In order to complete the 2025 state budget revenue estimate in the province, the Tax Department of Region XIII has implemented many solutions to manage revenue, prevent revenue loss, recover tax arrears and create favorable conditions for people and businesses to fulfill their tax obligations. Thanks to that, the domestic budget revenue in the first quarter of 2025 in the province managed by the department reached and exceeded the same period last year.

4.3% above estimated progress

Since the beginning of the year, the Tax Department of Region XIII has focused on synchronously implementing tax management measures, promptly responding to new fluctuations in the situation, supporting taxpayers, strengthening inspection and examination to prevent tax losses, tax evasion and tax debts. As of March 31, the total amount of tax arrears in Khanh Hoa province is estimated at more than VND 1,967 billion, down 28% compared to December 31, 2024 (VND 2,731 billion). In addition, the Tax sector closely monitors, evaluates and analyzes each locality, region and tax type to have a plan to direct and manage timely collection; focuses on directing tax teams to regularly review and analyze newly arising revenue sources, with room for improvement and the production and business situation to have appropriate management measures.

|

| Business activities at a supermarket in Nha Trang. |

According to the report of the Tax Department of Region XIII, in the first quarter, the unit collected domestic budget in Khanh Hoa province of VND 6,161 billion (data up to April 4), reaching 29.3% of the ordinance estimate (exceeding the estimate progress by 4.3%) and equal to 154.3% compared to the same period last year. The revenue exceeding the estimate mainly comes from the non-state-owned enterprise sector, foreign-invested enterprises, personal income tax, environmental protection tax... Specifically: Vinpearl Nha Trang Joint Stock Company and VinWonders Nha Trang Joint Stock Company have paid extended value-added tax (VAT) and provisionally paid corporate income tax in 2024 with the amount of VND 1,281 billion. Some enterprises have provisionally paid corporate income tax from real estate transfer activities such as: Vinpearl Nha Trang Joint Stock Company paid VND 90.7 billion; KN Cam Ranh Company Limited paid VND 88 billion; VCN Joint Stock Company paid 38.6 billion VND; Nhat Tien Investment, Trade and Service Joint Stock Company paid 36 billion VND from selling fixed assets...

Along with striving to complete the budget revenue estimate, the Tax Department of Region XIII also promptly implemented policies of the National Assembly, the Government and the Ministry of Finance to support businesses and taxpayers such as: Reducing environmental protection tax on gasoline, oil, and grease; reducing VAT. Accordingly, in the first quarter of 2025, it is estimated that environmental protection tax in the province will be reduced by VND 171 billion according to Resolution No. 60/2024 of the National Assembly; reducing VAT by VND 174 billion according to Resolution No. 180/2024 of the Government, regulating VAT reduction policy according to Resolution No. 174/2024 of the National Assembly.

Boosting land revenue

In addition to the achieved results, tax management in the province is still facing many difficulties, especially in collecting land use fees and land rents for projects in the province. According to the plan, land revenue in the first quarter of 2025 is expected to be 1,785 billion VND. However, by the end of the first quarter, this revenue was only 305 billion VND, reaching 4.3% of the plan set by the Provincial People's Committee. The revenue mainly arises from the number of land auction records and land use rights transfers in localities. Of which, the revenue shortfall of 1,480 billion VND is mainly land use fees and land rents from projects that have not been collected yet.

|

| Business activities at a supermarket in Nha Trang. |

According to Mr. Pham Hoai Trung - Deputy Head of the Tax Department of Region XIII, in order to complete the budget revenue estimate for the second quarter and the whole year of 2025 in the province, in the coming time, the Tax Department of Region XIII will direct specialized departments to focus on implementing new tax policies issued since the beginning of the year, in order to promptly support and accompany taxpayers in the context of complicated changes in the domestic and world economy; especially policies to reduce environmental protection tax, VAT, special consumption tax on domestically assembled cars and policies to extend tax and land rent payment in 2025. In addition, continue to promote debt collection and tax debt enforcement measures, strive to reduce the debt from the previous year to 2025; monitor outstanding projects in the area that have budget obligations; Coordinate with relevant departments, agencies and sectors to resolve outstanding issues in order to promptly mobilize revenue from land use fees and land rents; closely coordinate with relevant agencies to grasp the situation of mineral resource exploitation in the province to request taxpayers to declare and pay taxes in accordance with the exploitation output, especially for expressway projects, inter-regional roads, industrial parks... On the other hand, strengthen coordination with local authorities and tax advisory councils of communes and wards to review and fully update the quantity, scale and business lines in the area; strictly manage cases of change in business scale, cessation of operations or new business start-ups; promote propaganda and guidance for taxpayers to use electronic invoices from cash registers; check the use of invoices to prevent fraud...

Regarding the task of collecting state budget revenues from land, in 2025, the target for collecting land use fees and land rent is 10,703 billion VND. In the first two quarters of the year alone, it is expected to collect 4,185 billion VND; of which, the first quarter is expected to be 1,785 billion VND, the second quarter is 2,400 billion VND. However, the land revenues from the first quarter that have not yet been collected are 1,480 billion VND. Thus, according to the plan, in the second quarter, the total amount to be collected from land use fees and land rent is 3,880 billion VND. In order to complete the task of collecting domestic budget in the second quarter and strive to complete the state budget collection targets in 2025 set by the Provincial Party Committee and the Provincial People's Committee, the Tax Department of Region XIII recommends that the Provincial People's Committee continue to direct relevant departments and branches to further accelerate the progress of implementing the list of land plots for auction of land use rights and projects for collecting land use fees and land rents in 2025 in the province.

CAM VAN

Source: https://baokhanhhoa.vn/kinh-te/202504/no-luc-thu-ngan-sach-noi-dia-4b52264/

![[Photo] Tourists line up to receive special information publications from Nhan Dan Newspaper](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/24/3ac2c0b871244512821f155998ffdd60)

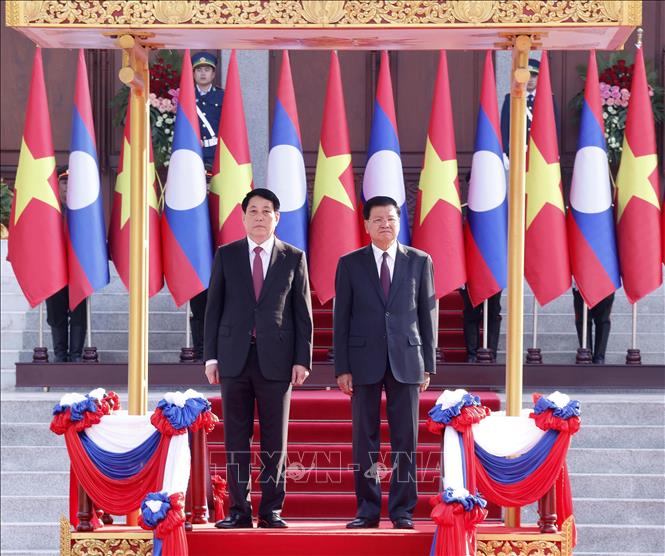

![[Photo] President Luong Cuong holds talks with Lao General Secretary and President Thongloun Sisoulith](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/24/98d46f3dbee14bb6bd15dbe2ad5a7338)

![[Photo] General Secretary To Lam receives Philippine Ambassador Meynardo Los Banos Montealegre](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/24/6b6762efa7ce44f0b61126a695adf05d)

![[Photo] Prime Minister Pham Minh Chinh works with the Academy of Posts and Telecommunications Technology](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/24/83f86984b516422fb64bb4640c4f85eb)

Comment (0)