Please ask about some new regulations on compulsory motorbike insurance from September 6, 2023 in Decree 67/2023/ND-CP? - Reader Hoa Binh

|

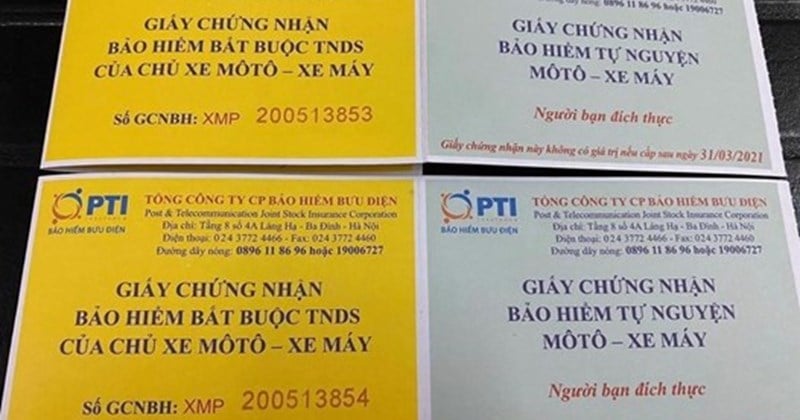

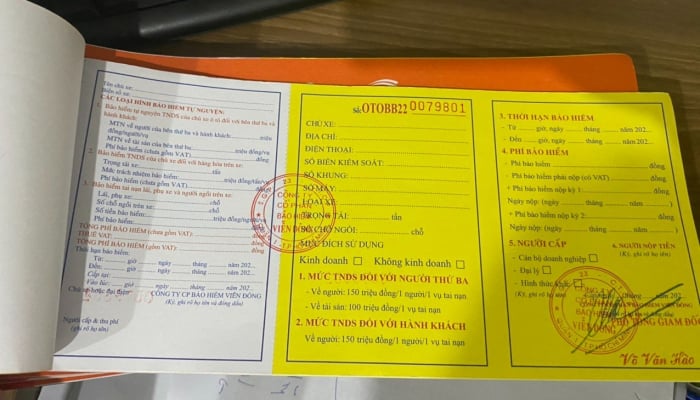

| New regulations on compulsory motorbike insurance from September 6, 2023 in Decree 67/2023/ND-CP. (Source: TVPL) |

On September 6, 2023, the Government issued Decree 67/2023/ND-CP regulating compulsory insurance for vehicle owners, compulsory fire and explosion insurance, and compulsory insurance in construction investment activities.

In particular, there are many new regulations related to compulsory insurance for motorbike and scooter owners (in fact, often called compulsory motorbike insurance), for example:

Effect of compulsory motorcycle insurance when transferring vehicle ownership

- New regulation: During the validity period stated on the Insurance Certificate, if there is a transfer of vehicle ownership, the old vehicle owner has the right to terminate the insurance contract according to the provisions of Article 11 of Decree 67/2023/ND-CP.

- Old regulation: During the validity period stated on the Insurance Certificate, if there is a transfer of vehicle ownership, all insurance benefits related to the civil liability of the old vehicle owner will remain valid for the new vehicle owner.

Regulations on advance compensation when it is not yet determined that the accident is within the scope of compensation for damages

Point b Clause 3 Article 12 Decree 67/2023/ND-CP stipulates the level of advance compensation for damage to health and life in cases where it is not yet determined whether the accident is within the scope of compensation for damage as follows:

- 30% of the prescribed insurance liability limit for one person in an accident in the event of death and an estimated injury rate of 81% or more.

(Previously, the advance payment was 30% of the prescribed insurance liability level/person/case in case of death)

- 10% of the prescribed insurance liability limit for one person in an accident for cases where the estimated injury rate is from 31% to less than 81%.

(Previously, the advance payment was 10% of the prescribed insurance liability level/person/case for cases of body part injury that required emergency treatment)

After making an advance payment, the insurance company has the right to request the Motor Vehicle Insurance Fund to refund the advance payment in case the accident is determined to be excluded from insurance liability or not covered by insurance.

New regulations on insurance claim records

Pursuant to Article 13 of Decree 67/2023/ND-CP, the vehicle owner's compulsory civil liability insurance claim file includes the following documents:

(1) Claim document. (Previously not specified)

(2) Documents related to the motor vehicle and driver (Certified copy of the original or Copy certified by the insurance company after comparison with the original or photocopied copy):

- Vehicle registration certificate (or a certified copy of the original Vehicle registration certificate with the original valid Receipt from the credit institution, in lieu of the original Vehicle registration certificate during the period the credit institution holds the original Vehicle registration certificate) or vehicle ownership transfer documents and vehicle origin documents (in case there is no Vehicle registration certificate).

- Driving license.

- Identity card or Citizen Identification card or Passport or other identification documents of the driver.

- Insurance certificate.

(3) Documents proving damage to health or life (Copies from medical facilities or copies certified by the insurance company after comparison with the original or photocopies). Depending on the extent of damage to people, one or more of the following documents may be included:

- Certificate of injury.

- Medical records.

- Extract of death certificate or Death certificate or confirmation document of the police agency or forensic examination result of the forensic examination agency in case the victim died in a vehicle or died in an accident.

(4) Documents proving damage to property:

- Valid invoices, documents or evidence proving the repair or replacement of damaged property caused by the accident (in case the insurance company carries out repairs or damages, the insurance company is responsible for collecting these documents).

- Documents, invoices, and vouchers related to the costs incurred by the vehicle owner to minimize losses or to follow the instructions of the insurance company.

(5) Copies of relevant documents of the police agency in accidents causing death to third parties and passengers or in cases where it is necessary to verify that the accident was caused entirely by the fault of the third party, including: Notice of investigation results, verification, and settlement of the accident or Notice of conclusion of investigation and settlement of the accident.

(6) Minutes of assessment by the insurance company or the person authorized by the insurance company.

(7) Court decision (if any). (Previously not specified)

The policyholder and the insured are responsible for collecting and sending to the insurance company the documents specified in items (1), (2), (3), (4) and (7) above. The insurance company is responsible for collecting the documents specified in items (5) and (6) above.

See details in Decree 67/2023/ND-CP effective from September 6, 2023.

Source

Comment (0)