The legal framework on green finance still has many limitations, causing difficulties for credit institutions in implementing related products and services...

In the context of the increasingly strong impact of sustainable development and climate change, the financial demand for green growth in Vietnam is huge. However, current resources for this sector are still relatively limited. One of the main reasons pointed out is the incomplete legal corridor.

Cong Thuong Newspaper had an interview with Mr. Pham Ngoc Khang - General Director of Home Credit Vietnam Finance Company Limited about this issue.

|

| Mr. Pham Ngoc Khang - General Director, Home Credit Vietnam Finance Company Limited. Photo: Quoc Chuyen |

Can you share what green financial products and services Home Credit is implementing in Vietnam?

Currently, Home Credit Vietnam has a number of activities to promote green financial solutions and sustainable consumption for customers. I can point out a few groups of initiatives as follows:

Financial solutions for green products: In recent years, we have cooperated with retailers and green product manufacturers in Vietnam to provide preferential financial solutions for environmentally friendly products such as bicycles, electric bicycles, electric motorbikes, etc. In addition, we have expanded our service coordination with small businesses in provinces/cities to provide financial support for quality secondhand products. For us, this helps green products become more accessible, more attractive to consumers, and more competitive compared to other products.

100% digitalization of customer service: 100% of our customer service processes are fully digitalized, covering all stages of the customer journey from loan registration, appraisal to loan management.

In addition, our products also demonstrate the spirit of comprehensive digital transformation. For example, the Home PayLater product, which accompanies customers in their daily lives from the smallest expenses, helps financial solutions become more convenient and accessible to diverse customer groups, especially young people.

By applying digital technology to our products and processes, we not only provide customers with a seamless experience, but also help reduce the negative impact on the environment from business operations.

Supporting sustainable livelihood transformation: Over the past 10 years, we have implemented the Home for Life community support initiative. Through this, we provide financial capital to disadvantaged women across the country who have green business ideas. At the same time, we organize training courses on financial management knowledge and coordinate with partners to provide knowledge and skills on sustainable livelihoods to these households. Since then, our program has helped many women across the country increase their income and transform their livelihoods in a greener, more sustainable direction.

|

| Consulting and supporting customers to access green finance is a focus of Home Credit. Photo: Home Credit |

When implementing green financial products and services, what difficulties and challenges have Home Credit in particular and the consumer finance industry in general encountered, sir?

The first challenge is that there is no separate mechanism or regulation on green finance with the characteristics of the consumer finance industry: Currently, regulations and frameworks for evaluating green credit criteria are mainly for large projects, industrial projects, and commercial projects, but there are no regulations related to green credit for personal consumer lending purposes.

Therefore, our activities are currently being carried out mainly based on the will and orientation of sustainable development of enterprises, but have not been able to expand the scale of green credit support for consumers, nor have we been able to measure and evaluate the exact effectiveness of green finance in the consumer sector.

The second challenge is limited consumer awareness and demand: Many consumers, especially in rural areas or groups with insufficient financial access, are not fully aware of the benefits of green products and often still tend to prioritize cost over sustainability.

This requires us to invest significantly in education and awareness campaigns to drive demand for green financial solutions.

From a business perspective, what recommendations do you have for state management agencies so that green credit (including personal credit) can develop commensurate with the potential of Vietnam's more than 100 million people?

We would like to propose 2 solutions to promote green credit in the domestic consumer market with great potential as follows:

On the management side, it is possible to consider building a separate mechanism for green consumer credits, loans supporting livelihoods and sustainable development. At the same time, it is possible to provide more detailed instructions on the subjects, categories and scope of receiving these credits.

In addition, it is necessary to develop a framework to evaluate and measure the effectiveness of green consumer finance as well as loans to support livelihoods and sustainable development for individual customers.

Thank you!

Source: https://congthuong.vn/hoan-thien-khuon-kho-phap-ly-de-khoi-dong-tai-chinh-xanh-361033.html

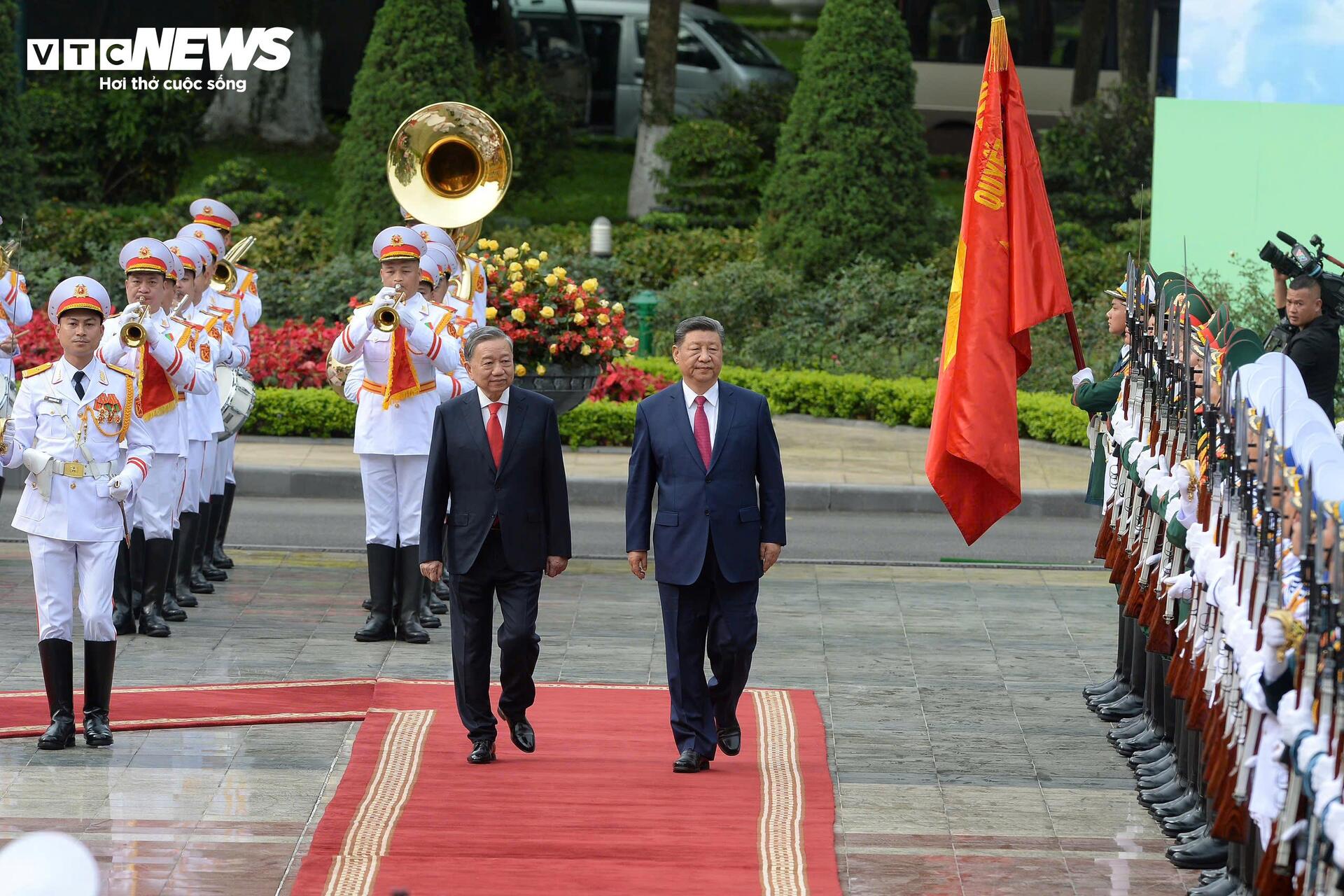

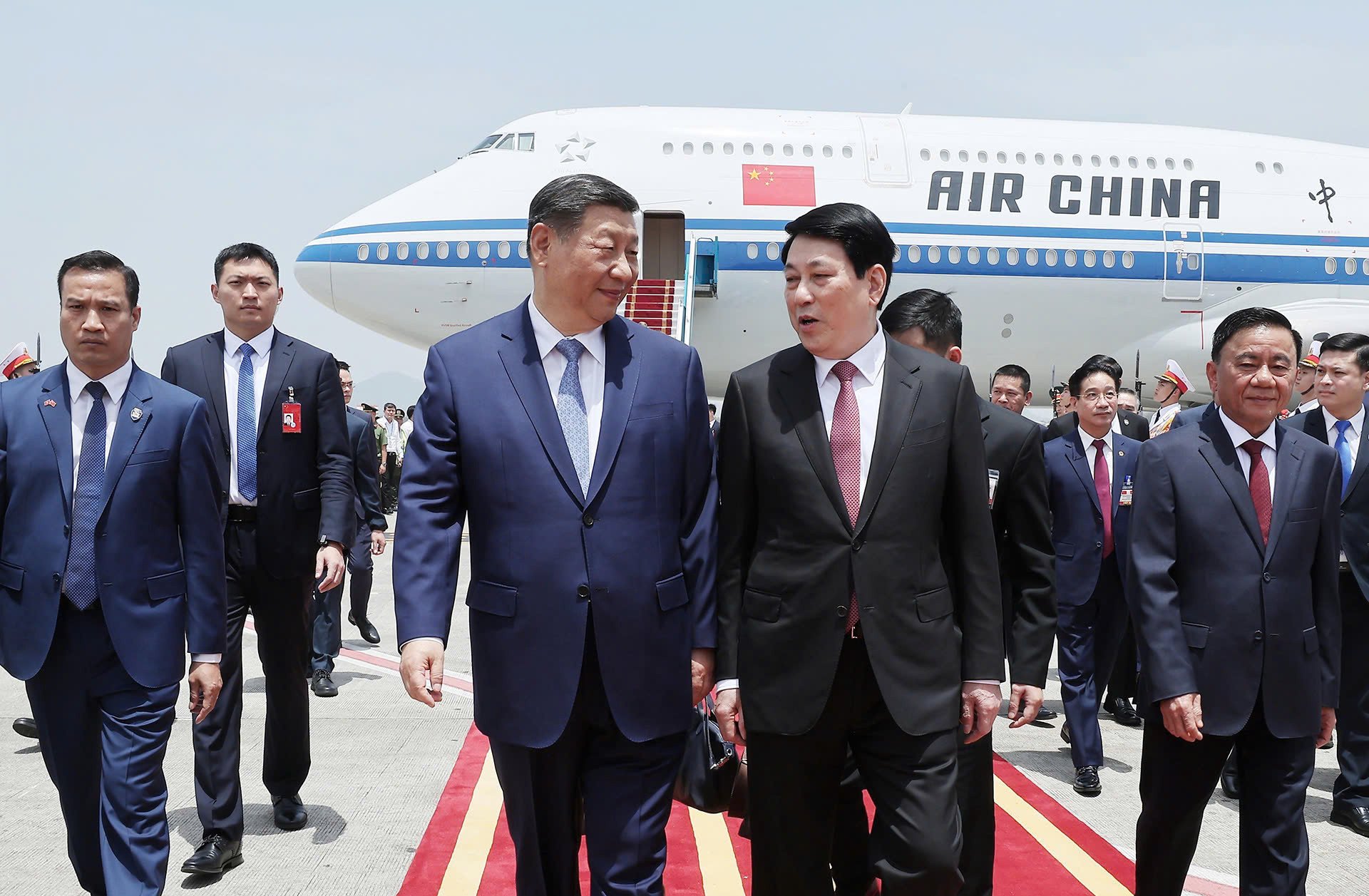

![[Photo] Ceremony to welcome General Secretary and President of China Xi Jinping on State visit to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/5318f8c5aa8540d28a5a65b0a1f70959)

![[Photo] Prime Minister Pham Minh Chinh meets with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/893f1141468a49e29fb42607a670b174)

![[Photo] National Assembly Chairman Tran Thanh Man meets with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/4e8fab54da744230b54598eff0070485)

![[Photo] General Secretary To Lam holds talks with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/b3d07714dc6b4831833b48e0385d75c1)

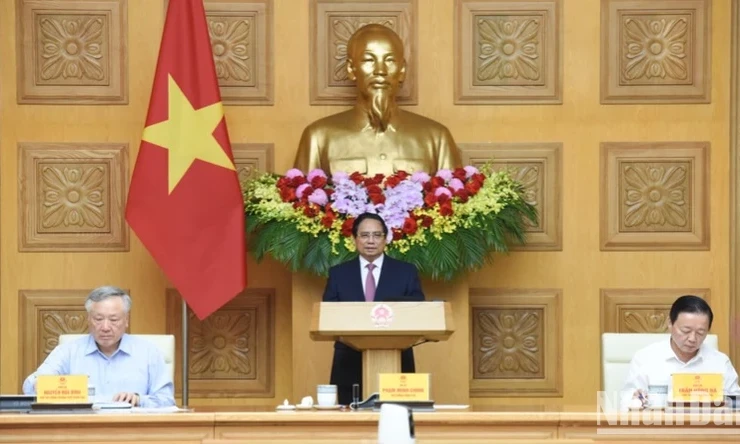

![[Photo] Prime Minister Pham Minh Chinh chairs conference to review the implementation of Resolution No. 18-NQ/TW](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/dcdb99e706e9448fb3fe81fec9cde410)

Comment (0)