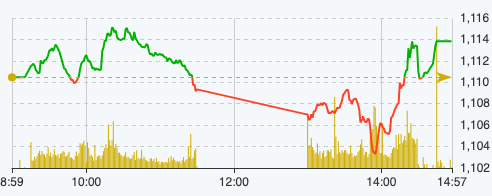

The selling pressure is always lurking, along with the cautious sentiment of investors, causing the market to open slightly higher in a rather divided state. The VN-Index moved sideways within a narrow range this morning, but the market was no less exciting because of that.

The bright spot is the real estate group with pillar stocks playing a leading role in the market such as NVL up 4.9%, DXG up 4%, DIG, CII, VCG up more than 1%.

At the end of the morning session on November 22, VN-Index decreased by 1.13 points, equivalent to 0.1% to 1,109.33 points. The entire floor had 195 stocks increasing and 240 stocks decreasing. HNX-Index decreased by 0.42 points to 229.38 points. UPCoM-Index decreased by 0.25 points, equivalent to 0.29% to 85.97 points.

VN-Index developments on November 22 (Source: Fire Ant).

Entering the afternoon session, investors were more cautious and weak demand caused the index to fluctuate and reverse slightly compared to the morning session.

At the end of the trading session on November 22, VN-Index decreased by 1.13 points, equivalent to 0.1% to 1,109.33 points. The entire floor had 195 stocks increasing, 240 stocks decreasing and 98 stocks remaining unchanged.

The HNX-Index increased by 0.69 points, equivalent to 0.3% to 230.49 points. The entire floor had 78 stocks increasing, 65 stocks decreasing and 80 stocks remaining unchanged. The UPCoM-Index decreased by 0.18 points to 86.04 points. The VN30 basket alone recorded 18 stocks decreasing in price.

The real estate group increased when NVL hit the ceiling with nearly 68 million units matched, DXG increased by 4.69% and matched 38 million units, DIG increased by 2.5% and matched 25.6 million units, CEO increased by 1.3% and matched 20 million units. On the contrary, two Vin stocks, VHM and VIC, decreased by 0.26% and 1.41% respectively.

Securities stocks also attracted money when VIX matched 42.7 million units, VND matched 31.4 million units, SHS matched more than 29 million units, and SSI matched 23 million units.

Two retail giants MWG and FRT ended the session in red, down 2.69% and 0.29% respectively.

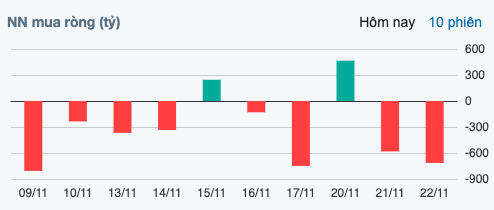

Foreign transaction statistics.

The total order matching value in today's session reached VND11,435 billion, down 35% compared to the previous session, of which the order matching value on the HoSE floor reached VND8,803 billion, down 31%. In the VN30 group, liquidity reached VND2,120 billion.

Foreign investors continued to net sell strongly with a value of nearly 714.7 billion VND, of which this group disbursed 827.91 billion VND and sold 1,542.6 billion VND.

The codes that were sold strongly were VPB 452.5 billion VND, VHM 73.43 billion VND, MWG 59 billion VND, VRE 44 billion VND, VIC 43 billion VND,... On the contrary, the codes that were bought strongly were mainly STB 103.8 billion VND, NKG 35 billion VND, PVT 12 billion VND, SSI 8.6 billion VND, 6.5 billion VND,...

Today is the second session that foreign investors have “dumped” VPB shares. In just yesterday and today’s sessions, foreign investors have net sold a total of 663.6 billion VND.

Previously, in early September 2023, this code received great attention from foreign investors after officially expanding foreign room to 30% of charter capital.

The trading session on September 6 witnessed a sudden surge in foreign transactions in VPB shares when this group of investors net bought nearly 20.3 million units, worth more than VND430 billion. This is the strongest net buying session of foreign investors in VPB since the beginning of the year. In the week from September 4 to 9, foreign investors net bought VND856.4 billion in VPB shares, mainly through negotiation channels.

Previously, VPB shares were continuously net sold by foreign investors in August with a total accumulated volume of more than 40.7 million units, worth more than VND 860 billion .

Source

![[Photo] Prime Minister Pham Minh Chinh chairs conference on anti-smuggling, trade fraud, and counterfeit goods](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/14/6cd67667e99e4248b7d4f587fd21e37c)

Comment (0)