|

| Reducing VAT reduces state budget revenue but also stimulates production and consumption, promoting production and business activities. |

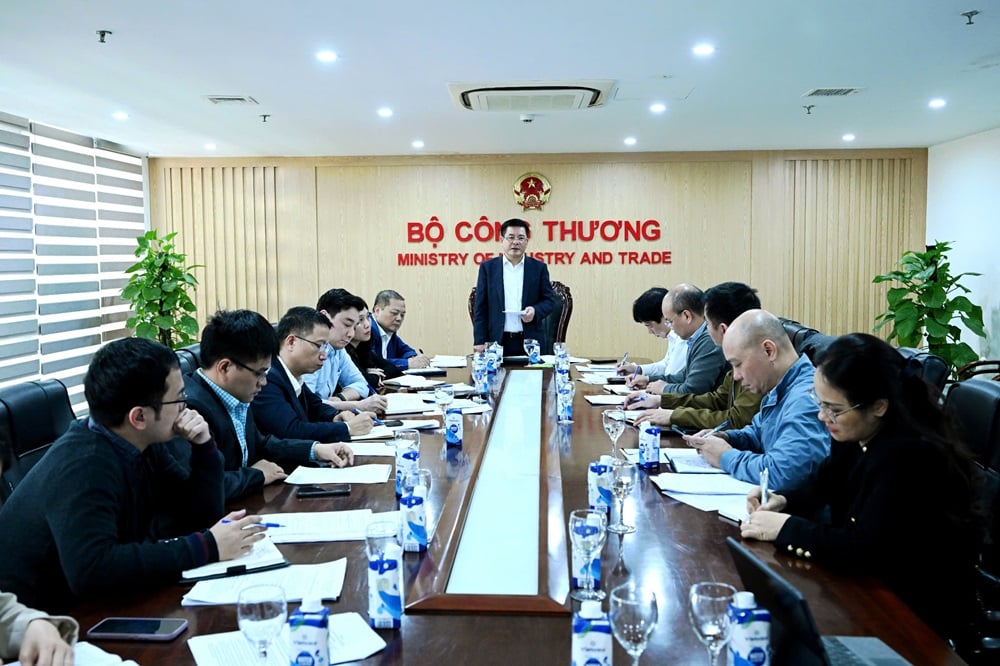

Accordingly, the Ministry of Finance continues to propose a 2% reduction in VAT rates for groups of goods and services currently subject to a tax rate of 10% (to 8%), except for the following groups of goods and services: telecommunications, financial activities, banking, securities, insurance, real estate business, metal products, mining products (except coal), goods and services subject to special consumption tax (except gasoline).

This proposal is based on the 2% reduction policy that has been implemented steadily from 2022 to present according to Resolution No. 43/2022/QH15, Resolution No. 101/2023/QH15, Resolution No. 110/2023/QH15, Resolution No. 142/2024/QH15, Resolution No. 174/2024/QH15, while ensuring the goal of promoting production, business, tourism, domestic consumption and the national growth target of 8% or more in 2025.

The reduction of VAT will reduce the state budget revenue but also stimulate production, thereby contributing to creating jobs for workers, stabilizing the macro economy and economic growth in the last 6 months of 2025. At the same time, this policy does not affect international commitments.

To offset the revenue shortfall due to policy implementation, the Ministry of Finance advised the Government to direct ministries, central agencies and localities to focus on implementing tasks, solutions and fiscal policies according to the Resolutions issued by the National Assembly and the Government to remove difficulties for businesses and people, promote GDP growth drivers in 2025 to reach at least 8% and strive for double digits in more favorable conditions, thereby creating additional revenue for the state budget.

Assessing the impact of reduced state budget revenue, the Ministry of Finance said that if this policy is approved, the expected reduction in state budget revenue in the last 6 months of 2025 and the whole year of 2026 is equivalent to about 121.74 trillion VND (of which: the last 6 months of 2025 will decrease by about 39.54 trillion VND, in 2026 it will decrease by about 82.2 trillion VND). It is estimated that in the first 2 months of 2025, the amount of VAT reduced according to Resolution No. 174/2024/QH15 will be about 8.3 trillion VND.

Source: https://thoibaonganhang.vn/bo-tai-chinh-de-xuat-tiep-tuc-giam-thue-gtgt-den-het-nam-2026-161814.html

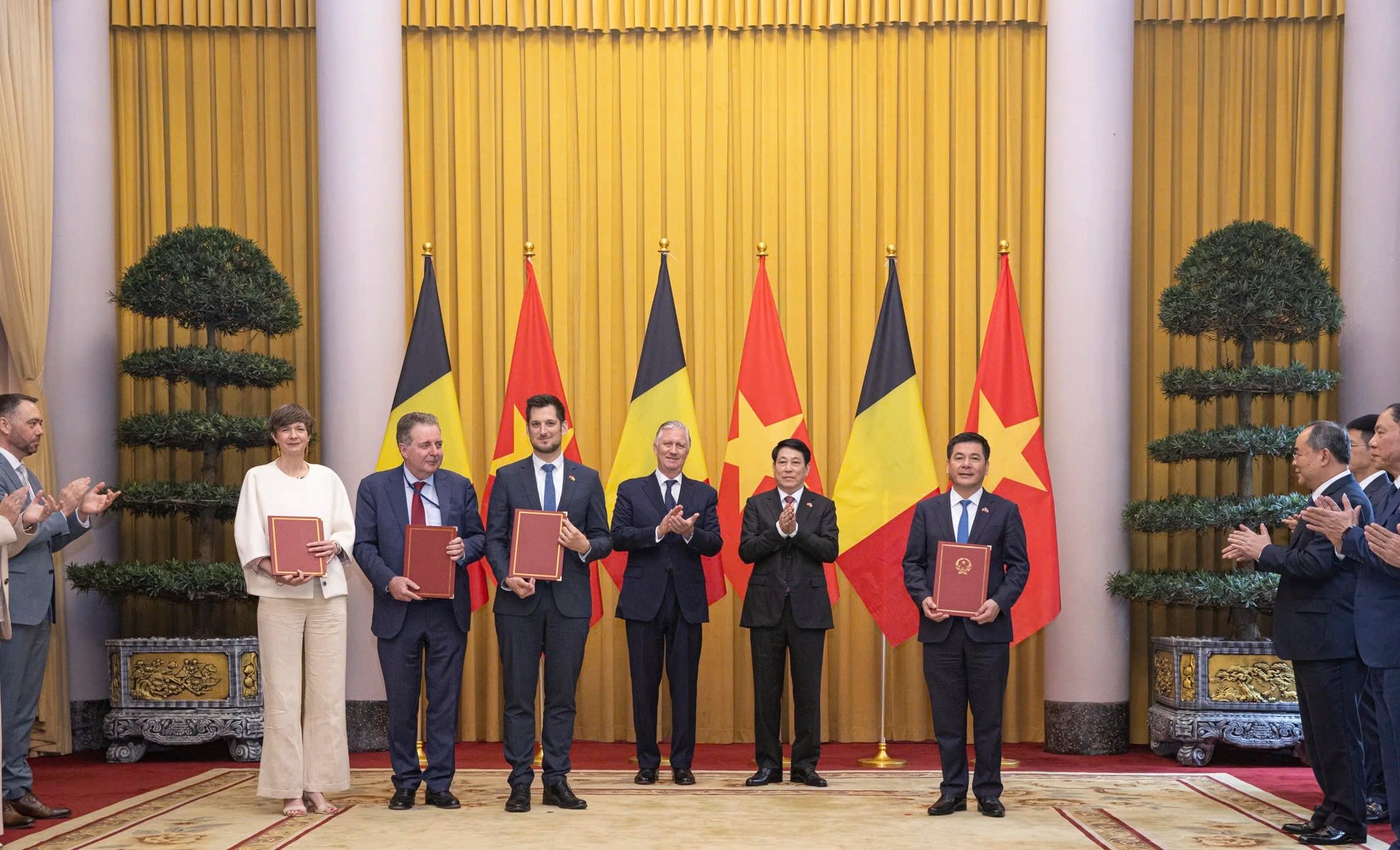

![[Photo] General Secretary To Lam receives King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/e5963137a0c9428dabb93bdb34b86d7c)

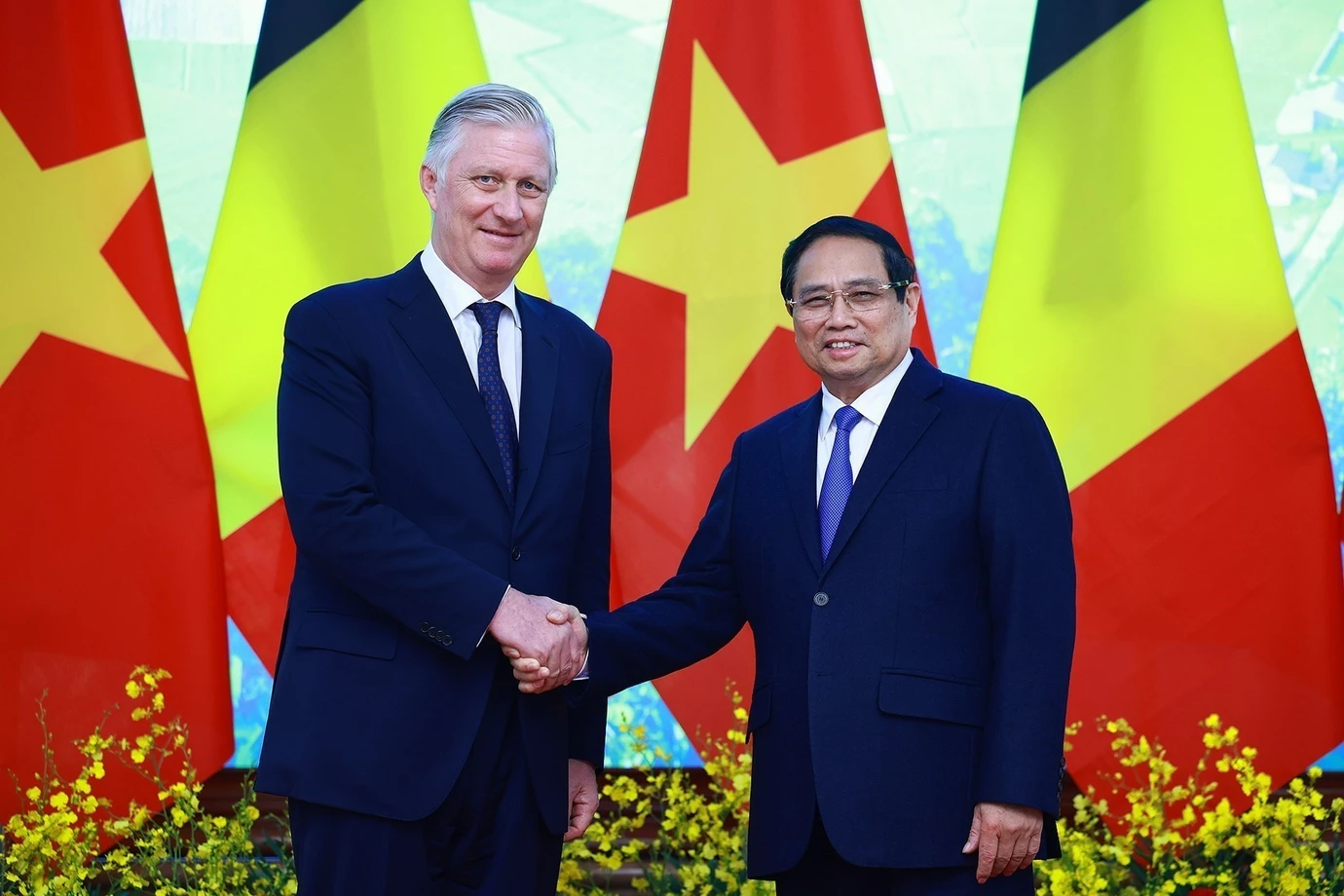

![[Photo] Prime Minister Pham Minh Chinh meets with King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/be2f9ad3b17843b9b8f8dee6f2d227e7)

![[Photo] President Luong Cuong and King Philippe of Belgium visit Thang Long Imperial Citadel](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/cb080a6652f84a1291edc3d2ee50f631)

![[Photo] Close-up of Vietnam's sniffer dog team searching for earthquake victims in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/d4949a0510ba40af93a15359b5450df2)

![[Infographic] 10 factors to consider when deciding to buy or rent a house](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/d6e87dce074b455d95231a4c3e22353a)

![[Photo] Myanmar's capital in disarray after the great earthquake](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/7719e43b61ba40f3ac17f5c3c1f03720)

Comment (0)