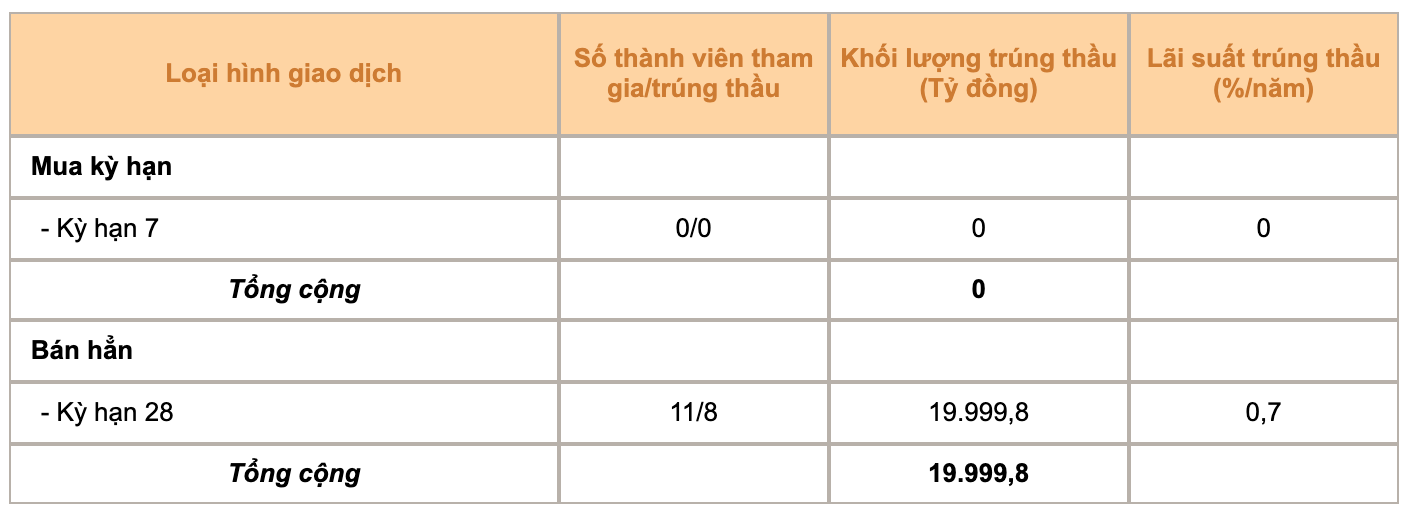

On September 28, the State Bank of Vietnam (SBV) continued to attract VND20,000 billion through the treasury bill channel with the highest winning interest rate since the beginning of the issuance. Specifically, the SBV offered 28-day treasury bills under the interest rate bidding mechanism. As a result, 8/11 participating members won the bid with a total volume of nearly VND20,000 billion, winning interest rate of 0.7%.

On the channel of pledging valuable papers, there were no new transactions and the circulation remained at 0. In total, the State Bank withdrew VND 20,000 billion from the system in the trading session on September 28. With a term of 28 days, this amount will be pumped back into the system by the State Bank on October 26, 2023.

This is the 6th consecutive issuance of treasury bills by the State Bank of Vietnam with a total issuance scale of nearly 90,000 billion VND. These treasury bills all have a term of 28 days and are offered for sale through the interest rate bidding method.

Previously, the State Bank of Vietnam reopened the channel to withdraw money through treasury bills after more than 6 months of suspension in the context of excess liquidity in the system and interest rates in the interbank market remaining at the lowest level since the beginning of 2021.

Notably, after 3 exploration sessions with a volume of 10,000 billion VND, in recent sessions, the operator has gradually doubled the issuance volume and the winning interest rate has also tended to increase.

Open market auction results on September 28 (Source: SBV).

According to Mr. Dinh Quang Hinh - Head of Macro and Market Strategy Department, VNDirect Securities Company, to stabilize the exchange rate, the State Bank issues credit notes to absorb excess liquidity from the banking system, in order to limit foreign exchange speculation.

However, many investors have a negative view and are concerned that this is a tightening move by the State Bank. In fact, Mr. Hinh believes that this move by the State Bank is not a move to tighten or reverse the current loosening policy, but only a temporary, short-term solution to absorb excess liquidity to help limit exchange rate speculation.

This move also aims to neutralize the State Treasury's previous purchase of foreign currency and pumping of VND liquidity into the market. The State Bank of Vietnam said it will continue to implement solutions to maintain liquidity in the banking system to support the economy , so the expert believes that the market may soon reconsider the State Bank's recent move to issue credit notes .

Source

![[Photo] Readers line up to visit the photo exhibition and receive a special publication commemorating the 135th birthday of President Ho Chi Minh at Nhan Dan Newspaper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/85b3197fc6bd43e6a9ee4db15101005b)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting on science and technology development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/ae80dd74c384439789b12013c738a045)

![[Photo] More than 17,000 candidates participate in the 2025 SPT Competency Assessment Test of Hanoi National University of Education](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/e538d9a1636c407cbb211b314e6303fd)

![[Photo] Nearly 3,000 students moved by stories about soldiers](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/21da57c8241e42438b423eaa37215e0e)

Comment (0)