According to the financial report of Royal International Corporation (RIC), sales and service revenue in the second quarter of 2023 reached VND 24.2 billion, down 42% over the same period. After deducting expenses, Royal International lost VND 23.7 billion. This is the 15th consecutive quarter of loss for this enterprise.

According to Royal International, sales and service revenue in the second quarter of 2023 decreased compared to the same period last year, when the Covid epidemic was under control in the second quarter of 2022.

In the second quarter of 2023, financial operating expenses increased due to interest expenses and exchange rate differences. However, administrative expenses decreased due to the company cutting salary expenses.

The leader of Royal International said that the company has taken every measure to stabilize existing customer sources and exploit new customer sources to increase revenue, but it is still not enough to offset costs. In the second quarter, the company continued to incur losses.

In the first 6 months of the year, the company had a revenue of more than 55 billion VND, a slight increase compared to the same period in 2022.

After-tax profit is negative more than 35 billion VND.

Royal International Corporation's main activities are construction and business of 5-star hotels, business of prize-winning games for foreigners, along with some entertainment activities in Ha Long (Quang Ninh).

According to the amended investment certificate dated July 20, 2022, the company's investment capital is VND 1,171 billion, charter capital is VND 703 billion. The owner is Khai Viet Investment Company Limited (established in the British Virgin Islands). As of June 30, the company's number of employees was 475, down from the end of 2022.

The company was listed on the Ho Chi Minh City Stock Exchange (HoSE) in 2007. In May 2022, RIC shares were forced to be delisted from HoSE due to three consecutive years of losses.

As of June 30, the shareholder structure includes Khai Viet Investment Company Limited (52.49%), Ms. Ngo Thu Mat (3.21%), Nguyen Tieu Mai (2.52%), Nguyen Khoi Phat (2.68%) and other shareholders (39.09%).

After the pandemic, the casino industry faced many difficulties. According to information from Bloomberg, the billionaire Cheng family bought Hoiana Resort & Golf - a resort combined with a casino in Hoi An South, Vietnam from "Macau Casino King" Alvin Chau.

Source

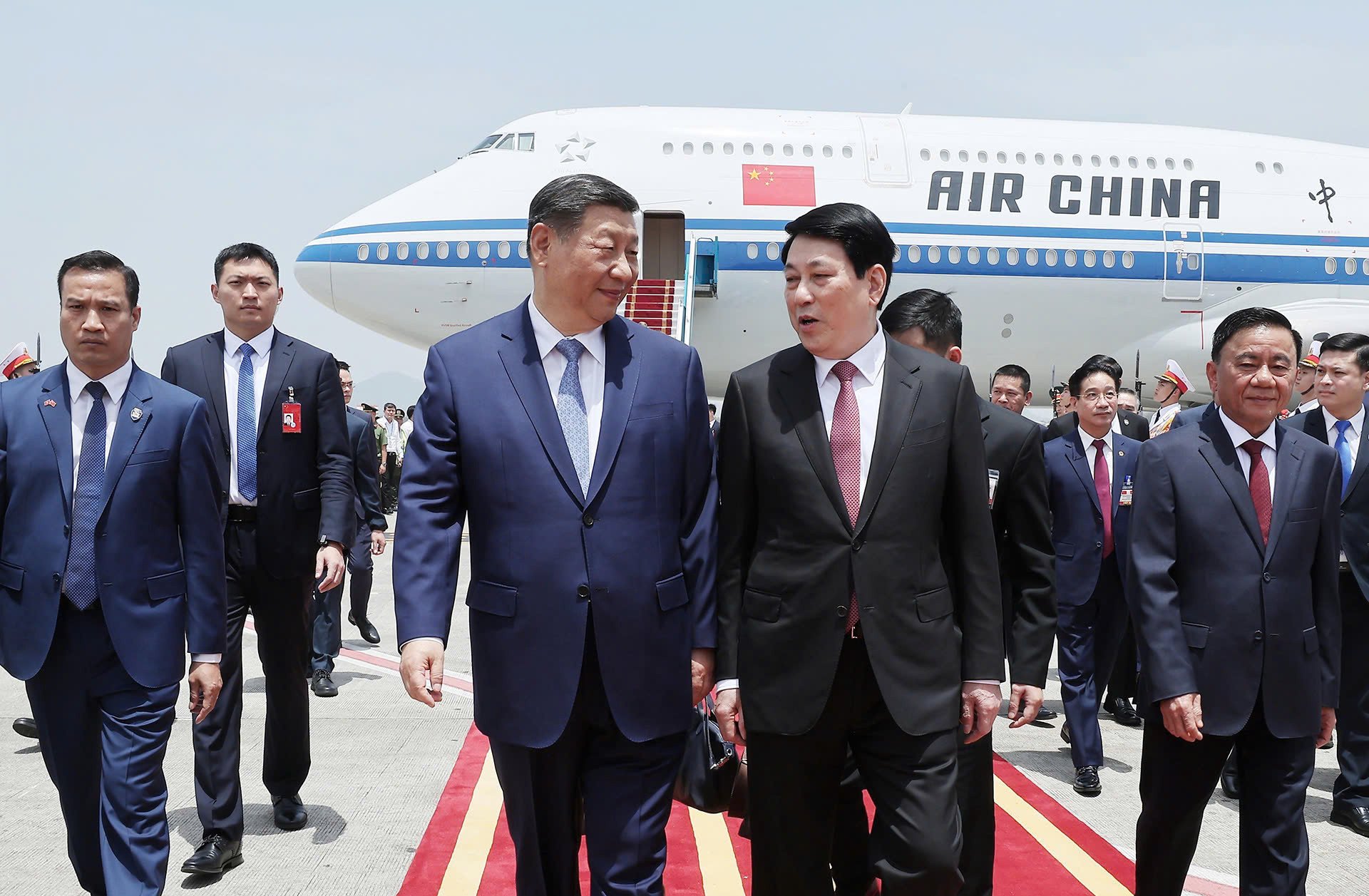

![[Photo] General Secretary To Lam holds talks with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/b3d07714dc6b4831833b48e0385d75c1)

![[Photo] Prime Minister Pham Minh Chinh meets with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/893f1141468a49e29fb42607a670b174)

![[Photo] Reception to welcome General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/9afa04a20e6441ca971f6f6b0c904ec2)

![[Photo] National Assembly Chairman Tran Thanh Man meets with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/4e8fab54da744230b54598eff0070485)

Comment (0)