Credit rating agency Fitch Ratings has downgraded the United States' credit rating from AAA to AA+, a move that surprised investors and drew an angry response from the White House.

The reasons given by Fitch include an expected financial downturn over the next three years, a high and growing government debt burden, and an erosion of governance relative to 'AA' and 'AAA' rated peers over the past two decades, reflected in repeated debt ceiling deadlocks and last-minute resolutions.”

White House outraged

Fitch’s change in the U.S. credit rating was not entirely unexpected. Fitch placed the U.S.’s AAA credit rating on “negative watch” in May, as lawmakers scrambled to find a way to address the nearly $32 trillion debt ceiling.

Ultimately, the US Senate and House of Representatives reached an agreement, and President Joe Biden signed the bipartisan debt ceiling bill on June 2, just three days before “Day X” – the day the US was scheduled to default.

Economists were quick to push back against Fitch's decision, however, noting that the latest economic data, from low unemployment to steady GDP growth, showed conditions were improving, not worsening, in the US.

US Treasury Secretary Janet Yellen speaks at an event on August 2 in McLean, Virginia, USA. Photo: ZAWYA

“The United States faces serious long-term fiscal challenges. But Fitch’s decision to downgrade the U.S. rating when the economy appears stronger than expected is both bizarre and inappropriate,” former U.S. Treasury Secretary Larry Summers wrote in a post on X (formerly Twitter).

“I don’t think Fitch has any new and useful insights into the current situation. The data over the past few months suggests that the US economy is stronger than people thought, which is good for the creditworthiness of US debt,” Mr. Summers said.

Treasury Secretary Janet Yellen was also quick to respond to Fitch’s rating decision. She disagreed with Fitch’s downgrade, calling the decision “arbitrary and based on outdated data.”

Ms. Yellen added that the lower credit rating “does not change what Americans, investors and people around the world already know. Treasury securities remain the world’s preeminent safe-haven and liquid asset, and the fundamentals of the U.S. economy are strong,” she asserted.

The White House took a similar stance, saying it “completely disagrees with this decision.”

“It defies reality to downgrade the US at a time when President Biden has delivered the strongest recovery of any major economy in the world,” White House press secretary Karine Jean-Pierre said.

Negligible impact

Fitch's decision doesn't seem to worry Wall Street's top economists and strategists.

The downgrade “does not reflect new financial information” and will have “little direct impact on financial markets,” said Alec Phillips, head of US political economics at Goldman Sachs.

The decision won't deter buyers of Treasury bonds or force them to sell, said Lauren DiCola, director of investment strategy and market research at asset manager Certuity.

“We do not believe this will undermine the confidence of foreign buyers of US Treasuries, as the US Treasury market plays an important role in global markets,” said Ms. DiCola.

Additionally, the Treasury market remains the most liquid market, and while that may change over time, we don’t think that’s a cause for concern in the near term,” DiCola said.

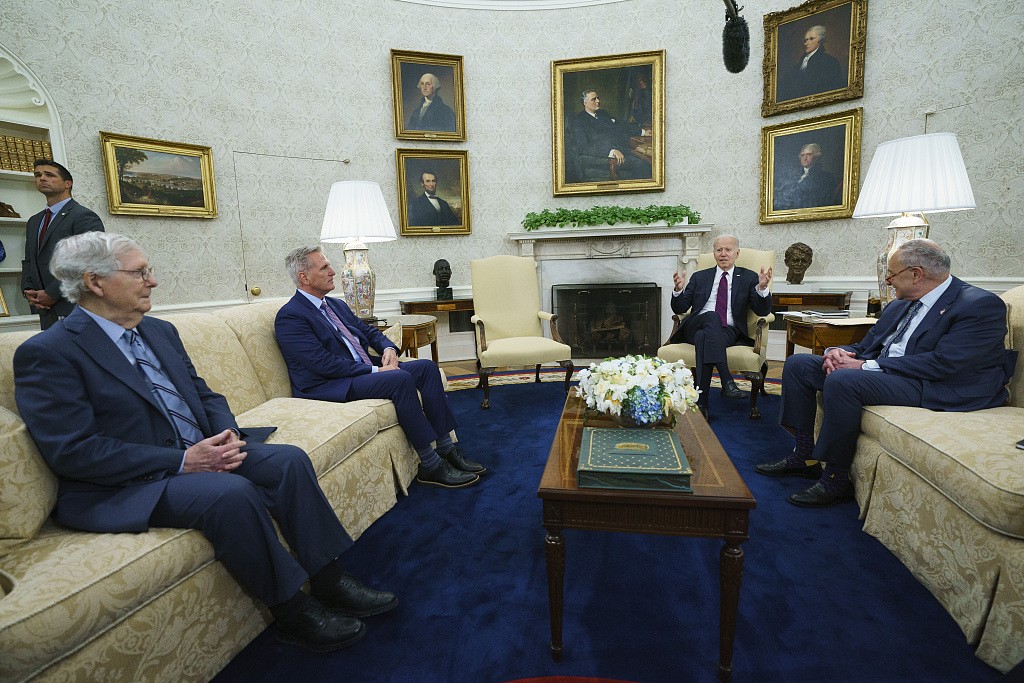

US President Joe Biden speaks with top congressional leaders about the debt ceiling at the White House on May 9, 2023. The US reached a deal to avoid default on June 2, but it did not change Fitch's decision on the country's credit rating. Photo: CGTN

“While the downgrade may prompt investors to consider the US’s high debt burden, it may be viewed as a medium-term concern,” said Laura Cooper, senior investment strategist at BlackRock International.

“Fitch’s credit rating is an indication of the probability of default. However, the risk of default in the US remains very low. Therefore, we do not expect this downgrade to have a lasting impact on the market. We believe that US Treasuries remain safe and will continue to play an important role in many investors’ portfolios,” said George Mateyo, chief investment officer at Key Private Bank.

Marc Goldwein, senior vice president and senior policy director at the Committee for a Responsible Federal Budget, also said that downgrading from AAA to AA+ is like downgrading your credit rating from excellent to excellent.

In other words, America's reputation will be less affected. The country is still considered a safe place to invest compared to the rest of the world, and that is unlikely to change anytime soon .

Nguyen Tuyet (According to Fortune, CNN, The Guardian)

Source

![[Photo] Prime Minister Pham Minh Chinh meets with US business representatives](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/5bf2bff8977041adab2baf9944e547b5)

![[Photo] President Luong Cuong attends the inauguration of the international container port in Hai Phong](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/9544c01a03e241fdadb6f9708e1c0b65)

Comment (0)