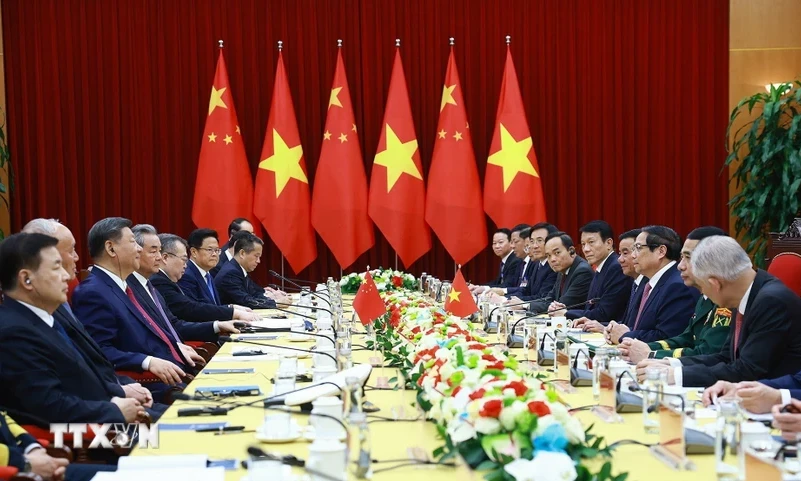

![[Photo] Prime Minister Pham Minh Chinh meets with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/893f1141468a49e29fb42607a670b174)

![[Photo] Reception to welcome General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/9afa04a20e6441ca971f6f6b0c904ec2)

Comment (0)