In the base scenario, with 18% growth in profits of listed companies, and a valuation of 12.5 - 13 times P/E, MBS expects the VN-Index to reach 1,400 - 1,420 points in 2025.

In the base scenario, with 18% growth in profits of listed companies, and a valuation of 12.5 - 13 times P/E, MBS expects the VN-Index to reach 1,400 - 1,420 points in 2025.

Vietnam is still a "star" in the region.

In its recently published strategic report, MBS Securities Company has provided positive perspectives for the market outlook in 2025.

Looking back at 2024, the Vietnamese stock market had a favorable start in the first half of 2024, but then concerns about exchange rates and net selling by foreign investors slowed down the index in the second half of 2024. The VN-Index has repeatedly failed to surpass the 1,300-point resistance zone.

The growth rate of VN-Index is lower than the growth rate of the global stock market, but still higher than the ASEAN market. Leading the market are still large-cap stocks when cash flow into blue-chip stocks pushed the VN30 index up 18.2%.

Market liquidity accelerated in the first half of 2024, following the index's upward momentum, but then decreased to about VND15,000 billion per trading session in the October-December period. Foreign net selling reached a record high, surpassing the threshold of USD3.3 billion, putting Vietnam in the group of emerging markets with the largest net foreign capital withdrawal since the beginning of 2024.

However, solid macroeconomic prospects, reformed institutions and favorable monetary policies are considered to be a solid foundation for the stock index's growth in 2025.

It is forecasted that after an impressive run in 2024, Vietnam will continue to accelerate its growth from 7% to 7.5% in the next 3 years, becoming the "star" of the ASEAN-6 region. MBS believes that there will be 6 main themes shaping the 2025 macroeconomic outlook.

Firstly, production still maintains a positive outlook in the context of continued recovery of global demand and positive domestic investment demand. Moreover, this period is different as Vietnam is ready to improve its position in the value chain, shifting to the service production sector with higher added value.

Second is to boost public investment, focusing on major infrastructure projects such as the completion of the North-South Expressway, high-speed railway and Long Thanh airport, to ensure growth and strengthen Vietnam's competitiveness in attracting foreign investment.

Third, inflation in 2025 is not a major concern, creating some room for the State Bank to launch policies to promote domestic consumption and investment.

Fourth, MBS also sees uncertainty about Trump 2.0's administration policies

Fifth, the unknown of China's economic recovery can create both opportunities and challenges for Vietnam.

Sixth, although the global easing cycle has begun, Vietnam’s fiscal policy room is no longer too large due to exchange rate pressure. Therefore, the SBV will need to balance short-term exchange rate risks with long-term growth targets.

VN-Index is expected to reach 1,400 - 1,420 points in 2025

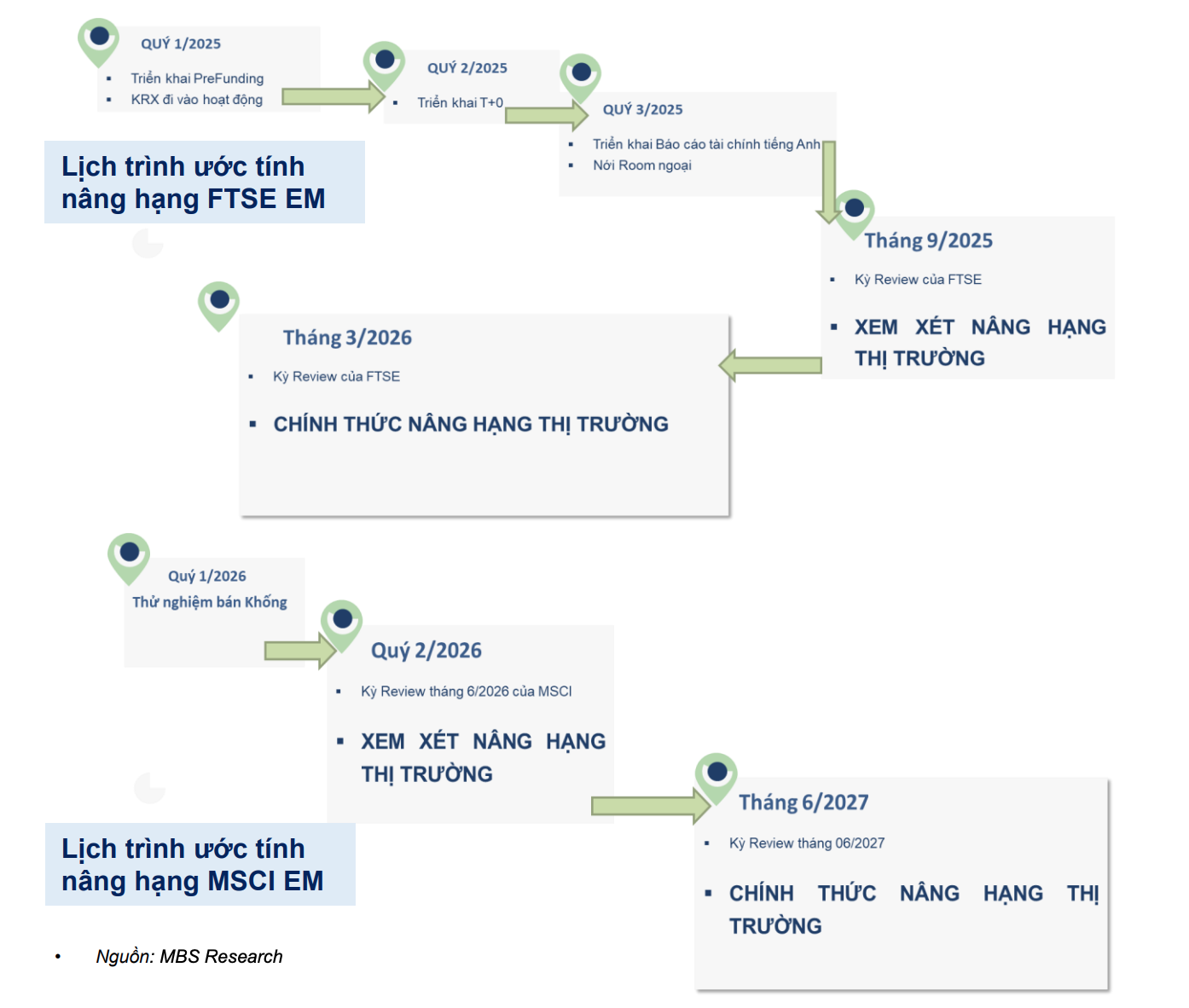

MBS assessed that 2025 will mark a transformation of the economy with a target of 7-8% breakthrough growth in the next decade. Market profits in 2025 - 2026 are forecast to grow by 18% and 19% respectively over the same period, supporting the index's growth momentum. Vietnam is getting closer to the opportunity to join the group of emerging stock markets, leading to expectations of activating foreign investment flows to return.

|

| Vietnam is getting closer to becoming an Emerging Market (EM) |

However, the market may also face risks such as the unpredictable management policies of the Trump 2.0 era that may impact the world and Vietnam economic outlook, possibly slowing down the FED's interest rate cuts; Exchange rate pressure in the context of a weak VND and the residential real estate market may recover more slowly than expected, creating a burden on the banking system's collateral assets.

The recent recovery of mid- and small-cap stocks has pushed VNMID's valuation to 17.3x 12-month P/E, about 17% higher than the VN-Index. In fact, mid-cap stocks are currently trading at P/B levels similar to large-cap stocks. Meanwhile, the valuation of large-cap stocks (represented by VN30 and VNX50) is about 11% lower than the market average. MBS believes that the valuation of large-cap stocks is still more attractive in terms of potential business profit growth in the 2025-2026 period compared to other groups of stocks.

By industry group, many industry groups have lower P/E valuations than the average of the last 3 years, opening up many opportunities to invest in accumulating stocks of leading enterprises.

As of December 5, the VN-Index is trading at a TTM P/E of 13.5, lower than the 3-year average (13.8x) and down 20% from the 3-year peak (16.7x in Q4/2021). In the base case scenario, with an 18% growth in listed companies' profits and a valuation of 12.5-13 times P/E, MBS expects the VN-Index to reach 1,400-1,420 points in 2025.

This securities company also identified 8 attractive investment topics for 2025, including: Real estate starts a new development cycle; Opportunities from increased public investment disbursement; The banking industry's own story; Economic stimulus effects from China; Shortage of electricity supply; Influence from Trump 2.0; The emergence of new industries and Upgrading the stock market.

Source: https://baodautu.vn/ky-vong-vn-index-vuot-1400-diem-trong-nam-2025-d233393.html

Comment (0)