The stock market has successfully tested the 1,100-point price zone and had a fairly positive first trading week of December. According to statistics, trading on the HOSE floor last week, the VN-Index had 2 sessions of decline and 3 sessions of increase. At the end of the trading week, the VN-Index increased by 22.28 points (+2.02%), to 1,124.44 points.

During the week, liquidity on HOSE reached VND 104,393.28 billion, a sharp increase of 59.9% compared to the previous week. Of which, there was a trading session on December 7, 2023, with sudden liquidity around the average price of MA200, trading volume of nearly 1.3 billion shares, the highest since September 2023, a strong surge in VN30.

The VN30 group of stocks is performing more positively than the VN-Index in general, which is a clear signal that the market's recovery in the following weeks will be higher. VN30 can fully expect to increase points to overcome the strong resistance zone of 1,125 - 1,150 points, while the challenge of 1,130 - 1,140 points is a difficult peak in the following week for VN-Index.

Commenting on factors affecting the market in December, analysts from ABS Securities Company said that concerns about conflicts in the Middle East have eased; inflation has somewhat cooled down in the EU and the US - Vietnam's major trading partner, while US economic growth remains strong. In addition, inventories in the US and EU countries have fallen sharply, and these markets are expected to boost imports to prepare for year-end consumer demand.

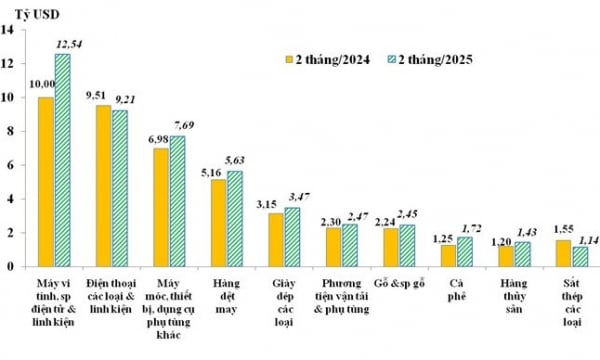

In Vietnam, at the end of the year, the Government is determined to promote public investment disbursement in the infrastructure and energy sectors, with a total capital of about VND 247,000 billion for this year. Along with public investment, exports are expected to be the driving force for Vietnam's growth in the fourth quarter of 2023.

The State Bank has also expanded credit room with the desire to add 730,000 billion VND to the economy to boost credit growth to reach the target.

With the above positive factors, ABS predicts a positive scenario, that is, the market will have a second short-term recovery, with a high probability of occurring in the first weeks of December.

In terms of valuation, with the VN-Index recovering in November, the P/E of the entire market increased from 12.7 times at the end of October to 13.5 times at the end of November based on the financial report data of the third quarter of 2023. Abundant liquidity and low interest rates will be factors supporting the increase in market valuation in December.

The current stock market return is estimated at 7.41%, higher than the average bank deposit interest rate. Therefore, it is forecasted that domestic investors' cash flow will continue to stay in the stock market and lead the recovery.

For foreign investors, the net selling trend may continue because US Treasury bond yields, although cooling down, remain high, while gold prices continue to increase, becoming an attractive alternative investment channel for emerging markets.

With positive market expectations for the second short-term recovery, ABS suggests that investors can disburse positions for stocks in sectors that are stronger than the general market, stocks that are deeply discounted after the recent medium-term correction. However, investors should note that the support level of the second recovery at 1,075 points is an area that requires short-term risk management.

Source

![[Photo] President Luong Cuong and King Philippe of Belgium visit Thang Long Imperial Citadel](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/cb080a6652f84a1291edc3d2ee50f631)

![[Photo] Close-up of Vietnam's sniffer dog team searching for earthquake victims in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/d4949a0510ba40af93a15359b5450df2)

![[Photo] General Secretary To Lam receives King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/e5963137a0c9428dabb93bdb34b86d7c)

![[Photo] Prime Minister Pham Minh Chinh meets with King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/be2f9ad3b17843b9b8f8dee6f2d227e7)

Comment (0)