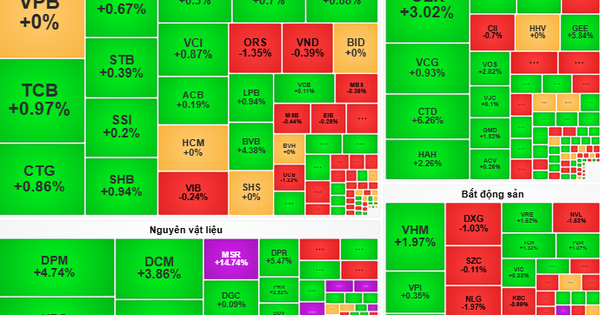

The stock market in the third quarter of this year did not move very positively. The securities company's proprietary trading sector also had significant fluctuations.

Self-trading contributes significantly to securities companies' profits - Photo: QUANG DINH

Proprietary trading is comprised of financial assets at fair value through profit or loss (FVTPL), held-to-maturity (HTM) investments and available-for-sale (AFS) financial assets.

By the end of the third quarter of this year, the value of securities companies' proprietary assets reached about VND242,400 billion, an increase of 10% compared to the end of last year.

Vietcap closes stock profit

Each company with its own taste will have different allocations. For example, at Vietcap Securities (VCI) chaired by Ms. Nguyen Thanh Phuong, profit-taking activities have reduced the size of AFS assets by about 21% compared to the beginning of the year.

Based on the purchase price, VCI's AFS value at the end of the third quarter was VND3,625 billion, while at the beginning of the year it was VND4,594 billion.

In the third quarter, VCI sold out some stocks such as Masan's MSN and MBBank's MBB. VCI reduced its investment proportions for stocks such as KDH of Nha Khang Dien, PNJ, and STB of Sacombank.

On the contrary, VCI increased its investment in TDM of Thu Dau Mot Water JSC, FPT... Ms. Phuong's company also increased its bond investment to 540 billion VND.

Overall, VCI is still a "lucky" unit in the self-trading sector when the listed securities portfolio is estimated to earn a profit of about 2,700 billion VND, equivalent to an increase of more than 90% compared to the purchase price.

In the listed securities portfolio, with a purchase price of 663 billion VND but a market price of up to 851 billion VND, VCI also estimated a profit of more than 187 billion VND.

Q3-2024 reported a profit after tax of VND 215 billion, up 20% over the same period, VCI said that the company has realized profits from a number of investments, so revenue from FVTPL assets increased sharply...

Another securities company also has a strong proprietary trading segment with "stock trading" like VIX Securities.

The third quarter 2024 financial report shows that VIX's EVTPL financial asset portfolio increased from VND 5,438 billion at the beginning of the year to VND 8,726 billion at the end of September.

VIX poured heavily into listed stocks with VND3,457 billion, accounting for 40% of the portfolio, while unlisted stocks, investment trusts and bonds accounted for 7%, 22% and 31% respectively.

The report does not explain in detail the stocks and bonds that VIX invests in. But investing in stocks, bonds, and investment trusts is temporarily bringing VIX a return of nearly 7%.

Many securities companies add money to "play stocks"

The most profitable self-employed is VCI, but the industry's leading portfolio size must include SSI of chairman Nguyen Duy Hung.

However, the size of SSI's FVTPL portfolio has also decreased significantly, from VND 43,837 billion at the beginning of the year to more than VND 36,919 billion after 9 months.

The Q3-2024 report shows that SSI's FVTPL financial assets have an original price of VND 36,919 billion, but the fair value (market price) only increased slightly, reaching about VND 36,975 billion.

Certificates of deposit are still the item with the largest proportion in SSI's portfolio with more than VND 20,918 billion, down 30% compared to the beginning of the year.

This third quarter, SSI invested in stocks such as VPB of VPBank (original price 854 billion VND), HPG of Hoa Phat (105 billion VND), TCB of Techcombank (91.8 billion VND), VHM of Vinhome (91.5 billion VND)...

In contrast to VCI, SSI's listed securities portfolio increased significantly from more than VND 1,000 billion at the beginning of the year to nearly VND 1,750 billion.

Meanwhile, VNDirect's proprietary trading is mainly in bonds. The Q3-2024 report shows that Ms. Pham Minh Huong's company has increased the proportion of investment in both listed and unlisted bonds compared to the beginning of the year.

VNDirect's bond value includes VND2,118 billion listed and VND11,016 billion unlisted, up 208% and 46% respectively.

At the end of September, VNDirect is "holding" stocks such as VPB (448 billion VND), HSG (379 billion VND)...

Some other companies also invested a lot in bonds such as: HSC, VPBankS, TCBS... In which, TCBS reduced the proportion of listed bonds held from 1,422 billion VND at the beginning of the year to 447 billion VND.

Techcombank Securities also reduced the proportion of its unlisted bond portfolio from VND12,147 billion to VND11,171 billion after 9 months. In contrast, TCBS increased its investment in listed stocks by nearly 2.3 times, reaching nearly VND1,130 billion at the end of September.

A securities company leader said that, unlike many foreign-invested companies, domestic companies promote proprietary trading in addition to margin lending and brokerage.

Self-trading has made a significant contribution to the overall liquidity of the entire market in recent times.

However, the story of a securities company that both trades stocks for profit and also acts as a broker and advisor to clients has long raised some concerns about conflicts of interest.

Source: https://tuoitre.vn/loat-noi-rot-them-tien-choi-chung-vietcap-tu-doanh-chung-khoan-lai-nghin-ti-20241027111654028.htm

Comment (0)