Accordingly, many opinions predict that gasoline prices may decrease by 400 VND/liter at most, and oil prices may decrease by 250 VND/liter/kg. In this management period, the joint agency of the Ministry of Finance - Industry and Trade is likely to continue not to set aside or use the price stabilization fund.

Gasoline prices tomorrow, November 21, are expected to be adjusted down. (Illustration: Minh Duc).

Meanwhile, according to the gasoline price forecast model of the Vietnam Petroleum Institute (VPI), in the operating period on November 21, gasoline prices will continue to decrease by 0.3 - 1.6% if the Ministry of Finance - Industry and Trade does not set aside or use the gasoline price stabilization fund.

Specifically, VPI forecasts that the retail price of E5 RON92 gasoline may decrease by VND255 (1.3%) to VND19,195/liter, while the price of RON95 gasoline may decrease by VND201 (1%) to VND20,399/liter. Diesel prices may decrease by up to 1.6% to VND18,277/liter, kerosene prices are forecast to decrease by 0.9% to VND18,804/liter, and fuel oil may decrease slightly by 0.3% to VND15,948/kg.

In the operating period on November 14, the price of E5 RON92 gasoline decreased by 292 VND/liter, not higher than 19,452 VND/liter. The price of RON95 gasoline decreased by 247 VND/liter, not higher than 20,607 VND/liter.

Prices of all types of oil also decreased simultaneously. Of which, diesel price decreased by 344 VND/liter, not higher than 18,573 VND/liter. Kerosene price decreased by 306 VND/liter, not higher than 18,988 VND/liter and fuel oil price decreased by 385 VND/kg, not higher than 16,009 VND/kg.

In this management period, the Ministry of Industry and Trade - Ministry of Finance continued not to set aside or use the petrol price stabilization fund for any products.

At 6:00 a.m. on November 20, Brent crude oil prices increased slightly by 0.01 USD, equivalent to 0.01%, to 73.31 USD/barrel. WTI crude oil prices increased by 0.23 USD, equivalent to 0.33%, to 69.39 USD/barrel.

Oil prices rose as tensions over the Russia-Ukraine conflict escalated late last week. Saul Kavonic, energy analyst at MST Marquee, said that so far, Russian oil exports have had little impact, but oil prices could rise further if Ukraine targets more oil infrastructure.

Also supporting oil prices are supply problems at Kazakhstan's largest oil field, Tengiz. Tengiz's output has been cut by 28% to 30% due to repairs.

Source: https://vtcnews.vn/ngay-mai-gia-xang-dau-trong-nuoc-tiep-tuc-giam-ar908418.html

![[Photo] National Assembly Chairman Tran Thanh Man meets with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/4e8fab54da744230b54598eff0070485)

![[Photo] Ceremony to welcome General Secretary and President of China Xi Jinping on State visit to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/5318f8c5aa8540d28a5a65b0a1f70959)

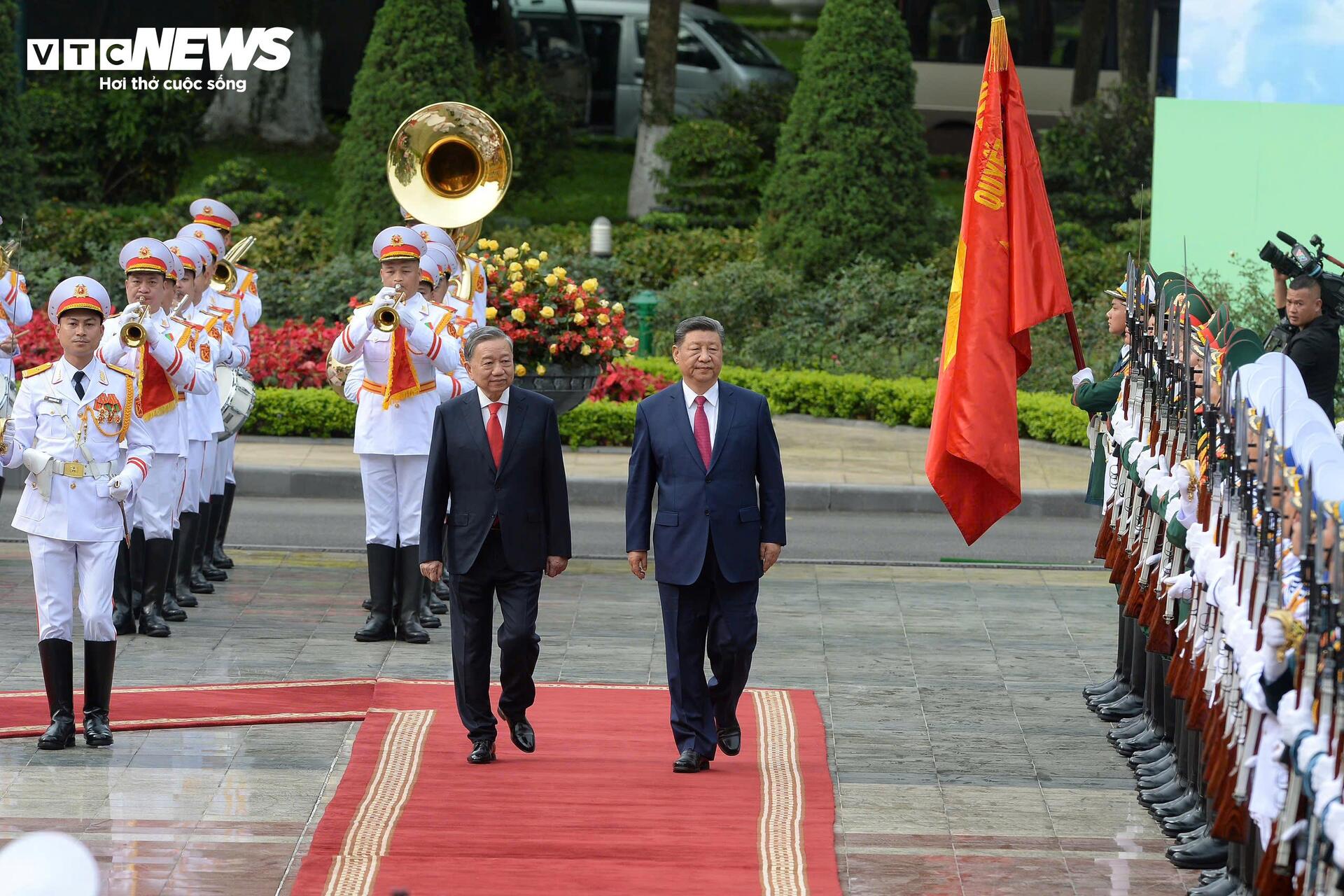

![[Photo] General Secretary To Lam holds talks with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/b3d07714dc6b4831833b48e0385d75c1)

![[Photo] Prime Minister Pham Minh Chinh meets with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/893f1141468a49e29fb42607a670b174)

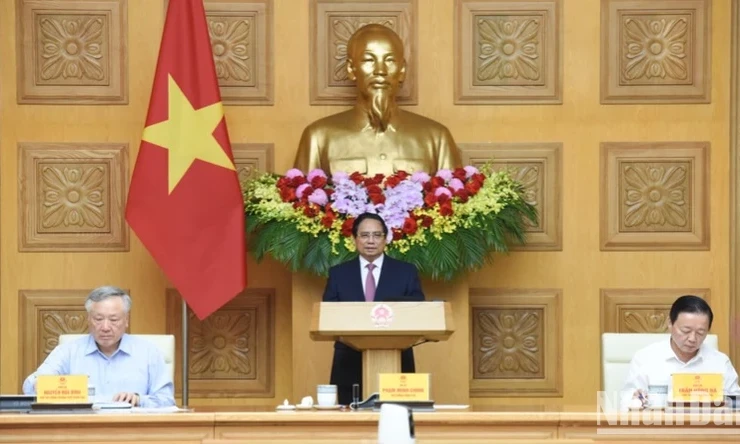

![[Photo] Prime Minister Pham Minh Chinh chairs conference to review the implementation of Resolution No. 18-NQ/TW](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/dcdb99e706e9448fb3fe81fec9cde410)

Comment (0)