Real estate enterprises issue 55%

The Ministry of Finance has just reported on the corporate bond market situation in the first 7 months of 2023.

Accordingly, from the beginning of the year to July 21, 36 enterprises have issued bonds with a volume of VND 61,200 billion (down 78% compared to the same period in 2022), of which real estate enterprises account for 55% (VND 33,000 billion); 60.91% of bonds issued have secured assets; the volume of early repurchase is VND 130,400 billion (1.65 times higher than the same period in 2022).

Since Decree No. 08/2023 took effect (March 5, 2023), the volume of corporate bonds issued was VND 60,300 billion, accounting for 99% of the volume since the beginning of 2023.

Outstanding corporate debt as of July 21, 2023 is about VND 1,030 trillion, accounting for 10.8% of GDP in 2022, equal to 8.3% of the total outstanding credit of the economy.

The Ministry of Finance said that in the first 7 months of 2023, more than 61,000 billion VND of corporate bonds were issued (Photo: Huu Thang).

According to the Ministry of Finance, in the context of difficult production and business activities, based on the provisions of Decree No. 08, many enterprises have negotiated with bond owners to restructure debt repayment terms.

Some real estate issuers have reached agreements to extend bond payments from 1 month to 2 years; interest rates have been agreed to increase by 0.5-3% compared to the original interest rates.

The fact that businesses proactively negotiate with bondholders is assessed by the Ministry of Finance to have contributed to stabilizing investor sentiment, while also creating conditions for businesses to have time to restructure, restore production and business, thereby having cash flow to repay debts when bonds mature after the restructuring process.

The Ministry of Finance analyzed: The Government and the Prime Minister have given very strong directions to stabilize the market, such as synchronously implementing policies to stabilize the macro economy;

Reasonable management of fiscal policy (reducing, extending, postponing taxes, supporting affected subjects, accelerating public investment disbursement; removing difficulties for businesses including the real estate market; stepping up propaganda to stabilize market psychology and strictly handling cases of incitement and impact on social security;

Timely promulgation of legal regulations related to the corporate bond market (Decree No. 65, Decree No. 08, Circular No. 16). In addition, the Government has established working groups on banking, securities, corporate bonds and real estate to propose solutions to stabilize and develop the market. Accordingly, the market has gradually stabilized.

Actively removing difficulties for the real estate market

Regarding proposed solutions in the coming time, the Government continues to direct the synchronous implementation of solutions to stabilize the macro economy, control inflation, and stabilize the investment environment to ensure the achievement of the growth target as assigned by the National Assembly.

The State Bank of Vietnam continues to flexibly operate monetary policy tools to promptly meet credit capital needs for economic development (taking into account the fact that the corporate bond market may not recover immediately in 2023).

In particular, it is necessary to step up the implementation of solutions to promote the issuance of corporate bonds to the public in addition to the channel of issuing individual bonds, removing difficulties for the real estate market.

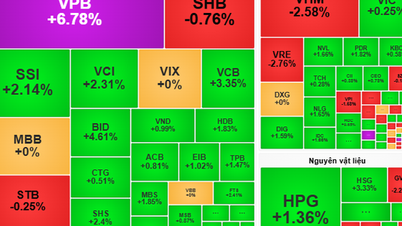

Real estate enterprises issuing bonds accounted for 55% from the beginning of the year to July 21, 2023 (Photo: Pham Tung).

Regarding monitoring the payment of corporate bonds due, the Ministry of Finance continues to monitor the information disclosure of enterprises working directly with enterprises with large maturing bonds and requires enterprises to be responsible to the end for fully paying bond obligations to investors according to the committed terms and conditions.

Regarding increasing liquidity of the corporate bond market, the Ministry of Finance will promote the implementation of regulations in Decree No. 08 of the Government.

Regarding market development and improving the effectiveness of management and supervision, the Ministry of Finance has directed the Stock Exchange to put into operation the individual corporate bond trading system to develop the secondary market and increase liquidity for individual corporate bonds. This system has been in operation since July 2023.

The Ministry of Finance said that: The State Bank, the State Securities Commission, and the Stock Exchange will continue to strengthen inspection, supervision, and rectification of the activities of organizations and financial institutions involved in corporate bond issuance in accordance with the law. Any violations will be strictly handled in accordance with the law.

Regarding medium and long-term solutions, the Ministry of Finance proposed a comprehensive review and research to report to competent authorities to amend relevant legal documents (Securities Law, Enterprise Law, Credit Institutions Law) regarding regulations on conditions for issuing individual corporate bonds.

The issue of related parties and cross-ownership between credit institutions, securities companies and enterprises, accelerate the review, completion and improvement of the enforcement of legal regulations on bankruptcy so that enterprises have sufficient procedures to carry out bankruptcy in an orderly manner, contributing to ensuring the healthy and sustainable operation of the market.

The Ministry of Construction needs to study and submit to competent authorities to supplement regulations on financial safety indicators in the construction and real estate sectors ...

Source

![[Photo] Prime Minister Pham Minh Chinh chairs conference on anti-smuggling, trade fraud, and counterfeit goods](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/14/6cd67667e99e4248b7d4f587fd21e37c)

Comment (0)