"Tradition" does not disclose information

Prosperity and Development Joint Stock Commercial Bank (PGBank - UPCoM: PGB) was recently fined VND157.5 million by the State Securities Commission for a series of information disclosure violations.

The bank has not disclosed information within the time limit prescribed by law regarding a number of Board of Directors (BOD) Resolutions, reports related to bonds, etc.

At the same time, PGBank has disclosed information with incomplete content according to legal regulations in the Corporate Governance Report for 2022 and 2023.

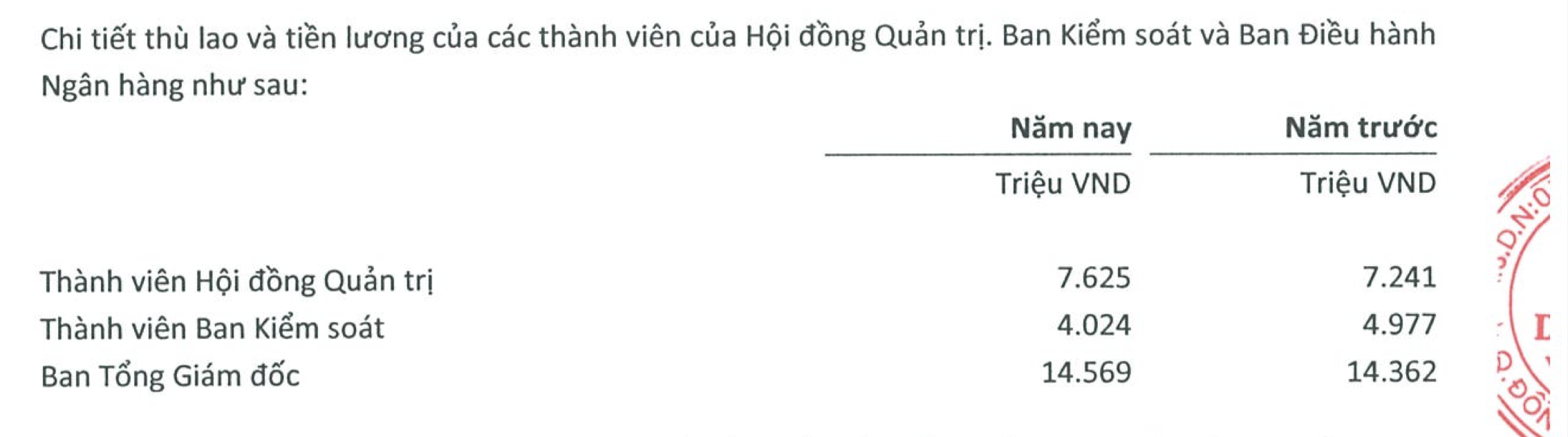

The bank also did not include the remuneration of each member of the Board of Directors, the salary of the General Director (Director) and other managers as a separate item in the Audited Financial Statements for 2022 and 2023.

The difference between PGBank's remuneration announcement and other banks' in the financial statements.

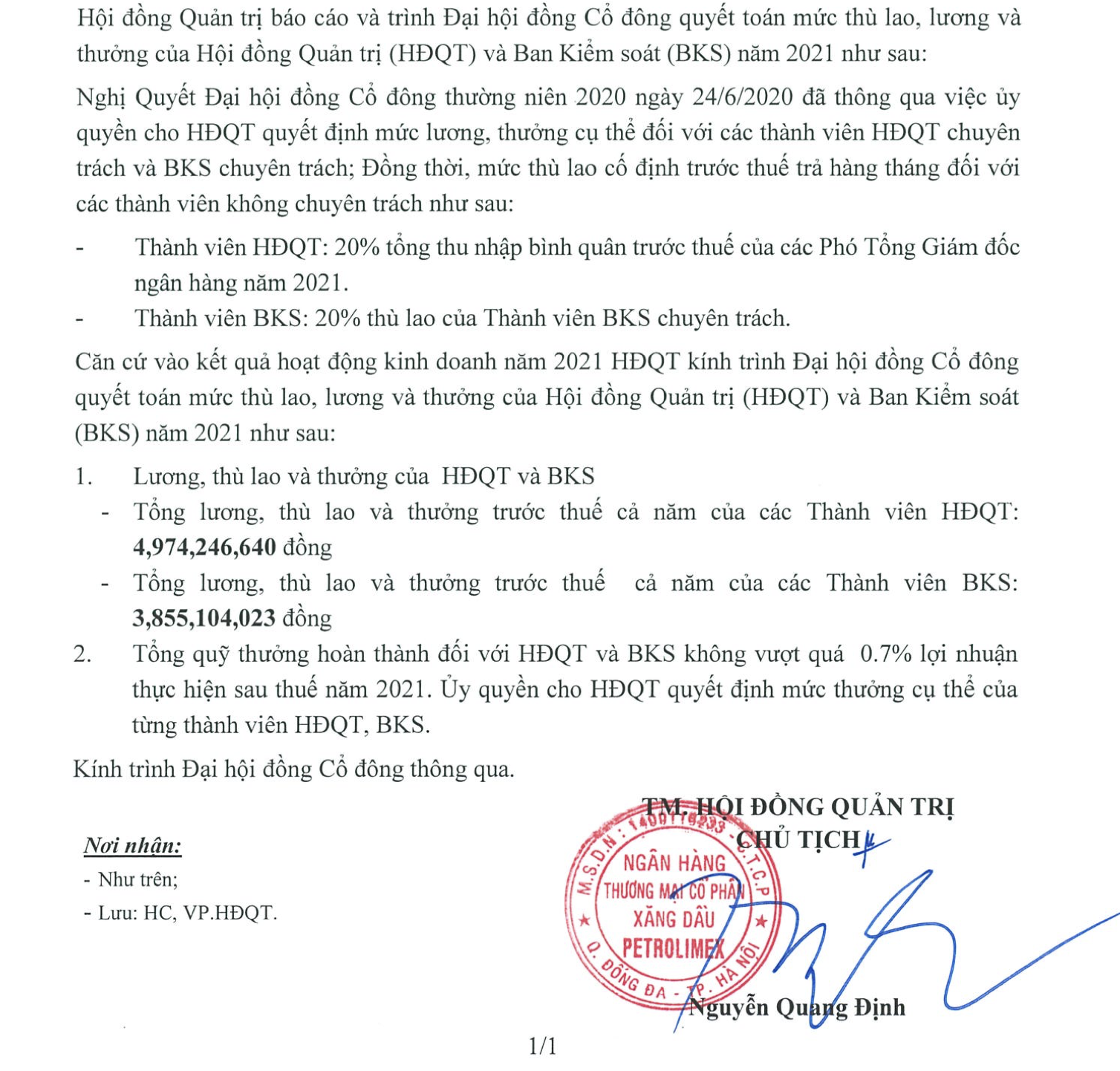

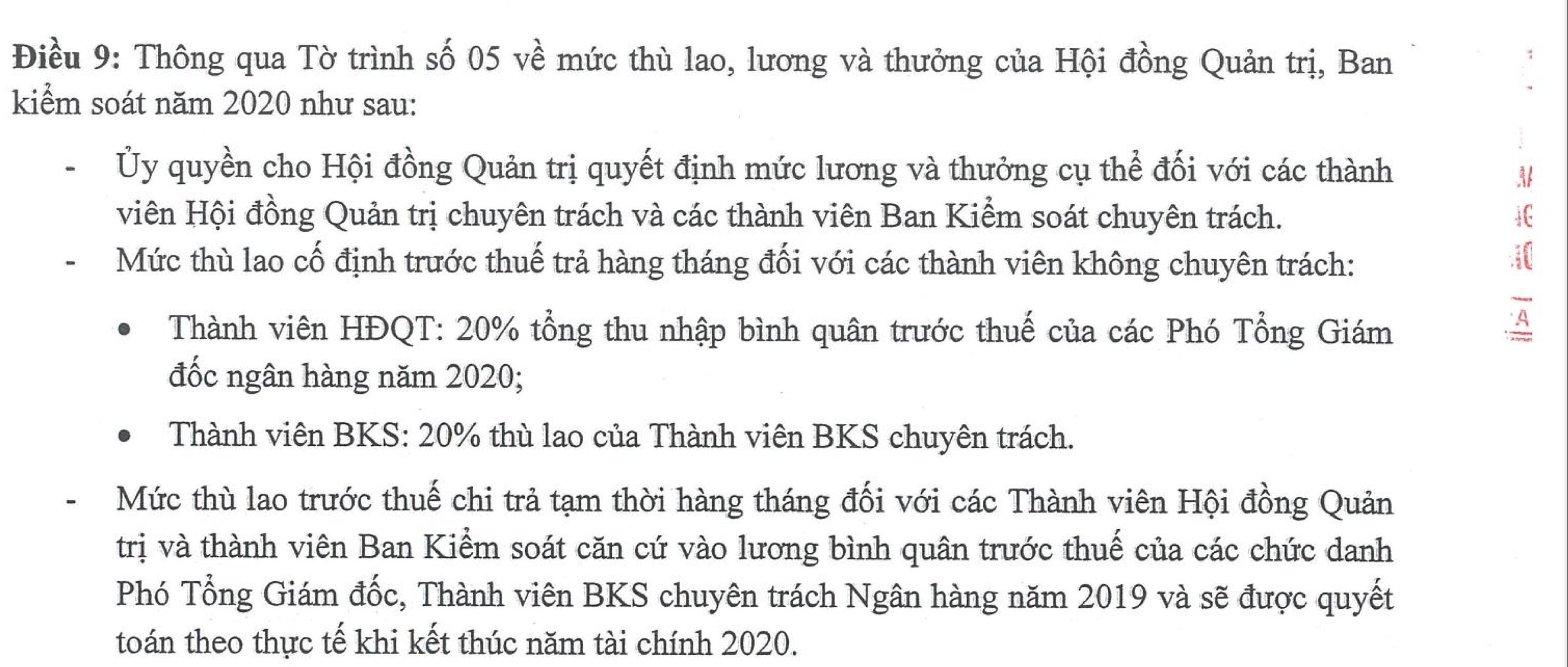

In fact, since 2020, when it started listing on UPCoM, the content related to members' remuneration has not been clearly disclosed in PGBank's documents.

Apart from the information on remuneration of the Board of Directors and the Board of Supervisors announced in the Report to the General Meeting of Shareholders, other documents of PGBank do not mention the remuneration of senior personnel.

From July 1, the amended Law on Credit Institutions will take effect. It stipulates that shareholders owning 1% or more of charter capital must disclose information.

Also on July 1, PGBank announced the provision and public disclosure of information on shareholders owning more than 1% of the bank's charter capital, according to regulations in Clause 2, Article 49, Law on Credit Institutions 2024.

Accordingly, shareholders owning 1% or more of charter capital must provide information on their full name; personal identification number; nationality, passport number of foreign shareholders; business registration certificate number or equivalent legal documents of organizational shareholders; date of issue, place of issue of this document or change of information about related persons.

The deadline for information disclosure is 7 working days from the date of occurrence or change of information. Up to now (July 18), PGBank has not yet disclosed any additional information about shareholders owning more than 1% of the bank's charter capital.

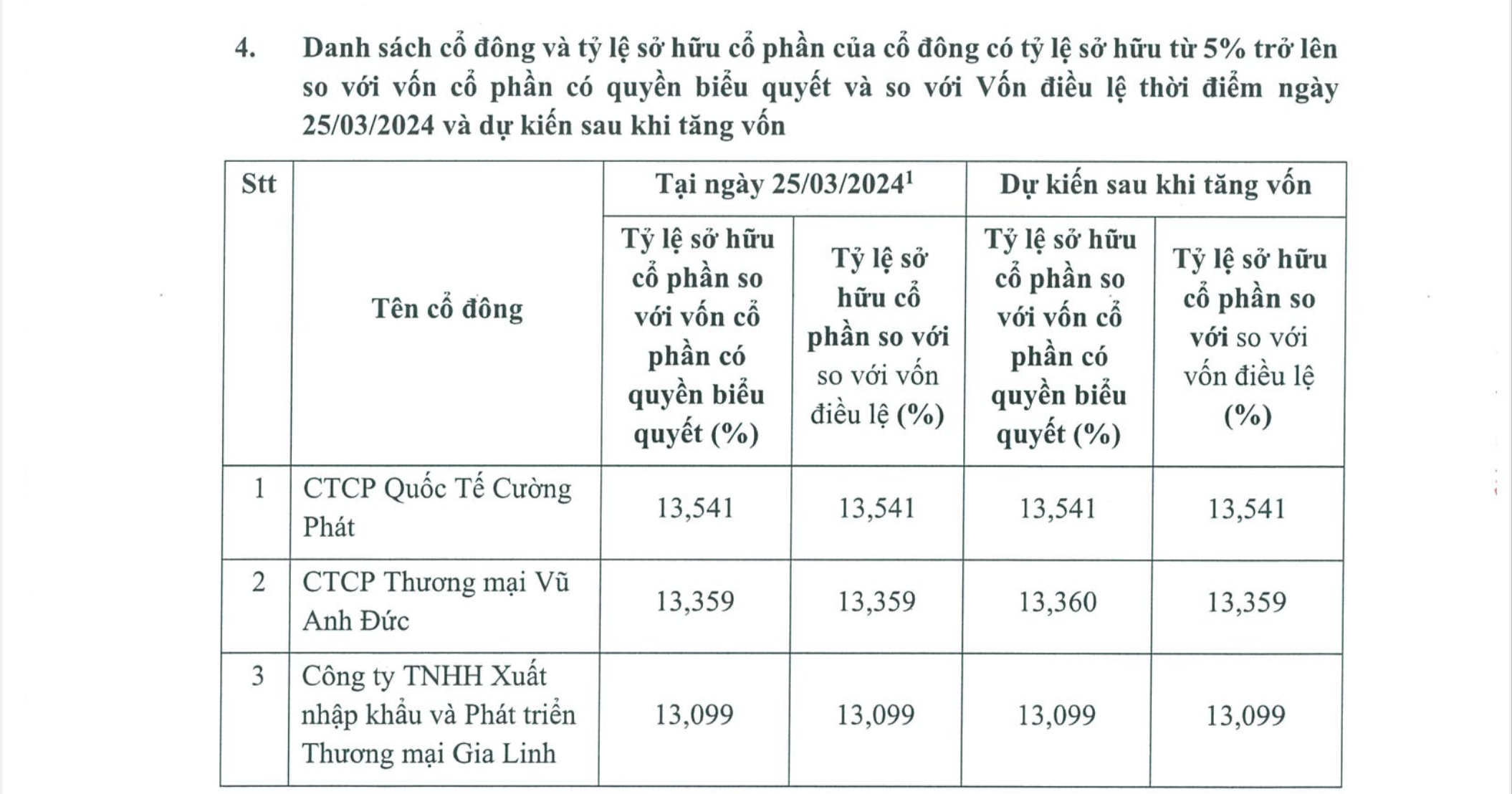

3 strategic shareholders all own over 10% of capital

Notably, PGBank's three strategic shareholders all own more than 10% of the charter capital. Specifically, Gia Linh Import-Export and Trade Development Company Limited owns 13.099% of the capital.

Cuong Phat International JSC owns 13.541% of voting shares. Vu Anh Duc Trading JSC owns 13.359%.

Ownership ratio of 3 strategic shareholders announced by PGBank.

In 2024, although PGBank plans to increase its charter capital by a maximum of VND800 billion, from VND4,200 billion to VND5,000 billion through a public offering of shares to existing shareholders. However, in the bank's charter capital increase document, the above ratio is expected to remain unchanged.

This is not consistent with the provisions of Clause 2, Article 63 of the current Law on Credit Institutions (amended). Specifically, an organization shareholder is not allowed to own shares exceeding 10% of the charter capital of a credit institution.

According to the transitional regulations, these shareholders of PGBank in Clause 11, Article 210 of the Law on Credit Institutions 2024, shareholders, shareholders and related persons owning shares exceeding the share ownership ratio prescribed in Article 63 of this Law may continue to maintain shares but may not increase shares until they comply with the provisions on share ownership ratio as prescribed in this Law, except in the case of receiving dividends in shares.

Regarding the 3 strategic shareholders at PGBank, this group of shareholders appeared after Petrolimex divested all 40% of its capital at this bank.

According to Nguoi Dua Tin 's investigation, 2 out of the 3 legal entities above are related to Thanh Cong Group (TC Group). Specifically, the Chairman of the Board of Directors of Vu Anh Duc Trading Joint Stock Company updated to mid-2022 is Mr. Vu Van Nhuan. At that time, Mr. Nhuan was the Director of TCHB Company Limited - a subsidiary of TC Viet Hung Technology Complex Industrial Park Joint Stock Company.

Chairman of the Board of Directors and General Director of Cuong Phat International JSC, Mr. Nguyen Van Manh, is a founding shareholder of PL International JSC - a legal entity owned by businessman Nguyen Anh Tuan's family, in which Mr. Nguyen Toan Thang - Mr. Tuan's younger brother owns 40%; Ms. Nguyen Hong Hanh, Mr. Thang's wife, owns 50%.

The total ownership ratio at PGBank of the above two shareholders is 26.9% while the regulation in the new Law on Credit Institutions is that shareholders and related persons of that shareholder cannot own shares exceeding 15% of the charter capital of a credit institution.

In the near future, does PGBank have any plans to reduce the ownership ratio of the above shareholders? This coming August, the bank plans to hold an extraordinary General Meeting of Shareholders, but the content of the General Meeting of Shareholders documents only plans to elect additional independent members of the Board of Directors for the 2020-2025 term.

"Change skin" after the appearance of TC Group

After welcoming a new group of shareholders, many major changes have taken place at PGBank. The bank has officially changed its commercial name to Prosperity and Growth Commercial Joint Stock Bank, abbreviated as PGBank.

At the same time, the new brand identity was changed with the center of the logo replaced by a stylized S.

PGBank changes brand identity.

In addition, after more than a decade of silence, PGBank officially plans to increase its charter capital by issuing shares. In March 2024, the bank completed the distribution of 120 million bonus shares to shareholders, expanding its capital scale from VND 3,000 billion to VND 4,200 billion.

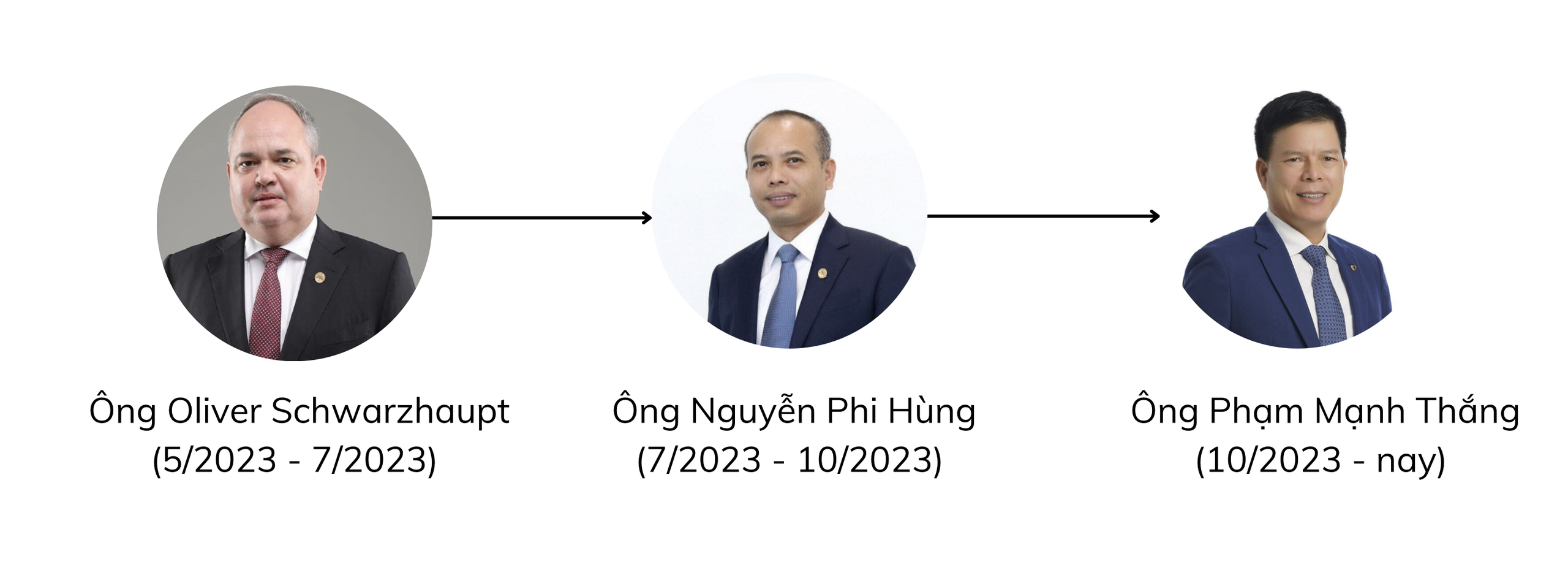

The bank's senior staff also changed constantly. In just 5 months, the bank changed 3 Board Chairmen.

PGBank Chairman through the ages.

In addition, a notable name appearing on the Board of Directors of PGBank is Vice Chairman Dao Phong Truc Dai. Mr. Dao Phong Truc Dai was an independent member of the Board of Directors of Eximbank, representing the Thanh Cong Group.

In addition, Mr. Dai has held many key positions at Thanh Cong "family" enterprises such as Financial Director of Thanh Cong Technical Service Joint Stock Company, General Director of Thanh Cong Viet Hung Technology Complex Industrial Park Joint Stock Company, General Director of PV-Inconess Investment Joint Stock Company...

At the General Meeting of Shareholders last April, when asked about Thanh Cong Group's role in PGBank, how Thanh Cong will support PGBank's restructuring and whether the Thanh Cong Group ecosystem is an advantage for the bank, PGBank's Board of Directors said that Thanh Cong Group is one of PGBank's strategic partners.

Therefore, the company will participate as a supporting partner, cooperating in the bank's business activities.

When answering about the different products and services compared to other banks in the market, the bank representative also said that it will make tailor-made products for individual customers of strategic partners such as TC Group, Petrolimex and related ecosystem groups.

At the same time, the bank focuses on guaranteeing/lending Hyundai car dealership products manufactured, assembled and distributed in Vietnam by TC Group.

PGBank also plans to change its headquarters location to HEAC Building No. 14-16 Ham Long, Phan Chu Trinh Ward, Hoan Kiem, Hanoi.

According to the introduction on the website of Thanh Cong Asset Management and Services Company Limited, a member of Thanh Cong Group, the investor of HEAC building is Thanh Cong Group.

Information about Ham Long building on PSC website.

In the financial report for the first quarter of 2024 of DSC Securities Corporation, a company related to TC Group, it shows that this company has a short-term loan of VND 546 billion at PGBank, an increase of more than 21% compared to VND 450 billion at the beginning of the year.

In May 2024, DSC also announced the decision of the Chairman of the Board of Directors to approve the credit contract at PGBank. Accordingly, PGBank will lend DSC VND 600 billion for a maximum period of 12 months for the purpose of supplementing working capital for the company's business and investment activities.

The current Chairman and major shareholder at DSC Securities is Mr. Nguyen Duc Anh, son of Mr. Nguyen Quoc Hoan - Chairman of Thanh An Group. Mr. Duc Anh is also the nephew of Mr. Nguyen Anh Tuan, Chairman of Thanh Cong Group (TC Group).

Source: https://www.nguoiduatin.vn/pgbank-hau-doi-chu-va-nhung-bai-toan-kho-giai-tu-luat-tctd-2024-204240716191010575.htm

Comment (0)