Anpha Petrol - one of the three companies that dominate the largest market share of domestic gas in the country, has frozen the collateral assets in the company's account at ACB Bank, South Saigon branch, to serve the company's lawsuit against its former manager.

Anpha Petrol serves more than 2 million household and business customers in Vietnam - Photo: ASP

Suing the old boss

An Pha Petroleum Group Joint Stock Company (Anpha Petrol, stock code ASP) has just announced unusual information to the State Securities Commission and the Ho Chi Minh City Stock Exchange, this weekend.

Anpha Petrol said that the company has received the decision to implement security measure No. 17/2025 dated February 4, 2025 of the People's Court of Ho Chi Minh City, regarding: freezing the secured assets in the company's account at ACB Bank, South Saigon branch.

Notably, the decision is to serve the company's lawsuit against the former manager, related to management operations. The company did not specifically name this boss.

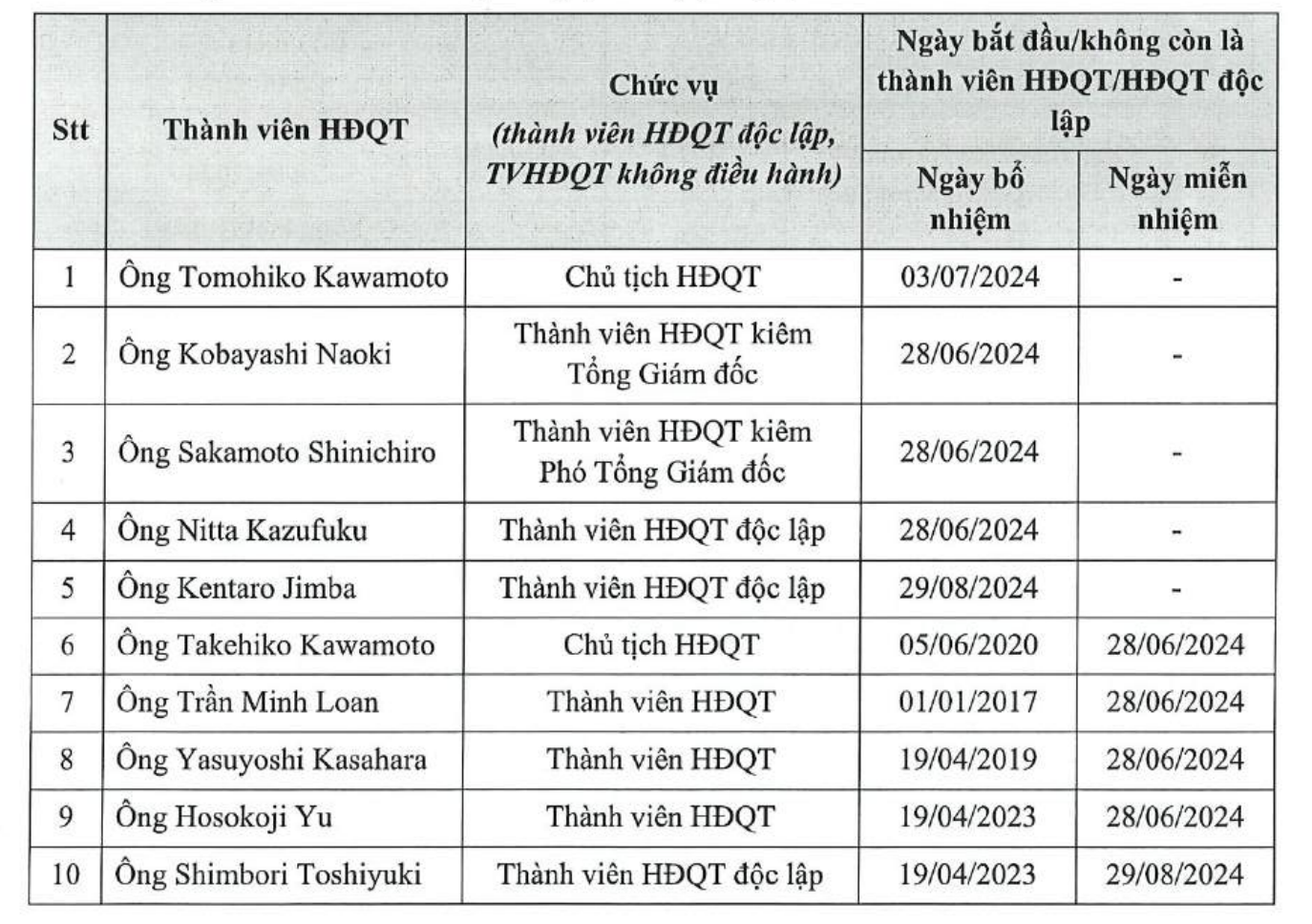

Based on the newly released 2024 corporate governance report, it can be seen that in the past year, Anpha Petrol has witnessed major changes in the "hot seat" positions. Mr. Takehiko Kawamoto left the chairman position, while Mr. Tomohiko Kawamoto took over.

At the same time, four new members of the board of directors were appointed, all foreigners, to replace the old leaders. Thus, Mr. Tran Minh Loan - the only Vietnamese in the old senior management team, who had been with the company for many years, also left the "hot seat".

Anpha Petrol's board of directors will have big changes in 2024 - Photo: ASP

Business is down

Anpha Petrol has been in business for more than two decades. According to its website, the company describes itself as "holding the leading position in the liquefied petroleum gas business in Vietnam."

This is one of the three companies that dominate the largest domestic gas market share in the country, with a system of key warehouses in both the North and South.

However, the business picture has somewhat declined. According to the consolidated financial report, last year Anpha Petrol brought in nearly VND3,340 billion in sales and service revenue, down approximately 12% compared to the previous year.

Financial revenue also decreased to more than VND15,500 billion (-3%). After deducting cost of goods sold and expenses, the "giant" in the gas industry only retained a profit after tax of approximately VND3.8 billion (-12%).

As of the end of last year, the company had assets of nearly VND1,590 billion (-28%). It had liabilities of VND1,285 billion, while its equity was at VND302 billion. On the balance sheet, undistributed profit after tax was negative by more than VND79 billion.

At the end of last year, the company sent an explanation to the Ho Chi Minh City Stock Exchange when the stock fell into the warning category - because undistributed profit after tax was negative.

Specifically, regarding the negative undistributed profit after tax, the company said that due to the economic crisis and recession worldwide, business activities encountered many difficulties in the first half of last year.

Selling price decreases and cost price increases, purchase price depends on world gas price according to general contract (CP price) announced monthly.

Find a way to overcome the loss

To overcome the negative undistributed profit after tax, thereby helping ASP stock escape the warning status on the stock exchange, at the end of last year, Anpha Petrol proposed 3 solutions.

First , the company completed the new management personnel structure. It replaced senior managers and members of the board of directors.

The unit is strengthening the review and improvement of the accounting personnel organization at parent companies and subsidiaries. Strengthening inspection and control over affiliated companies and subsidiaries.

To ensure the recording of accounting data, debt reconciliation, debt control, and accounting accurately reflects the arising economic transactions.

Second , Anpha Petrol has implemented synchronous solutions to improve efficiency since June 2024, negotiating to reduce input capital costs, cut costs and increase business output. Currently, the company is operating stable production and business activities, making profits from LPG (liquefied petroleum gas, gas).

In addition , the company has implemented solutions to overcome short-term financial imbalances. It is re-evaluating the effectiveness of financial investments in mergers and acquisitions in recent years and divesting ineffective investments.

"The financial resources from divestment will reduce the current short-term capital imbalance. In addition, the company has extended the current credit limit with credit institutions until 2025, ensuring stable financial resources for business operations," the company said.

On the stock market, ASP is currently in the green at VND4,160/share. In the past quarter, this code has increased by 4%, but has decreased by nearly 17% over the past year.

Source: https://tuoitre.vn/ong-lon-top-dau-nganh-gas-phong-toa-tai-khoan-ngan-hang-de-tien-khoi-kien-sep-cu-20250207203041522.htm

![[Photo] Prime Minister Pham Minh Chinh receives Swedish Minister of International Development Cooperation and Foreign Trade](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/ae50d0bb57584fd1bbe1cd77d9ad6d97)

![[Photo] Prime Minister Pham Minh Chinh works with the Standing Committee of Thai Binh Provincial Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/f514ab990c544e05a446f77bba59c7d1)

![[Photo] Prime Minister Pham Minh Chinh starts construction of vital highway through Thai Binh and Nam Dinh](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/52d98584ccea4c8dbf7c7f7484433af5)

Comment (0)