From September 1 to November 30, SSI Securities Company announced the implementation of the program "Margin Interest Refund" and "M9 - Margin Power: The more you 'borrow', the more "Lovely" the interest rate. Accordingly, the margin lending interest rate is applied from 9 - 11%/year for customers with an average monthly debt balance of 3 billion VND or more.

In addition, SSI also applies a margin interest refund policy of up to 30%. Specifically, customers with an average outstanding balance of VND 100 million to less than VND 500 million in a month will be refunded VND 300,000; average outstanding balance of VND 500 million to less than VND 1 billion will be refunded VND 500,000... According to the broker's explanation, for example, customers using margin worth from VND 30 million to VND 499 million will be refunded a maximum of VND 300,000, equivalent to enjoying the lowest margin interest rate of 9.5 - 9.9%, while SSI's current lending interest rate is 13.5%.

Many securities companies reduce interest rates and promote margin lending.

Or Techcombank Securities Company (TCBS) on September 1 also announced a change in margin lending interest rates applicable to all general customers. Accordingly, the T3 flexible loan package has an interest rate of 3%/year for the first 3 days and then 18.25%/year (equivalent to 0.05%/day). For the T5 flexible loan package, the interest rate is 10%/year. Previously, TCBS reduced the general margin lending interest rate from 13.7%/year to 12.99%/year. Or the company also launched a promotion program "Preferential loans, gratitude interest" with an interest rate of only 9.9%/year from the beginning of August and lasting until October 6...

Meanwhile, ACBS Securities Company applies a 7-day interest-free margin program. After this period, customers will have to pay 15% interest per year. For the T14 margin program, in the first 14 days, customers only pay 8% interest per year and from the 15th day onwards, the interest rate is 15% per year...

According to securities companies and experts, the decrease in interest rates is an important factor promoting the financial services industry, including securities. Many investors have shifted capital from banking channels to other investment channels, but securities are the most attractive. At the same time, the margin lending interest rate has also decreased, stimulating borrowing demand to increase investment.

According to a report by VnDirect Securities Company, by the end of the second quarter of 2023, the amount of margin lending at securities companies was at VND140,000 billion. The industry's margin lending ratio over the total value of listed assets in the past 3 years has often been around 17 to 20%, the analysis team expects total margin lending in the entire market to reach VND155,000 - 180,000 billion in the second half of 2023, an increase of 10 - 30% compared to the end of the second quarter of 2023. With the total equity of 30 companies reaching nearly VND183,000 billion by the end of the second quarter of 2023, this figure shows that the margin lending/equity ratio of the entire industry will fall to around 0.85 - 1 times.

Source link

![[Photo] General Secretary To Lam holds talks with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/b3d07714dc6b4831833b48e0385d75c1)

![[Photo] Reception to welcome General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/9afa04a20e6441ca971f6f6b0c904ec2)

![[Photo] National Assembly Chairman Tran Thanh Man meets with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/4e8fab54da744230b54598eff0070485)

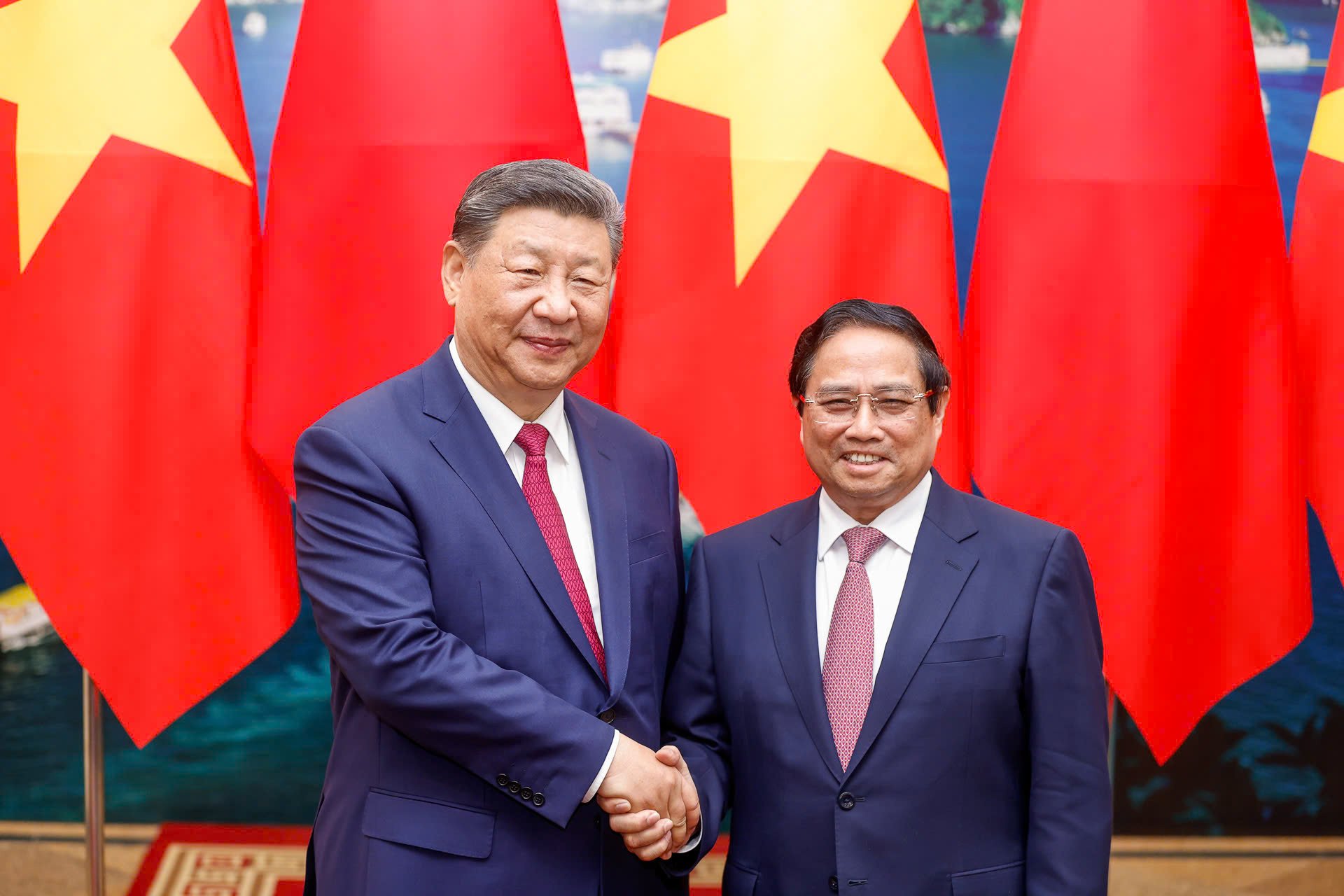

![[Photo] Prime Minister Pham Minh Chinh meets with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/893f1141468a49e29fb42607a670b174)

Comment (0)