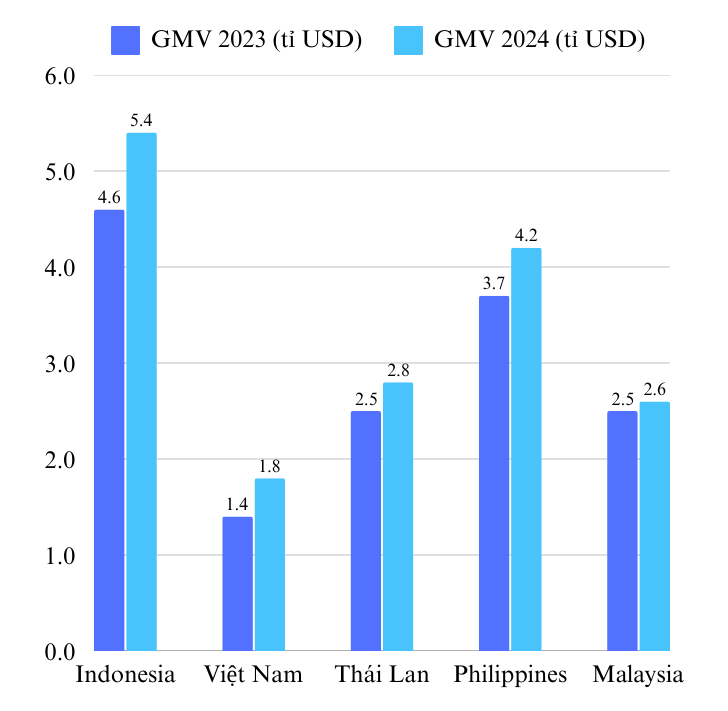

In 2024, the total transaction value (GMV) of the food delivery industry in Vietnam is estimated to reach 1.8 billion USD, an increase of 26% compared to 2023 and also the highest growth rate in Southeast Asia.

Shipper delivers food to customers in front of an office building in District 1, Ho Chi Minh City - Photo: QUANG DINH

According to the annual report "Food Delivery Platforms in Southeast Asia" recently released by Momentum Works, Vietnam continues to be the fastest growing market.

This comes from expanding customer base, service area, as well as the ability to leverage business ecosystems from large platforms.

Vietnam and Indonesia boost growth

Grab and ShopeeFood currently maintain a duopoly in Vietnam.

The above GMV estimates are calculated with food delivery orders through platforms such as Grab, Foodpanda, Gojek, Deliveroo, Lalamove, LINE MAN, ShopeeFood and BeFood (including cancelled or refunded orders).

In the region, Indonesia is the market with the highest GMV at $5.4 billion. Meanwhile, the Philippines is a different story, with restaurant chains operating their own delivery systems and partnering with food delivery platforms.

This is a special market where more than 60% of F&B industry revenue comes from restaurant chains.

Overall, the Southeast Asian food delivery market is expected to grow 13% year-on-year by 2024, with a total GMV of US$19.3 billion, with Indonesia and Vietnam being the two main growth drivers.

Total transaction value in the food delivery industry of countries in the region - Source: MOMENTUM WORKS

Grab takes the lead, ShopeeFood surpasses Gojek

In terms of food delivery platforms, Grab maintained its number one position in Southeast Asia, while ShopeeFood surpassed Gojek to take second place. In Vietnam, the Philippines, Malaysia and Singapore, these two leading platforms hold more than 90% market share.

Another notable development is TikTok’s foray into the services space in Indonesia and Thailand, where it is testing F&B vouchers and other services, potentially changing the game if it partners with delivery platforms.

Momentum Works' report also predicts a potential merger between Grab and Gojek in the future.

If this happens, the Southeast Asian food delivery market, which is already highly concentrated with two major platforms accounting for more than 80% of the market share, could enter a period of strong restructuring by 2025.

Investment bank Maybank also made a similar assessment late last week.

This unit believes that if the merger takes place, Grab will continue to hold the number one position in the food delivery and ride-hailing sector in most ASEAN countries.

Source: https://tuoitre.vn/viet-nam-dan-dau-tang-truong-thi-truong-giao-do-an-dong-nam-a-20250218094817096.htm

![[Photo] Vietnam and Sri Lanka sign cooperation agreements in many important fields](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/5/9d5c9d2cb45e413c91a4b4067947b8c8)

![[Photo] President Luong Cuong and Sri Lankan President Anura Kumara Dissanayaka visit President Ho Chi Minh relic site](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/5/0ff75a6ffec545cf8f9538e2c1f7f87a)

![[Photo] President Luong Cuong presided over the welcoming ceremony and held talks with Sri Lankan President Anura Kumara Dissanayaka](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/5/351b51d72a67458dbd73485caefb7dfb)

Comment (0)