After a period of stagnation since the beginning of the year, the stock market is currently experiencing positive growth with the attraction of cash flow back into the market in the past 2 months.

In that context, many large and small stocks took advantage of the situation to break out. Notably, PVD stock of the Oil and Gas Drilling and Well Services Corporation (PV Drilling) in the trading session on June 15 increased by nearly 4.3% to VND24,400/share, thereby returning to the highest price range in 14 months, since April last year.

Compared to the long-term bottom in November last year, PVD's market price has increased by nearly 88% to VND24,150/share. Market capitalization has also increased by more than VND6,300 billion after half a year, to nearly VND13,600 billion. Meanwhile, the VN-Index has increased by 1.6% since the beginning of the year and increased by 3% over the past month.

In September 2022, before the announcement of putting PVD shares on the list of securities ineligible for margin trading, because the after-tax profit of PV Drilling's parent company's shareholders in the first 6 months of 2022 was negative at nearly VND 116 billion, the fund group managed by Dragon Capital "quickly" bought an additional 3.1 million PVD shares.

PVD stock performance over the past 7 years (Source: TradingView).

As a result, the stock had a breakthrough increase, even reaching the ceiling at one point before profit-taking pressure narrowed the range. PVD shares closed the session on September 14 with an increase of 2.9% and recorded the 4th consecutive session of strong breakthrough to the 24,000 VND/share area. From the bottom confirmed in early July, this stock has increased by nearly 60% in just over 2 months.

In addition, reports from securities companies have always assessed that PVD shares have growth potential and are recommended for investment because the price of rig rentals from the bottom of 2022 will continue to improve and PVD will start to re-sign rental contracts. Therefore, this stock has a certain interest from investment cash flow in the market.

PetroVietnam Drilling and Well Services Corporation (PV Drilling) was established in 2001 on the basis of the Offshore Petroleum Technical Services Enterprise (PTSC Offshore). In 2009, Vietnam Oil and Gas Drilling Investment Joint Stock Company (PVD Invest) merged into PetroVietnam Drilling and Well Services Corporation with charter capital increased to VND 2,105 billion. PV Drilling operates in the field of owning and operating offshore and onshore drilling rigs,...

According to experts, the oil and gas industry in general and PVD shares in particular are cyclical, heavily dependent on fluctuations in oil prices as well as rig rental prices worldwide.

Recently, the oil and gas group has received some positive support information from the implementation of key domestic projects, typically the Block B - O Mon mega project.

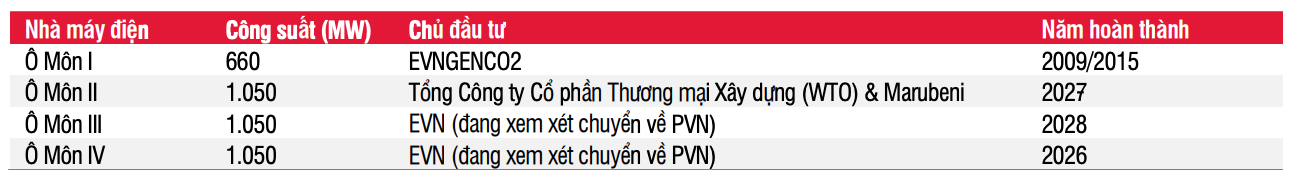

The electricity capacity of the four O Mon power plants is 3.8 GW, providing about 10.2% of the capacity of domestic gas-fired power plants by 2030 (Source: SSI).

SSI Securities commented that PVD is one of the oil and gas companies that will benefit the most from this project due to its important role in the construction and upstream drilling process to exploit the first gas flow in 2026.

Therefore, despite the market being in a tug-of-war around the reference level, the group of oil and gas stocks still had a quiet increase going against the general market, PVS, PXS, PVC, POS,… all increased by over 4% in value; PVS jumped up to 8%, PVB even set a ceiling increase of “no buyers”.

Block B – O Mon is a series of projects to develop, exploit and transport gas from upstream gas fields in Block B & 48/95 and Block 52/97 to downstream gas-fired power plants. The Final Investment Decision (FID) for the project is expected to be approved in June 2023 and the first gas is expected to be exploited in 2026.

Based on the assumption that FID will be approved by the end of 2023, SSI Research forecasts that PVD shares can achieve a net profit CAGR of 26% in the 2023-2026 period, in which the backlog from the Block B project will be the key to this growth rate.

Regarding the financial picture, in the first quarter of 2023, PVD recorded net revenue of VND 1,226 billion, up 7% over the same period last year. Cost of goods sold decreased by 8% to VND 988 billion, resulting in gross profit of VND 238 billion, up 240% over the first quarter of 2022.

The company's financial revenue increased by 78%, reaching nearly VND48 billion. Financial expenses also increased by 77%, to VND98.5 billion, mainly due to interest expenses increasing by 159%, to VND69.3 billion.

Meanwhile, selling expenses and administrative expenses increased by 2% and 29%, respectively, to VND1.38 billion and VND111.4 billion. As a result, the company's after-tax profit was VND52.3 billion, while in the same period last year it lost VND75.1 billion.

According to the explanation, all jack-up rigs operated continuously in the first quarter of 2023, compared to the first quarter of 2022, the jack-up rig utilization rate was only 55%. In addition, the rental price of jack-up rigs in the first quarter of 2023 increased by over 20% compared to the first quarter of 2022 and increased profits shared from joint ventures.

In 2023, PV Drilling plans to achieve consolidated revenue of VND5,400 billion, a slight decrease compared to the previous year. However, consolidated profit after tax is expected to reach VND100 billion, while in 2022 it lost VND155 billion. Thus, compared to the achieved results, PVD has completed 22% of the revenue target and 52.3% of the annual profit target .

Source

![[Photo] Prime Minister Pham Minh Chinh starts construction of vital highway through Thai Binh and Nam Dinh](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/52d98584ccea4c8dbf7c7f7484433af5)

![[Photo] Prime Minister Pham Minh Chinh receives Swedish Minister of International Development Cooperation and Foreign Trade](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/ae50d0bb57584fd1bbe1cd77d9ad6d97)

![[Photo] Prime Minister Pham Minh Chinh works with the Standing Committee of Thai Binh Provincial Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/f514ab990c544e05a446f77bba59c7d1)

Comment (0)