Green covered the entire market when opening this morning, but the lack of leadership in cash flow and profit-taking pressure gradually appeared, causing the VN-Index to weaken.

Divergence spread across many industry groups. Despite the mixed green and red, real estate was the main leading group with the increase of Vin, when VHM, VIC, VRE all maintained the increase.

At the end of the morning session on November 23, VN-Index decreased by 0.76 points, equivalent to 0.07% to 1,113.06 points. The entire floor had 215 stocks increasing and 218 stocks decreasing. HNX-Index increased by 0.54 points to 231.03 points. UPCoM-Index decreased by 0.23 points, equivalent to 0.27% to 85.8 points.

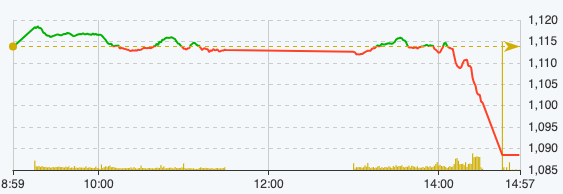

VN-Index developments on November 23 (Source: Fire Ant).

Entering the afternoon session, investors' decisive selling decision made red and blue the dominant colors, along with pressure from large-cap groups, causing the market to gradually decline towards the end of the session.

At the end of the trading session on November 23, VN-Index decreased by 25.33 points, equivalent to 2.27% to 1,088.49 points. The entire floor had 109 stocks increasing but 397 stocks decreasing and 79 stocks remaining unchanged.

HNX-Index decreased by 5.95 points, equivalent to 2.58% to 224.54 points. The whole floor had 60 stocks increasing, 107 stocks decreasing and 58 stocks remaining unchanged. UPCoM-Index decreased by 1.09 points to 84.95 points.

The VN30 basket alone recorded 29 stocks decreasing in price, which was also a burden on the market in today's session when the stocks HPG, VCB, GAS, SAB, MWG, GVR, VPB, BID, SSI, FPT took away 10.6 points from the general market.

Negative sentiment covered the entire market, notably the stock group when VIX, VCI, FTS, CTS, AGR, BSI decreased by the largest amplitude, VND decreased by 5.94%, SHS decreased by 7.61%, SSI decreased by 6.08%, HCM decreased by 5.61%, MBS decreased by 9.55%, ORS decreased by 6.05%.

In the same situation, the real estate group recorded DIG, PDR, DXG, TCH, NLG, HDC, SZC, QCG falling to the floor, NVL down 2.02%, CEO down 5.98%, KHG down 4.76%, KBC down 6.17%, HQC down 5.15%.

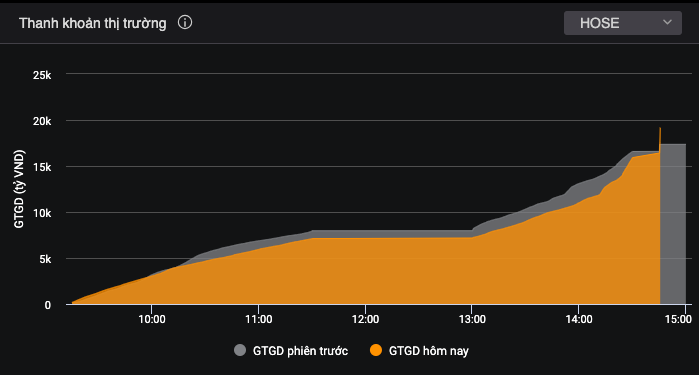

Liquidity today compared to previous session.

The total order matching value in today's session reached VND24,153 billion, 2.1 times higher than the previous session, of which the order matching value on the HoSE floor reached VND20,637 billion, 2.3 times higher. In the VN30 group, liquidity reached VND5,376 billion.

Foreign investors continued to net buy strongly with a value of nearly 442.7 billion VND, of which this group disbursed 917.2 billion VND and sold 1,359.9 billion VND.

The codes that were bought strongly were mainly DGC 92.9 billion VND, VND 80.8 billion VND, GMD 23 billion VND, PVD 21.3 billion VND, OCB 15.5 billion VND,... On the contrary, the codes that were pushed to sell strongly were VHM 118.6 billion VND, FUESSVFL 91.3 billion VND, VPB 69.3 billion VND, BCM 63 billion VND, VRE 54.8 billion VND,... .

Source

![[Photo] General Secretary To Lam meets and expresses gratitude to Vietnam's Belarusian friends](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/c515ee2054c54a87aa8a7cb520f2fa6e)

![[Photo] General Secretary To Lam concludes visit to Russia, departs for Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/0acf1081a95e4b1d9886c67fdafd95ed)

![[Photo] General Secretary To Lam arrives in Minsk, begins state visit to Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/76602f587468437f8b5b7104495f444d)

![[Photo] National Assembly Chairman Tran Thanh Man attends the Party Congress of the Committee for Culture and Social Affairs](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/f5ed02beb9404bca998a08b34ef255a6)

Comment (0)