For the first time, state budget revenue exceeded VND2 quadrillion, 19.1% higher than the estimate. Institutional improvement, bottleneck removal, and breakthroughs in digital transformation... were the outstanding marks of the financial sector last year.

Financial sector's mark in 2024: Budget revenue exceeds 2 million billion VND, digital transformation breakthrough

For the first time, state budget revenue exceeded VND2 quadrillion, 19.1% higher than the estimate. Institutional improvement, bottleneck removal, and breakthroughs in digital transformation... were the outstanding marks of the financial sector last year.

In 2024, the Finance sector will carry out its financial and budgetary tasks in the context of many unpredictable fluctuations in the world and the country, and the domestic economy facing many difficulties and challenges. The proactive and drastic implementation of many creative management solutions, reasonable, flexible and effective fiscal policy management, etc. has contributed to the comprehensive completion of the financial and budgetary tasks. The Ministry of Finance has selected and announced 10 outstanding events of the sector in 2024.

Proactive, flexible, focused, key fiscal policy to support the economy

In 2024, in the context of the country's socio-economic situation facing many difficulties and challenges, from the beginning of the year, the Ministry of Finance has proactively researched, proposed to competent authorities as well as issued under its authority many solutions to operate a reasonable, focused, key expansionary fiscal policy, coordinated synchronously and harmoniously with monetary policy and other macroeconomic policies to support production and business, and promote growth drivers.

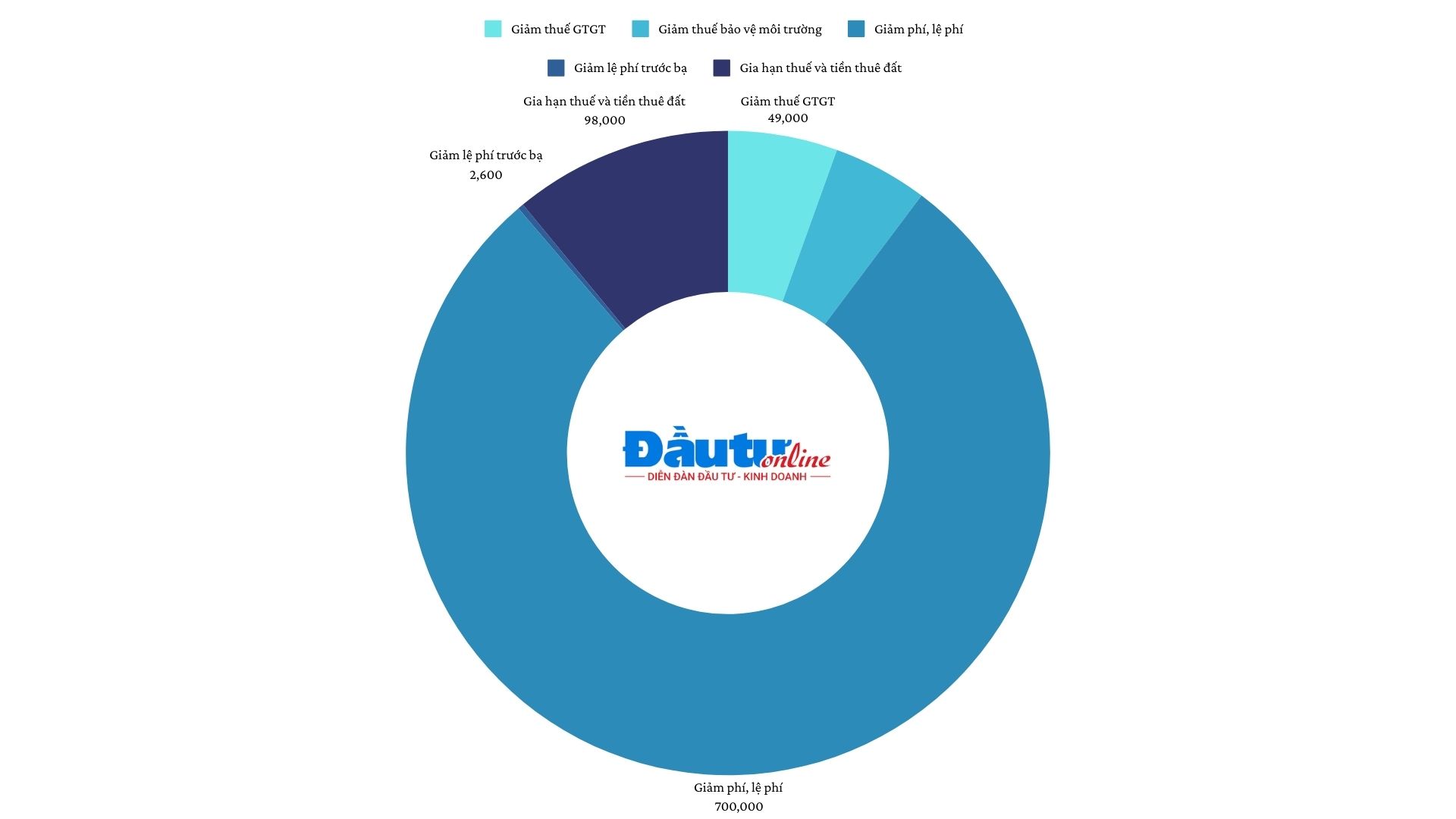

The total scale of the support package on taxes, fees, charges and land rents in 2024 is about 197 trillion VND. In particular, many outstanding policies have large spillover effects such as: reducing 2% of VAT rates for most groups of goods and services currently applying a VAT rate of 10%, the tax amount reduced is about 49 trillion VND; reducing environmental protection tax on gasoline, oil, and grease with a tax reduction of about 42.5 trillion VND; continuing to reduce the collection rate for 36 fees and charges with a reduction of about 700 billion VND; reducing 50% of registration fees for domestically assembled cars, reduced by about 2,600 billion VND; extending the deadline for paying VAT, corporate income tax..., the estimated amount of tax and land rent to be considered for extension is about 98 trillion VND...

|

| The scale of the support package for taxes, fees, charges and land rents in 2024 is about 197 trillion VND. |

State budget revenue exceeds 2 million billion VND for the first time

The 2024 state budget and financial tasks are being implemented in the context of the world situation continuing to be unstable, with many major challenges arising. However, the Finance sector has exceeded the 2024 state budget revenue target; estimated at about VND 2,025.4 trillion, equal to 119.1% (an increase of VND 324.4 trillion) compared to the estimate, an increase of 15.5% compared to the implementation in 2023 (central budget revenue is estimated at 123.7% of the estimate, local budget revenue is estimated at 114.4% of the estimate); the mobilization rate into the state budget is 17.8% of GDP, with taxes and fees alone reaching 14.2% of GDP. The synchronous implementation of policies on tax, fee, land rent exemption, reduction, etc. has practically supported people and businesses to recover, stabilize and develop production.

At the same time, the Finance sector has been very determined to promote solutions for managing state budget revenue, ensuring correct, full and timely collection, expanding the collection base and preventing tax losses; in particular, there have been many innovative solutions for tax management for e-commerce, digital platforms, land use fee collection; strengthening inspection, examination and handling of tax arrears... thanks to which budget revenue has exceeded expectations.

Digital transformation breakthrough

The Finance sector is determined to digitally transform and apply AI in budgetary financial management. The Minister of Finance has issued Decision No. 837/QD-BTC on the Ministry of Finance's Digital Transformation Plan for 2024, focusing on effectively implementing the Ministry of Finance's digital transformation tasks to ensure compliance with the goal of "Developing a digital economy with 4 pillars of information technology industry, digitalization of economic sectors, digital governance, digital data - Important driving force for rapid and sustainable socio-economic development".

The Tax Authority is a pioneer in implementing the digital transformation roadmap, applying IT to change to modern management in the online environment, bringing artificial intelligence (AI) into tax management with the launch of the Virtual Assistant Application in Tax Debt Management (TLA) and Virtual Assistant to support taxpayers (Chatbot). The Customs Authority has resolutely and successfully implemented "Digital Customs", "Smart Customs" and "Green Customs" to modernize the Customs sector, simplify customs clearance procedures for import and export goods, and create a favorable business environment for enterprises. The State Treasury has transformed digitally from a traditional transaction treasury to an electronic treasury; with this solution, the State Treasury has completed the deployment of online public services to 100% of units.

Ministry of Finance urgently streamlines apparatus

The Ministry of Finance has issued Decision No. 2879/QD-BTC to establish the Steering Committee for restructuring the organizational apparatus of the Ministry of Finance, headed by Minister Nguyen Van Thang. Units in the entire Finance sector have determined the highest political determination in implementation; resolutely and urgently reorganize and streamline the organizational apparatus of the unit, improve the effectiveness and efficiency of operations according to Resolution No. 18-NQ/TW.

Create institutional breakthroughs to remove bottlenecks in mechanisms and policies

In 2024, the Ministry of Finance completed 70/71 assigned projects and tasks, including 38 additional projects and tasks. Including projects submitted from previous years, the Government has issued 23 Decrees and 20 draft Decrees are under consideration for promulgation; the Prime Minister has issued 02 Decisions and 02 draft Decisions are under consideration for promulgation. At the same time, the Ministry of Finance has issued 86 Circulars guiding the field of finance - State budget.

In 2024, the National Assembly voted to pass the Law amending 9 Laws, including: Law amending and supplementing a number of articles of the Securities Law, the Accounting Law, the Independent Audit Law, the State Budget Law, the Law on Management and Use of Public Assets, the Tax Administration Law, the Personal Income Tax Law, the National Reserve Law, and the Law on Handling of Administrative Violations. The Law helps promptly remove bottlenecks and bottlenecks in mechanisms and policies, actively creating a favorable investment and business environment; removing difficulties for enterprises, attracting investment; improving the efficiency of using public assets; supplementing resources for the state budget; stabilizing the macro-economy, and effectively controlling public debt.

National credit rating is assessed positively

In the context of the world and regional situation continuing to fluctuate strongly and complicatedly, the global economy still faces many difficulties and challenges, all three credit rating organizations (Moody's, S&P and Fitch) continue to affirm the national credit rating with positive forecasts. The organizations all highly appreciate Vietnam's economic growth along with favorable economic growth prospects in the medium and long term. Government debt is stable (34% of GDP) and much lower than countries with the same rating with an average BB of 53% of GDP.

Proactive debt management strategy helps to minimize the Government's liquidity risk. Improved debt structure, reduced dependence on external loans, and a gradual decrease in the proportion of foreign currency debt help reduce foreign exchange risks. Organizations assess that Vietnam's current strengths are attracting stronger FDI flows than other countries in the region, diversified allocation among sectors; stable exports and maintaining a high annual growth rate. Challenges in the real estate and banking sectors have been gradually resolved; the real estate sector is gradually recovering.

Appointment of senior personnel of the Ministry of Finance

On November 28, 2024, at the 8th Session of the 15th National Assembly, 100% of the National Assembly delegates present voted to approve the appointment of Mr. Nguyen Van Thang to the position of Minister of Finance for the 2021-2026 term.

Previously, on the afternoon of August 26, at the 8th extraordinary session, the 15th National Assembly passed a resolution approving the Prime Minister's proposal to appoint Minister of Finance Ho Duc Phoc to the position of Deputy Prime Minister of the 15th term.

The Finance sector is proactively ready for a general inventory of public assets.

Immediately after the Prime Minister issued Decision No. 213/QD-TTg dated March 1, 2024 approving the Project on general inventory of public assets at agencies, organizations, units, and infrastructure assets invested and managed by the State, the Ministry of Finance issued Decision No. 798/QD-BTC dated April 5, 2024 on the plan to implement Decision 213/QD-TTg. This general inventory of public assets nationwide is to meet the requirements of strengthening management and improving the efficiency of exploiting and using public assets, which are important resources for development.

The Ministry of Finance, as the host unit, has issued many guiding documents, organized training, and piloted the inventory of public assets in ministries, branches, and localities nationwide, ensuring readiness for the general inventory of public assets to be carried out from 0:00 on January 1, 2025.

Developing financial markets, strengthening international financial cooperation

In 2024, the Vietnamese stock market will maintain stable growth, affirming itself as an important medium- and long-term capital channel for the economy. As of December 27, 2024, the VNIndex reached 1,275.14 points, up 12.9% compared to the end of 2023. The stock market capitalization reached nearly VND 7.2 million billion, up 21.2% compared to the end of 2023, equivalent to 70.4% of estimated GDP in 2023; the average trading value reached VND 21.1 trillion/session, up 19.9% compared to the average of the previous year. In order to ensure safe and sustainable development of the stock market towards the goal of upgrading, the Ministry of Finance has issued Circular No. 68/2024/TT-BTC - an important step in integration, creating momentum to achieve the goal of upgrading the Vietnamese stock market from "marginal" to "emerging".

The corporate bond market continues to recover strongly. In 2024, 96 enterprises issued individual corporate bonds with a volume of VND 396.7 trillion, an increase of 33.6% compared to 2023. The volume of early repurchases is about VND 187 trillion; 1,431 bond codes of 326 issuing organizations have registered for trading. The total value of corporate bond transactions reached VND 1,026.6 trillion, the average trading value per session reached about VND 4,224.8 billion/session. The insurance market continues to develop steadily, currently there are 85 insurance businesses and 01 branch of a foreign non-life insurance company. Total assets in 2024 are estimated at about VND 1,007 trillion (up 10.9% over the previous year); reinvestment in the economy reached VND 850 trillion, up 13.2%.

The Ministry of Finance also organized many financial investment promotion conferences in major financial centers, affirming the role of the Vietnamese financial market such as in Korea and Japan (March 2024), Australia and Singapore (August 2024).

Flexible price management contributes to controlling inflation

2024 is the 11th year of continued success in price management and operation, contributing to controlling inflation according to the target set by the National Assembly. Price management in 2024 has closely followed the management scenario, market prices are basically stable, the average CPI in 11 months increased by 3.69% over the same period, core inflation increased by 2.7%; the average CPI for the whole year is estimated to increase by less than 4%, lower than the target (4-4.5%). This figure is lower than many countries and regions in the world, making an important contribution to supporting businesses to restore production and business, promoting economic growth.

The system of legal documents on prices has been completed in sync with the Law on Prices (2023). In particular, the Ministry of Finance has submitted to the Government for promulgation 3 Decrees and issued 14 guiding Circulars under its authority.

This afternoon (December 31), the Ministry of Finance will hold a conference to review and evaluate the implementation of financial tasks - State budget in 2024, and deploy tasks in 2025. The conference will hear a report on the results of the implementation of financial tasks - State budget in 2024 and the direction of implementing tasks in 2025 in the fields of state management of the Ministry of Finance. Representatives of ministries, branches, central and local agencies will also participate in speaking and discussing the results achieved, proposals and recommendations to the Ministry of Finance in 2025.

Source: https://baodautu.vn/dau-an-nganh-tai-chinh-2024-thu-ngan-sach-vuot-2-trieu-ty-dong-dot-pha-chuyen-doi-so-d237316.html

![[Photo] General Secretary and President of China Xi Jinping arrives in Hanoi, starting a State visit to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/9e05688222c3405cb096618cb152bfd1)

Comment (0)