In a speech at the China Bridge 2024 Partnership Summit, Song Zhiping, chairman of the China Association of Listed Companies, said that currently there are only two profitable new energy vehicle (NEV) manufacturers: BYD and Li Auto.

According to Mr. Song, many companies have to make both internal combustion engine vehicles and new energy vehicles, but most large auto factories have not yet made a profit from electric vehicles.

“But if you don’t make electric cars, you have no future. That’s the dilemma of the newbie,” Mr. Song said.

BYD Seagull electric car model at the 2023 Shanghai Auto Show (Photo: CNC).

Li Auto, along with BYD, are the only two companies that Mr. Song said are profitable in China's new energy vehicle industry.

In 2023, Li Auto's total revenue reached 123.85 billion yuan (US$17 billion), up 173.5% from 2022. Of which, Li Auto earned a net profit of 11.81 billion yuan (US$1.6 billion), which means a profit margin of about 9.5%.

The outlook for electric vehicle startups is bleak. While Nio’s revenue is expected to rise 12.9% in 2023 to 55.6 billion yuan ($7.6 billion), it lost 20.72 billion yuan ($2.85 billion), or more than 45%, meaning an average loss of 100,000 yuan ($13,750) per vehicle sold.

In 2023, Xpeng's sales increased, but so did its losses. Revenue reached 30.68 billion yuan ($4.2 billion) but its net loss was 10.38 billion yuan ($1.4 billion).

What many Chinese automakers are chasing is market share, not profits. For companies that also make gasoline-powered cars, the losses from electric cars are partly offset by sales of gasoline cars, but for startups that only make electric cars, the situation is more difficult because they do not have the same source of profit.

The price war is also spreading to suppliers, who are forced to sell below cost to gain volume.

According to GlobalData , there will be 150 car brands operating in China in 2023; of these, 97 will be Chinese and 43 will be joint ventures (the rest are likely to be imported). Factory utilization in 2023 is expected to be 59%, but there will be a wide variation among manufacturers.

For BYD, the factory utilization rate is around 80%, while for Tesla it is 92%. However, many foreign brands have very low factory utilization rates, such as Hyundai at just 23%. The majority of China's output comes from the 15% of factories with utilization rates above 95%, and their combined output will account for 47% of total sales in China in 2023.

On the other hand, 20% of Chinese auto plants will produce fewer than 1,000 vehicles in 2023, and 17% will produce fewer than 10,000 vehicles. It should be noted that these figures are for cars in general, not new energy vehicles.

Source: https://dantri.com.vn/o-to-xe-may/hau-het-cac-hang-xe-dien-trung-quoc-deu-dang-lo-20240712005629802.htm

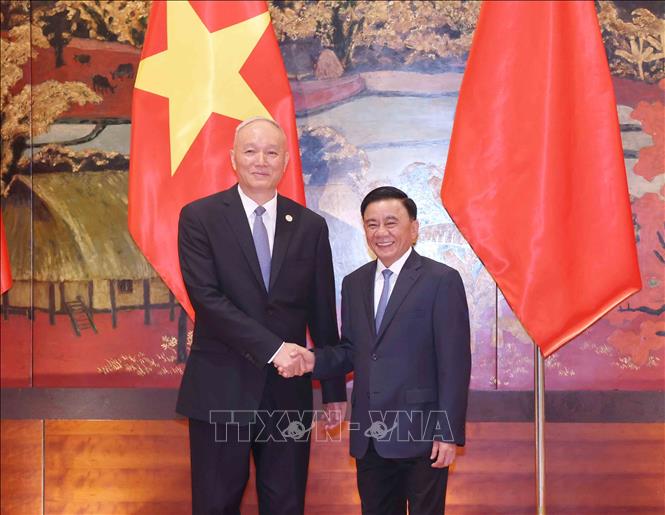

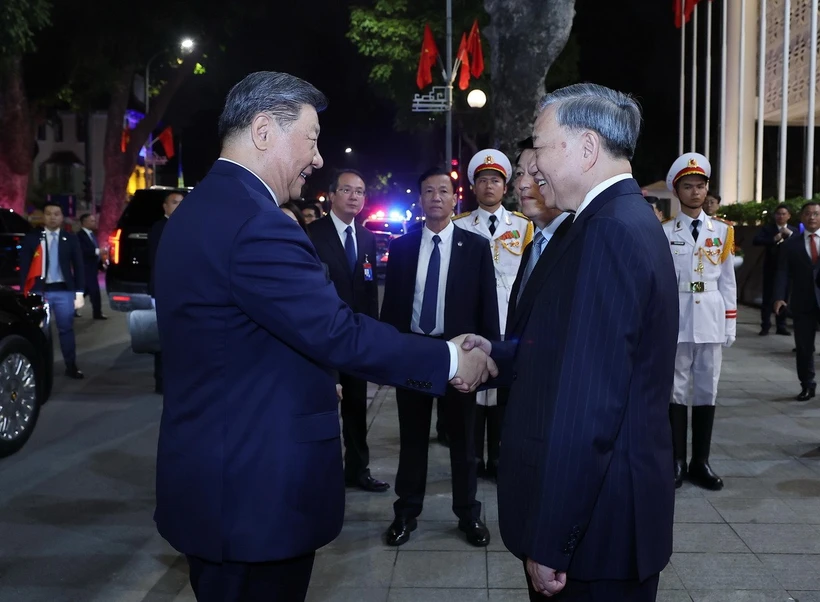

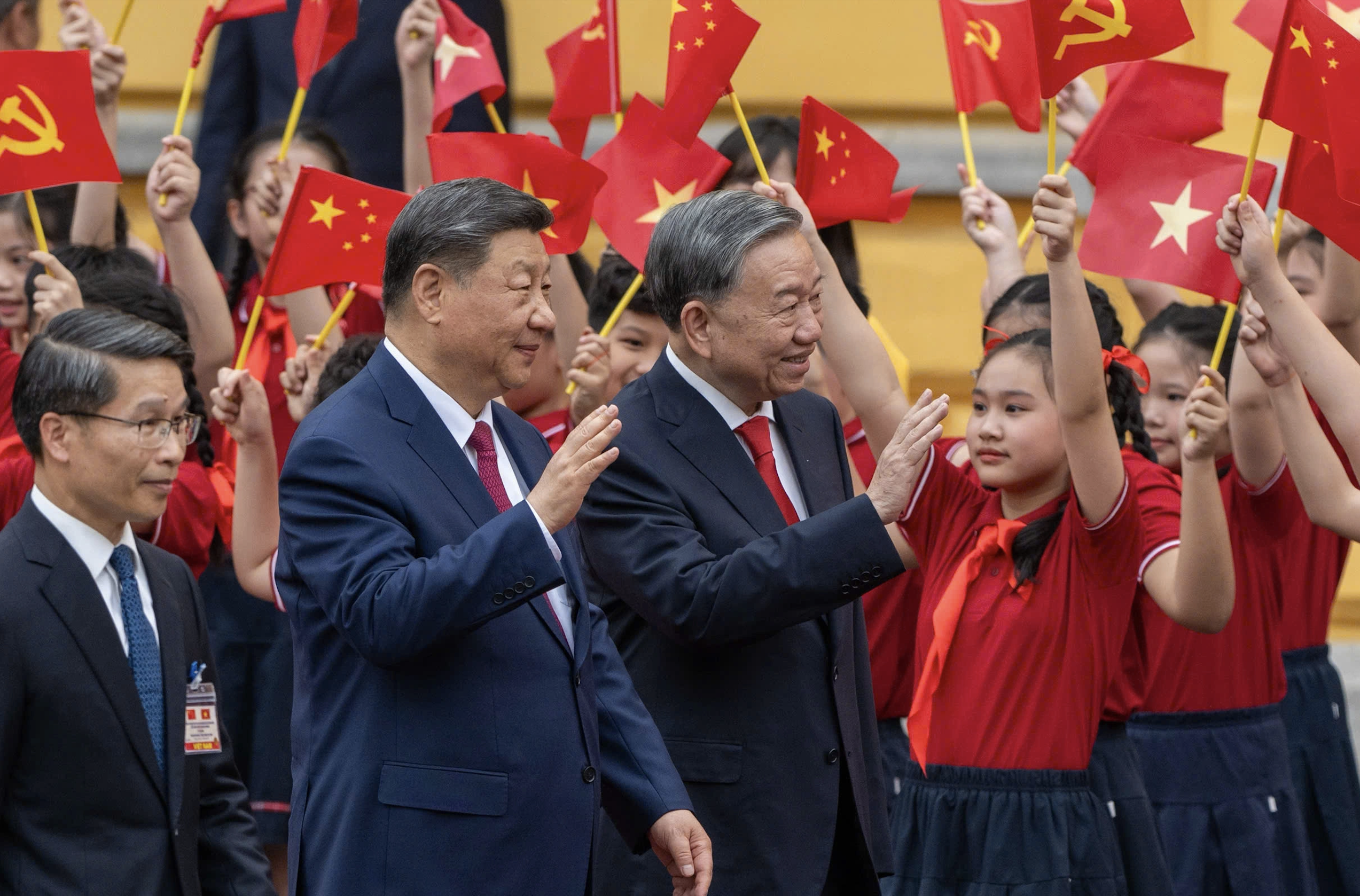

![[Photo] General Secretary To Lam holds talks with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/b3d07714dc6b4831833b48e0385d75c1)

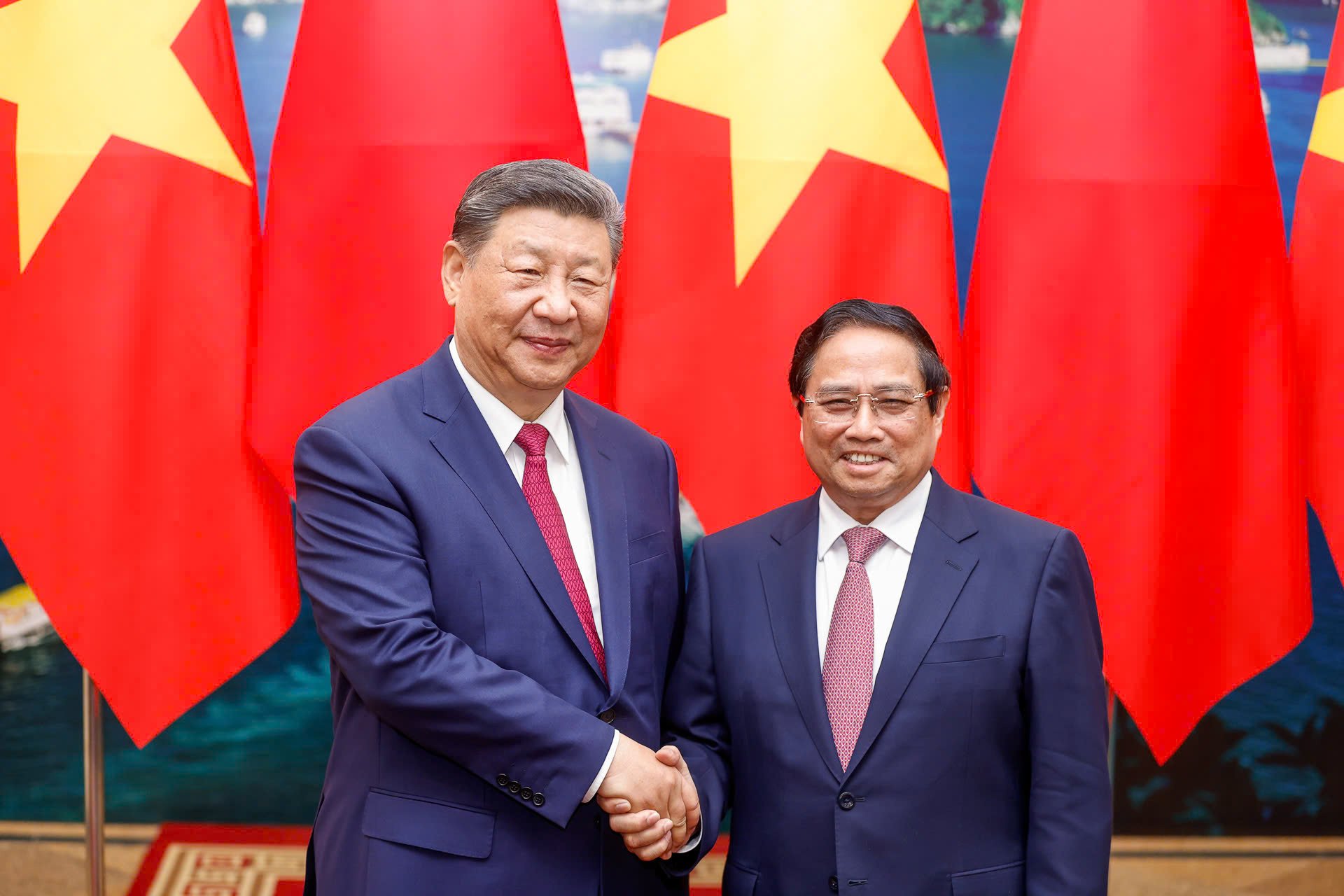

![[Photo] Prime Minister Pham Minh Chinh meets with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/893f1141468a49e29fb42607a670b174)

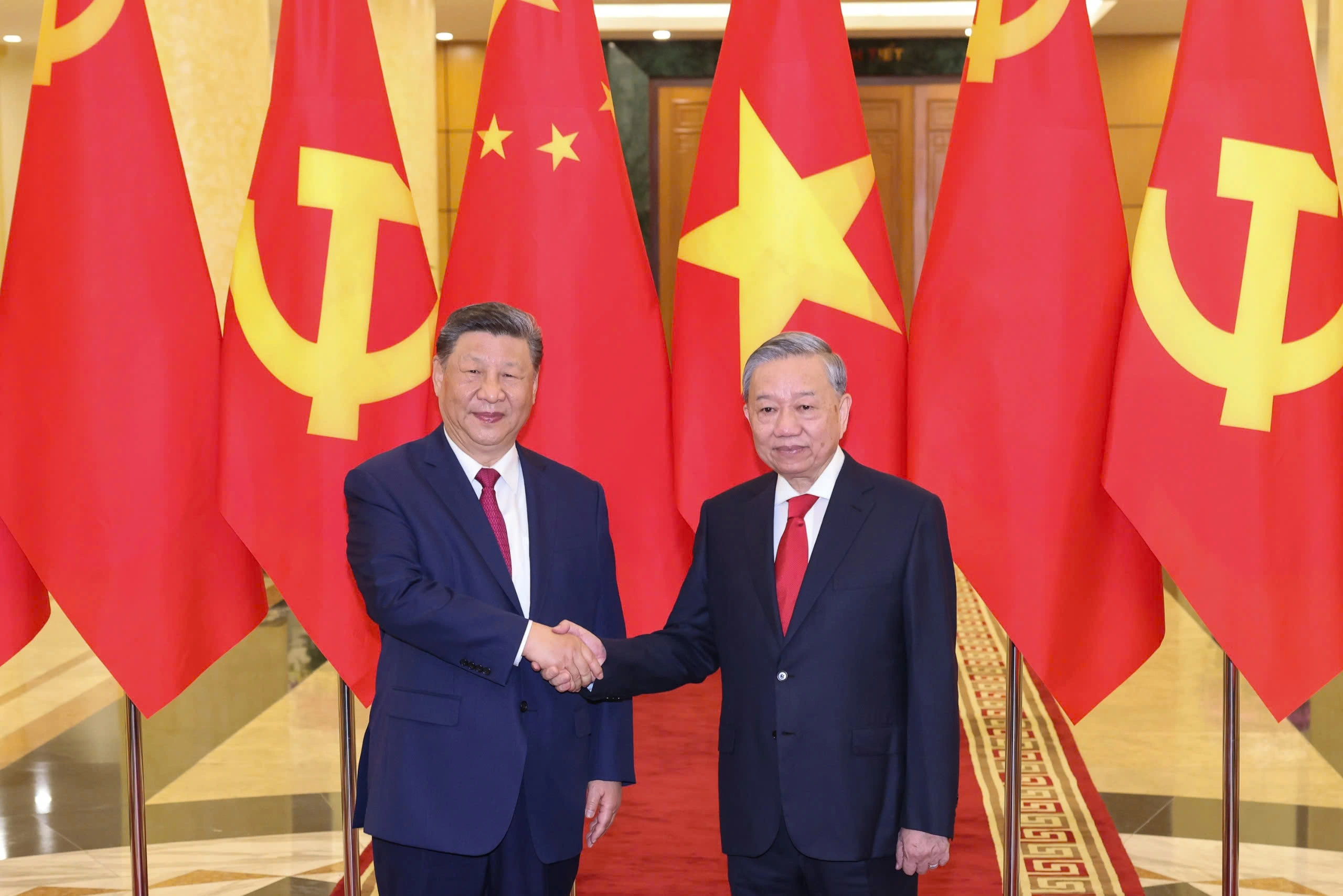

![[Photo] National Assembly Chairman Tran Thanh Man meets with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/4e8fab54da744230b54598eff0070485)

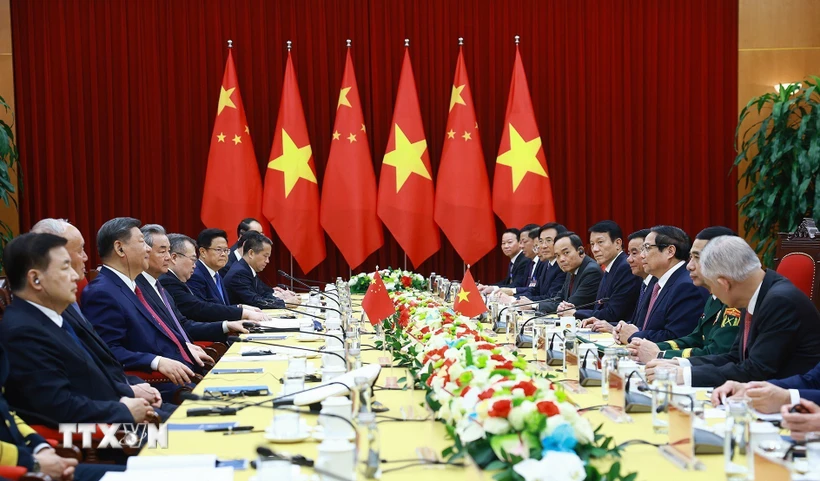

![[Photo] Reception to welcome General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/9afa04a20e6441ca971f6f6b0c904ec2)

Comment (0)