The US election results will not create major changes for Vietnam's economy, but the stock market could fluctuate strongly.

While the US presidential election is taking place, analysts say that no matter which candidate wins, it will not create major changes for Vietnam’s economy. However, the stock market could fluctuate strongly if Donald Trump returns to the White House.

According to Mr. Michael Kokalari - Director of Macroeconomic Analysis at VinaCapital: "The election results may not have much impact on Vietnam, regardless of who wins" .

|

| US Vice President Kamala Harris (right) - Democratic candidate and former President Donald Trump - Republican candidate. Photo: AP |

During her campaign, Kamala Harris emphasized boosting the economy through small reforms, such as increasing tax incentives for families with young children, raising the minimum wage, building affordable housing and supporting small businesses.

Mr. Trump has more protectionist policies, such as deporting illegal immigrants and imposing high import tariffs, especially on goods from China.

Both candidates have their own strengths and weaknesses in their policy approaches and this will certainly have a big impact on voters' votes.

In 2022, President Biden's Semiconductor Manufacturing Science and Productivity Incentives Act (CHIPS Act) created a wave of strong investment in technology manufacturing in the US, causing the amount of investment in building new factories to increase fourfold, but also causing a rise in production costs due to a shortage of skilled labor.

Mr. Kokalari said that moving production to the US does not mean that exports from Vietnam will be negatively affected. Although Mr. Trump can increase tariffs on imported goods, he can also choose to devalue the USD to promote exports, which will benefit Vietnam.

Specifically, according to the government's data, the former US President proposed imposing a 10-20% tax on goods imported from other countries, with China alone charging 60%. This is much higher than the average 2% tax currently applied to non-agricultural goods exported to the US.

In the context of the trade war between the US and China, if Mr. Trump imposes a high tariff of 60% on imported goods from China, goods from this country will be more expensive when entering the US market. Vietnam will become an attractive destination for businesses wanting to move their supply chains out of China.

According to a report from VinaCapital, whether or not tariffs are imposed, Vietnam's exports can still remain stable, because when the USD depreciates, other countries tend to buy Vietnam's export goods and Vietnamese products also become cheaper than US products in the international market.

Therefore, Vietnam can benefit from increased exports to the US market. Consumer demand in the US is still growing steadily, which has helped Vietnam's exports to the US increase this year.

In the third quarter, Vietnamese exports to this market reached nearly 33 billion USD, the highest ever. In the first 9 months of 2024, it was nearly 88.2 billion USD, an increase of about 26% over the same period last year. This growth momentum is forecast by analysts to continue after the US presidential election and early next year.

However, there are also some risks such as the possibility of Vietnam becoming a target for tariffs due to the difference in trade turnover.

In addition, the International Monetary Fund (IMF) warned that if import taxes increase, global economic growth could decline sharply, affecting many countries, including Vietnam.

For financial markets, if Ms Harris wins, volatility could be milder than if Mr Trump wins.

In addition, another issue that worries analysts if Mr. Trump returns to the White House is the possibility of affecting the independent operations of the US Federal Reserve (Fed).

Mr. Maurice Obstfeld - Expert of the International Monetary Fund (IMF) said that if he returns to White, Mr. Trump could interfere with the independent operations of the Fed. If the Fed is influenced by politics, decisions on interest rates or monetary policy may no longer be made based on long-term economic interests but instead serve political goals. This could make global financial markets unpredictable.

Source: https://congthuong.vn/ket-qua-bau-cu-my-anh-huong-the-nao-den-kinh-te-viet-nam-356957.html

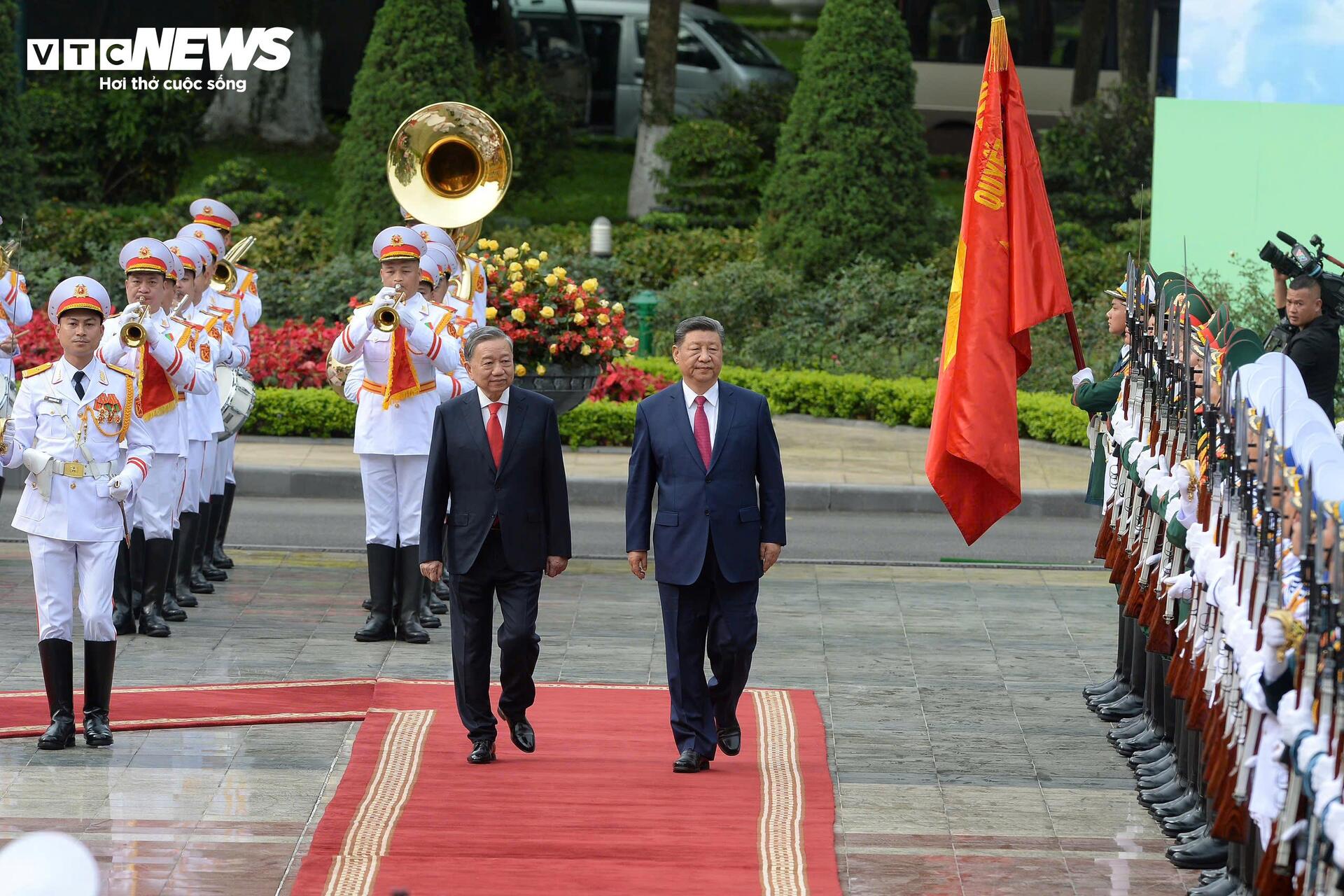

![[Photo] General Secretary To Lam holds talks with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/b3d07714dc6b4831833b48e0385d75c1)

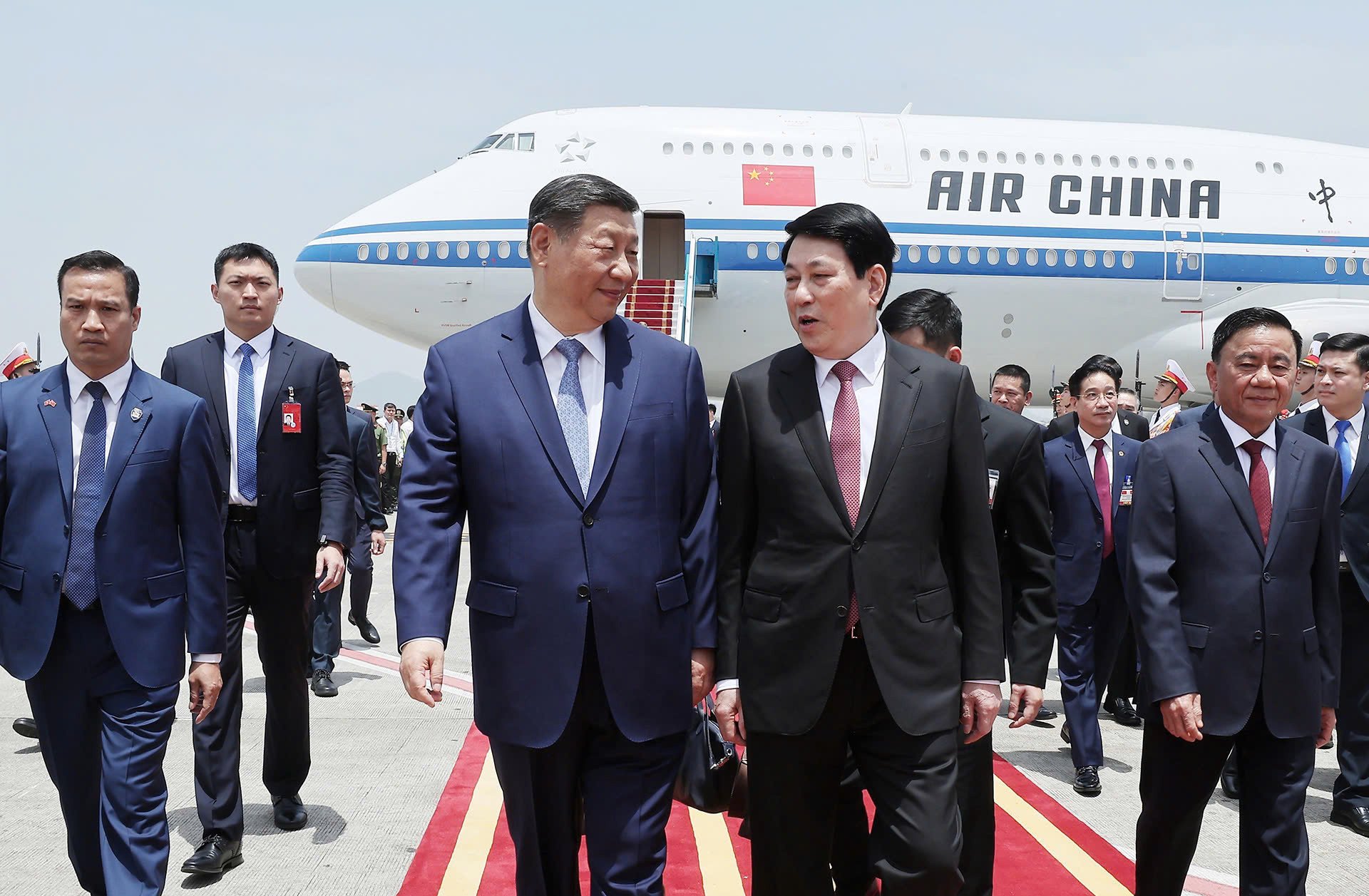

![[Photo] National Assembly Chairman Tran Thanh Man meets with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/4e8fab54da744230b54598eff0070485)

![[Photo] Reception to welcome General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/9afa04a20e6441ca971f6f6b0c904ec2)

![[Photo] Prime Minister Pham Minh Chinh meets with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/893f1141468a49e29fb42607a670b174)

Comment (0)