DNSE Securities Corporation (DNSE) has just submitted a document to the General Meeting of Shareholders on the plan to increase charter capital and the plan for initial public offering (IPO).

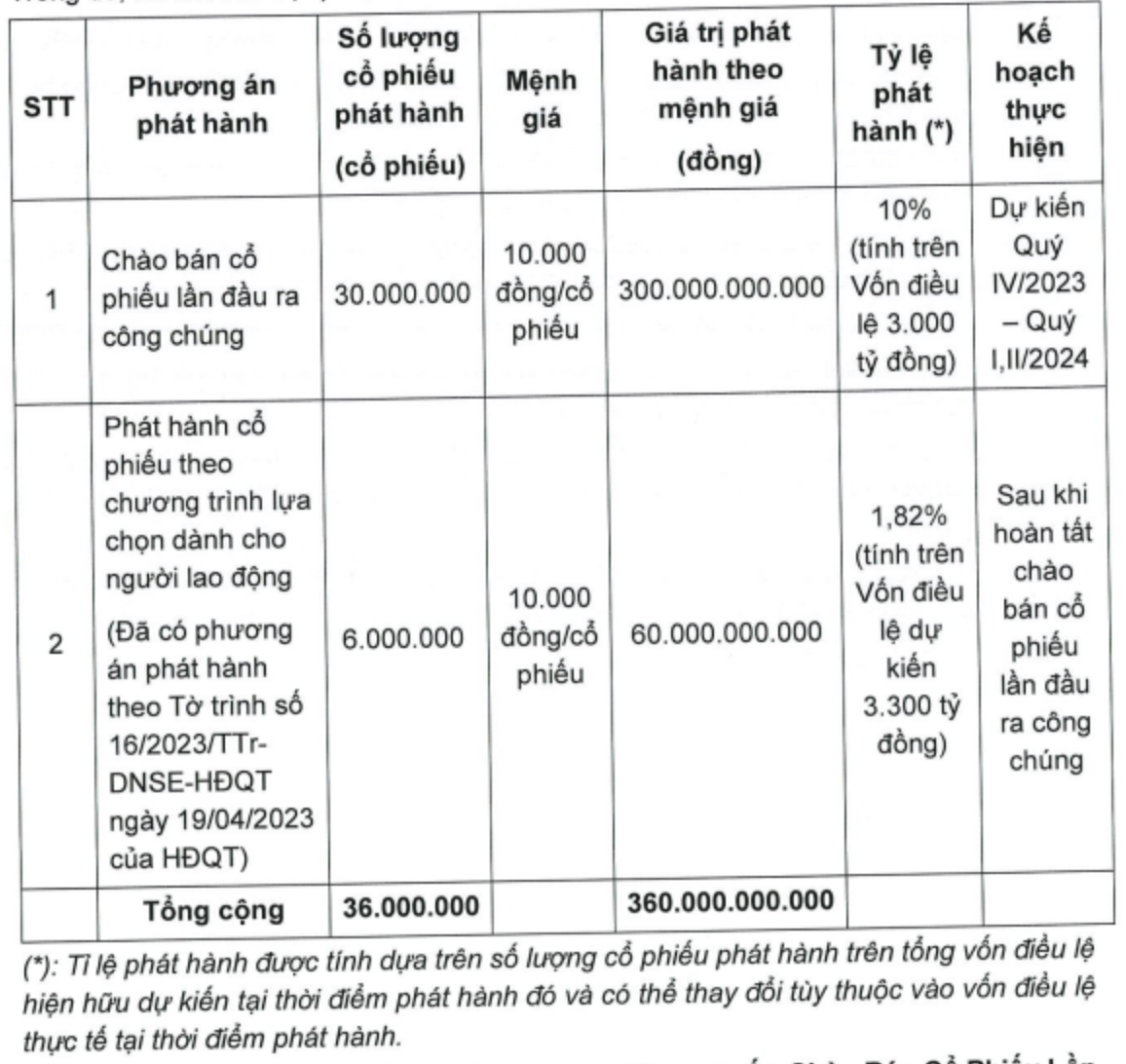

Specifically, DNSE plans to issue an additional 36 million shares to increase its charter capital from VND3,000 billion to VND3,360 billion, including IPO of 30 million shares and issuance of an additional 6 million shares under the employee stock option program (ESOP).

With the IPO plan, the expected number of shares offered is 30 million, corresponding to an issuance ratio of 10%. The offering price is not lower than the book value of VND 10,756/share, determined on the audited semi-annual financial statements of 2023.

The expected implementation time is from the fourth quarter of 2023 to the first and second quarters of 2024. The subjects of the offering are domestic and foreign organizations and individuals who want to buy the company's shares.

The proceeds will be allocated 50% to supplement capital to provide pre-sale services, margin trading, and other company operations/businesses.

In addition, DNSE will use 40% for self-trading activities and investing in valuable papers on the market; the final 10% will be used to invest in infrastructure, develop the company's system, supplement working capital and other legal activities of the company.

DNSE IPO Plan (Source: DNSE).

Regulations on maximum foreign ownership ratio, the General Meeting of Shareholders approved the company's maximum foreign ownership ratio of 100% and authorized the Board of Directors to decide on a plan to ensure that the issuance of shares meets the regulations on maximum foreign ownership ratio, adjust the maximum foreign ownership ratio in accordance with the company's needs and legal requirements (if any) and perform the obligation to notify the maximum foreign ownership ratio.

Regarding the ESOP issuance plan, DNSE plans to implement the plan after completing the IPO. The number of shares issued is 6 million shares, equivalent to 60 billion VND, accounting for 1.82% of charter capital.

Regarding the financial picture, DNSE Securities recorded a 41% increase in second-quarter revenue and an 8-fold increase in after-tax profit compared to the same period in 2022, reaching VND 176 billion and more than VND 58 billion, respectively. In the first 6 months of the year, DNSE's after-tax profit increased 5 times to VND 90 billion.

In the second quarter, DNSE recorded rapid growth in user market share. In June alone, the company had 31,114 newly opened accounts, accounting for about 21% of the total market. The company is also among the leaders in terms of newly opened account market share, reaching 12.49% .

Source

![[Photo] Prime Minister Pham Minh Chinh chairs meeting on science and technology development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/ae80dd74c384439789b12013c738a045)

![[Photo] More than 17,000 candidates participate in the 2025 SPT Competency Assessment Test of Hanoi National University of Education](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/e538d9a1636c407cbb211b314e6303fd)

![[Photo] Readers line up to visit the photo exhibition and receive a special publication commemorating the 135th birthday of President Ho Chi Minh at Nhan Dan Newspaper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/85b3197fc6bd43e6a9ee4db15101005b)

![[Photo] Nearly 3,000 students moved by stories about soldiers](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/21da57c8241e42438b423eaa37215e0e)

Comment (0)