Approaching the target

To carry out the tasks of budget collection to ensure expenditure in a period, the legal basis is the "compass" for building and implementing the goals. For Nghe An, the National Assembly has issued Resolution No. 36/2021/QH15 on piloting a number of specific mechanisms and policies for the development of Nghe An province; The Government issued an Action Program to implement Resolution No. 39-NQ/TW dated July 18, 2023 of the Politburo on building and developing Nghe An province to 2030, with a vision to 2045. In addition, the province has issued documents directing the operation and management of finance - budget, mechanisms and policies to remove difficulties for businesses, remove bottlenecks, create a stable environment, and mobilize maximum resources to increase state budget revenue.

In the period of 2021 - 2024, the world economy witnessed many major fluctuations due to the impact of the Covid-19 pandemic, military conflicts, and complex natural disasters, causing the global economy to decline. Import and export activities faced many challenges. In particular, gasoline prices continued to fluctuate complicatedly; oil prices increased while this was the main source of raw materials for production and consumption; the situation of supply shortages and interruptions, increased global production and transportation costs, etc. affected all aspects of life.

Faced with difficulties, the Government and the Ministry of Finance have also issued many policies to exempt and reduce taxes, fees, charges, land rents, etc. to support businesses and taxpayers to restore production and business activities and develop the socio-economy, thus significantly affecting the state budget collection in the province.

With flexible and close management, promoting the combined strength, the financial and budget situation of Nghe An has had significant developments and changes. Budget revenue and expenditure (including additional revenue from the central budget) have basically met the socio-economic development goals of the province, gradually improving people's lives, ensuring social order and security.

Through administrative reform, strengthening the role of managing business entities and focusing on directing the collection, exploitation of revenue sources and the fight against tax losses, Nghe An's budget collection has achieved certain results.

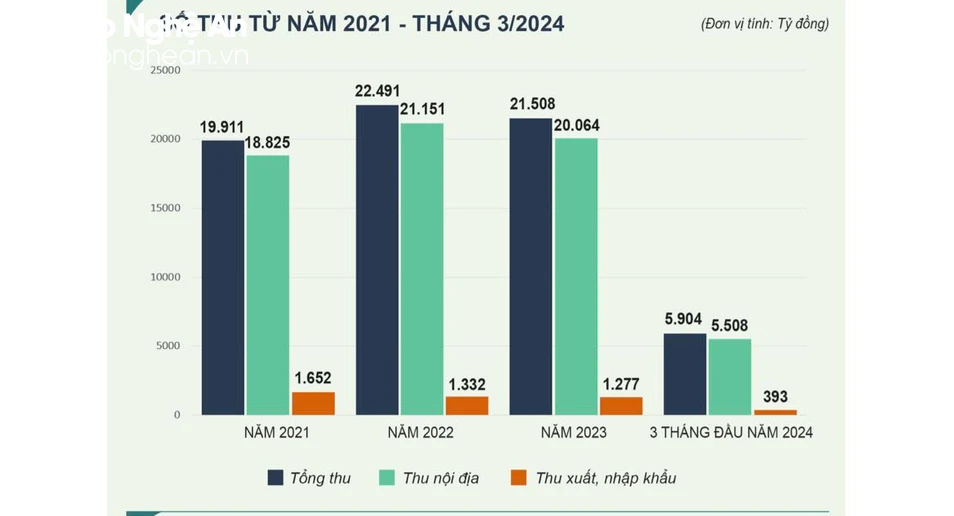

Specifically: In 2021, budget revenue reached VND 19,911 billion, of which domestic revenue reached VND 18,825 billion, equal to 143% of the estimate assigned by the Provincial People's Council and increased by 12% over the same period; revenue from import and export activities reached VND 1,652 billion, equal to 132.2% of the estimate.

2022: Budget revenue reaches VND 22,491 billion, of which domestic revenue reaches VND 21,159 billion, equal to 150% of the estimate assigned by the Provincial People's Council and increases by 13% over the same period; revenue from import and export activities reaches VND 1,332 billion, equal to 102% of the estimate.

2023: Budget revenue reached 21,508 billion VND, of which domestic revenue reached 20,064 billion VND, equal to 135.6% of the estimate assigned by the Provincial People's Council and equal to 96% over the same period; revenue from import and export activities reached 1,277 billion VND, reaching 102.2% of the estimate. The first 4 months of 2024 reached 7,711 billion VND. It can be said that the above results have demonstrated the efforts of the entire political system and of the business classes.

Resolutely implement budget collection

Nghe An clearly identifies budget revenue as a resource to ensure regular expenditure tasks according to plan, allocates capital to implement key projects in addition to public investment capital as committed by the province, such as: Liberation of Vinh International Airport; Bridge connecting National Highway 7C with Cua Lo Deepwater Port; Traffic road connecting Vinh - Cua Lo (phase 2); Coastal road from Nghi Son (Thanh Hoa) to Cua Lo (Nghe An); Road N3 in Hoang Mai Industrial Park; Industrial park infrastructure, drainage system of VSIP - Tho Loc Industrial Park; Inter-commune traffic road from Tay Son to Na Ngoi commune, Ky Son district, ... In addition, it also supports the construction of rural roads, ensuring educational and defense tasks...

However, according to the analysis of the budget management agency: The structure of state budget revenue in Nghe An is not really sustainable, in which revenue from land use fees accounts for a large proportion and tends to increase, while state budget revenue from production and business activities tends to decrease.

Specifically: In 2021, the proportion of revenue from production and business activities will reach 37%, land use fees will reach 31% of total domestic revenue. In 2022, the proportion of revenue from production and business activities will reach 34%, land use fees will reach 37% of total domestic revenue. In 2023, the proportion of revenue from production and business activities will reach 36%, land use fees will reach 41.9% of total domestic revenue.

Key enterprises such as beer and hydropower, which are large budget contributors, continue to face difficulties due to consumption trends and beer consumption continuing to decline; increasingly severe weather. Dairy companies have been producing and operating at full capacity, unable to increase state budget revenue. New projects that have come into operation have not generated revenue as expected: Hoa Sen Steel Company, MDF wood, VSIP...

Ms. Nguyen Thi Trang - Head of the General Department of Estimates of Nghe An Tax Department, added: The National Assembly and the Government issued many policies on tax, fee, and charge exemption, reduction, and extension... to remove difficulties for businesses and taxpayers due to the Covid-19 pandemic, which has simultaneously reduced the state budget revenue in the province from 2021-2023 by about more than 2,500 billion VND.

Some businesses enjoy corporate income tax incentives or trade in tax-free items or 0% tax rates (animal feed production units), or Korean garment processing units that mainly export... so they do not incur value added tax.

To increase budget revenue in the coming time, according to the leader of Nghe An Tax Department: The province continues to effectively implement the State Budget Law and the Tax Administration Law. Resolutely carry out the state budget collection work, striving to complete the assigned revenue estimate at the highest level in 2024 and 2025. Ensure coverage of all revenue sources, improve tax management capacity to prevent and combat tax evasion, tax losses and tax debts, implement electronic tax management, risk management, protect legitimate rights as well as create a favorable, clear and transparent environment for taxpayers.

At the same time, strengthen tax inspection and examination, handle tax arrears, and ensure correct and sufficient collection.

The Tax sector applies modern information technology and reforms administrative procedures in budget collection. Departments, branches and localities review, simplify and reduce the time for carrying out administrative procedures; promote the responsibility of leaders in directing administrative reform work.

Localities closely monitor the progress of budget collection, evaluate and analyze each locality, each area, each tax, and advise the Provincial Party Committee, People's Council, and Provincial People's Committee on measures to collect state budget to complete and exceed the assigned estimate.

Departments, branches, sectors and localities also continue to promote the exploitation of revenue from land funds. Continue to synchronously implement solutions to attract investment in key projects in the province, create all favorable conditions for investors to speed up the implementation of projects that have been started, promote work related to project implementation...

Source

Comment (0)