USD exchange rate today 06/02/2025: The USD fell to its lowest level in more than a week as investors' worries about the trade war subsided.

USD exchange rate today 02/06/2025

At the time of survey at 5:00 a.m. on February 6, the central exchange rate at the State Bank was currently 24,395 VND/USD, an increase of 35 VND compared to yesterday's trading session.

Specifically, at Vietcombank, the USD exchange rate is 24,950 - 25,340 VND/USD, down 20 VND for buying and up 200 VND for selling compared to yesterday's trading session.

TPB Bank is buying USD cash at the lowest price: 1 USD = 24,390 VND

TPB Bank is buying USD transfers at the lowest price: 1 USD = 24,430 VND

VietinBank is buying USD cash at the highest price: 1 USD = 25,190 VND

VietinBank is buying USD transfers at the highest price: 1 USD = 25,549 VND

TPB Bank is selling USD cash at the lowest price: 1 USD = 24,870 VND

HSBC Bank is selling USD transfers at the lowest price: 1 USD = 25,296 VND

Saigonbank is selling USD cash at the highest price: 1 USD = 25,614 VND

VIB Bank is selling USD transfers at the highest price: 1 USD = 25,525 VND

|

| USD exchange rate at some banks today. Source Webgia.com |

| 1. Agribank - Updated: February 6, 2025 05:30 - Time of website source supply | ||||

| Foreign currency | Buy | Sell | ||

| Name | Code | Cash | Transfer | |

| USD | USD | 24,980 | 25,000 | 25,340 |

| EUR | EUR | 25,592 | 25,695 | 26,779 |

| GBP | GBP | 30,782 | 30,906 | 31,884 |

| HKD | HKD | 3,166 | 3,179 | 3,285 |

| CHF | CHF | 27,266 | 27,375 | 28,248 |

| JPY | JPY | 160.34 | 160.98 | 168.14 |

| AUD | AUD | 15,411 | 15,473 | 15,987 |

| SGD | SGD | 18,273 | 18,346 | 18,872 |

| THB | THB | 726 | 729 | 761 |

| CAD | CAD | 17,239 | 17,308 | 17,815 |

| NZD | NZD | 13,991 | 14,486 | |

| KRW | KRW | 16.61 | 18.34 | |

| 2. Sacombank - Updated: 08/23/2007 07:16 - Time of website source | ||||

| Foreign currency | Buy | Sell | ||

| Name | Code | Cash | Transfer | |

| USD | USD | 24980 | 24980 | 25360 |

| AUD | AUD | 15450 | 15550 | 16121 |

| CAD | CAD | 17267 | 17367 | 17918 |

| CHF | CHF | 27487 | 27517 | 28403 |

| CNY | CNY | 0 | 3424.9 | 0 |

| CZK | CZK | 0 | 985 | 0 |

| DKK | DKK | 0 | 3485 | 0 |

| EUR | EUR | 25749 | 25849 | 26724 |

| GBP | GBP | 31020 | 31070 | 32191 |

| HKD | HKD | 0 | 3241 | 0 |

| JPY | JPY | 161.79 | 162.29 | 168.8 |

| KHR | KHR | 0 | 6,032 | 0 |

| KRW | KRW | 0 | 16.8 | 0 |

| LAK | LAK | 0 | 1,133 | 0 |

| MYR | MYR | 0 | 5827 | 0 |

| NOK | NOK | 0 | 2219 | 0 |

| NZD | NZD | 0 | 14101 | 0 |

| PHP | PHP | 0 | 402 | 0 |

| SEK | SEK | 0 | 2272 | 0 |

| SGD | SGD | 18265 | 18395 | 19118 |

| THB | THB | 0 | 694.5 | 0 |

| TWD | TWD | 0 | 760 | 0 |

| XAU | XAU | 8650000 | 8650000 | 8950000 |

| XBJ | XBJ | 7900000 | 7900000 | 8950000 |

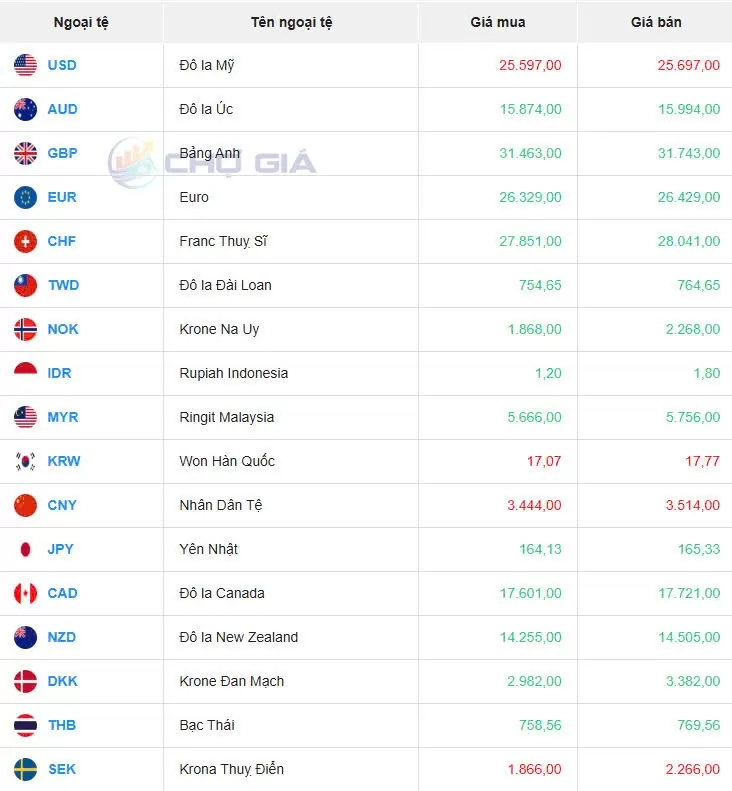

In the "black market", the black market USD exchange rate as of 5:00 a.m. on February 6, 2025 decreased by 24 VND in both buying and selling compared to yesterday's trading session, trading around 25,597 - 25,697 VND/USD.

|

| Black market on February 6, 2025. Photo: Chogia.vn |

USD exchange rate today February 6, 2025 on the world market

The Dollar Index (DXY), which measures the USD against six major currencies (EUR, JPY, GBP, CAD, SEK, CHF), stopped at 107.62 - down 0.39 VND compared to February 5, 2025.

|

| DXY index developments in recent times. Source Investing |

The dollar fell to its lowest in more than a week on Wednesday as investor worries about a global trade war eased, while the Japanese yen gained on strong wage data.

The dollar index, which tracks the currency against six others, fell 0.435% to 107.58, having earlier hit its lowest since January 27 at 107.29.

The dollar jumped as much as 1.3% to 109.88 on Monday as U.S. President Donald Trump prepared to impose 25% import tariffs on Mexico and Canada. The greenback has since fallen about 2% after both Mexico and Canada secured a one-month reprieve by beefing up border security, even as the U.S. raised tariffs on China.

"In particular, markets were relieved that China did not retaliate too strongly, suggesting that China is willing to accept higher US tariffs for now," said Adam Button, currency analyst at ForexLive.

The euro rose 0.24% to $1.041 after falling as much as 2.3% on Monday on concerns about the global impact of tariffs and the possibility of tax extensions on the European Union.

The dollar fell the most against the yen on Wednesday, boosted by strong Japanese wage data and comments from a Bank of Japan official hinting at further interest rate hikes.

The US currency fell 1.19% to 152.525, its lowest since December.

“The dollar’s decline this morning (Wednesday) looks like an extension of recent trends, as markets continue to price in tariff risks from the FX market,” said Nick Rees, head of macro research at Monex Europe.

The dollar continued to fall against the yen after data showed US services sector activity unexpectedly slowed in January due to falling demand.

The Institute for Supply Management (ISM) said on Wednesday that its non-manufacturing purchasing managers' index (PMI) fell to 52.8 last month from 54.0 in December. Economists polled by Reuters had forecast the services PMI rising to 54.3.

Data showed Japan’s inflation-adjusted real wages rose 0.6% year-on-year in December, helped by a rise in winter bonuses. That has traders increasingly betting on the BOJ raising interest rates further this year, with the price set at just over 30 basis points by year-end.

The pound rose 0.2% after hitting a one-month high of $1.255.

Trump's imposition of new 10% tariffs on China sent the yuan slightly lower on Monday as markets returned from an extended Lunar New Year holiday.

The yuan fell 0.47 percent in onshore trading, with gains limited by the People's Bank of China setting a stronger-than-expected midpoint, around which the currency is allowed to trade within a 2 percent band.

Investors have been watching the exchange rate adjustment for clues on whether Beijing will allow the yuan to weaken to cushion the impact of trade measures.

On Tuesday, China imposed its own tariffs on imports from the United States in a swift response, and that same day, Trump said he was in no rush to speak with Chinese President Xi Jinping in an attempt to defuse the situation.

|

| USD exchange rate today February 6, 2025. Illustration photo |

Refer to the popular addresses for Foreign Currency Exchange - Buying and Selling USD in Hanoi: 1. Quoc Trinh Ha Trung Gold Shop - No. 27 Ha Trung, Hang Bong, Hoan Kiem District, Hanoi 2. Gold and Silver Fine Arts - No. 31 Ha Trung, Hang Bong, Hoan Kiem District, Hanoi 3. Minh Chien Gold and Silver Store - No. 119 Cau Giay, Cau Giay District, Hanoi 4. Thinh Quang Gold and Silver Company - No. 43 Ha Trung, Hang Bong, Hoan Kiem District, Hanoi 5. Toan Thuy Store - No. 455 Nguyen Trai, Thanh Xuan, Hanoi and No. 6 Nguyen Tuan, Thanh Xuan District, Hanoi 6. Bao Tin Minh Chau Gold, Silver and Gemstones - No. 19 Tran Nhan Tong, Hai Ba Trung District, Hanoi 7. Chinh Quang Store - No. 30 Ha Trung, Hang Bong, Hoan Kiem District, Hanoi 8. Kim Linh 3 Store - No. 47 Ha Trung, Hang Bong, Hoan Kiem District, Hanoi 9. Huy Khoi Store - No. 19 Ha Trung, Hang Bong, Hoan Kiem District, Hanoi 10. System of transaction offices at banks such as: Sacombank, VietinBank, Vietcombank, SHB Refer to the popular addresses for Foreign Currency Exchange - Buying and Selling USD in Ho Chi Minh City: 1. Minh Thu Currency Exchange - 22 Nguyen Thai Binh, District 1, HCMC 2. Kim Mai Gold Shop - 84 Cong Quynh, District 1, HCMC 3. Kim Chau Gold Shop - 784 Dien Bien Phu, Ward 10, District 10. Ho Chi Minh City 4. Saigon Jewelry Center - 40-42 Phan Boi Chau, District 1, HCMC 5. Kim Hung foreign currency exchange agency - No. 209 Pham Van Hai, Binh Chanh, Ho Chi Minh City 6. DOJI Jewelry Store - Diamond Plaza Le Duan, 34 Le Duan, Ben Nghe, District 1, HCMC 7. Kim Tam Hai Shop - No. 27 Truong Chinh, Tan Thoi Nhat Ward, District 12, HCMC 8. Bich Thuy Gold Shop - No. 39 Pham Van Hai Market, Ward 3, Tan Binh District, HCMC 9. Ha Tam Gold Shop - No. 2 Nguyen An Ninh, Ben Thanh Ward, District 1, HCMC 10. System of transaction offices at banks in Ho Chi Minh City such as: Sacombank, VietinBank, Vietcombank, SHB, Eximbank |

Source: https://congthuong.vn/ty-gia-usd-hom-nay-06022025-giam-xuong-thap-nhat-1-tuan-372459.html

Comment (0)