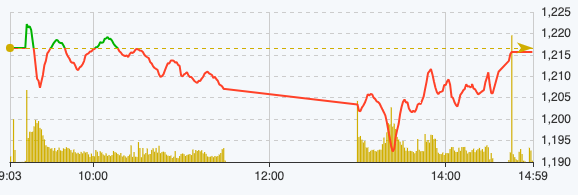

After the session when VN-Index dropped 60 points, the market opened in a tug-of-war around the reference thanks to support from the banking group. Meanwhile, selling pressure in small and medium-sized stocks increased, pushing the main index further away from the reference at the end of the morning session.

In the large-cap group, BID had the best gain with 2.2% and FPT, VIB, STB, ACB , TCB, VPB increased from 0.4% to 0.8%. Meanwhile, VIC led the decline with a loss of 3.5%, MSN and MWG decreased by 2.2%.

At the end of the morning session on April 16, VN-Index decreased by 9.64 points, equivalent to 0.79% to 1,206.97 points. The entire floor had 64 stocks increasing and 423 stocks decreasing.

VN-Index performance on April 16 (Source: FireAnt).

Entering the afternoon session, pessimism continued to dominate, causing the VN-Index to lose the 1,200-point mark at times before recovering towards the end of the session.

At the end of the trading session on April 16, VN-Index decreased by 0.93 points, equivalent to 0.08% to 1,215.68 points. The entire floor had only 140 stocks increasing but 361 stocks decreasing, 58 stocks remaining unchanged.

HNX-Index decreased 0.88 points to 228.83 points. The entire floor had 67 stocks increasing, 129 stocks decreasing and 45 stocks remaining unchanged. UPCoM-Index decreased 0.35 points to 88.63 points.

The VN30 basket witnessed a divergence with 14 stocks increasing in price and 13 stocks decreasing in price. On the positive side, the four big banks TCB, BID, CTG, MBB led the increase and contributed a total of 3.2 points to the index, while three stocks LPB, VPB, ACB were also in the top 10 stocks with good gains. On the contrary, VCB led the market's decline when it took away nearly 1.4 points from the general index.

The chemical group also recorded positive results when the eldest GVR increased by 1.85% and contributed more than 0.5 points to the general market index. Other codes in the industry also increased by 1-2% such as DGC, DCM, DPM, LAS, DPR, notably QBS hit the ceiling.

Meanwhile, negativity dominated the real estate group as VIC dropped points from the opening to the closing session, taking away nearly 0.6 points from the market. Other stocks also fell sharply, such as NVL down 4.55%, DXG down 4.34%, DIG down 3.68%, ASM down 6.2%, CEO down 2.46%, PDR down 2.02%, HQC down 3.84%.

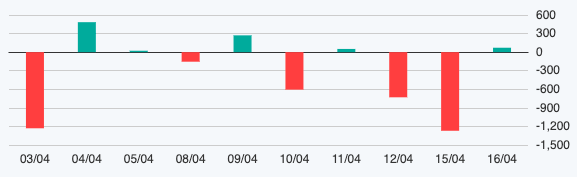

Foreign block transaction developments.

The total order matching value in today's session was VND33,752 billion, down 12% compared to yesterday, of which the order matching value on the HoSE floor reached VND30,325 billion. In the VN30 group, liquidity reached VND12,355 billion.

After two consecutive sessions of net selling, foreign investors returned to net buying with a value of 71 billion VND today, of which this group disbursed 2,881 billion VND and sold 2,809 billion VND.

The codes that were sold strongly were VHM 209 billion VND, VNM 84 billion VND, VRE 64 billion VND, VCB 59 billion VND, VIC 48 billion VND,... On the contrary, the codes that were mainly bought were SSI 91 billion VND, MWG 58 billion VND, VIX 57 billion VND, DGC 52 billion VND, DPG 50 billion VND,... .

Source

![[Photo] General Secretary To Lam attends the conference to review 10 years of implementing Directive No. 05 of the Politburo and evaluate the results of implementing Regulation No. 09 of the Central Public Security Party Committee.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/2f44458c655a4403acd7929dbbfa5039)

![[Photo] President Luong Cuong presents the 40-year Party membership badge to Chief of the Office of the President Le Khanh Hai](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/a22bc55dd7bf4a2ab7e3958d32282c15)

![[Photo] Close-up of Tang Long Bridge, Thu Duc City after repairing rutting](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/086736d9d11f43198f5bd8d78df9bd41)

![[Photo] Panorama of the Opening Ceremony of the 43rd Nhan Dan Newspaper National Table Tennis Championship](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/5e22950340b941309280448198bcf1d9)

![[Photo] Prime Minister Pham Minh Chinh inspects the progress of the National Exhibition and Fair Center project](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/35189ac8807140d897ad2b7d2583fbae)

![[VIDEO] - Enhancing the value of Quang Nam OCOP products through trade connections](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/17/5be5b5fff1f14914986fad159097a677)

Comment (0)