SGGP

On May 17, US President Joe Biden left for the Group of Seven (G7) Summit in Hiroshima, Japan; at the same time, he announced the cancellation of his trip to Australia and Papua New Guinea, to return to Washington soon to negotiate and prevent the possibility of the US government defaulting on its debt.

|

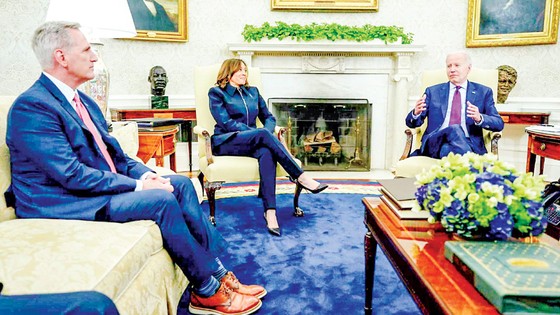

| US President Joe Biden and Vice President Kamala Harris (center) negotiate the debt ceiling with US House Speaker Kevin McCarthy. Photo: AP |

The Quad cancels meeting

The White House announced that President Biden will return to the United States on May 21 to meet with congressional leaders to ensure that Congress acts before the deadline to prevent a government default. Following the G7 summit in Japan, Biden was scheduled to attend a meeting of leaders of the Quad (the United States, Australia, Japan and India) in Sydney, Australia on May 24. However, following President Biden's announcement, Prime Minister Albanese announced the cancellation of the Quad meeting in Australia.

Regarding the debt ceiling negotiations in the US, after many days of negotiations, the views of the Republican majority in the House of Representatives and President Biden are still very different. Republicans have refused to vote to raise the debt ceiling beyond the limit of 31.3 trillion USD unless President Biden and members of the Democratic Party agree to cut spending in the federal budget.

However, according to Reuters, after negotiations on May 16, US House Speaker Kevin McCarthy said the two sides could reach an agreement this weekend. Republicans said Mr. Biden agreed to significant spending cuts in exchange for their support in raising the debt ceiling. According to the White House, Mr. Biden is “optimistic” about a responsible bipartisan budget deal if both sides negotiate in good faith.

The fight against inflation is long.

While the fight against default is intensifying, the White House is also facing a longer-term battle against inflation. Economists and policymakers say the country is preparing for a long and difficult road back to the Federal Reserve's 2% inflation target, even with early signs of optimism. As concerns about Covid-19 subside and restaurants, movie theaters, etc. reopen, service-related inflation has begun to rise; housing costs have also exploded. That has pushed up inflation, according to the Financial Times.

The Fed has raised interest rates by more than 5% in the past 15 months, the fastest pace in decades, as it seeks to tame inflation. Officials are now weighing whether to tighten the economy further to ensure inflation returns to its 2% target. As of March, annual inflation in the U.S. averaged 4.6%. Economists surveyed by Bloomberg expect the Fed to continue raising rates through 2025. The Fed has said it won't cut rates until 2024.

Source

Comment (0)