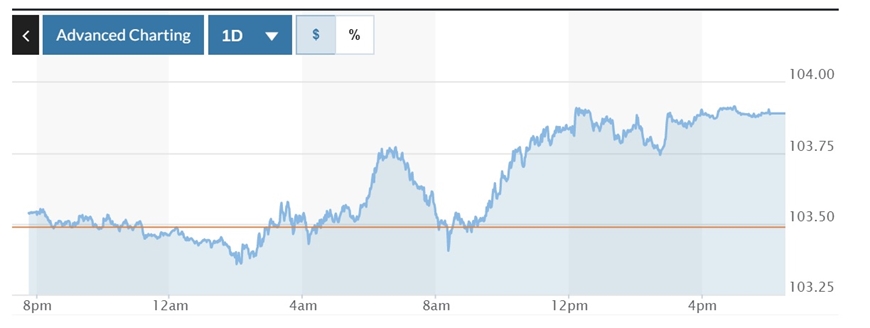

Meanwhile, in the US market, the US Dollar Index (DXY) measuring the greenback's fluctuations against six major currencies (EUR, JPY, GBP, CAD, SEK, CHF) increased by 0.40%, reaching 103.89.

USD exchange rate in the world today

The dollar hit a fresh two-month high against other currencies on Tuesday, supported by recent signs of a recovery in the US economy, while worries about US debt ceiling negotiations sent investors fleeing to safe havens.

|

DXY Index volatility chart over the past 24 hours. Photo: Marketwatch. |

Market expectations that the US Federal Reserve will cut interest rates soon have decreased as US economic data shows resilience and gives the greenback an advantage, said Joe Manimbo, senior market analyst at Convera in Washington.

“There has been a view that the US dollar could lose its yield advantage if the Fed cuts rates as much as the market has recently anticipated and if Europe continues to raise rates. However, there has now been some change to the global interest rate outlook,” he noted.

Market expectations for a Fed rate hike at its next meeting in June have risen slightly after the minutes of its policy meeting in early May were released. According to the minutes, Fed officials all said that further rate hikes should be carefully considered, while others warned that the US central bank should keep interest rate decisions open due to persistent inflation risks.

According to CME Group's FedWatch tool, Federal Funds Futures show a 35.3% probability of the Fed raising interest rates at its two-day policy meeting ending June 14.

Marc Chandler, chief market strategist at Bannockburn Global Forex in New York, said debt ceiling negotiations are a big factor in the foreign exchange market.

Meanwhile, the pound fell to a five-week low against the greenback of $1.2358 and was last down 0.42%, after data showed UK inflation slowed much less than markets expected.

|

| USD exchange rate today (May 25): USD bounces back. Illustration photo: Reuters. |

Domestic USD exchange rate today

In the domestic market, at the end of the trading session on May 24, the State Bank announced the central exchange rate of the Vietnamese Dong to the USD increased by 14 VND, currently at: 23,684 VND.

* The reference exchange rate at the State Bank's transaction office increased slightly, currently at: 23,400 VND - 24,818 VND.

USD exchange rates at commercial banks are as follows:

USD exchange rate | Buy | Sell |

Vietcombank | 23,320 VND | 23,660 VND |

Vietinbank | 23,260 VND | 23,680 VND |

BIDV | 23,340 VND | 23,640 VND |

* The Euro exchange rate at the State Bank's exchange office for buying and selling slightly decreased to: 24,241 VND - 26,793 VND.

Euro exchange rates at commercial banks are as follows:

Euro exchange rate | Buy | Sell |

Vietcombank | 24,916 VND | 26,048 VND |

Vietinbank | 24,392 VND | 25,682 VND |

BIDV | 24,931 VND | 26,056 VND |

MINH ANH

Source

Comment (0)