China's consumer price index (CPI) fell 0.3 percent year-on-year in December after a 0.5 percent decline in November, the National Bureau of Statistics said on Jan. 12. Meanwhile, the annual CPI remained positive at 0.2 percent, its lowest level in 13 years, highlighting the problems Beijing faces that are very similar to Tokyo's "lost decade" - which was accompanied by deflation, a property slump and a demographic crisis.

The producer price index (PPI), a measure of the cost of goods at factories, fell for the 15th consecutive month in December and was down 2.7% from a year earlier.

|

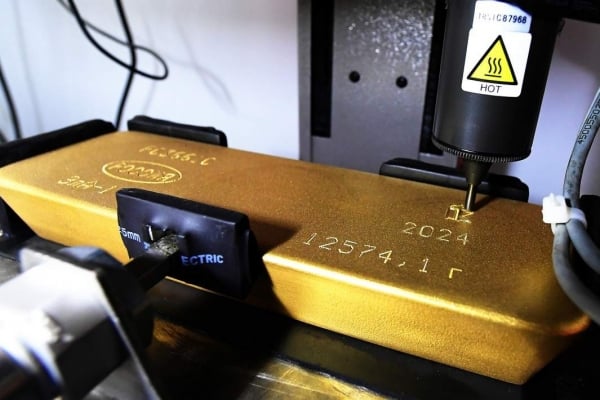

| China's consumer price index fell for a third straight month in December, raising concerns about deflation. (Source: EPA-EFE) |

Deflation fears

Chinese policymakers have long viewed inflation as a constant threat and have consistently targeted annual consumer price growth at 3% over the past decade. But many economists say this thinking needs to change because deflation is even more dangerous for the economy, especially at a time of low confidence and weak demand.

“Policymakers should realize that deflation will cause damage. China should pay more attention to this situation,” Wang Tao, chief China economist at UBS, said at a forum in Shanghai on Jan. 8.

The Swiss bank forecasts that China's CPI will rise 0.8% in 2024. Li Xunlei, chief economist at Zhongtai Securities, said China should consider setting a lower limit of no less than 1% for consumer inflation to raise market expectations.

Beijing is expected to announce inflation and gross domestic product targets, as well as budget deficit ratios and local bond quotas, in the premier's work report to the National People's Congress in early March this year.

China has shown the same large gap between producer and consumer prices as seen in Japan decades ago, said Alicia Garcia-Herrero, chief economist for Asia-Pacific at Natixis, warning that deflation could hit wages and the household sector.

“Without productivity, wages need to fall because there is no reason to pay workers more if productivity is falling. China’s negative wage growth in the final quarter of 2023 is a sign that deflationary pressures may become entrenched,” he said.

The average salary for new employees in 38 major cities fell 1.3 percent year-on-year to 10,420 yuan ($1,458) in the fourth quarter, data from online job portal Zhilian Zhaopin showed.

Historically, China has experienced three periods of falling consumer prices in the past 25 years, two of which coincided with financial crises.

The first, a 22-month slump that began in early 1998, was largely the result of Beijing's monetary tightening to rein in bad debts, coupled with falling external demand following the Asian financial crisis.

In 2002, a year after China joined the World Trade Organization, there was a brief period of deflation, as the influx of foreign companies improved productivity and reduced costs.

The threat of deflation returned in 2009, when the global financial crisis hit Chinese exporters.

Government action

In response to the latest concerns, Beijing has announced a series of measures since last summer to support the economy.

But the recovery remains fragile as China's property market struggles, the private sector remains weak, pressure to create jobs is high and price inflation remains low.

The government's efforts to tackle low inflation and a sluggish economy have raised market expectations for further policy easing.

Stronger fiscal spending and looser monetary policy are seen as effective measures to boost domestic demand as the export outlook faces uncertainties, while addressing overcapacity will ease pressure on prices.

Beijing is well aware of this risk. At the Central Economic Work Conference in December 2023, it acknowledged deflationary pressures for the first time, stating that “total social financing and money supply must be consistent with economic growth and price targets.”

Larry Hu, chief China economist at Macquarie, said monetary policy could be more accommodative going forward.

“The Conference’s recognition of deflation implies that there will be more cuts to policy rates and reserve requirements in the coming months,” he predicted.

(according to SCMP)

Source

Comment (0)