To reduce tax debt, Ha Tinh Tax Department has implemented many flexible measures, including temporarily suspending entry and exit for legal representatives of businesses that are slow to pay tax debts.

Apply strong measures

This is the second year that Ha Tinh Tax Department has applied temporary suspension of entry and exit for legal representatives of tax-indebted enterprises that deliberately delay in fulfilling their obligations to the State budget.

This drastic measure has brought about significant results because if the tax payment obligation is not fulfilled, the legal representative of the enterprise will have limited rights. Therefore, taxpayers must raise their awareness and responsibility in fulfilling their obligations to the State budget. After being suspended from entering and exiting the country, some foreign individuals have proactively contacted the tax authorities and complied more strictly with the provisions of current tax laws.

Up to now, the Ha Tinh Tax Department has issued 179 notices proposing to temporarily suspend exit for legal representatives of enterprises that have not fulfilled their tax obligations. Thereby, 9 foreign individuals and representatives of 16 enterprises, after being temporarily suspended from exit and entry, have paid 39.9 billion VND in tax arrears.

Mr. Vuong Kha Quang - Head of Debt Management Department, Ha Tinh Tax Department said: "For debts from 1 to 90 days, the tax sector implements measures such as: calling, texting, sending emails, issuing tax debt notices... to taxpayers to urge payment. Particularly for debts over 90 days, the unit implements appropriate enforcement measures. Including the measure of temporarily suspending entry and exit for legal representatives of enterprises that are slow to pay tax debts".

Ha Tinh Tax Department officials are reviewing the list of businesses that are slow to pay tax debts to make it public in the mass media.

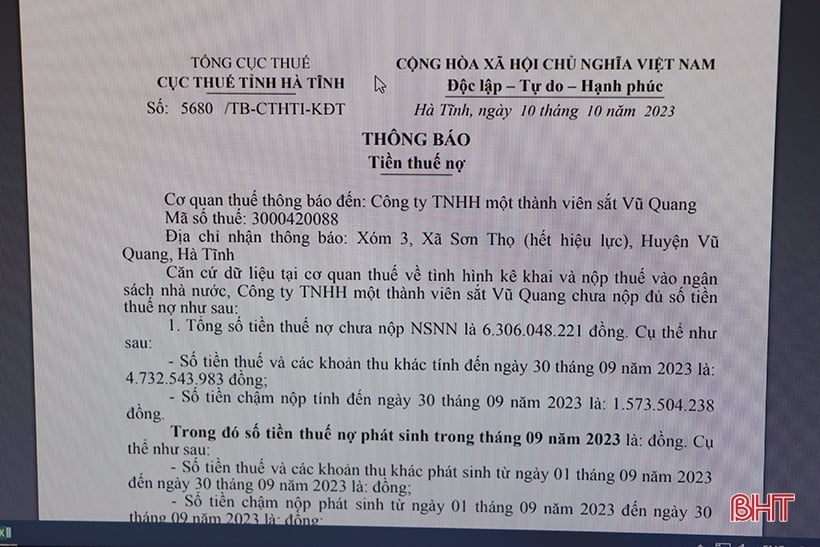

Not only flexibly implementing debt collection measures, Ha Tinh Tax Department will also publicly announce tax debts on mass media channels every month. In the list of enterprises whose tax debts are publicly announced, some units are named multiple times such as: Ha Tinh Bridge and Road Construction Joint Stock Company, Ha Tinh Trade and Service Joint Stock Company, Ly Thanh Sac General Trading Joint Stock Company, Xuan Ha Construction Company Limited, Ha Tinh Construction Joint Stock Company 1, Dong A Construction and Trading Company Limited, Vu Quang Iron Company Limited...

Collected 2,352 billion VND in tax debt

Recently, Ha Tinh Tax Department has promptly issued many documents directing regional tax branches to strengthen the implementation of measures to collect and handle tax debts.

Since the beginning of the year, Ha Tinh Tax Department has issued 82,038 tax debt notices and 9,098 enforcement decisions. The unit has also publicly announced tax debts on mass media for 3,747 businesses.

Ha Tinh Tax Department has issued 82,038 notices of tax arrears to businesses.

Thanks to the flexible application of many measures, to date, the Ha Tinh Tax Department has collected VND 2,352 billion in tax arrears (nearly double that of the same period in 2022), of which VND 804.6 billion was collected from enforcement measures. As of September 30, the total tax arrears of the whole industry was VND 842 billion (down 15% compared to the same period in 2022).

In addition to tax debt collection, in recent times, Ha Tinh Tax Department has also made efforts to implement debt forgiveness and debt cancellation according to Resolution 94/2019/QH14 to contribute to reducing tax debt.

Up to now, Ha Tinh Tax Department has frozen VND 110.6 billion of debt for 2,943 taxpayers and cleared VND 47.7 billion of debt for 703 taxpayers according to Resolution 94/2019/QH14.

Ha Tinh Tax Department is stepping up the review of enterprises that still owe land use fees and land rents to increase debt collection.

Currently, the Ha Tinh Tax Department is stepping up the review of enterprises that still owe land use fees and land rents and have applied enforcement measures but have not complied. The unit will continue to urge and recommend the Provincial People's Committee to reclaim land if these enterprises still do not comply with their tax obligations.

Ha Tinh Tax Department is also reviewing, comparing, and verifying whether the investor using budget capital still owes the enterprise unpaid tax; if paid, the enterprise is required to pay the tax debt to the State budget in a timely manner in accordance with regulations.

In 2023, Ha Tinh was assigned by the General Department of Taxation a maximum total tax debt of VND 1,028 billion as of December 31, 2023, not exceeding 8% of the total actual revenue to the State budget in 2023. Therefore, in the last months of the year, Ha Tinh Tax Department will continue to strengthen solutions to urge and collect tax arrears to pay to the State budget in a timely manner, striving to exceed the target assigned by the General Department of Taxation.

Mr. Truong Quang Long

Director of Ha Tinh Tax Department.

Phan Tram

Source

![[Photo] Prime Minister Pham Minh Chinh receives Chairman of Commercial Aircraft Corporation of China (COMAC)](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/93ca0d1f537f48d3a8b2c9fe3c1e63ea)

![[Photo] General Secretary and President of China Xi Jinping arrives in Hanoi, starting a State visit to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/9e05688222c3405cb096618cb152bfd1)

Comment (0)