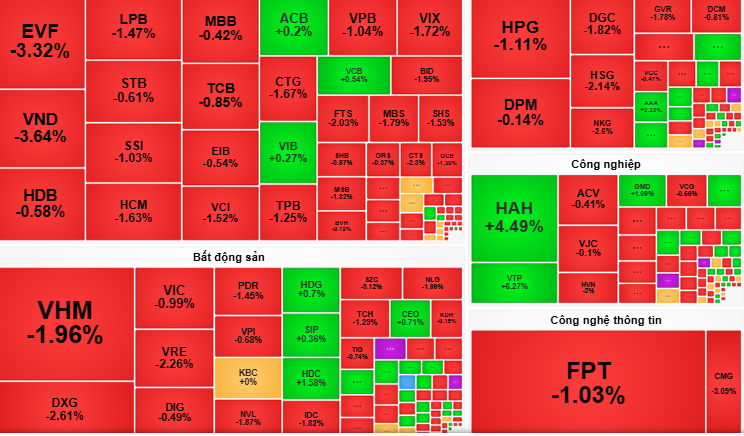

(NLDO) – At the end of the session on December 4, selling pressure increased sharply, causing stocks to sink deep into the red zone. Investors should pay attention to this factor in the next session.

At the end of the session on December 4, the VN-Index closed at 1,240 points - down 9 points, equivalent to 0.75%.

The downward pressure from blue-chip stocks caused the market to lose points at the beginning of the session on December 4. The VN-Index gradually slid and then fluctuated due to the lack of support from pillar stocks and increased selling pressure.

In the morning session, the active selling force of stocks was not strong, while the demand for low prices was still waiting for disbursement, helping the market regain balance.

In the afternoon session, some banking stocks reversed and increased, helping the market reduce the red color. However, selling pressure increased sharply near the end of the session. In particular, foreign investors dumped blue-chip stocks such as FPT, MWG, VRE..., leading to selling pressure in many other stocks, causing the prices of hundreds of stocks to sink.

At the end of the session, the VN-Index closed at 1,240 points - down 9 points, equivalent to 0.75%.

Due to the sharp drop in stock prices, some securities companies expect that in the next session, investors will actively participate in disbursement.

VCBS Securities Company believes that the sharp decline in VN-Index will open up opportunities for investors to buy stocks that maintain cash flow, such as fertilizer, banking, technology - telecommunications, oil and gas, etc.

However, experienced people on the stock market note that stock "players" need to monitor supply and demand to decide the right time to buy.

"Investors need to slow down to assess the market situation, avoid falling into an overbought state, and can take short-term profits when the market recovers" - Dragon Capital Securities Company (VDSC) recommends.

Source: https://nld.com.vn/chung-khoan-ngay-mai-5-12-can-trong-ap-luc-ban-gia-tang-196241204172250149.htm

![[Photo] Prime Minister Pham Minh Chinh meets with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/893f1141468a49e29fb42607a670b174)

![[Photo] Tan Son Nhat Terminal T3 - key project completed ahead of schedule](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/85f0ae82199548e5a30d478733f4d783)

![[Photo] Reception to welcome General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/ef636fe84ae24df48dcc734ac3692867)

![[Photo] National Assembly Chairman Tran Thanh Man meets with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/4e8fab54da744230b54598eff0070485)

Comment (0)