VN-Index under strong selling pressure due to pre-Tet sentiment; Textile giant reports record profit thanks to export revenue; List of potential stocks in Q1; Notable economic events; Dividend payment schedule.

VN-Index strongly adjusted at the beginning of the year

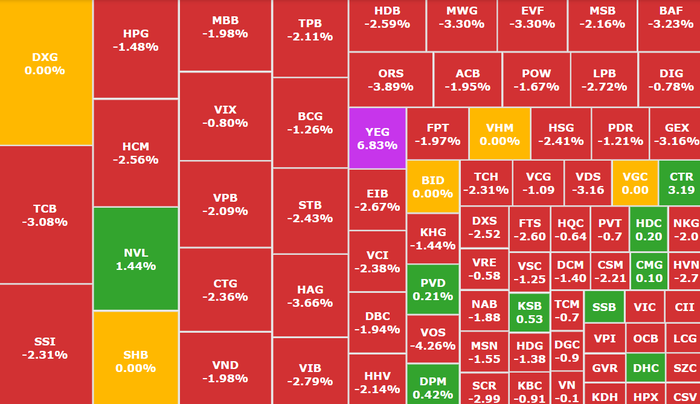

The stock market was in red in the first sessions of the year. VN-Index dropped sharply by 15.1 points, falling back to 1,254.6 points.

Market liquidity reached nearly VND15,000 billion, but red dominated with 455 stocks decreasing and 126 stocks increasing. The VN30 group lost 22.6 points when witnessing strong selling pressure, especially stocks in the financial group. 13 stocks in this group decreased by 2-3.5%, except for SSB (SeABank, HOSE) and VCB (Vietcombank, HOSE) which still maintained a slight green color.

The securities group recorded the worst signal among the three financial pillars (Securities, Real Estate and Services, Banking) when it decreased by 2.3%, equivalent to about 1,700 billion VND leaving the market.

The market is under strong selling pressure in the first sessions of the year (Photo: SSI iBoard)

Specifically, DSE (DNSE Securities, HOSE) decreased by 3.8%, MBS (MB Securities, HOSE) decreased by 3.5%, BSI (BIDV Securities, HOSE) decreased by 3.2%,... Notably, APG shares (APG Securities, HOSE) decreased to the bottom of 6,530 VND/share, a decrease of 2.4%. Compared to the time from March 2024, this stock has decreased by nearly 60% of its value, almost losing liquidity.

Going against the market trend, small-cap stocks rose with KSV (Vimico, HNX) and YEG (Yeah1, HOSE) unexpectedly hitting the ceiling. Oil and gas stocks with codes such as PLX (Petrolimex, HOSE), PVS (PTSC, HNX), PVD (PV Drilling, HOSE) also maintained green.

Foreign investors increased their net selling to VND777 billion, creating great pressure on the index, with the focus on FPT shares (FPT, HOSE) with a value of VND228 billion, followed by CTG (VietinBank, HOSE) with VND122 billion and TCB (Techcombank, HOSE) with VND73 billion.

Notable events for the Vietnamese stock market in January 2025

VN-Index is among the high growth groups in 2024 in the world stock market when recording the second consecutive year of growth of about 13%. Stepping into 2025, many comments said that the important story affecting the stock market is the high economic growth and profit recovery.

Accordingly, investors should pay attention to important events in January that may impact the stock market.

Announcement of purchasing managers' index (PMI) of Vietnam and the US (January 2) Announcement of Vietnam's economic data for the fourth quarter and 2024 (January 6): Optimistic forecasts about Vietnam's economic situation in 2024 continue to be made, after the GDP growth rate in the third quarter of 2024 was 7.4% and in the first 9 months was 6.82% announced by the General Statistics Office. In addition, the Prime Minister emphasized that 2025 "is the year of acceleration and breakthrough" to successfully complete the 2021-2025 socio-economic development plan, at the same time, requiring maximum efforts, creating breakthroughs to attract investment, boosting production and business so that in 2025, growth will be at least 8%, from 2026 reaching double digits.

Announcement of new stock composition in VN30 (January 20): Yuanta Securities predicts that the VN30 index will add new shares of LPB due to meeting all conditions, while POW shares are predicted to be eliminated due to insufficient capitalization. ETFs will complete their portfolio structure on February 3, 2025.

The latest report from S&P Global shows that the Vietnam Manufacturing Purchasing Managers' Index (PMI) in December only reached 49.8 points, down 1 point compared to 50.8 points in November. This shows that overall business conditions have slightly deteriorated at the end of the year.

FED announces policy interest rate (January 30): Fed Chairman Jerome Powell said in a December press conference that "the Fed now needs to be cautious in the process of cutting interest rates as well as in all monetary policy decisions and look for clues and data showing progress in inflation". This will partly affect the movement of foreign capital flows. According to HSC Securities, in the months surrounding Donald Trump's victory in the US presidential election, the market expected the Fed to maintain policy interest rates at a high level for a longer period of time.

" Big guy " TNG textile highest profit in history

TNG Investment and Trading Joint Stock Company (TNG, HOSE) recently announced a quick report on its 2024 business results with revenue reaching VND 7,736 billion, up 9% year-on-year (YoY), net profit reaching the highest level in history, up to VND 315 billion, up 44% YoY, completing 98% and 102% of the yearly plan, respectively.

TNG reports record profit thanks to export revenue (Illustration photo: Internet)

Accordingly, 97% of total revenue comes from exports and only 3% comes from the domestic market.

Regarding the order situation, as of the end of 2024, the company said that orders have been confirmed until June 2025 and are continuing to negotiate to finalize the production plan for 2025.

In addition, TNG will soon pay the third interim dividend of 2024 in cash at a rate of 4% (VND 400/share) on January 22, 2025, right before Tet At Ty 2025. With 122.6 million outstanding shares, shareholders will receive a total of VND 49 billion before tax.

Potential stock group in the first quarter of the year

Mirae Asset Securities (MAS) has released a statistical report on stocks that have shown an increasing trend in the first quarter of recent years.

Accordingly, the data is filtered based on the VN100 group and selects stocks with positive growth in the first quarter of each year. The selected portfolio groups all have good growth over the years, including the construction materials, banking and real estate industries.

MAS pointed out a number of stocks with outstanding performance in the first quarter, mostly in the banking group, because the fourth quarter is usually the peak time for business, especially for banks, this is the period when banks start to boost credit growth after receiving new credit limits from the State Bank. Notable codes are TCB (Techcombank, HOSE) and MBB (MBBank, HOSE).

MAS emphasized that January is usually stable, investors should focus on banking stocks and be less dependent on the market. March will be a time of strong growth, with stocks breaking out compared to the VN-Index, especially in the construction and real estate sectors.

In the real estate industry, it is worth noting that SIP (Saigon VRG Investment, HOSE) achieved the highest growth rate in 2024, up to 47.8% and has grown well in recent years, outperforming the VN-Index. In addition, KDH (Khang Dien, HOSE) has a stable growth rate.

This is followed by the construction materials group, notably CTR (Viettel Construction, HOSE) when it increased by 54% in 2024. In addition, there are PTB (Phu Tai, HOSE) and HT1 (Vicem Ha Tien Cement, HOSE).

Comments and recommendations

Mr. Do Thanh Son, Head of Investment Consulting Department, Mirae Asset Securities, assessed that the first two trading sessions of the year were not very favorable for the Vietnamese stock market due to the pressure of high exchange rates, which partly affected the psychology of investors. In the immediate future, investors need to clearly recognize the opportunities and risks of the market.

In terms of opportunities, positive Q4/2024 business results will create momentum for stock price increases, with the driving force coming from import-export activities with many improvements when interest rates remain low, helping businesses save on interest costs, increasing scale and operating capacity from Q3, which is expected to improve revenue and profit. Next is the positive cash flow from domestic individuals and organizations in the early stages of the year, helping to improve liquidity. Finally, there is a signal that the market has no longer had exchange rate risks.

The adjustment status will take place in the period before Lunar New Year.

On the other hand, some risks still appear when foreign investors continue to sell heavily to shift cash flow to other assets with higher yields, causing confusion among investors and transactions gradually becoming more cautious, even panic selling due to negative market concerns.

Overall, the market will remain negative in the short term as the exchange rate shows no signs of cooling down. Furthermore, the cautious sentiment before Tet has caused the market to continue to fluctuate, with cash flow tending to be gloomy.

Therefore, he recommended that the sharp decline last weekend created a sense of panic. Investors should continue to observe the State Bank's USD selling and gradually accumulate basic stocks. The market will soon reflect all exchange rate risks in the period close to Tet, thereby helping investors have a good position and take advantage of the momentum of new cash flow after Tet.

Notable stock groups are Banking and Real Estate (residential and industrial areas).

BSC Securities believes that, based on the developments of last weekend, the next movement of VN-Index will depend on the bottom-fishing cash flow here. In a negative case, the index could continue to fall to the threshold of 1,240 points.

TPS Securities comment, VN-Index reacted negatively when it fell sharply in the session of January 3, with liquidity near the average level of the last 20 sessions, the current support zones of VN-Index are around 1,240 points and 1,220 points. Investors should be cautious, only disbursing when the market surpasses resistance or buying at the support levels below.

Dividend schedule this week

According to statistics, there are 16 enterprises that have fixed dividend rights from January 6 to January 10, 2025, of which 12 enterprises pay in cash, 1 enterprise pays in shares and 3 enterprises issue additional shares this week.

The highest rate is 100%, the lowest is 5%.

1 company pays by stock:

Military Commercial Joint Stock Bank ( MBB , HOSE), ex-dividend date is January 7, rate is 15%.

3 additional issuers:

Dat Xanh Group Corporation (DXG, HOSE), ex-dividend date is January 6, ratio is 21%.

Guotai Junan Securities JSC (Vietnam) (IVS, HNX), ex-right trading date is January 7, ratio is 100%.

Vietourist Tourism JSC (VTD, UPCoM), ex-dividend date is January 9, ratio is 100%.

Cash dividend payment schedule

*Ex-right date: is the transaction date on which the buyer, upon establishing ownership of shares, will not enjoy related rights such as the right to receive dividends, the right to purchase additional issued shares, but will still enjoy the right to attend the shareholders' meeting.

| Code | Floor | GDKHQ Day | Date TH | Proportion |

|---|---|---|---|---|

| IDP | UPCOM | 6/1 | 20/1 | 50% |

| BWS | UPCOM | 6/1 | 16/1 | 11% |

| NTP | HNX | 6/1 | 22/1 | 15% |

| SAF | HNX | 6/1 | 16/1 | 30% |

| NTH | HNX | 7/1 | 23/1 | 10% |

| SMB | HOSE | 8/1 | 17/1 | 15% |

| DC4 | HOSE | 8/1 | 20/1 | 5% |

| NBT | UPCOM | 9/1 | 23/1 | 5% |

| QNS | UPCOM | 9/1 | 21/1 | 10% |

| GVT | UPCOM | 9/1 | 26/2 | 25% |

| DAD | HNX | 9/1 | 22/1 | 15% |

| HNP | UPCOM | 9/1 | 20/1 | 6% |

Source: https://pnvnweb.dev.cnnd.vn/chung-khoan-tuan-6-1-10-1-vn-index-dieu-chinh-trong-ngan-han-tai-vung-1240-1250-20250106081542073.htm

![[Photo] General Secretary To Lam receives French Ambassador to Vietnam Olivier Brochet](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/49224f0f12e84b66a73b17eb251f7278)

![[Photo] Promoting friendship, solidarity and cooperation between the armies and people of the two countries](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/0c4d087864f14092aed77252590b6bae)

![[Photo] Nhan Dan Newspaper announces the project "Love Vietnam so much"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/362f882012d3432783fc92fab1b3e980)

![[Photo] Closing of the 4th Summit of the Partnership for Green Growth and the Global Goals](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/c0a0df9852c84e58be0a8b939189c85a)

![[Photo] National Assembly Chairman Tran Thanh Man meets with outstanding workers in the oil and gas industry](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/1d0de4026b75434ab34279624db7ee4a)

![[Photo] Welcoming ceremony for Chinese Defense Minister and delegation for friendship exchange](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/fadd533046594e5cacbb28de4c4d5655)

![[Video] Viettel officially puts into operation the largest submarine optical cable line in Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/f19008c6010c4a538cc422cb791ca0a1)

Comment (0)