What is opening a credit card from a savings book?

Saving is a safe and effective way to accumulate idle money. After depositing, the bank will give the customer a book containing information about the deposit amount, term, applicable interest rate, etc.

Accordingly, owning a savings book is considered a valuable asset. Banks will use that to create conditions for customers to open credit cards instead of having to prove their income.

When opening a credit card using a savings book, the user must sign a mortgage contract with the bank. The bank considers this as collateral.

To register to open a credit card using a savings book, customers must ensure the following conditions:

- Be a Vietnamese citizen aged 18 or older

- Have deposits at the bank and be issued a savings book according to bank regulations.

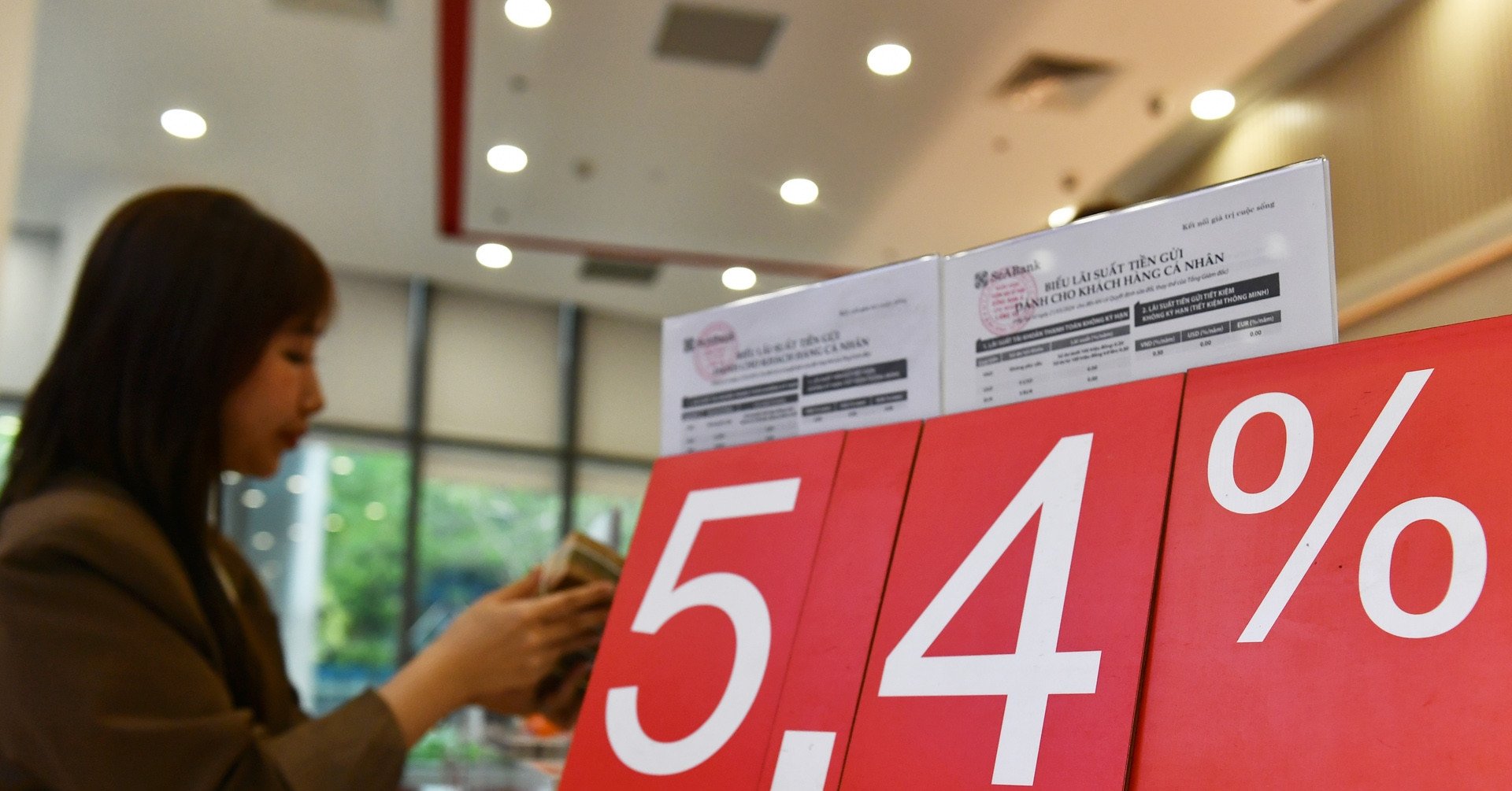

- Depending on the conditions of each bank, the savings book must be active for 4 - 6 months with a minimum balance of 20 million VND/month or according to the bank's own regulations.

Illustration

Documents and procedures for opening a credit card from a savings book

Application for opening a credit card from a savings book includes the following documents:

- Credit card application form with contract provided by the bank.- Identity documents: ID card/CCCD/Passport

- Photocopy of savings book notarized by state agency.

- The mortgage contract has full information and signature of the owner or beneficiary of the property on the book.

- Labor contract, business registration certificate...

Process of opening a credit card with a savings book

To complete the credit card application process, customers need to follow these steps:

- Bring documents to the nearest branch or transaction office to request to open a credit card using a savings book.

- Fill out the credit card application form and submit it to the bank.

- Submit relevant documents as required by the bank

- The teller collects relevant fees before issuing the card and issues a receipt for the card pick-up date.

Minh Huong (synthesis)

Source

![[Photo] Unique folk games at Chuong Village Festival](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/cff805a06fdd443b9474c017f98075a4)

![[Photo] Phuc Tho mulberry season – Sweet fruit from green agriculture](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/1710a51d63c84a5a92de1b9b4caaf3e5)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to discuss tax solutions for Vietnam's import and export goods](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/19b9ed81ca2940b79fb8a0b9ccef539a)

Comment (0)