The Ministry of Finance has just issued an official dispatch responding to questions from National Assembly deputies of Lam Dong province's National Assembly Delegation.

"According to current statistics, our country has more than 60 million motorbikes. The law has stipulated compulsory insurance for motorbikes, two-wheelers, and motorbikes.

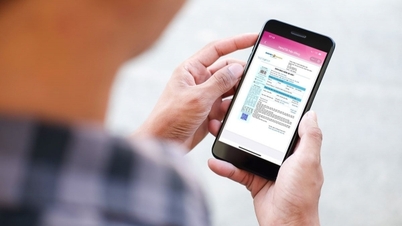

However, the participation in compulsory insurance for the above mentioned vehicles is ineffective. One of the reasons is that the invoices, documents, administrative procedures, and compensation procedures are cumbersome, causing difficulties for insurance buyers.

To help voters clearly see the superiority of buying compulsory motorbike insurance and strictly implementing legal regulations. Does the Ministry of Finance have any fundamental solutions to resolve the above situation?", voters asked.

Regarding this issue, the Ministry of Finance said that compulsory civil liability insurance for motor vehicle owners has been implemented for 34 years. Currently, motorbikes and scooters are still the main means of motor transport and the biggest cause of accidents.

Specifically, according to statistics from the National Traffic Safety Committee, as of October 2020, the total number of registered motorbikes was 72 million, accounting for 63.48% of the causes of accidents.

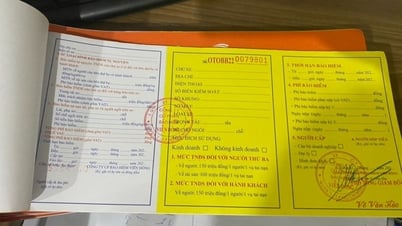

Most motorbike owners do not have high incomes. With an insurance premium of 55,000 VND or 60,000 VND, if they unfortunately cause an accident to a third party, the insurance will cover a maximum of 150 million VND; for property, the insurance will cover a maximum of 50 million VND.

In particular, with the provision of advance insurance compensation of up to 105 million VND within three days of receiving the accident notification, financial resources will be provided quickly and promptly to the motorbike owner to support the victim and the victim's family to overcome the damage.

In addition, in cases where the vehicle causing the accident cannot be identified, the vehicle is not insured, is not covered by insurance, and other cases where insurance liability is excluded, the Motor Vehicle Insurance Fund will provide humanitarian support for damage to health and life up to 45 million VND.

After the Law on Insurance Business 2022 was promulgated, the Ministry of Finance coordinated with relevant agencies to submit to the Government for promulgation Decree 67/2023/ND-CP on compulsory insurance.

Decree 67/2023/ND-CP inherits and supplements many new regulations to simplify compensation procedures and ensure the rights of insurance buyers.

Specifically, the insurance company is responsible for assessing compensation, only in cases of death, are police records required.

The vehicle owner may provide documentation of the claim in electronic form or may provide evidence of repair or replacement of the damaged property.

Within three working days, the insurance company must make an advance payment for damages to health and life.

To ensure the rights of car owners, increase or decrease insurance premiums by a maximum of 15%.

Insurance liability is excluded in cases where the driver has an alcohol concentration exceeding the level prescribed by the Ministry of Health .

Expand the scope of humanitarian assistance for cases not covered by insurance, increase the level of support for total disability cases.

Insurance companies must set up a 24/7 hotline to promptly receive accident information, provide guidance, and answer questions for vehicle owners...

According to the Ministry of Finance, Decree 67/2023/ND-CP takes effect from September 6, 2023. The Ministry will coordinate with the Vietnam Insurance Association and relevant organizations to promote and supervise the implementation of compensation advances, insurance compensation, and timely and proper payment of humanitarian assistance to vehicle owners.

At the same time, we will strengthen inspection and strictly handle violations.

TM

Source

![[Photo] Prime Minister Pham Minh Chinh chairs conference to promote public investment growth momentum](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/20/7d1fac1aef9d4002a09ee8fa7e0fc5c5)

Comment (0)