At the close of yesterday's trading session, precious metal prices turned to weaken while base metal commodities were supported.

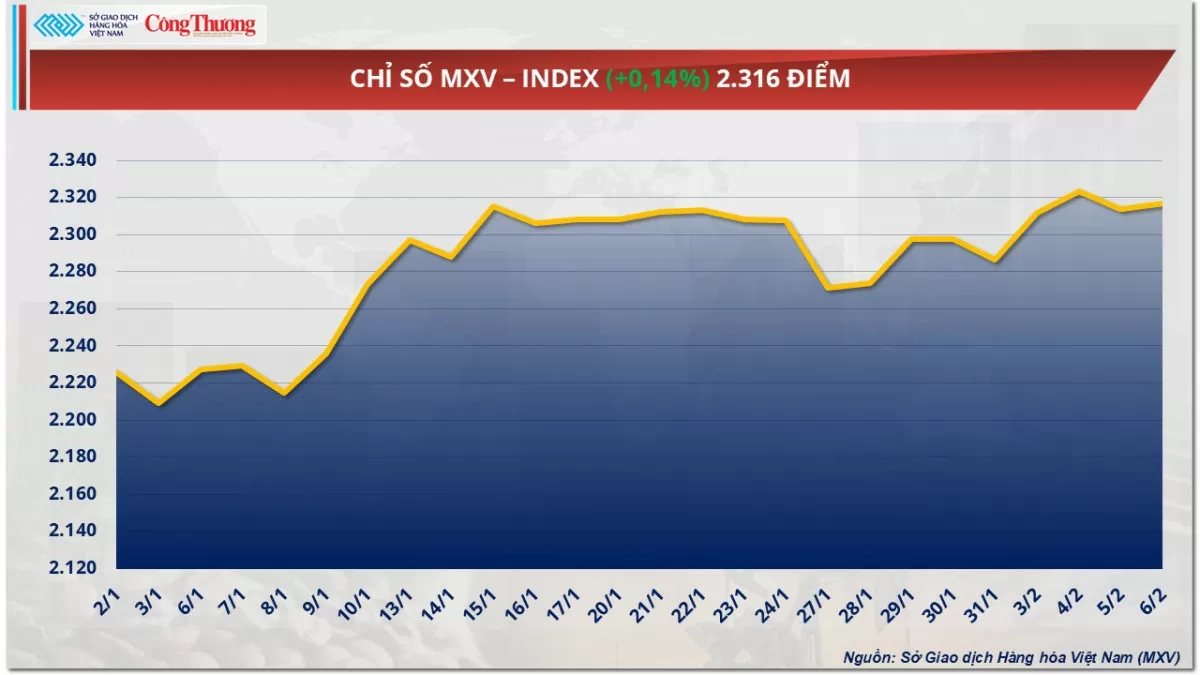

The Vietnam Commodity Exchange (MXV) said that green dominated the world raw material market in yesterday's trading session (February 6). After the previous session's plunge, the agricultural market recovered quickly when 6 out of 7 commodities increased in price. In addition, the base metal market also received support from expectations of China's new economic stimulus policy. At the end of the session, the MXV-Index increased slightly by 0.14% to 2,316 points.

|

| MXV-Index |

Soybean market fluctuates

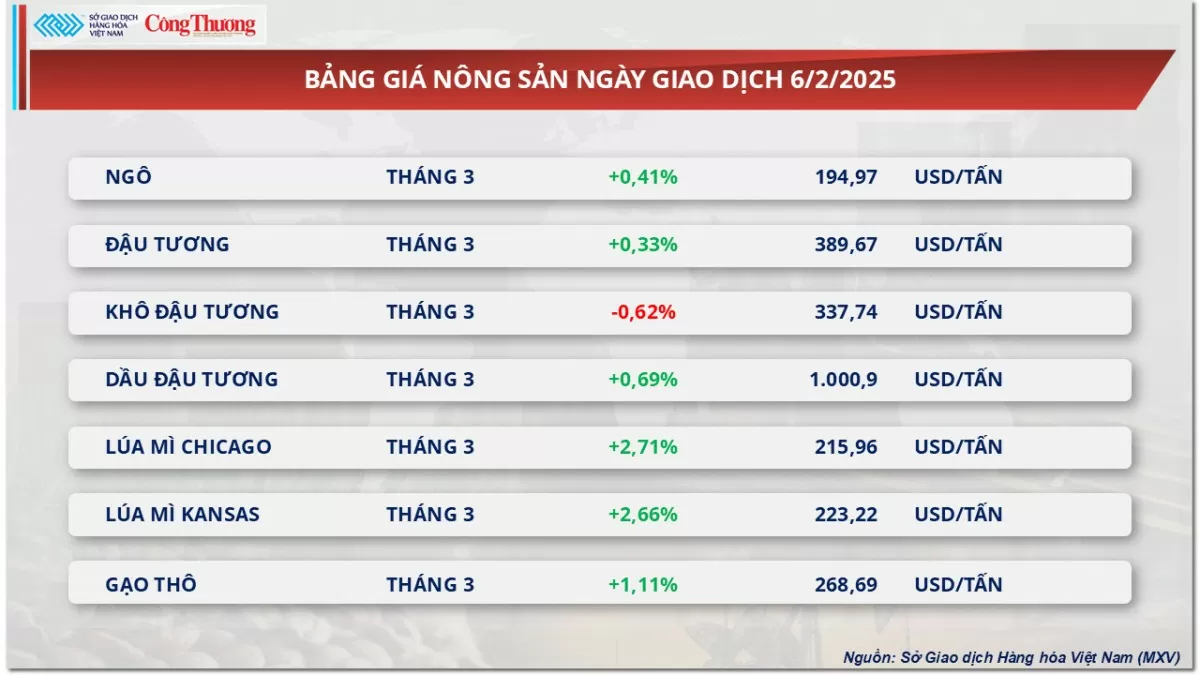

Yesterday's trading session, the agricultural market attracted the attention of investors. At the end of the session, the price index of this group increased by 0.76%. Notably, soybeans. As soon as the market opened, the price of this commodity increased, but the price gradually narrowed in the evening session.

|

| Agricultural product price list |

Markets were cautious amid President Donald Trump’s unpredictable tariff policies, while investors also focused on sales and weather in South America.

The weather forecast for the next two weeks in South America is not ideal, although there will be two rounds of rain next week in the dry growing areas from central to northern Argentina. However, crop quality is still being affected by the drought and high temperatures at the moment. According to the weekly report of the Buenos Aires Grains Exchange, the quality of Argentine soybeans continued to decline compared to the previous week and the same period last year, with 17% good to excellent and 32% poor to very poor. This is the reason why, despite the market's volatility, the buyers still have the upper hand.

On the other hand, in the weekly Export Sales report, the US Department of Agriculture (USDA) said that soybean sales in the week ending January 30 were more than 387,700 tons, down 12% compared to the previous week. The decrease in orders shows that demand for US soybeans is decreasing, putting pressure and restraining the decline in prices yesterday.

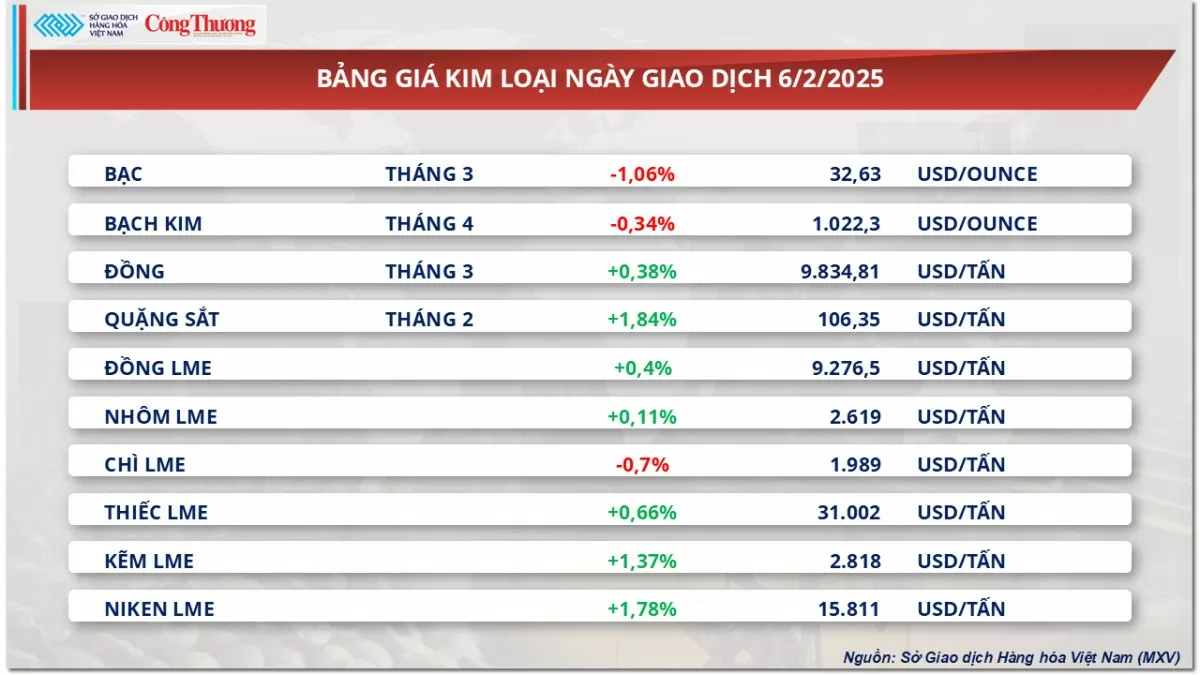

Metal market is divided.

At the close of yesterday's trading session, precious metal prices turned to weaken while base metal commodities were supported in the context of the market placing high expectations on China's new economic stimulus policies.

For the precious metals group, silver prices continued to weaken into the second session, losing 1.06% to 32.63 USD/ounce; platinum prices also turned down 0.34%, to 1,022 USD/ounce.

|

| Metal price list |

At the end of yesterday's trading session, the Dollar Index increased by 0.1% to 107.7 points. According to economists and analysts, the combination of the greenback's strength, rising US bond yields and strong profit-taking activities put pressure on the price of precious metals before the US announced the employment report.

The precious metals market turned weak in yesterday's trading session, pressured by a rebound in the US dollar and profit-taking after a series of consecutive gains amid concerns about rising global trade tensions. The market is now focused on the non-farm payrolls report due out today for further insights on the overall strength of the economy and the US Federal Reserve's policy path.

Meanwhile, in the base metals market, COMEX copper prices rose for the fourth consecutive session to $9,834 a tonne - the highest level since July last year. Iron ore prices also recovered 1.84% to $106.35 a tonne.

Base metals prices have been supported by expectations of rising consumption as China moves to electrify its economy and commits to massive investments in power grid infrastructure. Late last month, China’s State Grid Corporation announced a 650 billion yuan ($88.7 billion) investment in the country’s power grid, boosting demand for metals used in the power sector.

In addition, investors are focusing on the meeting of China's National People's Congress in March with hopes that Beijing will launch more economic stimulus. This expectation supported base metal prices in yesterday's trading session.

Notably, copper prices continued to rise amid forecasts of increased copper demand in 2025 due to the transition to green energy and grid power, in the context of limited supply. According to the Chilean Copper Commission (Cochilco), the global copper market is estimated to have a deficit of 118,000 tons this year. In addition, China has recently tightened export controls on a number of strategic metals to assert its dominance in the supply chain of important minerals. This has had a strong impact on market sentiment, thereby supporting copper prices.

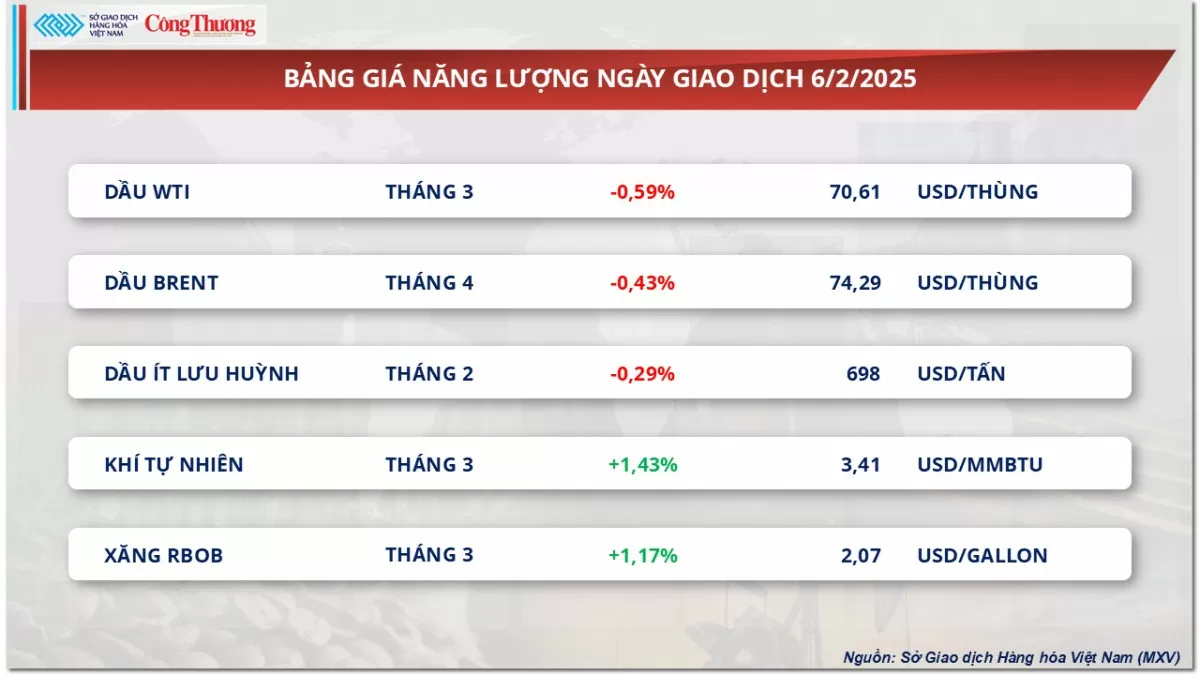

Prices of some other goods

|

| Energy price list |

|

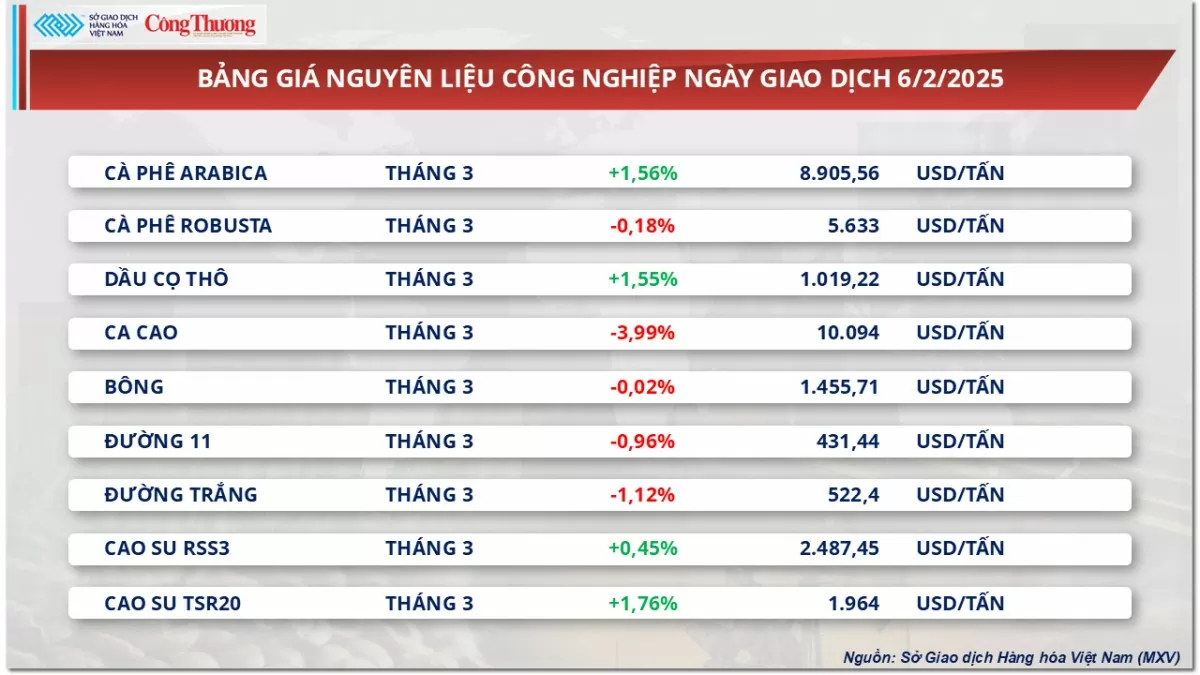

| Industrial raw material price list |

Source: https://congthuong.vn/thi-truong-hang-hoa-ngay-72-gia-kim-loai-quy-suy-yeu-372655.html

Comment (0)