The index fell amid worries spreading across Asian stock markets ahead of the US imposing tariffs on economies.

Negative developments appeared right from the first morning session of the week when VN-Index dropped sharply by 8.63 points, equivalent to 0.66% of its value. Meanwhile, market liquidity increased sharply, showing that the fear is spreading throughout the market.

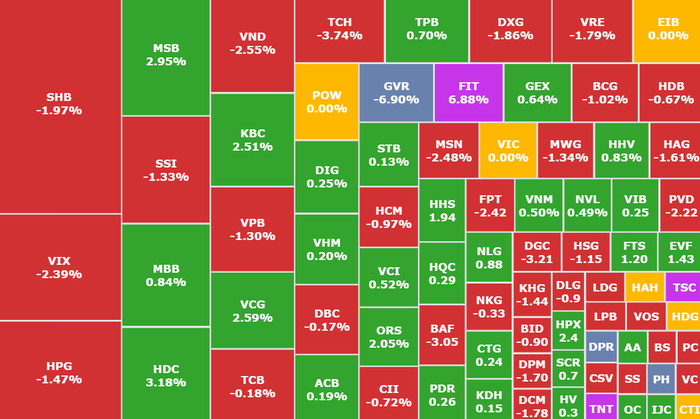

Blue-chips group pulls market down sharply (Photo: SSI iBoard)

The index fell sharply due to selling pressure in large-cap stocks. The VN30 group led the market "backwards" when it fell by 10.05 points with 8 stocks increasing, 2 stocks going flat and 20 stocks decreasing, of which 1 stock "hit the floor" was GVR (Vietnam Rubber, HOSE).

At the end of the session, VN-Index closed at 1,306.86 points, down 10.6 points (-0.8%). Previously, at the beginning of the afternoon session, the index had even dropped nearly 12 points.

The number of stocks decreasing overwhelmed the number of stocks increasing with 322 stocks decreasing (3 stocks "hit the floor") and 135 stocks increasing (9 stocks "hit the peak"), 63 stocks remaining unchanged.

Real estate, chemical, steel, and livestock groups were all in "red" with a decrease of 1-4%: DXG (Dat Xanh Real Estate, HOSE) decreased by 1.86%; PVS (PTSC, HNX) decreased by 3.45%, PVD (PV Drilling, HOSE) decreased by 2.22%, TCH (Hoang Huy Finance, HOSE) decreased by 3.74%,...

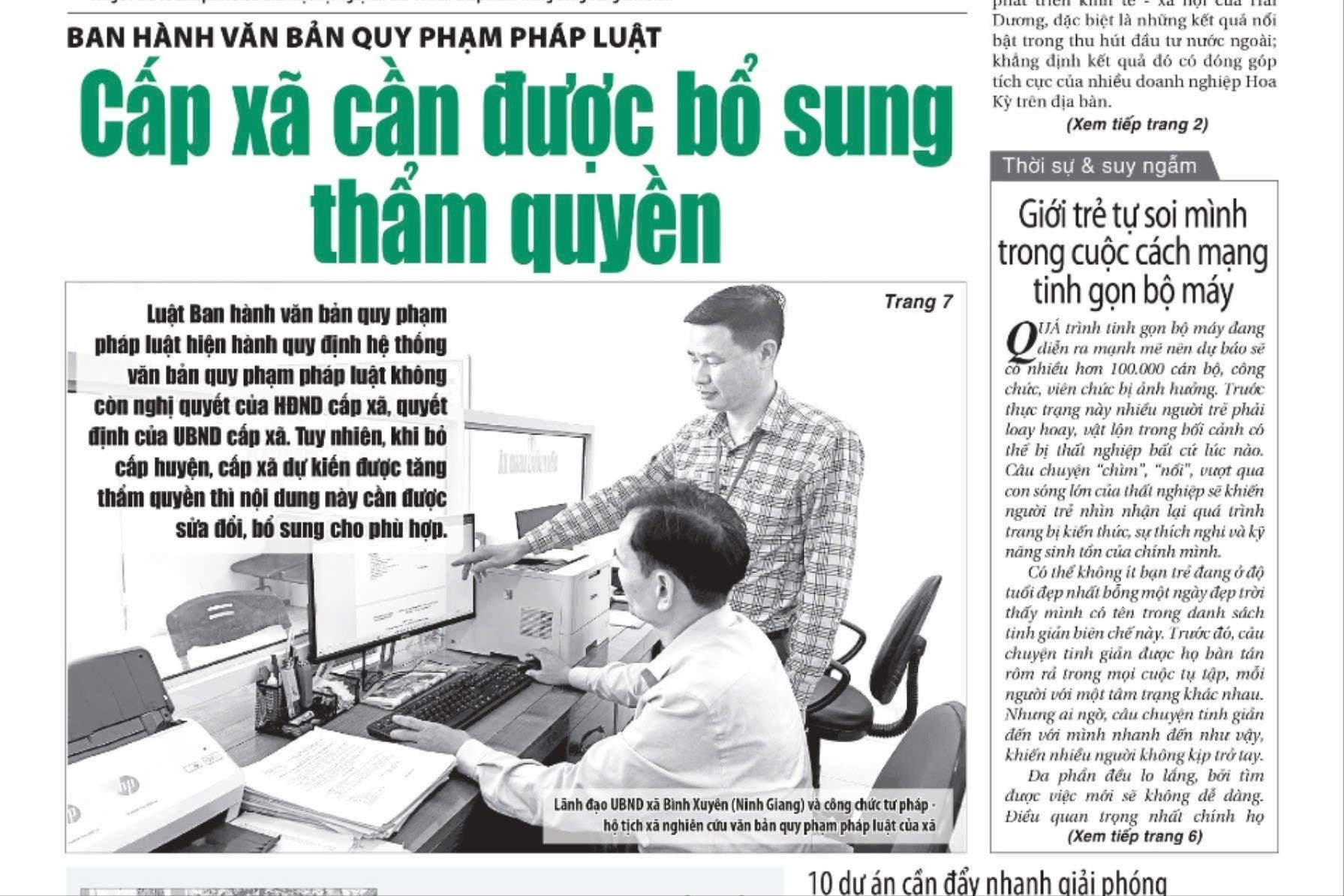

GVR shares continue to fall due to negative information (Photo: SSI iBoard)

GVR - the 12th largest capitalization stock in the VN-Index, became the center of attention as the only stock in the "VN30 basket" to hit the floor when it plunged nearly 7% in value, down to 32,400 VND/share, the lowest in the past month, since recovering with the market at the 1,300 point mark.

The cause of this development is believed to come from challenges from new EU regulations, creating strict requirements for the rubber industry, especially in the Mekong region (Vietnam).

Specifically, the EU has adopted the EU Deforestation Regulation (EUDR), which bans rubber imports if their production causes deforestation. Under this regulation, importers must ensure that their products can be traced back to the plot of land where the rubber was grown.

One of the main barriers is the requirement to trace the origin all the way down to the plantation plot. In Vietnam, 66% of household rubber plantations are less than 3 hectares in size. This not only increases the risk of not meeting export standards but also pushes up the costs of businesses.

Regarding foreign transactions, foreign investors today sold strongly with a value of up to 1,363 billion VND in the whole market.

On the HOSE floor alone, this group sold about 1,282 billion VND, of which, VNM (Vinamilk, HOSE) was under the strongest "dumping" pressure with 166 billion VND. Next were a series of stocks that were net sold with a value of more than 100 billion VND: HPG (Hoa Phat Steel, HOSE) with 136 billion VND, SSI (SSI Securities, HOSE) with 106 billion VND, FPT (FPT, HOSE) with 106 billion VND,...

On the other hand, VIX (VIX Securities, HOSE) was strongly net bought with 77 billion VND; KBC (Kinh Bac Urban Area, HOSE) was 41 billion VND, VCI (Vietcap Securities, HOSE) was 49 billion VND,...

Strong market differentiation

According to many experts, the market is entering a correction phase after a long period of increase recently, this is understandable.

Maintaining the state of differentiation can also be considered a positive signal of the market. At present, preparing to enter the season of shareholders' meetings and first quarter financial reports, therefore, the Vietnamese stock market still has room for positive growth. At this time, investors can consider and take advantage of the opportunity to increase the proportion of potential stocks.

However, in the short term, the probability of the VN-Index falling deeply, even breaking the 1,300-point mark, is still possible due to investors' profit-taking psychology before President Trump's tariff decision on April 2.

Source: https://phunuvietnam.vn/vn-index-giam-manh-ve-sat-moc-1300-diem-20250331164038744.htm

![[Photo] Phuc Tho mulberry season – Sweet fruit from green agriculture](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/1710a51d63c84a5a92de1b9b4caaf3e5)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to discuss tax solutions for Vietnam's import and export goods](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/19b9ed81ca2940b79fb8a0b9ccef539a)

![[Photo] Unique folk games at Chuong Village Festival](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/cff805a06fdd443b9474c017f98075a4)

Comment (0)