Mr. Nguyen Ngoc Thuy's Egroup Corporation has just proposed new solutions to offset debt with investors, including exchanging for household appliances.

The four debt reduction options that Egroup has just proposed include real estate, an investment package to restructure English centers, an English learning package, and household appliances. The first three options only change in content, while debt write-off (debt offset) with household appliances has just appeared.

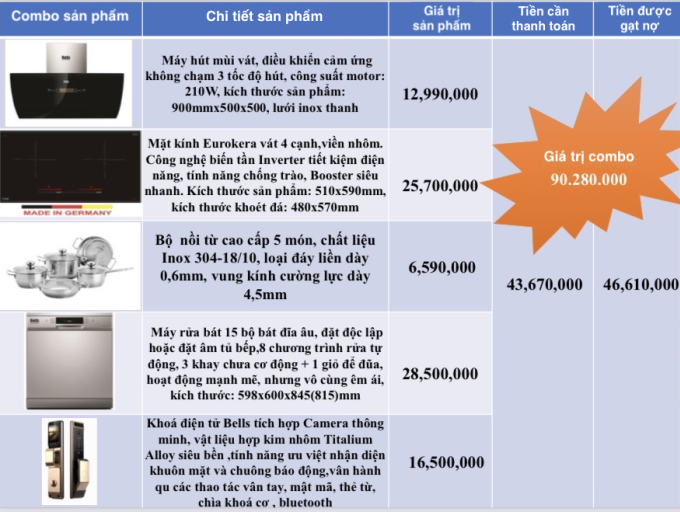

If choosing to pay off debt with household appliances, investors will receive products from Bells (Germany) such as range hoods, electric stoves, pot holders, dishwashers, electronic door locks... The products are provided in four packages (combos) with the lowest value of about 36 million VND and the highest value of more than 90 million VND.

Investors will pay more than half of the combo value, the rest will be paid by Egroup, considered as debt swap. This option is applied to all investors, regardless of the value of outstanding debt to the company.

Bells was founded in 1947 and is a German manufacturer of mid- and high-end home appliances. According to the distributor, the company has just signed a contract to bring its products to more than 20,000 social housing units in Ho Chi Minh City and Binh Duong in the near future. Egroup said that the prices are clearly listed, ensuring the quality of origin and a three-year warranty.

Egroup offers four home appliance combos for debt swaps, the largest value is over 90 million VND. Photo: Egroup

Another option that is also available to all investors is an online English learning package for children aged 6-15. This package costs 7.8 million VND per year, investors pay half, the rest will be settled by Egroup. This company is offering 100 slots.

The remaining two options are for investors with high debt balances, mainly continuing to implement the debt swap method that was previously proposed. With the restructuring package, investors will pour more money, at least 100 million VND, into 10 Apax Leaders/Apax English centers selected by Egroup, mainly in Hanoi and neighboring provinces. This enterprise commits that investors can earn up to 300 million VND after the restructuring process. To date, 5 centers have reached the limit for investors to participate.

With the real estate plan, Egroup offers two products including land and villas. Of which, 25 plots of land in Bac Giang are located in the districts of Hue Van, Tan Son, Doi Gai, Nha Nam and Thuy Cau. The area of the plots ranges from 45-775 m2 and have land use right certificates. The value offered by Mr. Nguyen Ngoc Thuy ranges from 680 million to 2.1 billion VND. After deducting the corresponding debt repayment rate, investors need to pay an additional 58-70% of the prescribed value to own.

The remaining debt-paying product line is 12 roughly finished villas at the Wynham SkyLake Resort & Golf Club project (Chuong My, Hanoi). Each villa has an area of 200 m2, valued at 12.6-12.9 billion VND. The debt-paying ratio is set at 43% and not more than 5.3 billion VND per villa, the remaining investors must add more money.

Previously, sharing with VnExpress , Egroup's leader said that by the end of March, more than 300 investors had agreed to swap real estate. This group had selected products, of which 100 were successful swaps.

Egroup did not mention the plan to fulfill financial obligations to investors who do not agree to debt swap according to the four options mentioned above. However, in the recent announcement, Mr. Nguyen Ngoc Thuy continued to ask for a delay in the payment of principal and interest. The company is determined to focus all cash flow on reviving business operations. Although 33 centers have been opened, this English teaching chain still "needs a lot of costs" to reopen the remaining centers, thereby ensuring stable cash flow to pay back investors.

For the same reason, Apax Leaders also sent a notice to parents, hoping to receive sympathy and support. "We would like to not handle any single withdrawal cases during the system improvement phase," the notice stated.

On the stock market, IBC shares of Apax Holdings Investment Joint Stock Company - the only listed subsidiary in the Egroup ecosystem, have just been transferred from controlled to restricted trading. The Ho Chi Minh City Stock Exchange (HoSE) said the reason was that the company was 45 days late in submitting its 2022 audited financial report. Previously, Apax Holdings was also warned for late submission of its annual report. In addition, IBC has not yet announced its first quarter financial report.

Siddhartha

Source link

![[Photo] April Festival in Can Tho City](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/bf5ae82870e648fabfbcc93a25b481ea)

![[Photo] Unique folk games at Chuong Village Festival](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/cff805a06fdd443b9474c017f98075a4)

![[Photo] Opening of the 11th Conference of the 13th Party Central Committee](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/f9e717b67de343d7b687cb419c0829a2)

Comment (0)