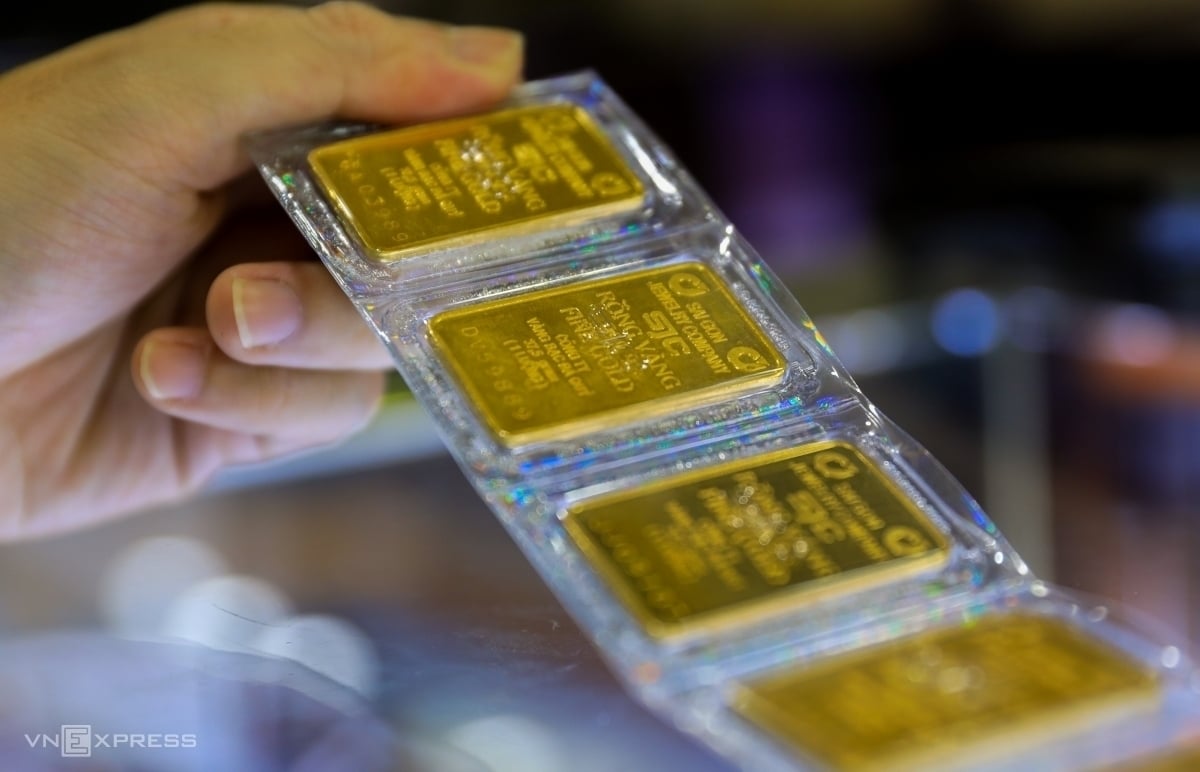

Recorded in the domestic gold market, after increasing by 800,000 VND/tael in buying and 600,000 VND/tael in selling on May 6, the SJC gold price of Saigon Jewelry Company opened on the morning of May 7 and continued to increase by 1 million VND/tael, currently listed at 85.3-87.52 million VND/tael (buy-sell). This price has far exceeded the record of 86.5 million VND set the previous afternoon.

In the world gold market, the spot gold price closed the session on May 6 in the US up 22.2 USD to 2,324 USD/ounce. In the Asian session on the morning of May 7, the gold price reversed and decreased slightly by 1.6 USD to around 2,323 USD/ounce.

Central banks actively buy more gold

The World Gold Council's Gold Demand Trends report for Q1 2024 shows that total global gold demand (including OTC purchases) increased by 3% year-on-year to 1,238 tonnes in Q1 2023, marking the strongest Q1 increase since 2016. Excluding the OTC market, gold demand decreased by 5% to 1,102 tonnes in Q1 2023. Vietnam recorded a 12% increase in investment demand for gold bars and coins, with total consumer demand increasing by 6% year-on-year in 2023.

Strong gold investment from the OTC market, continued central bank buying, and increased gold purchases from Asian clients pushed the average quarterly gold price to a record high of $2,070/ounce—up 10% year-over-year and up 5% quarter-over-quarter.

Central banks continued to buy gold, adding 290 tonnes to their reserves in the first quarter. The continued and large-scale purchases by the official banking sector underscore the importance of gold in international reserve assets amid market volatility and increased risks.

“Local currency depreciation is a common theme across ASEAN markets as we track aspects of Gold Demand Trends. This drives demand for gold as a safe haven/store of wealth, as well as attracting investors with the highest returns on local gold prices,” said Shaokai Fan, Regional Director for Asia-Pacific (excluding China) and Global Head of Central Banks at the World Gold Council.

Outflows from gold exchange-traded funds (ETFs) continued, led by North America and Europe, with global ETF holdings falling by 114 tonnes, but were partly offset by inflows into Asian-listed products. China accounted for much of the increase, as investors rekindled interest in gold as its currency weakened and its domestic stock market underperformed.

Additionally, demand for gold in the technology sector has recovered 10% year-on-year thanks to the boom in AI in the electronics sector.

On the supply side, gold mine production rose 4% year-on-year to 893 tonnes in the first quarter of 2023, a record. Recycled gold also hit its highest level since the third quarter of 2020, rising 12% year-on-year to 351 tonnes, as some investors saw high prices as a good opportunity to profit.

Vietnam's demand for gold bar investment grows strongly

According to the World Gold Council, Vietnam’s investment demand for gold bars and coins recorded the strongest growth in the first quarter since 2015. Domestic investors were attracted by the sharp rise in gold prices in the first quarter, especially in the face of rising energy prices - which are forecast to boost inflation - and the depreciation of the local currency against the USD. The price difference for gold bars reached a record high of 650 USD/ounce.

“To address this situation, the Vietnamese Government has loosened supply restrictions, and the State Bank plans to continue organizing auctions to sell gold bars to the market at the end of April,” the report stated.

Global gold jewelry demand remained stable despite record high prices, falling just 2% year-on-year. Gold jewelry demand in Vietnam, Thailand and Indonesia all saw similar declines in the first quarter, down 10-12% as a late-quarter gold price surge curbed demand in March.

“The demand for gold jewelry in Vietnam in the first quarter recorded the fifth consecutive decline, down more than 10% to 4 tons, which is the lowest demand in the first quarter since 2015. Despite the boom in demand in February during the Lunar New Year and God of Wealth Day, the demand for gold jewelry was still strongly influenced by the high gold price,” Mr. Shaokai Fan added.

Meanwhile, according to Louise Street, senior market analyst at the World Gold Council: “Gold prices have risen to an all-time high since March, despite the prevailing headwinds of a high US dollar and interest rates that are showing signs of “increasingly rising”.

Several factors have contributed to the recent surge in gold prices, including rising geopolitical risks and ongoing macroeconomic uncertainty, which have fueled demand for gold as a safe-haven asset. In addition, continued and massive gold buying by central banks, strong investment in the OTC market, and net purchases in the derivatives market have all contributed to the rise in gold prices.

“It is interesting to see a shift in investor behaviour between the East and the West. Traditionally, investors in Eastern markets have been more price sensitive, waiting for gold prices to fall before buying, while Western investors have historically been attracted to rising gold prices, tending to buy when prices are high. In Q1, we saw those roles reverse as investment demand in markets such as China and India increased significantly as gold prices soared,” said Louise Street.

“2024 will deliver higher gold investment returns than we expected at the start of the year based on recent gold performance,” said Louise Street. “If gold prices move sideways in the coming months, some price-sensitive buyers will re-enter the market and investors will continue to seek gold as a safe haven asset while awaiting clarity on interest rate cuts and election results.”

Source

Comment (0)