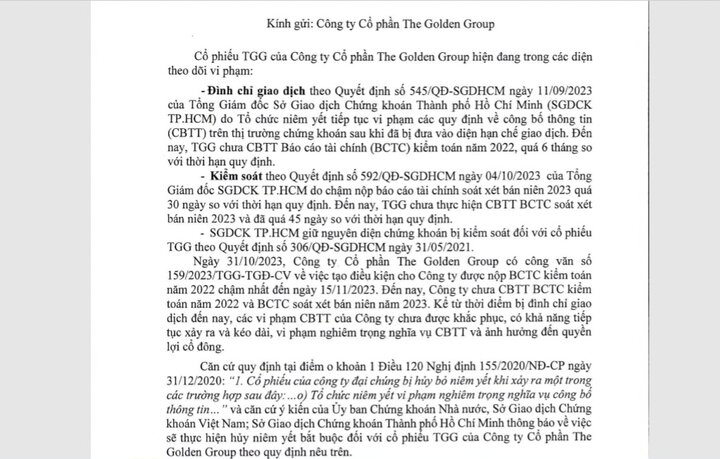

According to HoSE, TGG shares of The Golden Group Company are currently under monitoring for violations, trading suspension and inspection.

HoSE announced that it will carry out mandatory delisting of TGG shares of The Golden Group Joint Stock Company. (Photo: D.V)

Specifically, TGG was suspended from trading according to Decision No. 545/QD-SGDHCM dated September 11, 2023 of the General Director of HoSE due to the listed organization violating the regulations on information disclosure on the stock market after being placed on the restricted trading list. To date, TGG has not disclosed the 2022 audited financial report, 6 months after the prescribed deadline.

In addition, TGG shares are also under control according to Decision No. 592/QD-SGDHCM dated October 4, 2023 of the General Director of HoSE due to the delay in submitting the audited financial statements for the 2023 semi-annual period of more than 30 days compared to the prescribed deadline. To date, TGG has not yet disclosed the audited financial statements for 2023 and is 45 days behind the prescribed deadline.

In addition, HoSE also maintains the controlled securities status for TGG shares according to Decision No. 306/QD-SGDHCM dated May 31, 2023.

On October 31, 2023, The Golden Group Joint Stock Company issued an official dispatch on creating conditions for the company to submit its audited financial statements for 2022 no later than November 15, 2023. However, according to HoSE, to date, The Golden Group Company has not yet announced the audited financial statements for 2022 and the semi-annual reviewed financial statements for 2023.

“ Since the time of suspension of trading, the company's information disclosure violations have not been remedied and are likely to continue to occur and persist, seriously violating the obligation to disclose information and affecting the rights of shareholders,” HoSE stated.

Therefore, based on regulations and opinions of the State Securities Commission and Vietnam Stock Exchange, HoSE announced that it will carry out mandatory delisting of TGG shares of The Golden Group Joint Stock Company.

According to VTC News, TGG shares are currently trading at VND2,370/share. Over the past 2 months, the price of this stock has been almost “stagnant” and there has been no transaction.

Meanwhile, in September 2021, TGG shares peaked at VND74,800/share. Thus, after more than 2 years, the price of this stock has decreased by nearly 97%.

The Golden Group was formerly known as Truong Giang Investment and Construction Company. Mr. Do Thanh Nhan and a group of shareholders related to Louis Holding acquired this enterprise and changed its name to Louis Capital.

After the stock manipulation case involving Do Thanh Nhan was exposed, the company changed its name to The Golden Group.

Defendant Do Thanh Nhan appears in court. (Photo: Danh Trong)

The first instance verdict announced in May 2023 determined that defendants Do Thanh Nhan and Do Duc Nam - former General Director of Tri Viet Securities Company discussed and proposed buying and selling strategies to manipulate the stock prices of two stocks BII and TGG, pushing the stock prices up.

The defendants set up 17 cross-trading accounts to buy and sell these two stocks to manipulate and create fake supply and demand, leading to many investors misunderstanding and participating in buying and selling.

The BII stock code was initially bought by Mr. Nhan and Nam's group at the price of 1,000 - 5,000 VND. This group used many cross-buying and selling accounts to inflate the price.

During the nine months of manipulation, BII peaked at VND33,800/share, about 10 times higher than the price when Mr. Nhan's group bought it.

After establishing the price zone at the top, Do Thanh Nhan and Do Duc Nam group completed the sale to take profit and illegally profit.

Similarly, with the stock code TGG, Nhan's group started buying at the price of 1,800 VND. Then, the Chairman of Louis Holdings used many accounts to buy more than 10 million shares at the price range of 4,000 - 5,000 VND.

The Facebook fanpage was created to attract the attention of a large number of investors. TGG stock price continuously increased to the ceiling with large matching volume and reached a peak of 74,800 VND/share.

This price is determined to increase 37 times when Mr. Nhan bought it.

Immediately after establishing the peak price zone, TGG stock sessions continuously hit the floor due to lack of liquidity, no buyers or very low trading volume. TGG price then dropped to the bottom, causing many investors to suffer heavy losses.

The investigation results determined that the total amount of money that Mr. Do Thanh Nhan's group illegally profited from stock manipulation and "inflating" the prices of the two stocks above was more than 154 billion VND.

The Hanoi People's Court sentenced defendant Do Thanh Nhan, former Chairman of Louis Holdings Company, to 5 years and 6 months in prison for "Stock market manipulation".

DAI VIET

Source

Comment (0)