High interest rate banking group in early October 2023?

According to a survey by Lao Dong reporters (5:00 p.m. on October 1, 2023) with 20 banks in the system, PVcomBank's interest rates are ranging from 4.25 - 11.0%, of which the 12-month and 13-month terms have the highest interest rates, up to 11%.

Accordingly, the condition for customers to enjoy interest rates of up to 11% from PVcomBank is that the savings amount is from 2,000 billion VND or more.

Otherwise, if you deposit regular savings, the highest PVcomBank interest rate is 6.8%, for terms of 18 months, 24 months and 36 months for online savings. The lowest PVcomBank interest rate is 4.25%, for terms under 6 months.

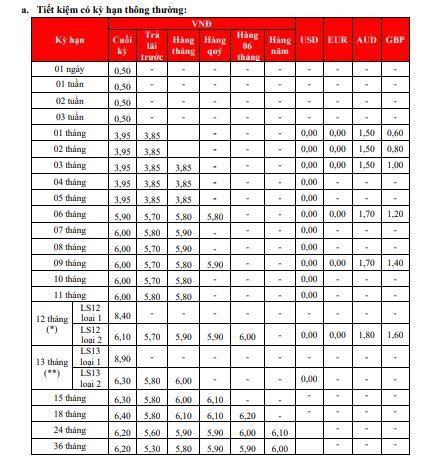

Next is HDBank's interest rate, with interest rates ranging from 3.95 - 8.9%. In particular, in case customers deposit for 12 months or 13 months with an amount of 300 billion VND or more, they will receive interest rates of 8.4% and 8.9%, respectively.

In addition, for regular savings customers, HDBank's highest interest rate is 6.4%, for a term of 18 months. On the contrary, HDBank's lowest interest rate is for a term of less than 6 months, at 3.95%.

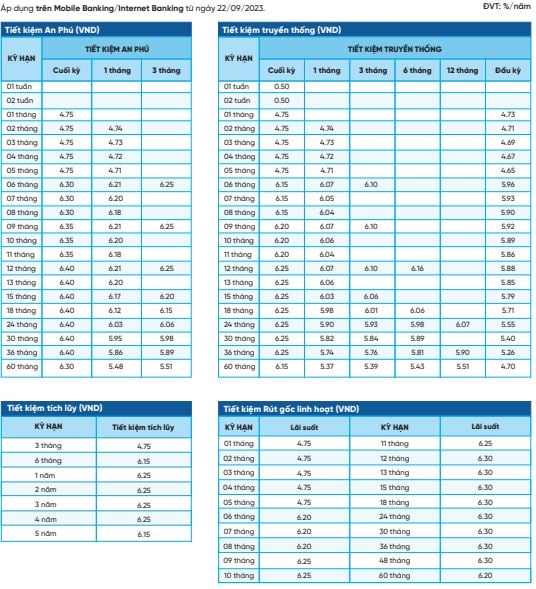

Also at the beginning of October, NCB listed interest rates ranging from 4.75 - 6.4%. Of which, for customers depositing savings from 12 months to 36 months, the highest interest rate is 6.4%. Compared to PVcomBank and HDbank, NCB is still one of the banks listing interest rates for many terms above 6%.

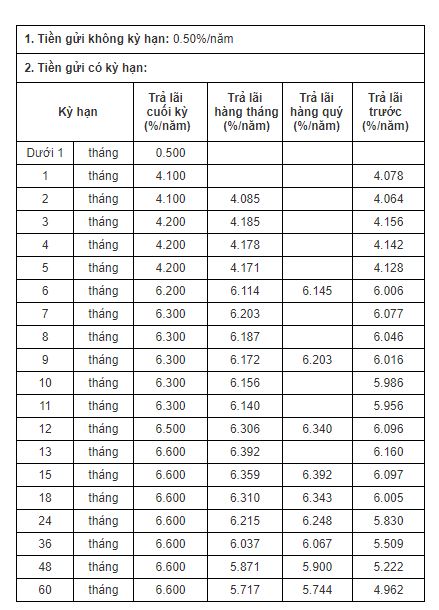

At CB Bank, the savings interest rate is fluctuating from 4.1 - 6.6%. Of which, the deposit term is from 13 months to 60 months, the highest interest rate is 6.6%.

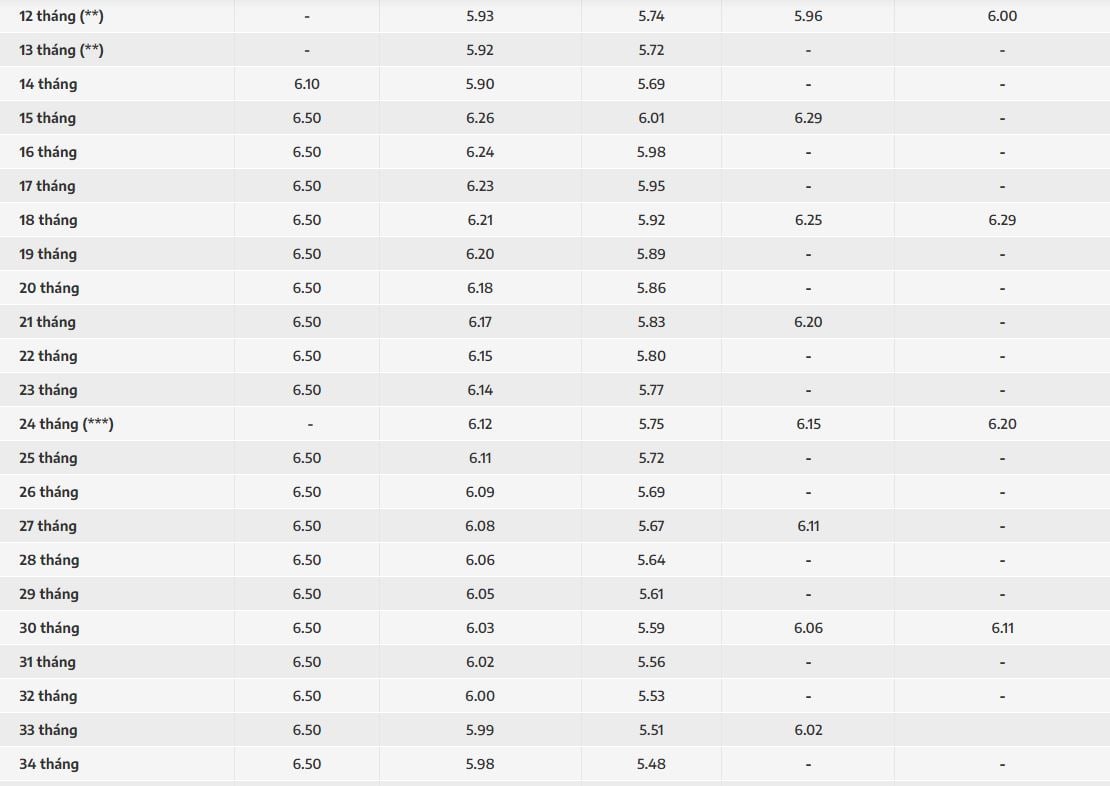

At NamABank, savings interest rates range from 4.65 - 6.5%, depending on the term. However, if you save for a long term, you will enjoy a higher interest rate.

Low interest rate banking group in early October 2023

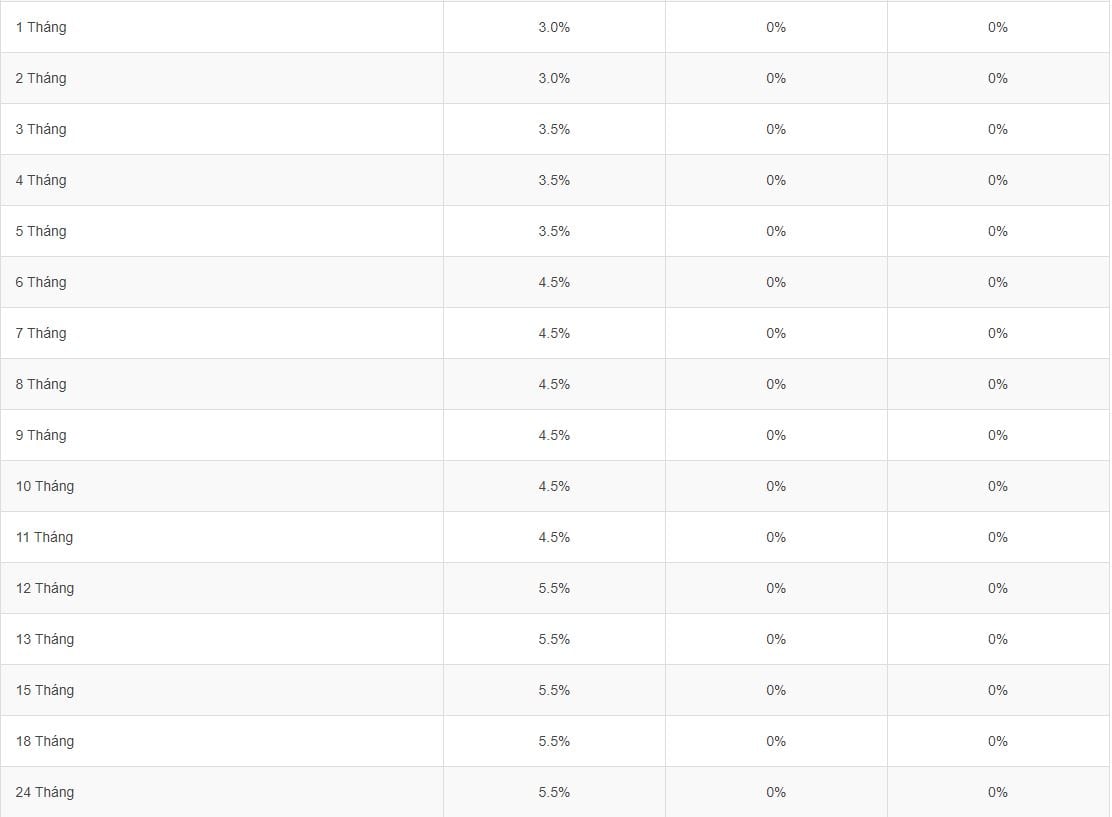

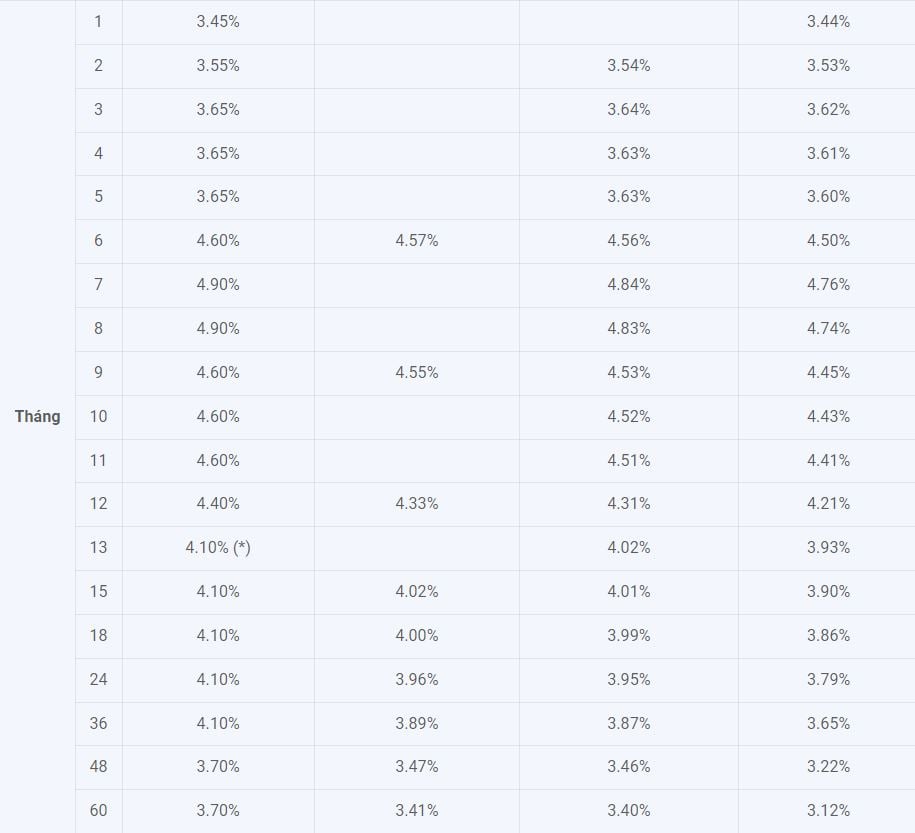

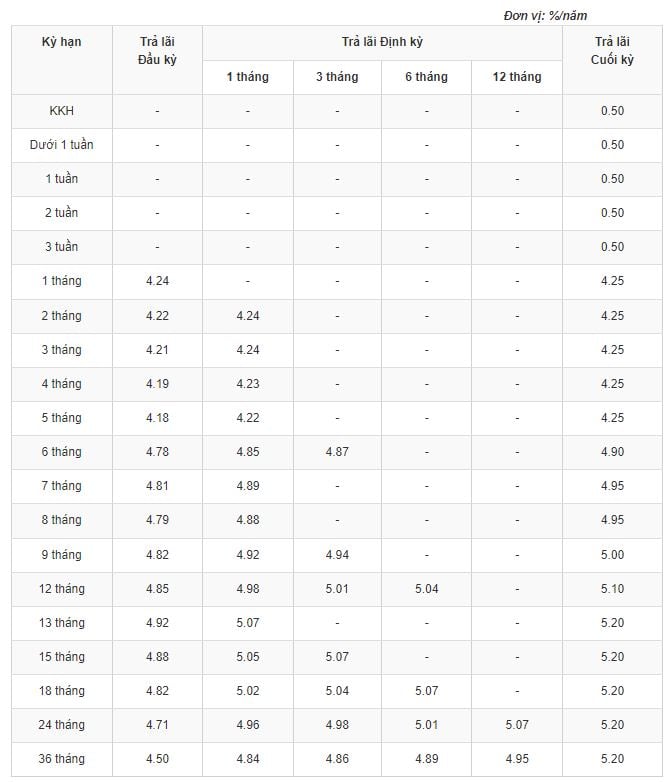

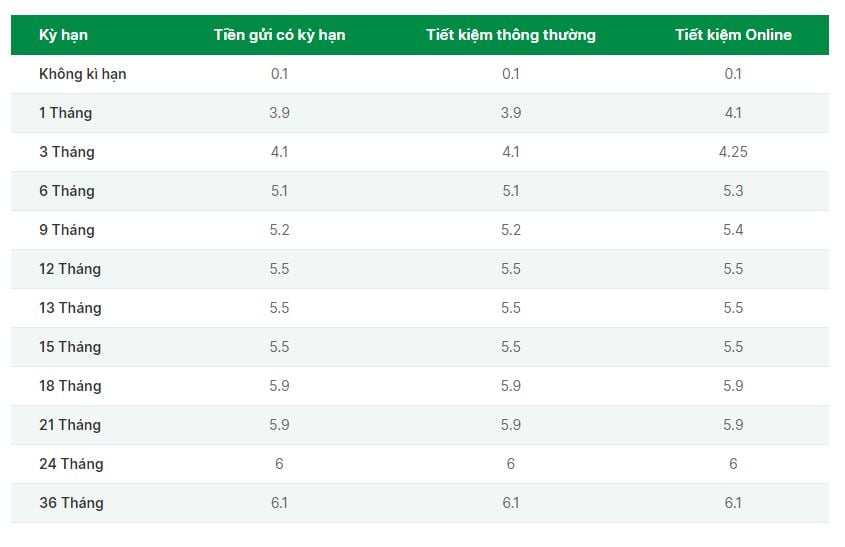

Some banks have many low interest rate terms at this time, such as: Agribank, ABBank, GPBank, OCB, Vietinbank... Below is the interest rate table of some banks, readers can refer to.

* Interest rate information is for reference only and may change from time to time. Please contact the nearest bank transaction point or hotline for specific advice.

Source

![[Photo] General Secretary and President of China Xi Jinping arrives in Hanoi, starting a State visit to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/9e05688222c3405cb096618cb152bfd1)

Comment (0)