On February 1, the Government Office issued a document on the direction of Deputy Prime Minister Le Minh Khai to the Ministry of Finance and the Ministry of Transport, stating: On January 19, 2024, Giao thong Newspaper published an article "Large tax loss from disguised vehicles, how to fill the "gap"? Along with amending and supplementing regulations to tighten contract vehicle operations, experts said that it is necessary to urgently apply technology and share databases to combat tax loss from this type.

Son Hai limousine driver has a contract badge but disguises himself as a fixed route Hanoi - Hai Phong, collecting cash from individual passengers, risking loss of VAT revenue for the State.

In particular, the article proposes that the Vietnam Road Administration allow the connection and sharing of data from vehicle tracking devices to serve tax management. From there, the tax authority will share with management departments and tax branches for comparison and checking during the tax declaration and payment process of enterprises.

At the same time, increase sanctions, tighten up on disguised vehicles; urgently complete the software for receiving journey monitoring data, and cameras to monitor drivers in a smarter way; build software for receiving transportation contract information to improve the management of passenger transportation business activities under contracts.

"Regarding this issue, Deputy Prime Minister Le Minh Khai assigned the Ministry of Finance to preside over and coordinate with the Ministry of Transport and relevant agencies to review and grasp the situation reported by Giao Thong Newspaper regarding the large tax loss from disguised contract vehicles to promptly find effective solutions; in cases beyond authority, report to the Prime Minister," the document stated.

Previously, Giao Thong Newspaper published a series of 4 articles reflecting on loopholes in tax losses from disguised contract vehicles.

The fact that contracted bus companies operate on fixed routes without entering stations, without issuing tickets to passengers, and without notifying the authorities of their trips has caused the State to lose a large amount of tax revenue. According to regulations, transport businesses must pay two types of taxes: VAT and corporate income tax (if they make a profit).

After many days of fieldwork, Giao thong Newspaper reporters discovered many loopholes in the implementation of tax obligations of fixed-route transportation companies. This not only causes disorder in traffic safety and unfair competition, but also causes huge losses to the State budget.

Part 1: Many tricks to avoid taxes

Part 2: Tax monitoring loopholes

Part 3: Where is the tax authority?

Part 4: Huge tax loss from disguised vehicles: How to fill the "loophole"?

Source

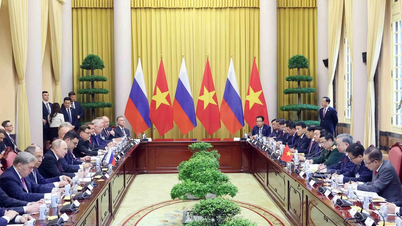

![[Photo] General Secretary concludes visit to Azerbaijan, departs for visit to Russian Federation](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/7a135ad280314b66917ad278ce0e26fa)

![[Photo] Prime Minister Pham Minh Chinh meets with the Policy Advisory Council on Private Economic Development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/387da60b85cc489ab2aed8442fc3b14a)

![[Photo] National Assembly Chairman Tran Thanh Man chairs the meeting of the Subcommittee on Documents of the First National Assembly Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/72b19a73d94a4affab411fd8c87f4f8d)

![[Photo] President Luong Cuong presents the decision to appoint Deputy Head of the Office of the President](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/501f8ee192f3476ab9f7579c57b423ad)

![[Photo] Prime Minister Pham Minh Chinh talks on the phone with Singaporean Prime Minister Lawrence Wong](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/8/e2eab082d9bc4fc4a360b28fa0ab94de)

Comment (0)