Accordingly, the subjects subject to road use fees are registered road motor vehicles (with vehicle registration certificate and license plate), inspected for circulation (granted with a Certificate of technical safety and environmental protection), including: Automobiles, tractors and similar vehicles (automobiles).

The above types of cars are in some cases not subject to road use fees.

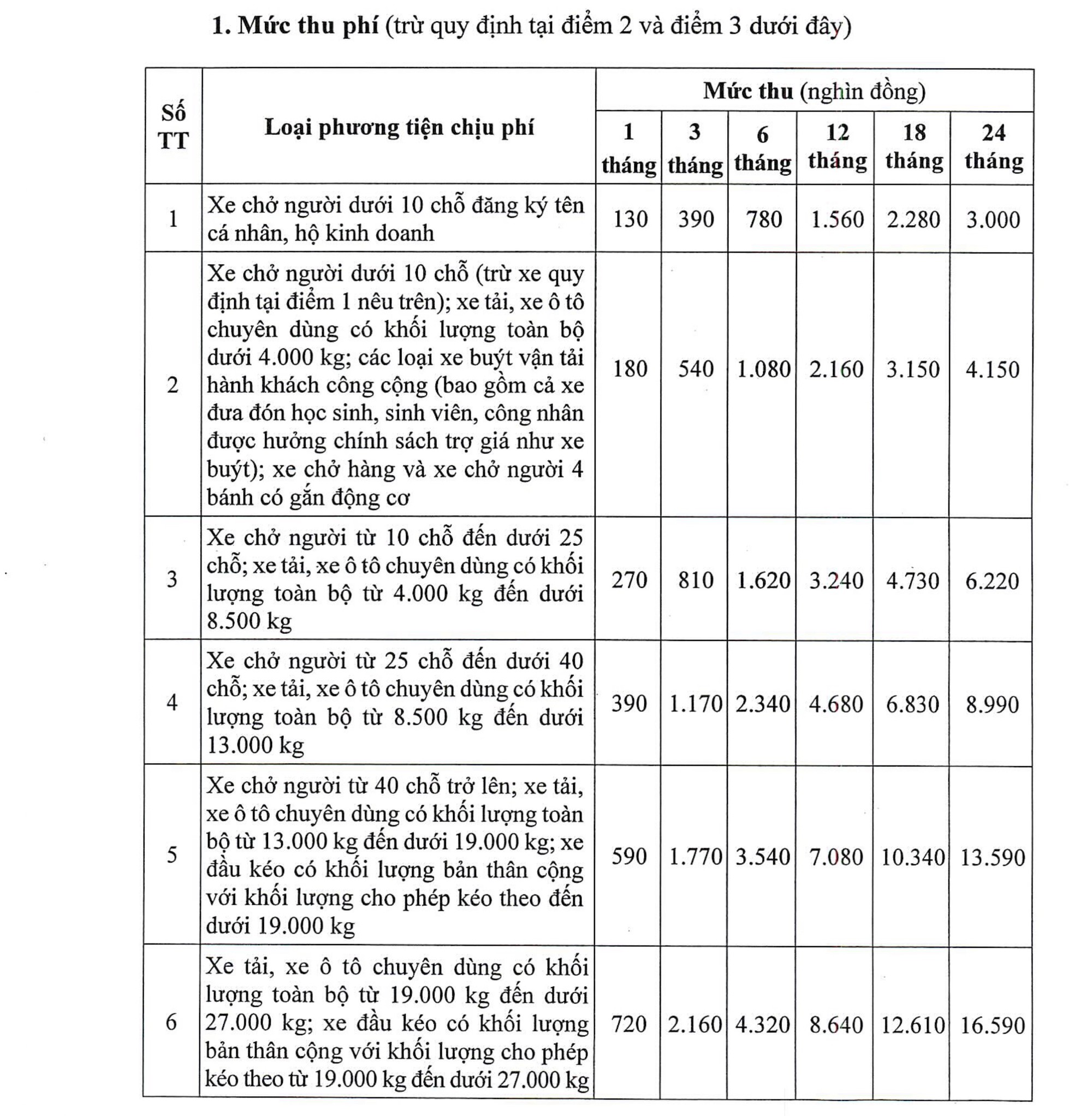

Road use fee schedule

Method of calculation and payment of fees

For cars of organizations and individuals registered in Vietnam (except cars of the national defense and police forces), the Decree stipulates that for cars inspected for the first time, the time for calculating road use fees is calculated from the date the vehicle is granted an Inspection Certificate. For cars that are converted, have their functions changed or have their ownership changed from an organization to an individual (and vice versa), the fee is calculated from the date of change of function or change of ownership according to the new car registration certificate.

Road use fees are calculated annually, monthly or according to the vehicle inspection cycle. The inspection unit issues a road use fee payment stamp corresponding to the fee payment period.

Specifically as follows:

Calculate and pay road usage fees according to inspection cycle

+ For cars with an inspection cycle of 1 year or less: Vehicle owners pay road use fees for the entire inspection cycle and are issued a road use fee payment stamp corresponding to the fee payment period.

+ For cars with an inspection cycle of more than 1 year (18 months, 24 months and 36 months): Vehicle owners must pay road use fees annually (12 months) or pay for the entire inspection cycle (18 months, 24 months and 36 months).

In case of paying fees according to the inspection cycle (18 months, 24 months and 36 months): The inspection unit issues a road use fee payment stamp corresponding to the inspection cycle. After the fee payment deadline (inspection cycle), the vehicle owner must go to the inspection unit for inspection and pay the fee for the next inspection cycle.

In case of paying the fee annually (12 months): The vehicle inspection unit issues a road use fee payment stamp corresponding to the 12-month fee payment period. After the fee payment period (12 months), the vehicle owner must go to the vehicle inspection unit to pay the fee and be issued a road use fee payment stamp for the next period (12 months or the remaining time of the inspection cycle).

+ In case the vehicle owner comes for inspection earlier or later than the time according to the prescribed inspection cycle, the inspection unit will inspect the vehicle and calculate the road use fee from the end of the previous road use fee payment period until the end of the next inspection cycle (if the next inspection cycle is more than 12 months, the vehicle owner can pay up to 12 months or pay the entire inspection cycle). If the fee calculation period is not a full month, the fee to be paid will be calculated by dividing the odd number of days by 30 days multiplied by the fee for 1 month.

+ In case the vehicle owner has not paid the road usage fee for previous inspection cycles within the prescribed time limit, in addition to the fee payable for the next cycle, the vehicle owner must also pay the unpaid fee of the previous cycle. The inspection unit will collect the fee payable for the previous cycle, the fee payable is equal to the fee collected for 1 month multiplied by the late payment period.

+ If the vehicle owner wants to pay road use fees for a period longer than the inspection cycle, the inspection unit will collect the fees and issue a road use fee payment stamp corresponding to the fee payment period.

+ For cars confiscated or revoked by competent State agencies; cars of administrative agencies and public service units (with blue license plates); cars liquidated by the defense force and police; mortgaged cars repossessed by credit institutions and foreign bank branches, which during the period of confiscation, revocation, and pending liquidation are not inspected for circulation and then are auctioned or liquidated, the new owner of the vehicle only has to pay road use fees from the time the vehicle is inspected for circulation.

When inspecting the vehicle for circulation, the vehicle owner must present to the inspection agency relevant documents such as: Decision on confiscation or revocation by competent authority; decision on revocation of mortgaged assets; decision on permission to liquidate assets for assets owned by administrative agencies, public service units, defense and police units; minutes or contract to complete procedures for purchasing assets to be liquidated or auctioned.

In case the vehicle is liquidated or auctioned and the fee has been paid past the time of re-inspection for circulation, the vehicle owner shall pay the fee from the time following the fee payment period of the previous cycle.

Pay road usage fees according to the calendar year

Agencies, organizations and enterprises that need to pay road use fees according to the calendar year must send a written notice (for the first time or when there is an increase or decrease in the number of vehicles) to the vehicle inspection unit and pay road use fees according to the calendar year for their vehicles.

Every year, before January 1 of the following year, vehicle owners must go to the inspection unit to pay the fee for the following year. When collecting the fee, the inspection unit issues a Road Use Fee Payment Sticker to each vehicle corresponding to the fee payment period.

Pay monthly road usage fee

Enterprises with road usage fees of 30 million VND/month or more must pay the fees monthly. Enterprises must send a written document (for the first time or when there is an increase or decrease in the number of vehicles) to the inspection unit and pay the fees for their vehicles.

Every month, before the 1st of the following month, the enterprise must go to the inspection unit (which has registered to pay monthly fees) to pay the road usage fee for the following month. When collecting fees, the fee collection organization issues a road usage fee payment stamp corresponding to the fee payment time.

The Decree stipulates that when collecting road usage fees, the toll collection organization must prepare and issue toll receipts to the toll payers in accordance with the Government's regulations on invoices, documents and implementation guidance documents of the Ministry of Finance.

Source link

Comment (0)