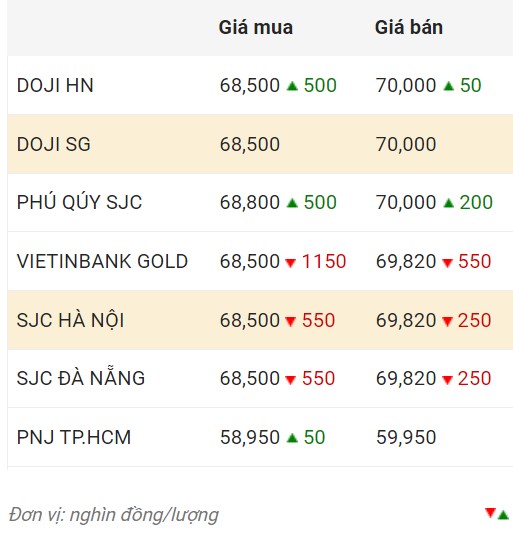

Domestic gold price

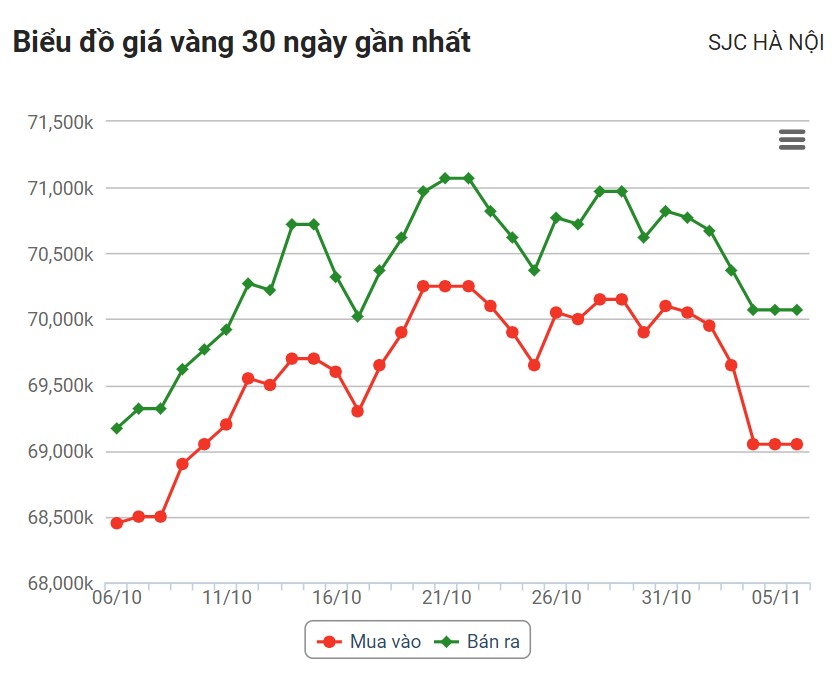

Domestic gold price developments

World gold price developments

Domestic gold prices adjusted in mixed directions in today's trading session. Some units adjusted up about 500,000 VND/tael, while some units adjusted down up to 1.15 million VND/tael.

Currently, the difference between buying and selling gold in the country is at a very high level. This can put buyers at risk of losing money when investing in the short term.

World gold prices fell despite the USD continuing its decline. At 5:30 p.m., the US Dollar Index, which measures the greenback's fluctuations against six major currencies, stood at 104.767 points (down 0.1%).

The failure of gold to break above $2,000 an ounce is creating a cautious mood in the market. While analysts advise against shorting gold in the current environment, some say the price action is disappointing as gold is not benefiting from the sharp decline in U.S. government bond yields and the weakness of the U.S. dollar.

“The geopolitical crisis is holding back further gains in gold prices,” said DailyFX expert Christopher Vecchio.

This expert assessed that although a geopolitical event can bring trading momentum to gold prices, it does not have the effect of attracting investors in the long term.

“Most of the volatility in gold has been over, but I don’t want to short gold. The fundamental backdrop is a weaker dollar and lower bond yields, which is positive for gold,” said Christopher Vecchio.

Meanwhile, David Morrison - senior market analyst at Trade Nation described that gold prices are looking for new catalysts.

Ole Hansen, commodities expert at Saxo Bank, is neutral on gold. Consolidation around current levels would be good.

“Gold has paused after rising nearly $200 last month, with profit-taking once again emerging above $2,000 an ounce. After such a strong run in such a short space of time, the market needs some consolidation; but so far the correction has been relatively shallow with support appearing at $1,953,” Hansen added.

Comment (0)