(Dan Tri) - Taking advantage of the fact that banks require users to confirm their biometrics on the application to transfer large amounts of money, scammers have used many tricks to appropriate people's assets.

Scam call banking app biometric verification guide

According to Decision 2345 of the State Bank of Vietnam, from July 1, online money transfer transactions via banking applications, with an amount of over 10 million VND at a time or an accumulated amount of over 20 million VND per day, will require facial authentication. This authentication process will be compared with a centralized database of residents. This is to ensure safety and security in online payments and bank card payments.

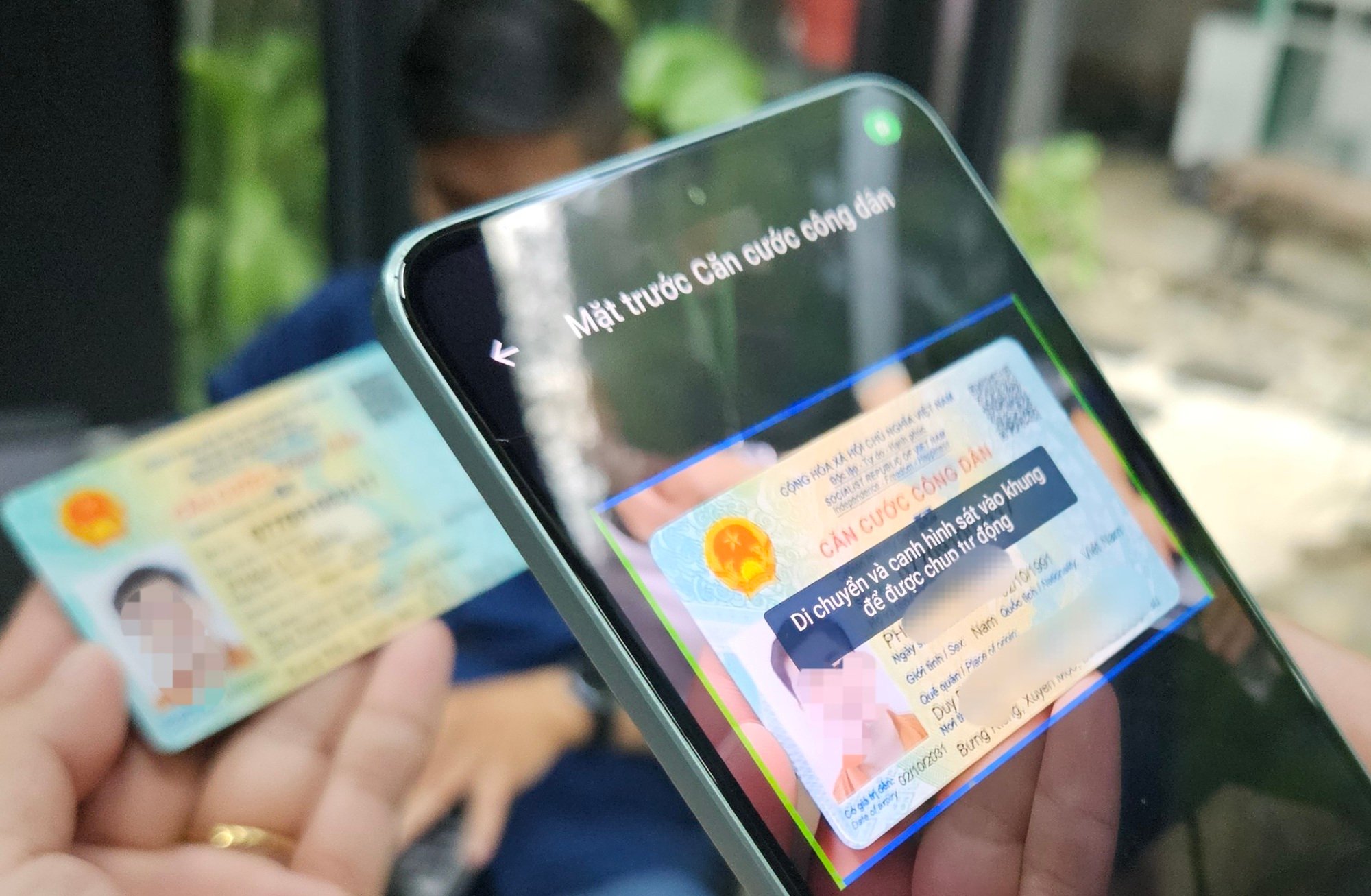

Biometric authentication helps to protect people more safely, avoiding the risk of being scammed and having all the money in their assets stolen (Photo: My Anh).

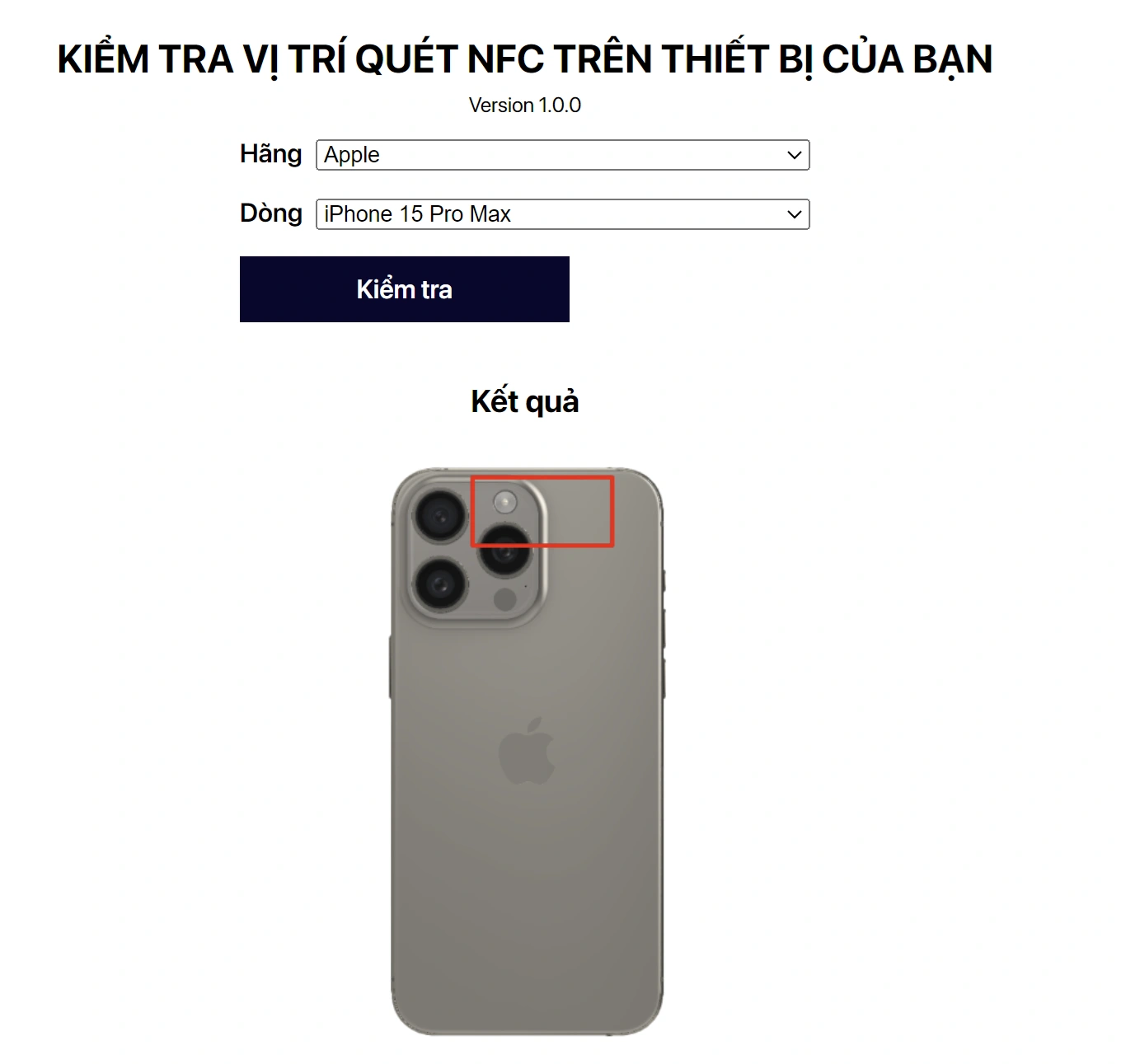

To do this, users need to perform biometric authentication through the banking application on their smartphone. The biometric authentication process will include taking a portrait photo of the user and using the NFC feature on the smartphone to scan the chip attached to their Citizen Identification Card (CCCD). Performing biometric authentication on the banking application will help increase security, reduce the risk of revealing bank account login information, and prevent bad guys from transferring all the money in the bank account after hacking into the smartphone... However, many users have encountered obstacles when performing biometric authentication on smartphones, because many devices do not support NFC connection to perform authentication or users do not know how to properly place the CCCD for the smartphone to read the NFC chip...

Many people have difficulty with biometric authentication because they do not know where the NFC chip is located on their smartphone (Screenshot).

Taking advantage of this, bad guys have carried out many tricks to scam users. The most common of these is that bad guys will impersonate bank employees, call people to advise and support them in performing biometric authentication on their smartphones. With this method, scammers will steal personal information or trick users into installing applications containing malicious code on their smartphones to take control of the device, thereby stealing money in the banking application. Many people have raised their vigilance and are too familiar with these tricks to follow the requests of scammers. However, they are still very annoyed when they have to receive dozens of phone calls every day impersonating bank employees to advise on biometric authentication. "Banks have warned people about scams impersonating bank employees, so I am very vigilant. But scammers keep calling me with the excuse of supporting biometric authentication on smartphones, making me very tired of being bothered," said HS, who lives in Cau Giay district, Hanoi.Common biometric authentication scams

The purpose of scammers is to steal users' personal information, trick them into installing malware on their smartphones to take control and steal money through banking applications on smartphones. Below are the most common tricks that bad guys use to exploit biometric authentication on smartphones to commit fraud, everyone needs to know to avoid becoming a victim: - Impersonating bank employees to make friends on social networks: With this form of fraud, bad guys will create fake social network accounts on Facebook, Zalo... impersonating bank employees or even creating fake social network accounts of major banks.

Bad guys will impersonate bank employees, call or get to know users to scam them in order to infiltrate and take control of smartphones (Illustration: IT).

Then, through articles and comments on Facebook or Zalo, they will intentionally contact and get acquainted with people who are having difficulty in the process of biometric authentication on smartphones to ask for support, but in fact, the purpose is to scam. - Ask people to provide personal information, photos of citizen identification : Scammers will call people, impersonating bank employees who want to support them in performing biometric authentication on smartphones, and at the same time ask users to provide personal information, take photos of citizen identification, portrait, voice... Many gullible people will follow the requests of scammers. They will use this personal information for fraudulent activities, borrowing money through financial applications... causing people to have debts without knowing it. - Make friends via Zalo, Facebook to trick people into installing malware: Similar to the above form, scammers will impersonate bank employees, try to make friends with people via Facebook or Zalo to guide them on how to authenticate biometrics on smartphones. After gaining users' trust, the bad guys will trick them into installing applications containing malware, impersonating banking applications, with the reason of making the biometric authentication process faster and easier. However, after installing these types of malware, the user's smartphone will be hacked, lose control, and the bad guys can steal all the money through the banking application on the smartphone infected with malware. - Trick users into accessing fake bank websites: In addition to tricking people into installing malware-containing applications, bad guys will also build websites with interfaces that copy and fake the bank's website, with a dialog box to enter login information into a bank account. The scammers then impersonate bank employees and send the victims a link to a fake website, tricking them into logging into their bank accounts to steal their login information. Sometimes, these fraudulent websites will also automatically download a file containing malicious code to the victim's smartphone, taking control without their knowledge.What should people do to avoid becoming victims?

By understanding the above forms of fraud, users can be more vigilant to avoid becoming victims of bad guys. Absolutely do not provide personal information, ID photos, portraits or bank account information to strangers or new acquaintances on social networks. If you see a stranger adding friends on Facebook, Zalo... and you do not know who they are, decline the request.

After biometric authentication, users will have to use their face to authenticate transactions worth more than 10 million VND, helping to increase safety and avoid fraud (Photo: Getty).

Through their official websites and apps, banks have also warned users about scams that exploit biometric authentication on smartphones. If you encounter difficulties in performing biometric authentication on your smartphone, you should bring your device directly to the bank for support, instead of listening to advice from strangers online.Dantri.com.vn

Source: https://dantri.com.vn/suc-manh-so/chieu-tro-lua-dao-ho-tro-xac-thuc-sinh-trac-hoc-ung-dung-ngan-hang-20240729110950017.htm

Comment (0)