Trading declines

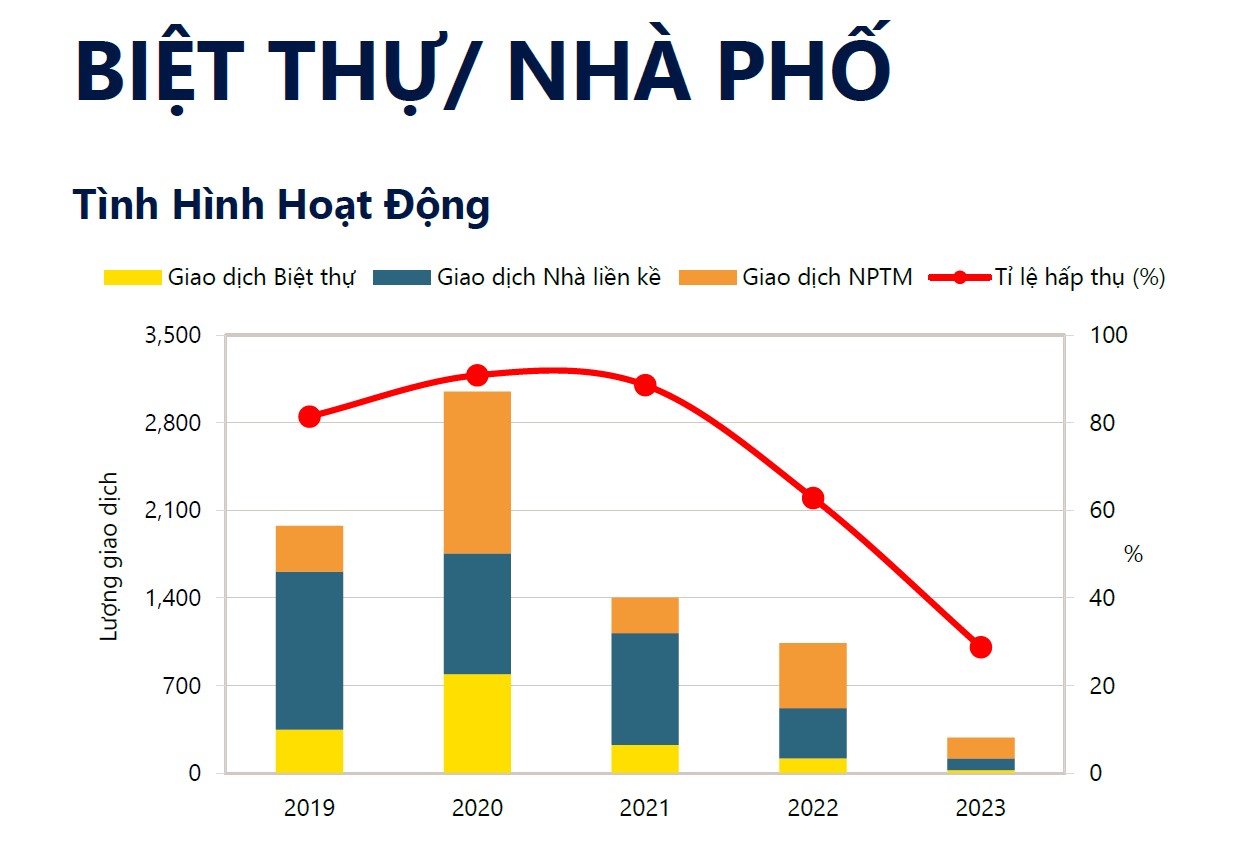

According to the latest real estate market report from Savills Vietnam, the villa/townhouse product line in Ho Chi Minh City is performing at its weakest since 2019 with consecutive declines in transaction volume and absorption rate.

Specifically, in 2023, primary supply decreased by 40% year-on-year to 993 units, the lowest in the past 5 years and mainly came from high-priced inventory.

Similarly, sales volume and absorption rate were the lowest in the past 5 years, down to 29% and sales volume reached only 286 units, down 73% YoY. As affordable supply remains limited, high-priced units continue to dominate the market, with units valued at over VND30 billion accounting for 67% of total sales.

Talking to Nguoi Dua Tin , Ms. Giang Huynh, Deputy Director, Head of Research and S22M (Savills) said that the objective reason comes from the fact that the capital mobilization process is affected by the inspection of real estate bond issuance.

In addition, the impact of global economic developments on the domestic economy has caused many difficulties, blocking the income and cash flow of businesses and people.

The transaction activity of villas and townhouses is decreasing. (Photo: SV).

According to Ms. Giang Huynh, another reason that directly affects the villa and townhouse real estate segment is the scarcity of land in the inner city of Ho Chi Minh City, which has pushed up housing prices, leading to reduced affordability.

Because supply is limited and investors are gradually moving towards the high-end housing segment, the target buyers are narrowing, causing the absorption rate to slow down significantly.

There are very few townhouse and villa projects in Ho Chi Minh City.

“In fact, this decline in activity reflects the cyclical development of the low-rise housing segment, with gradually less and less supply for these products in the inner city. Due to scarcity, the products will focus on the high-end segment and wealthy buyers. More importantly, according to the urban development orientation until 2030, Ho Chi Minh City will focus on developing the high-rise segment to optimize land funds as well as meet the large housing demand in the city,” Ms. Giang commented.

Savills Vietnam Research said that in 2024, new supply is expected to have 1,400 units entering the market, of which products from VND20-30 billion account for about 65%. The decline in performance and continued high selling prices in Ho Chi Minh City are major challenges to absorption rates.

Supply is concentrated in Dong Nai and Binh Duong.

According to Savills Vietnam, customer demand is currently shifting to neighboring provinces. For example, Binh Duong province will have more than 3,400 new apartments, of which more than 90% are priced under VND10 billion. Dong Nai province will have 2,900 new apartments, of which 41% are priced at VND5-10 billion and 29% are priced at VND10-20 billion.

Mr. Le Dinh Lang, Director of Song Long Real Estate Investment, Construction and Development Company Limited, commented: "Currently, satellite provinces such as Dong Nai and Binh Duong have advantages in developing low-rise housing because of synchronous infrastructure, large land funds and reasonable prices, so many investors will choose these provinces as destinations, in which the villa and townhouse segment will also receive attention."

Real estate villas and townhouses in Ho Chi Minh City are currently in limited supply and are gradually drifting to satellite provinces.

According to Ms. Giang Huynh, from a development perspective, in the context of a difficult market like the recent period, investors have become more cautious when making investment decisions.

Therefore, Ms. Giang recommends that when developing townhouse projects, especially in satellite urban areas, project investors need to pay more attention to development locations in areas with high real housing demand, invest in development quality, methodical planning, reasonable selling prices, clear construction progress and transparent legality.

“In order to anticipate this shift, in recent years, major investors have acquired land funds in these suburban markets to implement large-scale projects, helping to synchronize infrastructure and diversify products with different areas. In addition, selling prices in neighboring provinces are more competitive than in Ho Chi Minh City, when the average primary selling price in Binh Duong and Dong Nai provinces is equivalent to 16% and 22% of the selling price in Ho Chi Minh City, respectively,” Ms. Giang Huynh informed.

Source

![[Photo] Prime Minister Pham Minh Chinh starts construction of vital highway through Thai Binh and Nam Dinh](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/52d98584ccea4c8dbf7c7f7484433af5)

![[Photo] Buddha's Birthday 2025: Honoring the message of love, wisdom, and tolerance](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/8cd2a70beb264374b41fc5d36add6c3d)

![[Photo] Prime Minister Pham Minh Chinh works with the Standing Committee of Thai Binh Provincial Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/f514ab990c544e05a446f77bba59c7d1)

Comment (0)